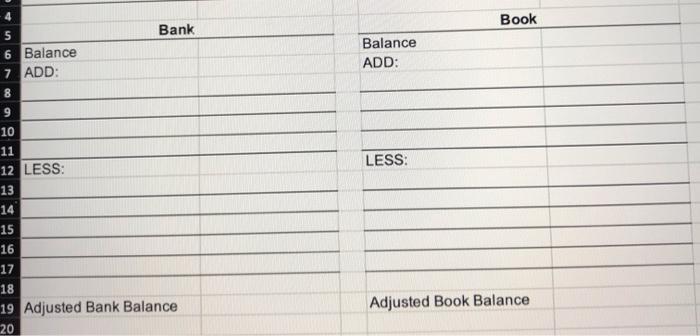

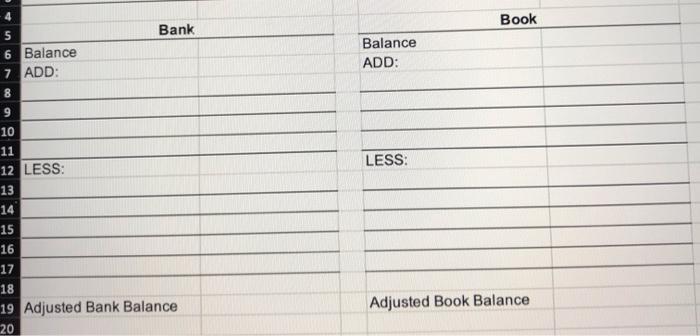

Prepare a bank & book reconcilation using bank statement the following format and information provided.

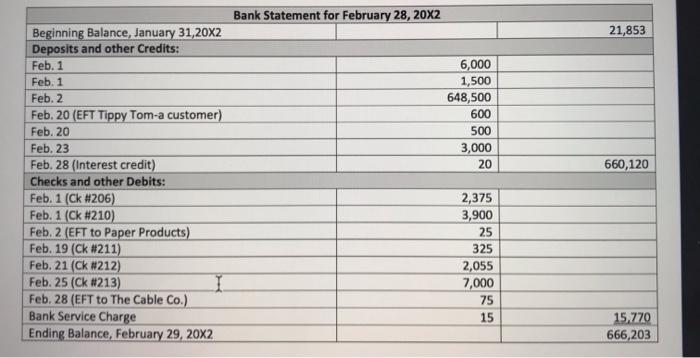

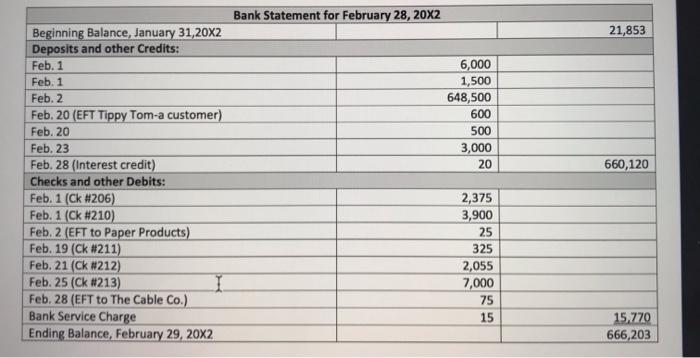

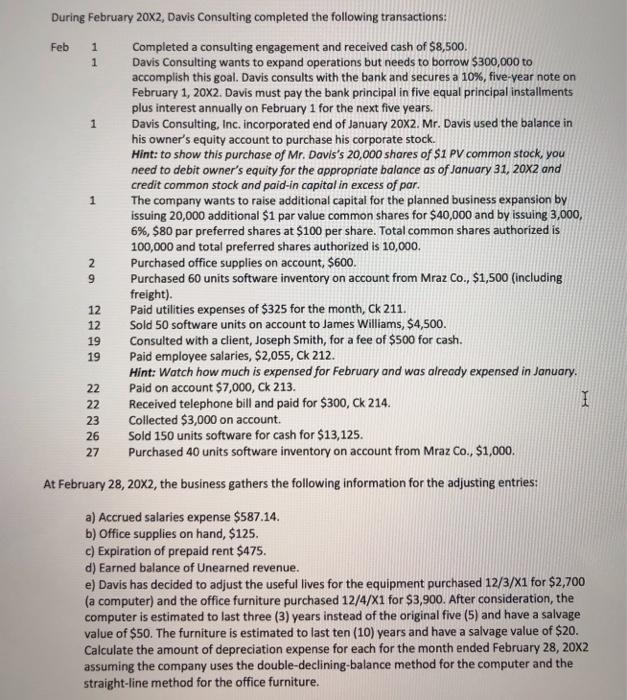

21,853 6,000 1,500 648,500 600 500 3,000 20 660,120 Bank Statement for February 28, 20X2 Beginning Balance, January 31,20x2 Deposits and other Credits: Feb. 1 Feb. 1 Feb. 2 Feb. 20 (EFT Tippy Tom-a customer) Feb. 20 Feb. 23 Feb. 28 (Interest credit) Checks and other Debits: Feb. 1 (Ck #206) Feb. 1 (Ck #210) Feb. 2 (EFT to Paper Products) Feb. 19 (Ck #211) Feb. 21 (Ck #212) Feb. 25 (Ck #213) I Feb. 28 (EFT to The Cable Co.) Bank Service Charge Ending Balance, February 29, 20X2 2,375 3,900 25 325 2,055 7,000 75 15 15,770 666,203 During February 20X2, Davis Consulting completed the following transactions: LON Feb 1 Completed a consulting engagement and received cash of $8,500. 1 Davis Consulting wants to expand operations but needs to borrow $300,000 to accomplish this goal. Davis consults with the bank and secures a 10%, five-year note on February 1, 20x2. Davis must pay the bank principal in five equal principal installments plus interest annually on February 1 for the next five years. 1 Davis Consulting, Inc. incorporated end of January 20x2. Mr. Davis used the balance in his owner's equity account to purchase his corporate stock. Hint: to show this purchase of Mr. Davis's 20,000 shares of $1 PV common stock, you need to debit owner's equity for the appropriate balance as of January 31, 20x2 and credit common stock and paid-in capital in excess of par. 1 The company wants to raise additional capital for the planned business expansion by issuing 20,000 additional $1 par value common shares for $40,000 and by issuing 3,000, 6%, $80 par preferred shares at $100 per share. Total common shares authorized is 100,000 and total preferred shares authorized is 10,000. 2 Purchased office supplies on account $600. 9 Purchased 60 units software inventory on account from Mraz Co., $1,500 (including freight). 12 Paid utilities expenses of $325 for the month, ck 211. 12 Sold 50 software units on account to James Williams, $4,500. 19 Consulted with a client, Joseph Smith, for a fee of $500 for cash. 19 Paid employee salaries, $2,055, ck 212. Hint: Watch how much is expensed for February and was already expensed in January. 22 Paid on account $7,000, ck 213. 22 Received telephone bill and paid for $300, ck 214. 1 23 Collected $3,000 on account. 26 Sold 150 units software for cash for $13,125. 27 Purchased 40 units software inventory on account from Mraz Co., $1,000 At February 28, 20X2, the business gathers the following information for the adjusting entries: a) Accrued salaries expense $587.14. b) Office supplies on hand, $125. c) Expiration of prepaid rent $475. d) Earned balance of Unearned revenue. e) Davis has decided to adjust the useful lives for the equipment purchased 12/3/X1 for $2,700 (a computer) and the office furniture purchased 12/4/X1 for $3,900. After consideration, the computer is estimated to last three (3) years instead of the original five (5) and have a salvage value of $50. The furniture is estimated to last ten (10) years and have a salvage value of $20. Calculate the amount of depreciation expense for each for the month ended February 28, 20X2 assuming the company uses the double-declining-balance method for the computer and the straight-line method for the office furniture. 21,853 6,000 1,500 648,500 600 500 3,000 20 660,120 Bank Statement for February 28, 20X2 Beginning Balance, January 31,20x2 Deposits and other Credits: Feb. 1 Feb. 1 Feb. 2 Feb. 20 (EFT Tippy Tom-a customer) Feb. 20 Feb. 23 Feb. 28 (Interest credit) Checks and other Debits: Feb. 1 (Ck #206) Feb. 1 (Ck #210) Feb. 2 (EFT to Paper Products) Feb. 19 (Ck #211) Feb. 21 (Ck #212) Feb. 25 (Ck #213) I Feb. 28 (EFT to The Cable Co.) Bank Service Charge Ending Balance, February 29, 20X2 2,375 3,900 25 325 2,055 7,000 75 15 15,770 666,203 During February 20X2, Davis Consulting completed the following transactions: LON Feb 1 Completed a consulting engagement and received cash of $8,500. 1 Davis Consulting wants to expand operations but needs to borrow $300,000 to accomplish this goal. Davis consults with the bank and secures a 10%, five-year note on February 1, 20x2. Davis must pay the bank principal in five equal principal installments plus interest annually on February 1 for the next five years. 1 Davis Consulting, Inc. incorporated end of January 20x2. Mr. Davis used the balance in his owner's equity account to purchase his corporate stock. Hint: to show this purchase of Mr. Davis's 20,000 shares of $1 PV common stock, you need to debit owner's equity for the appropriate balance as of January 31, 20x2 and credit common stock and paid-in capital in excess of par. 1 The company wants to raise additional capital for the planned business expansion by issuing 20,000 additional $1 par value common shares for $40,000 and by issuing 3,000, 6%, $80 par preferred shares at $100 per share. Total common shares authorized is 100,000 and total preferred shares authorized is 10,000. 2 Purchased office supplies on account $600. 9 Purchased 60 units software inventory on account from Mraz Co., $1,500 (including freight). 12 Paid utilities expenses of $325 for the month, ck 211. 12 Sold 50 software units on account to James Williams, $4,500. 19 Consulted with a client, Joseph Smith, for a fee of $500 for cash. 19 Paid employee salaries, $2,055, ck 212. Hint: Watch how much is expensed for February and was already expensed in January. 22 Paid on account $7,000, ck 213. 22 Received telephone bill and paid for $300, ck 214. 1 23 Collected $3,000 on account. 26 Sold 150 units software for cash for $13,125. 27 Purchased 40 units software inventory on account from Mraz Co., $1,000 At February 28, 20X2, the business gathers the following information for the adjusting entries: a) Accrued salaries expense $587.14. b) Office supplies on hand, $125. c) Expiration of prepaid rent $475. d) Earned balance of Unearned revenue. e) Davis has decided to adjust the useful lives for the equipment purchased 12/3/X1 for $2,700 (a computer) and the office furniture purchased 12/4/X1 for $3,900. After consideration, the computer is estimated to last three (3) years instead of the original five (5) and have a salvage value of $50. The furniture is estimated to last ten (10) years and have a salvage value of $20. Calculate the amount of depreciation expense for each for the month ended February 28, 20X2 assuming the company uses the double-declining-balance method for the computer and the straight-line method for the office furniture