Question

Preparation of projected statement of income statement The above is the 2012 to 2014 income statement for the company. Consider there is availability of new

Preparation of projected statement of income statement

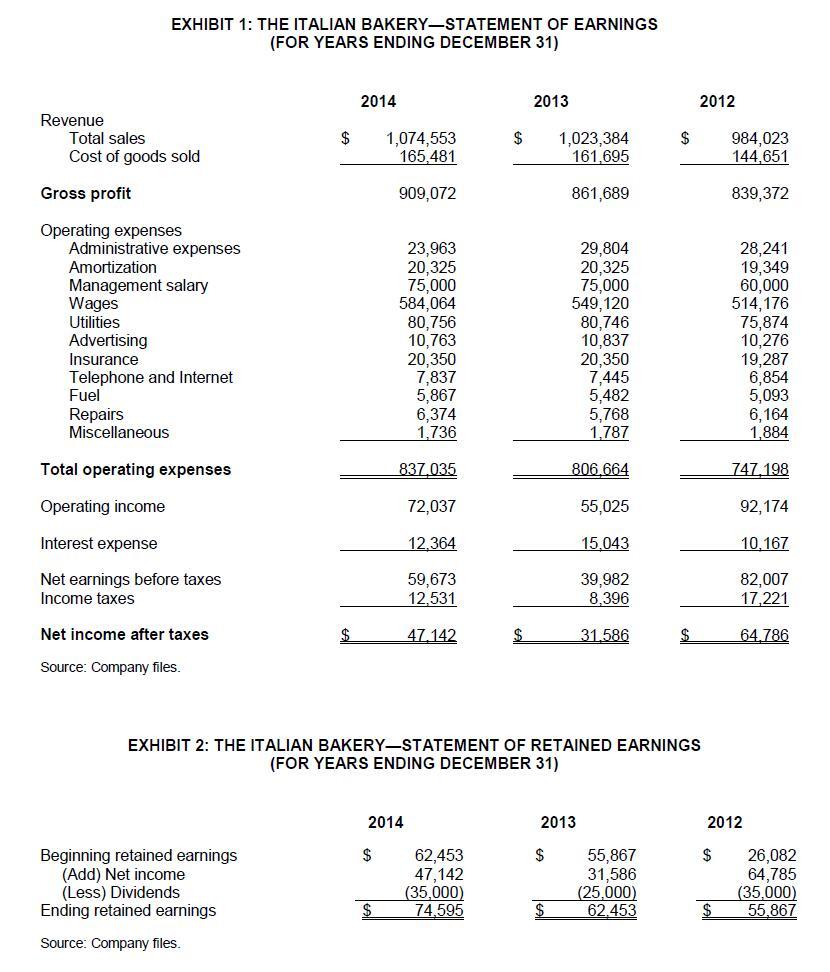

The above is the 2012 to 2014 income statement for the company. Consider there is availability of new market segment, please draft the projected income statement for 2015 based on the below given information.

After observing a segment of consumers purchasing fresh grocery items from independent specialty stores, Liambotis believed the Bakery could increase its sales to residential customers. For this option, he would rent an outdoor farmers' market booth at the Covent Garden Market located in downtown London. The market operated from May to October, and a booth rental cost $520 per season for 26 Saturdays. Another $500 would be spent on signage and supplies. Liambotis would hire a part-time employee at the minimum wage rate to sell the Bakery's loaves from 8:00 a.m. to 1:00 p.m. at the market and to set up and close the booth (an additional 60 minutes) each Saturday.

A selection of the Bakery's premium bread loaves (e.g., fresh-baked rolls artisan sourdough, and rye bread) would be sold for an average price of $4.50 per loaf (prices ranged from $2.99 to $5.99 per loaf). Liambotis liked the idea of increasing his residential customer base, connecting with customers on a personal level, and gaining more local exposure for the Bakery; however, he wondered if this was a good fit for the business. Would a temporary part-time employee be able to effectively represent the Bakery at the market? Another concern was the Bakery 's ability to secure a booth at the market. Booth entry was competitive and, to be eligible, businesses needed to be local growers, farmers, or producers. Although Liambotis planned to sell loaves made from locally-sourced ingredients, most of his primary suppliers were not from London.

Revenue EXHIBIT 1: THE ITALIAN BAKERY-STATEMENT OF EARNINGS (FOR YEARS ENDING DECEMBER 31) 2014 2013 $ 1,074,553 165,481 1,023,384 161,695 909,072 861,689 23,963 29,804 20,325 20,325 75,000 75,000 584,064 549,120 80,756 80,746 10,763 10,837 20,350 20,350 7,837 7,445 5,867 5,482 6,374 5,768 1,736 1,787 837,035 806.664 72,037 55,025 12,364 15.043 59,673 39,982 12,531 8,396 $ 47.142 $ 31,586 $ EXHIBIT 2: THE ITALIAN BAKERY-STATEMENT OF RETAINED EARNINGS (FOR YEARS ENDING DECEMBER 31) 2014 2013 2012 62,453 47,142 (35,000) 74.595 55,867 31,586 (25,000) 62.453 Total sales Cost of goods sold Gross profit Operating expenses Administrative expenses Amortization Management salary Wages Utilities Advertising Insurance Telephone and Internet Fuel Repairs Miscellaneous Total operating expenses Operating income Interest expense Net earnings before taxes Income taxes Net income after taxes Source: Company files. Beginning retained earnings (Add) Net income (Less) Dividends Ending retained earnings Source: Company files. $ $ $ $ $ 2012 $ $ 984,023 144,651 839,372 28,241 19,349 60,000 514,176 75,874 10,276 19,287 6,854 5,093 6,164 1,884 747,198 92,174 10,167 82,007 17,221 64,786 26,082 64,785 (35,000) 55,867 Revenue EXHIBIT 1: THE ITALIAN BAKERY-STATEMENT OF EARNINGS (FOR YEARS ENDING DECEMBER 31) 2014 2013 $ 1,074,553 165,481 1,023,384 161,695 909,072 861,689 23,963 29,804 20,325 20,325 75,000 75,000 584,064 549,120 80,756 80,746 10,763 10,837 20,350 20,350 7,837 7,445 5,867 5,482 6,374 5,768 1,736 1,787 837,035 806.664 72,037 55,025 12,364 15.043 59,673 39,982 12,531 8,396 $ 47.142 $ 31,586 $ EXHIBIT 2: THE ITALIAN BAKERY-STATEMENT OF RETAINED EARNINGS (FOR YEARS ENDING DECEMBER 31) 2014 2013 2012 62,453 47,142 (35,000) 74.595 55,867 31,586 (25,000) 62.453 Total sales Cost of goods sold Gross profit Operating expenses Administrative expenses Amortization Management salary Wages Utilities Advertising Insurance Telephone and Internet Fuel Repairs Miscellaneous Total operating expenses Operating income Interest expense Net earnings before taxes Income taxes Net income after taxes Source: Company files. Beginning retained earnings (Add) Net income (Less) Dividends Ending retained earnings Source: Company files. $ $ $ $ $ 2012 $ $ 984,023 144,651 839,372 28,241 19,349 60,000 514,176 75,874 10,276 19,287 6,854 5,093 6,164 1,884 747,198 92,174 10,167 82,007 17,221 64,786 26,082 64,785 (35,000) 55,867Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started