Prepare:

1. Comparative Analysis

2. Comparative Income Statement Analyst

2. Comparative Balance Sheet Analysis

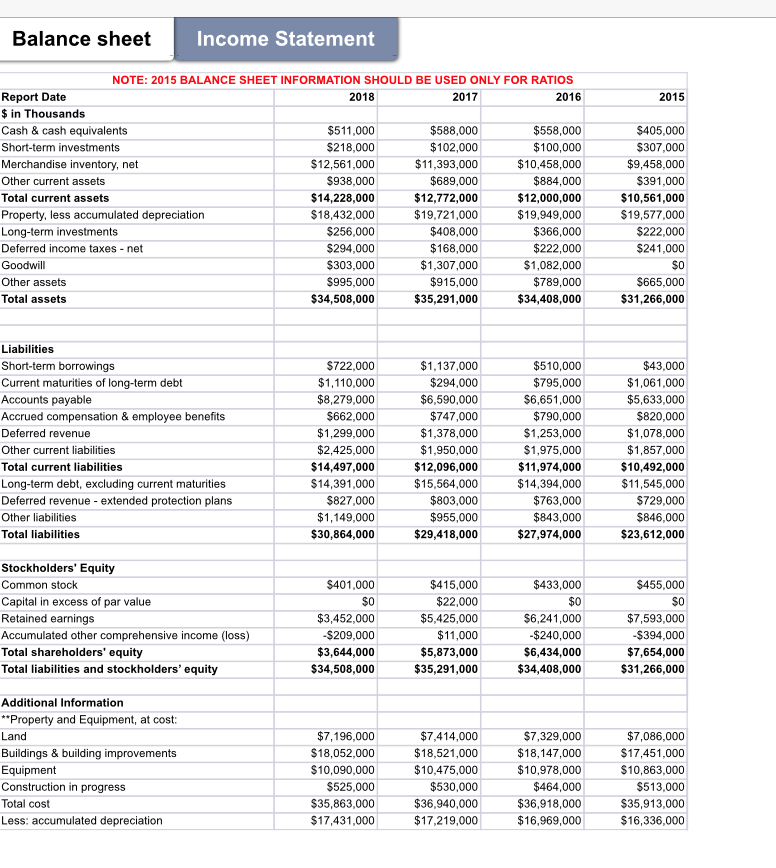

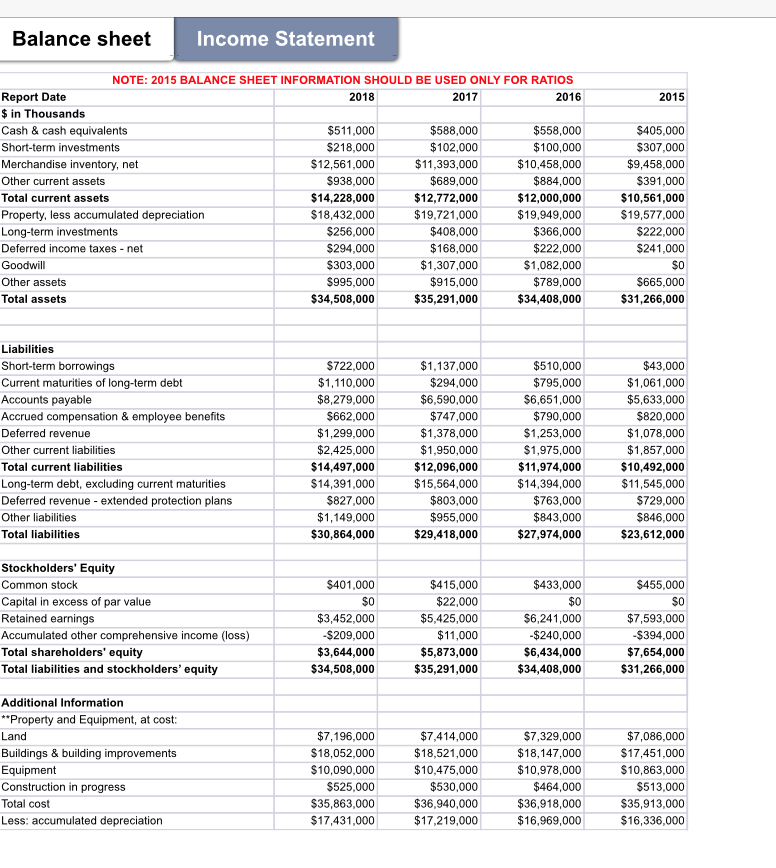

LOWES BALANCE SHEET: LOWES INCOME STATEMENT:

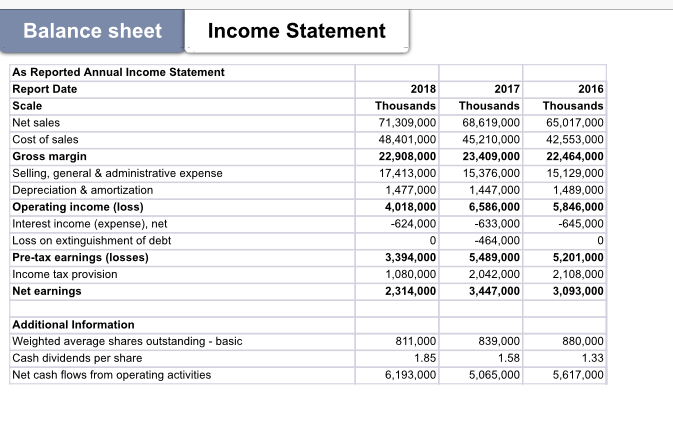

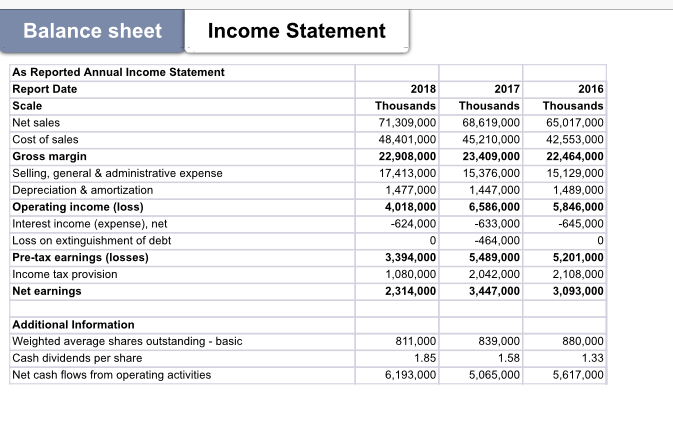

LOWES INCOME STATEMENT:

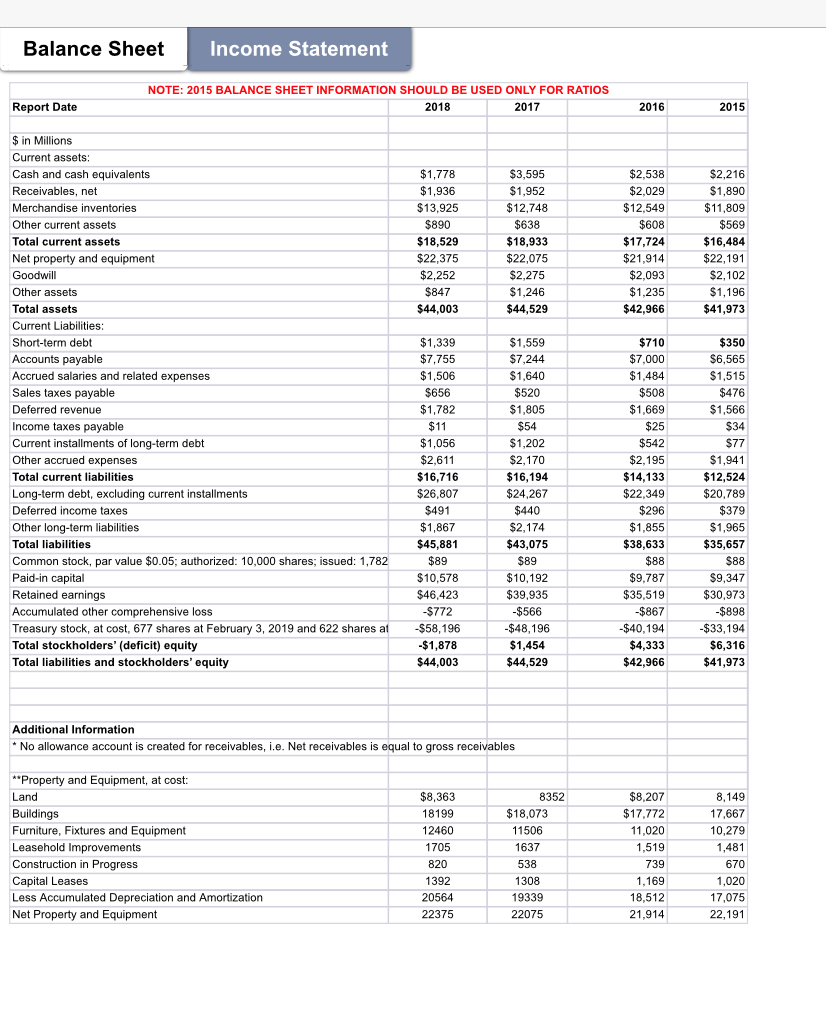

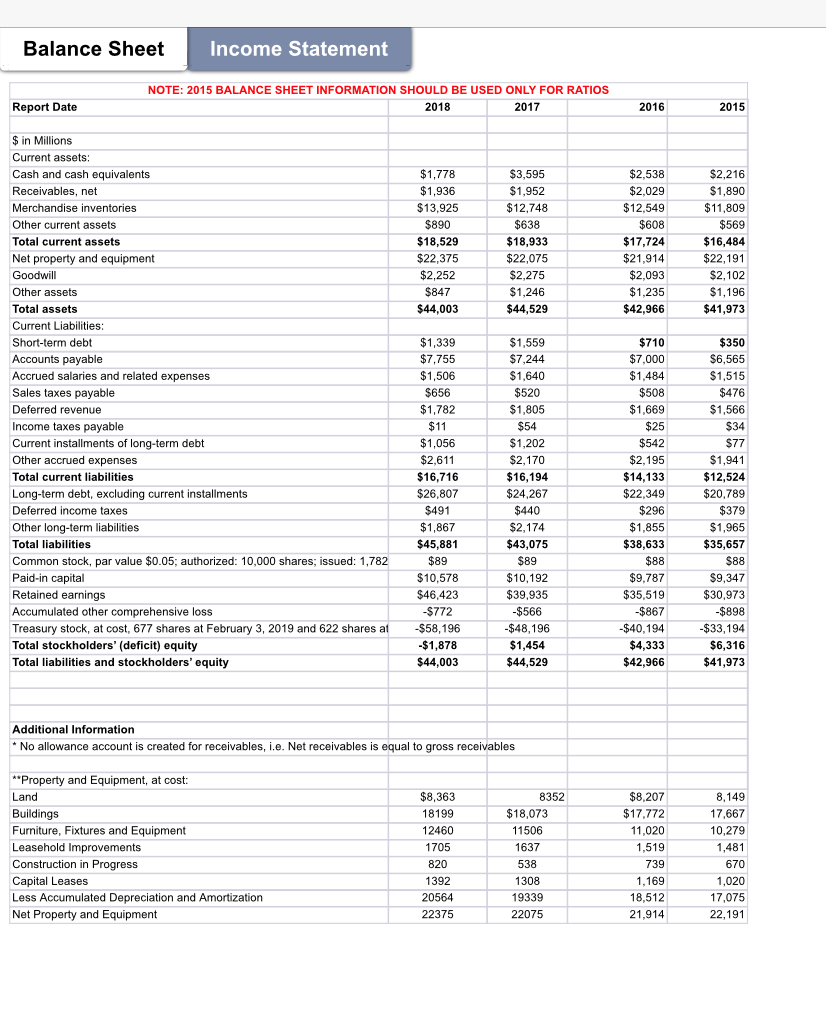

HOME DEPOT BALANCE SHEET:

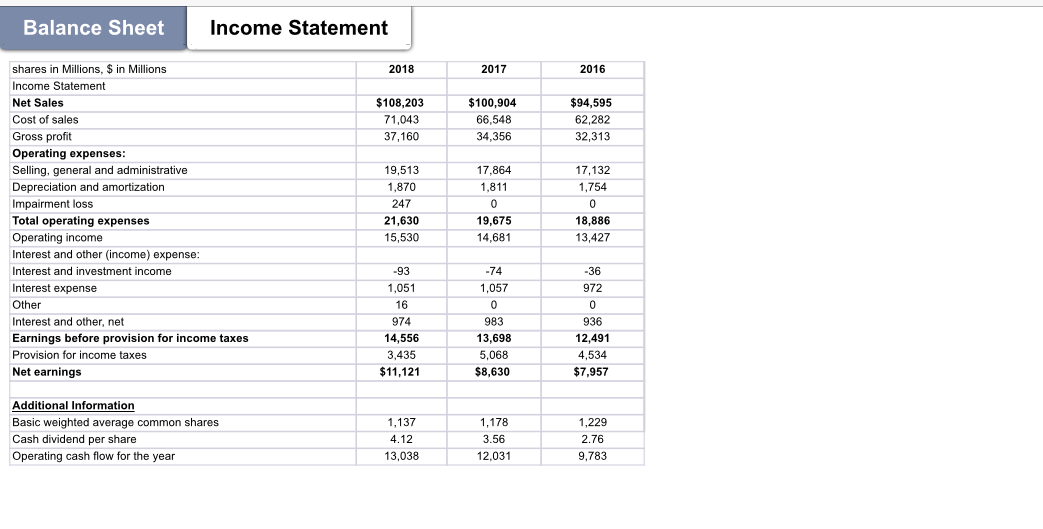

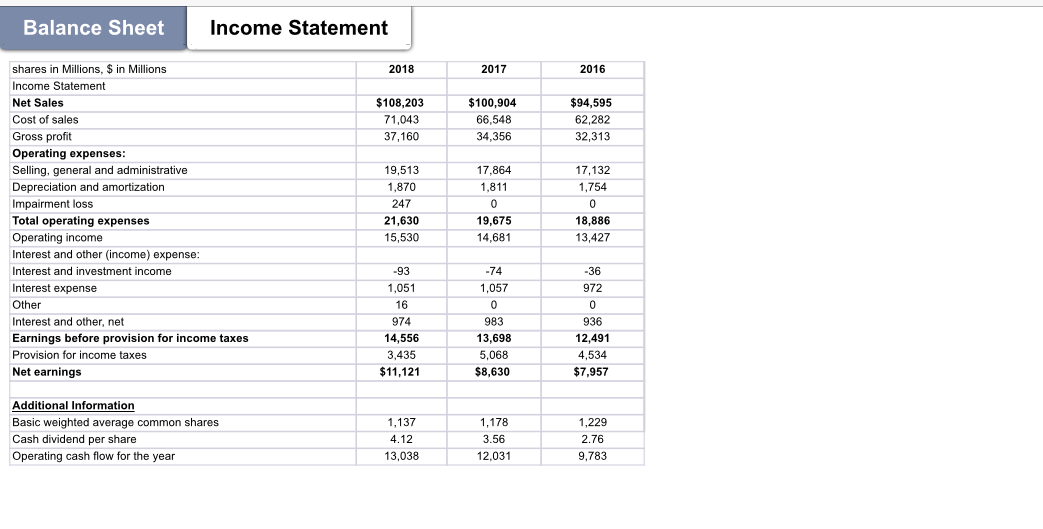

HOME DEPOT INCOME STATEMENT:

HOME DEPOT INCOME STATEMENT:

Balance sheet Income Statement 2015 NOTE: 2015 BALANCE SHEET INFORMATION SHOULD BE USED ONLY FOR RATIOS Report Date 2018 2017 2016 $ in Thousands Cash & cash equivalents $511,000 $588,000 $558,000 Short-term investments $218,000 $102,000 $100,000 Merchandise inventory, net $12,561,000 $11,393,000 $10,458,000 Other current assets $938,000 $689,000 $884,000 Total current assets $14,228,000 $12,772,000 $12,000,000 Property, less accumulated depreciation $18,432,000 $19,721,000 $19,949,000 Long-term investments $256,000 $408,000 $366,000 Deferred income taxes - net $294,000 $ 168,000 $222,000 Goodwill $303,000 $1,307,000 $1,082,000 Other assets $995,000 $915,000 $789,000 Total assets $34,508,000 $35,291,000 $34,408,000 $405,000 $307,000 $9,458,000 $391,000 $10,561,000 $19,577,000 $222,000 $241,000 $665,000 $31,266,000 Liabilities Short-term borrowings Current maturities of long-term debt Accounts payable Accrued compensation & employee benefits Deferred revenue Other current liabilities Total current liabilities Long-term debt, excluding current maturities Deferred revenue - extended protection plans Other liabilities Total liabilities $722,000 $1,110,000 $8,279,000 $662,000 $1,299,000 $2,425,000 $14,497,000 $14,391,000 $827,000 $1,149,000 $30,864,000 $1,137,000 $294.000 $6,590,000 $747,000 $1,378,000 $1,950,000 $12,096,000 $15,564,000 $803,000 $955,000 $29,418,000 $510,000 $795,000 $6,651,000 $790,000 $1,253,000 $1,975,000 $11,974,000 $14,394,000 $763,000 $843,000 $27,974,000 $43,000 $1,061,000 $5,633,000 $820,000 $1,078,000 $1,857,000 $10,492,000 $11,545,000 $729,000 $846,000 $23,612,000 $455,000 Stockholders' Equity Common stock Capital in excess of par value Retained earnings Accumulated other comprehensive income (loss) Total shareholders' equity Total liabilities and stockholders' equity $401,000 $0 $3,452,000 $209,000 $3,644,000 $34,508,000 $415,000 $22,000 $5,425,000 $11,000 $5,873,000 $35,291,000 $433,000 $0 $6,241,000 -$240,000 $6,434,000 $34,408,000 $7,593,000 $394,000 $7,654,000 $31,266,000 Additional Information ** Property and Equipment, at cost: Land Buildings & building improvements Equipment Construction in progress Total cost Less: accumulated depreciation $7,196,000 $18,052,000 $10,090,000 $525,000 $35,863,000 $17,431,000 $7,414,000 $18,521,000 $10,475,000 $530,000 $36,940,000 $17,219,000 $7,329,000 $18,147,000 $10,978,000 $464,000 $36,918,000 $16,969,000 $7,086,000 $17,451,000 $10,863,000 $513,000 $35,913,000 $16,336,000 Balance sheet Income Statement As Reported Annual Income Statement Report Date Scale Net sales Cost of sales Gross margin Selling, general & administrative expense Depreciation & amortization Operating income (loss) Interest income (expense), net Anse) net Loss on extinguishment of debt Pre-tax earnings (losses) Income tax provision Net earnings 2018 Thousands 71,309,000 48,401,000 22,908,000 17,413,000 1,477,000 4,018,000 -624,000 2017 Thousands 68,619,000 45,210,000 23,409,000 15,376,000 1,447,000 6,586,000 -633,000 -464,000 5,489,000 2,042,000 3,447,000 2016 Thousands 65,017,000 42,553,000 22,464,000 15,129,000 1,489,000 5,846,000 -645,000 3,394,000 1,080,000 2,314,000 5,201,000 2,108,000 3,093,000 Additional Information Weighted average shares outstanding - basic Cash dividends per share Net cash flows from operating activities 811,000 1.85 6,193,000 839,000 1.58 5,065,000 880,000 1.33 5,617,000 Balance Sheet Income Statement NOTE: 2015 BALANCE SHEET INFORMATION SHOULD BE USED ONLY FOR RATIOS 2018 2017 Report Date 2016 2015 $1,778 $1,936 $13.925 $890 $18,529 $22,375 $2,252 $847 $44,003 $3,595 $1,952 $12,748 $638 $18,933 $22,075 $2,275 $1,246 $44,529 $2,538 $2,029 $12,549 $608 $17,724 $21,914 $2,093 $1,235 $42,966 $2,216 $1,890 $11,809 $569 $16,484 $22,191 $2,102 $1,196 $41,973 $350 $6,565 $1,515 $476 $ in Millions Current assets: Cash and cash equivalents Receivables, net Merchandise inventories Other current assets Total current assets Net property and equipment Goodwill Other assets Total assets Current Liabilities: Short-term debt Accounts payable Accrued salaries and related expenses Sales taxes payable Deferred revenue Income taxes payable Current installments of long-term debt Other accrued expenses Total current liabilities Long-term debt, excluding current installments Deferred income taxes Other long-term liabilities Total liabilities Common stock, par value $0.05; authorized: 10.000 shares: issued: 1,782 Paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, at cost, 677 shares at February 3, 2019 and 622 shares at Total stockholders' (deficit) equity Total liabilities and stockholders' equity $1,566 $34 $77 $1,941 $12,524 $20,789 $1,339 $7,755 $1,506 $656 $1,782 $11 $1,056 $2.611 $16,716 $26,807 $491 $1,867 $45,881 $89 $10,578 $46,423 $772 $58, 196 -$1,878 $44,003 $1,559 $7,244 $1.640 $520 $1,805 $54 $1,202 $2,170 $16,194 $24,267 $440 $2,174 $43,075 $89 $10,192 $39,935 -$566 -$48,196 $1,454 $44,529 $710 $7,000 $1,484 $508 $1,669 $25 $542 $2,195 $14,133 $22,349 $296 $1,855 $38,633 $88 $9,787 $35,519 -$867 -$40,194 $4,333 $42,966 $379 $1,965 $35,657 $88 $9,347 $30,973 -$898 -$33,194 $6,316 $41,973 Additional Information * No allowance account is created for receivables, i.e. Net receivables is equal to gross receivables ** Property and Equipment, at cost: Land Buildings Furniture, Fixtures and Equipment Leasehold Improvements Construction in Progress Capital Leases Less Accumulated Depreciation and Amortization Net Property and Equipment $8,363 18199 12460 1705 820 1392 20564 22375 8352 $18,073 11506 1637 538 1308 19339 22075 $8,207 $17,772 11,020 1,519 739 1,169 18,512 21,914 8,149 17,667 10,279 1,481 670 1,020 17,075 22,191 Balance Sheet Income Statement 2018 2017 2016 $108,203 71,043 37,160 $100,904 66,548 34,356 $94,595 62,282 32,313 17,864 1,811 17,132 1,754 shares in Millions, $ in Millions Income Statement Net Sales Cost of sales Gross profit Operating expenses: Selling, general and administrative Depreciation and amortization Impairment loss Total operating expenses Operating income Interest and other (income) expense: Interest and investment income Interest expense Other Interest and other, net Earnings before provision for income taxes Provision for income taxes Net earnings 19,513 1,870 247 21,630 15,530 19,675 14,681 18,886 13,427 -36 972 -93 1,051 16 974 14,556 3,435 $11,121 -74 1,057 0 983 13,698 5,068 $8,630 936 12,491 4,534 $7,957 Additional Information Basic weighted average common shares Cash dividend per share Operating cash flow for the year 1,137 4.12 13,038 1,178 3.56 12,031 1,229 2.76 9,783

LOWES INCOME STATEMENT:

LOWES INCOME STATEMENT:

HOME DEPOT INCOME STATEMENT:

HOME DEPOT INCOME STATEMENT: