Question

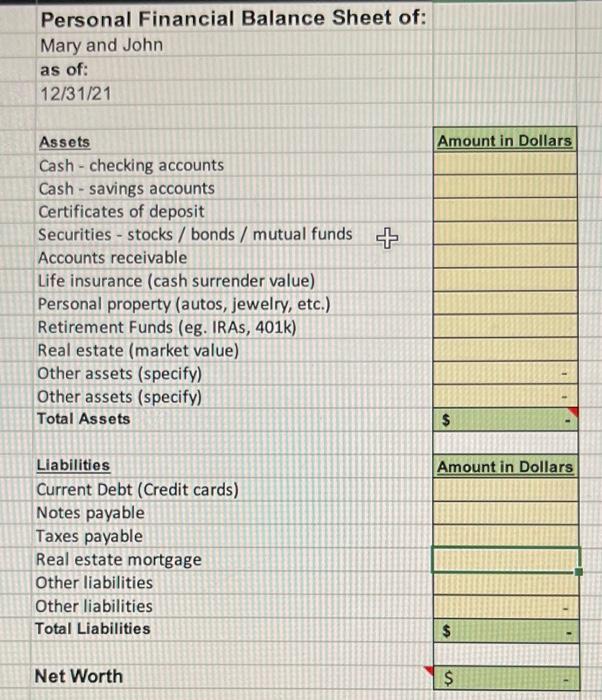

Prepare a balance sheet for them as of December 31, 2021 assuming the following information that Mary has gleaned from bank and investment account statements,

Prepare a balance sheet for them as of December 31, 2021 assuming the following information that Mary has gleaned from bank and investment account statements, life insurance contracts, a household inventory, and real estate documents. The biggest asset they own is their home. They purchased the home a few years ago for $225,000. The tax assessed value (used to calculate their property taxes is $250,000. A very recent appraisal was done on the property by an expert, independent real estate appraiser and showed an estimated market value of $300,000. The appraisal was done because the couple were thinking about refinancing their home mortgage but decided to wait a bit longer. Currently, the mortgage balance on the home is $200,000 and they owe $1,500 in property taxes as of 12/31/21. A small home improvement loan balance, which they used to fix up a bathroom, is $2,000. They borrowed the money from Johns Dad who wont demand repayment for another 2 years.

Mary reviews the bank statement and sees that their checking account balance as of 12/31/21 is $5,000 and they have another $10,000 in a passbook savings account at their credit union. They also have a certificate of deposit at Bank of America of $2,000.

In 2018, the couple bought a new car for $25,000 and the current estimated value per Kellys Bluebook of Used Cars is only $12,000. Furniture is estimated at $10,000 and Marys engagement ring was recently valued by a jewelry shop at $4,000.

Their investment portfolio (they own some shares of stock in a few corporations) cost $3,000 and their market value as of the close of the stock market on December 31, 2021 was $6,000. Their life insurance policy has a death benefit of $500,000 (if either one of them dies, the survivor will receive $500,000) and a cash surrender value of $4,000 which they could cash-in if they needed to or could borrow against it.

Between their employers 401(k) plan and their IRAs, the couple have a market value of $35,000. They recently used their credit cards for a vacation and holiday gifts and have an outstanding balance of $3,000.

John recently did some consulting work on the side and is owed $3,000. But even though he completed the consulting work, he believes he will not collect the $3,000 (accounts receivable) until sometime in February. Be sure to consider that amount for the September 1, 2020 balance sheet but also the budget.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started