Prepare a 1000 word business report for your manager providing analysis and business advice

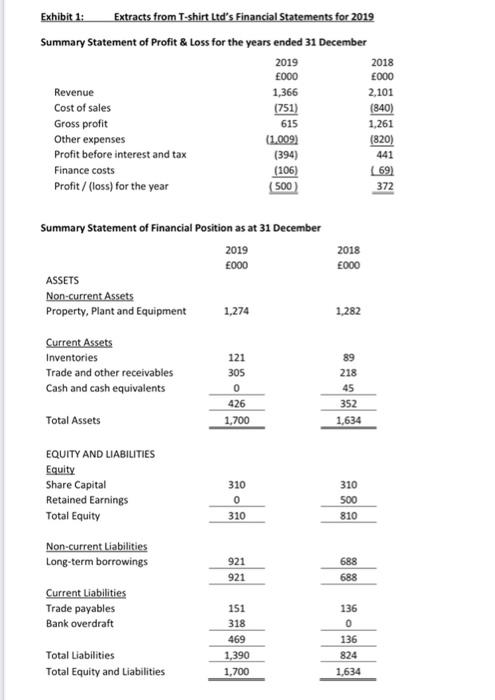

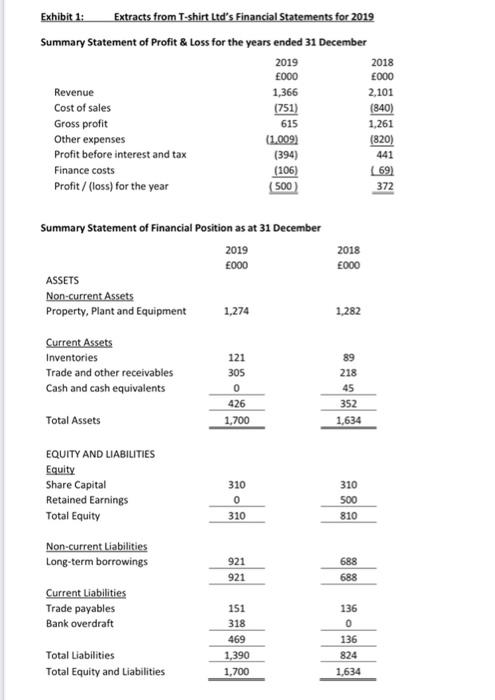

1.1 Case Study - T shirts Ltd You are a finance trainee for a company of Vests pic and have been asked by your marketing manager to review the business of your key competitor T-shirts plc and to assist her with helping the marketing team understand financial information You know that T-shirts pic is struggling in the current economic climate and that other expenses have risen as a result of an aggressive advertising campaign to stimulate sales. Your sales manager has informed you that T-shirts pic increased the credit terms given to their customers from 30 days to 60 days in an attempt to attract more business. The rate of interest on the bank overdraft in 2019 is significantly higher than the rate of interest on the loan. 1.2. Prepare a 2,000 word business report for your manager providing analysis and business advice Part 1: Business Performance Analysis: To support your analysis for this part you will need to calculate and use appropriate ratios using the course definitions. You need to show all ratio calculations workings which should be placed in the appendices to your report Exhibit 1: Extracts from T-shirt Ltd's Financial Statements for 2019 Summary Statement of Profit & Loss for the years ended 31 December 2019 2018 000 E000 Revenue 1,366 2,101 Cost of sales (751) (840) Gross profit 615 1,261 Other expenses (820) Profit before interest and tax (394) 441 Finance costs (106) (69) Profit / (loss) for the year (500) 372 (1,009 Summary Statement of Financial Position as at 31 December 2019 000 ASSETS Non-current Assets Property, Plant and Equipment 1,274 2018 E000 1,282 Current Assets Inventories Trade and other receivables Cash and cash equivalents 121 305 0 426 1,700 89 218 45 352 1,634 Total Assets EQUITY AND LIABILITIES Equity Share Capital Retained Earnings Total Equity 310 0 310 310 500 810 Non-current Liabilities Long-term borrowings 921 921 688 688 Current Liabilities Trade payables Bank overdraft 151 318 469 1,390 1,700 136 0 136 824 Total Liabilities Total Equity and Liabilities 1,634 1.1 Case Study - T shirts Ltd You are a finance trainee for a company of Vests pic and have been asked by your marketing manager to review the business of your key competitor T-shirts plc and to assist her with helping the marketing team understand financial information You know that T-shirts pic is struggling in the current economic climate and that other expenses have risen as a result of an aggressive advertising campaign to stimulate sales. Your sales manager has informed you that T-shirts pic increased the credit terms given to their customers from 30 days to 60 days in an attempt to attract more business. The rate of interest on the bank overdraft in 2019 is significantly higher than the rate of interest on the loan. 1.2. Prepare a 2,000 word business report for your manager providing analysis and business advice Part 1: Business Performance Analysis: To support your analysis for this part you will need to calculate and use appropriate ratios using the course definitions. You need to show all ratio calculations workings which should be placed in the appendices to your report Exhibit 1: Extracts from T-shirt Ltd's Financial Statements for 2019 Summary Statement of Profit & Loss for the years ended 31 December 2019 2018 000 E000 Revenue 1,366 2,101 Cost of sales (751) (840) Gross profit 615 1,261 Other expenses (820) Profit before interest and tax (394) 441 Finance costs (106) (69) Profit / (loss) for the year (500) 372 (1,009 Summary Statement of Financial Position as at 31 December 2019 000 ASSETS Non-current Assets Property, Plant and Equipment 1,274 2018 E000 1,282 Current Assets Inventories Trade and other receivables Cash and cash equivalents 121 305 0 426 1,700 89 218 45 352 1,634 Total Assets EQUITY AND LIABILITIES Equity Share Capital Retained Earnings Total Equity 310 0 310 310 500 810 Non-current Liabilities Long-term borrowings 921 921 688 688 Current Liabilities Trade payables Bank overdraft 151 318 469 1,390 1,700 136 0 136 824 Total Liabilities Total Equity and Liabilities 1,634