Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Preparatory Question Set: Financial Environment ( Module I ) Use the discussion in class and the textbook to answer the questions below ( Not every

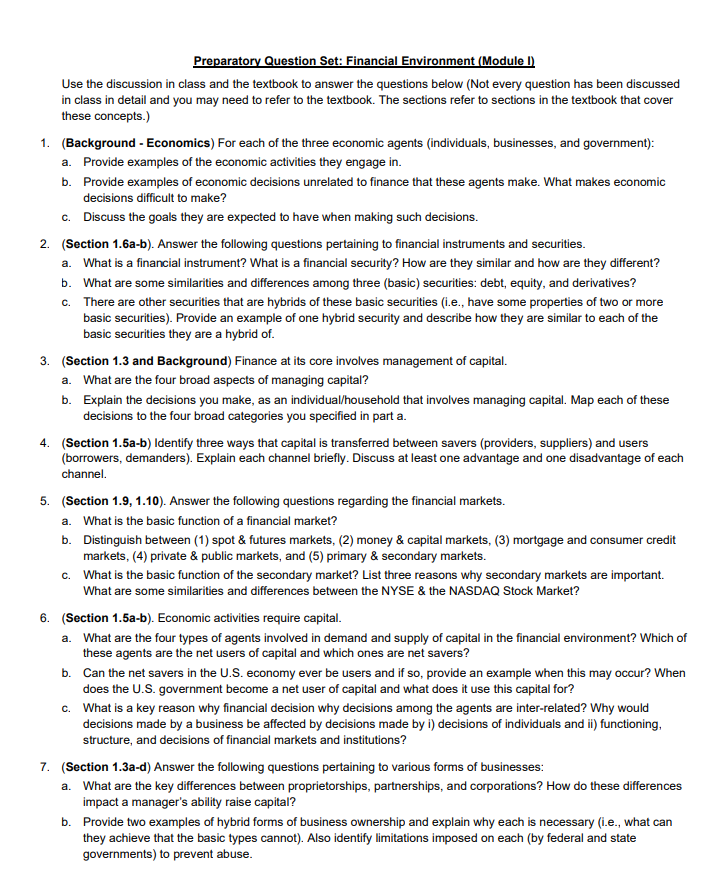

Preparatory Question Set: Financial Environment Module I

Use the discussion in class and the textbook to answer the questions below Not every question has been discussed

in class in detail and you may need to refer to the textbook. The sections refer to sections in the textbook that cover

these concepts.

Background Economics For each of the three economic agents individuals businesses, and government:

a Provide examples of the economic activities they engage in

b Provide examples of economic decisions unrelated to finance that these agents make. What makes economic

decisions difficult to make?

c Discuss the goals they are expected to have when making such decisions.

Section ab Answer the following questions pertaining to financial instruments and securities

a What is a financial instrument? What is a financial security? How are they similar and how are they different?

b What are some similarities and differences among three basic securities: debt, equity, and derivatives?

c There are other securities that are hybrids of these basic securities ie have some properties of two or more

basic securities Provide an example of one hybrid security and describe how they are similar to each of the

basic securities they are a hybrid of

Section and Background Finance at its core involves management of capital.

a What are the four broad aspects of managing capital?

b Explain the decisions you make, as an individualhousehold that involves managing capital. Map each of these

decisions to the four broad categories you specified in part a

Section ab Identify three ways that capital is transferred between savers providers suppliers and users

borrowers demanders Explain each channel briefly. Discuss at least one advantage and one disadvantage of each

channel.

Section Answer the following questions regarding the financial markets.

a What is the basic function of a financial market?

b Distinguish between spot & futures markets, money & capital markets, mortgage and consumer credit

markets, private & public markets, and primary & secondary markets.

c What is the basic function of the secondary market? List three reasons why secondary markets are important.

What are some similarities and differences between the NYSE & the NASDAQ Stock Market?

Section ab Economic activities require capital.

a What are the four types of agents involved in demand and supply of capital in the financial environment? Which of

these agents are the net users of capital and which ones are net savers?

b Can the net savers in the US economy ever be users and if so provide an example when this may occur? When

does the US government become a net user of capital and what does it use this capital for?

c What is a key reason why financial decision why decisions among the agents are interrelated? Why would

decisions made by a business be affected by decisions made by i decisions of individuals and ii functioning,

structure, and decisions of financial markets and institutions?

Section ad Answer the following questions pertaining to various forms of businesses:

a What are the key differences between proprietorships, partnerships, and corporations? How do these differences

impact a manager's ability raise capital?

b Provide two examples of hybrid forms of business ownership and explain why each is necessary ie what can

they achieve that the basic types cannot Also identify limitations imposed on each by federal and state

governments to prevent abuse.

If you can answer these questions step by step with as much detail as needed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started