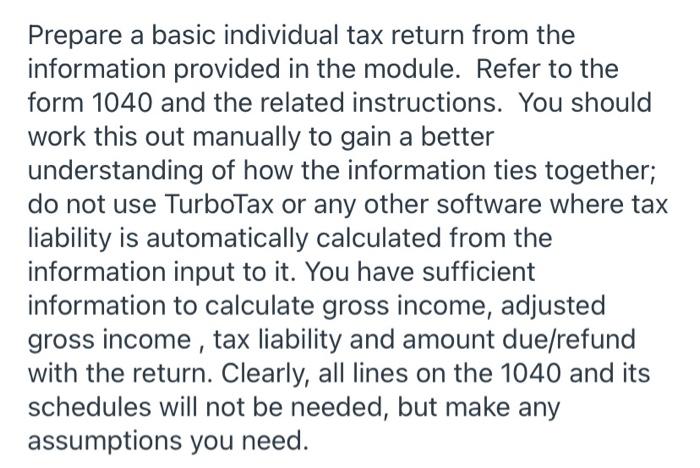

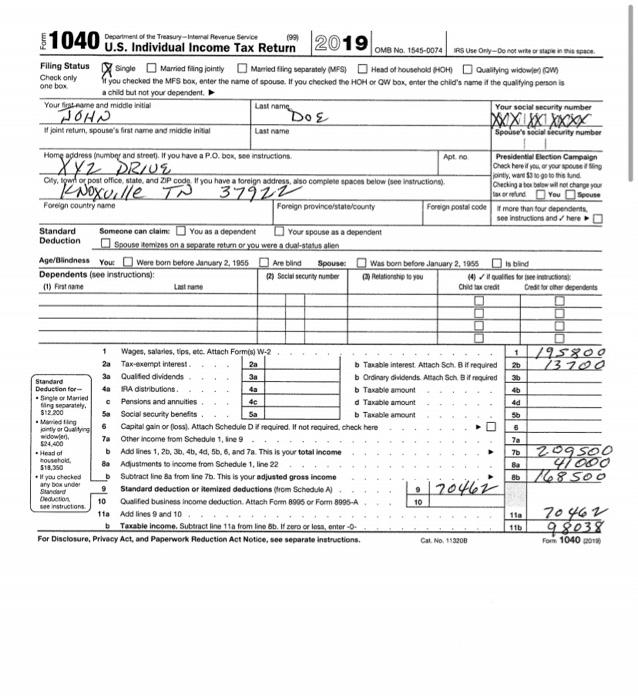

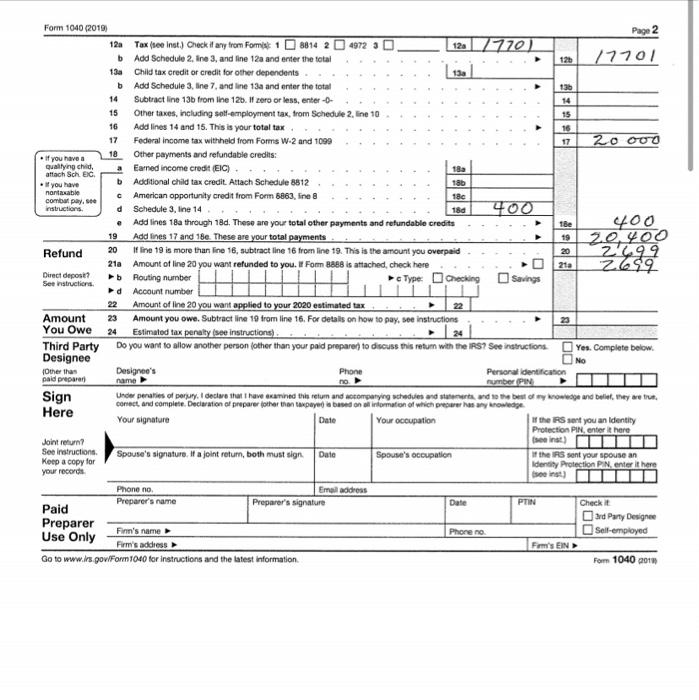

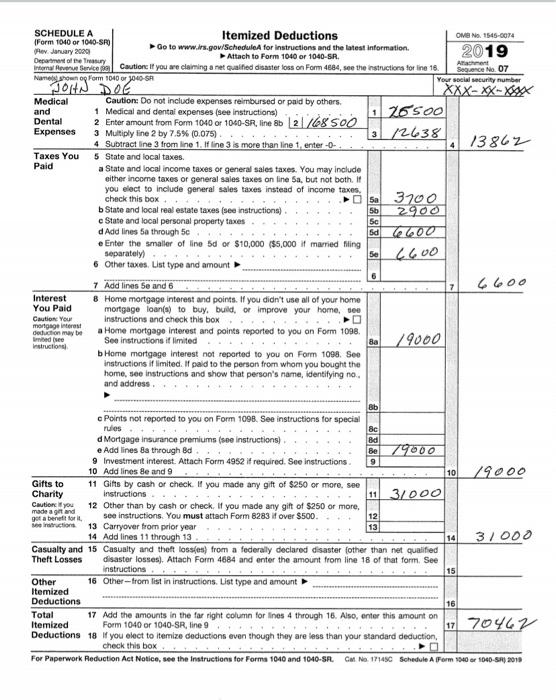

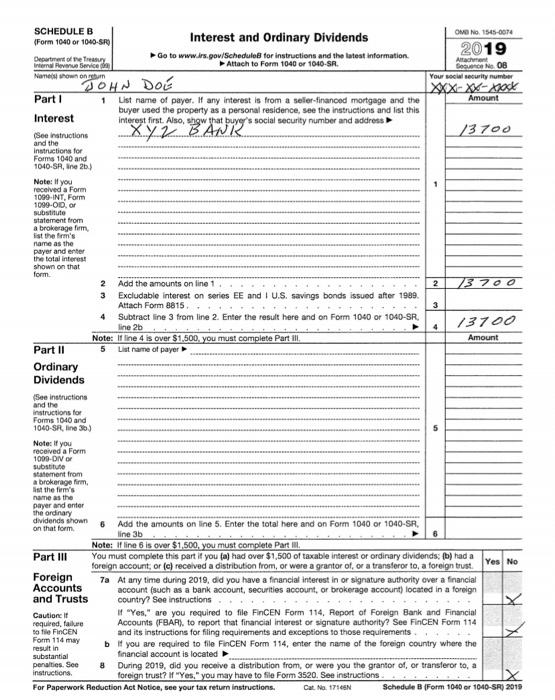

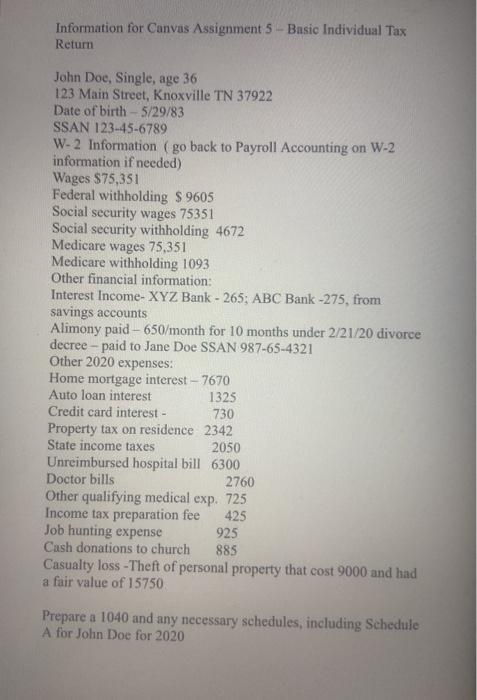

Prepare a basic individual tax return from the information provided in the module. Refer to the form 1040 and the related instructions. You should work this out manually to gain a better understanding of how the information ties together; do not use TurboTax or any other software where tax liability is automatically calculated from the information input to it. You have sufficient information to calculate gross income, adjusted gross income, tax liability and amount due/refund with the return. Clearly, all lines on the 1040 and its schedules will not be needed, but make any assumptions you need. Department of the Treasury - Revenue Service 1040 1991 U.S. Individual Income Tax Return 2019 OMB No 1545-0074 R Use Only-Do not writerapi Filling Status Single Married fing jointly Marled fling separately Me Head of household OH Qualiting women com Check only St you checked the MFS tok, enter the name of spouse. If you checked the HOH O GW box, enter the child's name it the qualifying person is one box a child but not your dependent Your first name and middle initial Last name Your social security number JOHN Doe XXXXXXXX of joint return, spouse's first name and midde initial Last name Spouse's social security number Xy2 DRAUE "Knoxville TN 37922 Home address number and street. If you have a P.O.box, so instructions Apt. President Election Campaign Check here you, your vering Hanty, ward $3 to go to this tund City. Egal or post office, state, and ZIP code, you have a foreign address, so complete spaced below (see natructional Cracking te bow will not change you korund You Spouse Foreign country name Foreign province/statcounty Foreign postal code more than four dependents son instructions and / here Standard Someone can claim You as a dependent Your spouse as a dependent Deduction Spouse temizes on a separate return or you were a dual-status alien Age/Bindness you were born before January 2, 1955 Are bilind Spouse was born before January 2, 1955 is blind Dependents (see instructions): (2) Social security unter Relation to you (4) liste (1) Feste Lane Chid acred Cest for her dependents O 1 Wages, salaries, tips, etc. Attach Forms) W.2 1 295800 2a Tax-exempt interest 2a b Taxable interest Attach Sch. Bif required 25 23 700 30 3a Qualified dividends Standard 3b b Ordinary Guidends Attach Sch if required Deduction for 4 FA distributions b Taxable amount Segle or Married ting wately Pensions and annuities 4c 4d Taxable amount $12.200 56 Social security benefits Sa Taxable amount . Married ling tyruality 6 Capital gain or loss). Attach Schedule Dt required. If not required, check here 5 widowed). 7a 7a Other income from Schedule 1 Ine 9 24400 Head of Add lines 1, 2, 36, 46, 4, 5, 6, and 7a. This is your total income 7b 209 Son householt. 8a Adustments to income from Schedule 1, line 22 88 47000 +ity Subtract line sa from ine 70. This is your adjusted gross income Bb 768 SOO any bond Standard 9 Standard deduction or itemized deductions from Schedule 20161 Deduction 10 Qualified business income deduction. Attach Form 8905 or Form 8996-A 10 Instructions 1ta Add lines and 10 70462 b Taxable income. Subtract line 11a from line 6b. 1 zero or loss, enter- 111 9.8038 For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, se separate instructions, Cat No. 113200 For 104001 $18.30 you checked 12 14 15 17 instructions, Be Form 1040 (2019 Page 2 120 Tax (see Inst) Check it any trom Formist 18814 2 4972 120/7701 Add Schedule 2. Iine 3, and Ine 12 and enter the total 17701 130 Child tax credit or credit for other dependents 130 Add Schedule 3, line 7, and line 13a and enter the total 136 14 Subtract line 136 from Ine 12b. If zero or less, enter -- 15 Other taxes, including self-employment tax, from Schedule 2 line 10 16 Add lines 14 and 15. This is your total tax 15 17 Federal income tax withheld from Forms W-2 and 1099 20 000 . if you have a 18 Other payments and refundable credits: Qualitying child a Earned income credit (EIC) 18a attach Sch. EIC if you have Additional child tax credit. Attach Schedule 8812 180 nantaxable c American opportunity credit from Form 6863, line 8 186 combat pay, se d Schedule 3, line 14 180 400 Add lines 18a through 18d. These are your total other payments and refundable credits 400 19 Add lines 17 and 16e. These are your total payments 19 20.400 Refund 20 If line 19 is more than line 16, subtract line 16 from line 19. This is the amount you overpeid 20 2499 218 Amount of line 20 you want refunded to you. Form 8888 is attached, check here D 218 2659 Direct depost? Routing number See instructions Type: Checking Savings d Account number 22 Amount of line 20 you want applied to your 2020 estimated tax 22 Amount 23 Amount you owe. Subtract line 19 from line 16. For details on how to pay. See instructions You Owe 24 Estimated tax penalty see instructions) Third Party Do you want to allow another person fother than your paid prepared to discuss this return with the RS? Soe instructions Yes. Complete below. Designee No Other than Designee's Phone Personal Identification paid preparar name sumber (PIN Sign and to of my knowledge and befint. They are fit contact and complete. Declaration of prepare the then tarpeell based on oil information of which prerer has any owledge Here Your signature Date Your occupation If the Set you an identity Protection PIN enter there Joint reum? See Instructions Spouse's signature. If a joint return, both must sign Date Spouse's occupation the IRS sont your spouse an Keep a copy for Identity Protection PIN enter there your records Ise) Phone no Email address Preparer's name Preparer's signature Date PTIN Paid Check it Preparer and Party Designee Finn's name Use Only Phone no Self-employed Firm's address Firm's EIN Go to www.rs powForm 1040 for instructions and the latest information Form 1040 201 00 | 21/68500 Sa SCHEDULE A Itemized Deductions O No. 1545-0074 Form 1040 or 1040-SRO Hey, January 2020 Go to www.ins.gov/Schedule for instructions and the latest Information. Department of the Tury 2019 Attach to Form 1040 or 1040-SR. A Intem outre Serice a Cautione If you are claiming a net Qualified disaster foss on Form 4884, see the instructions for line 18. Segance No 07 Naniely Snown op Form 1040 or 3040-SR Your social security number JOHN DOE XXX-XX-XS Medical Caution: Do not include expenses reimbursed or paid by others. and 1 Medical and dental expenses (see instructions) 12osoo Dental Expenses 3 Multiply line 2 by 7.5% (0.075) 13 12638 4 Subtract line 3 from line 1. If line 3 is more than line 1. enter- 13862 Taxes You 5 State and local taxes. Paid a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5a, but not both. If you elect to include general sales taxes instead of income taxes, check this box 3700 b State and local real estate taxes (see instructions) 5b 2900 e State and local personal property taxes 5c d Add lines 5 through 5c 5d 600 e Enter the smaller of line 5d of $10,000 $5,000 if married filing separately) 5e 6600 6 Other taxes. List type and amount 6 7 Add lines Se and 6 6600 7 Interest 8 Home mortgage Interest and points. If you didn't use all of your home You Paid mortgage loan(s) to buy, buld, or improve your home. tee CautionYou Instructions and check this box delle con may be a Home mortgage Interest and points reported to you on Form 1098 ribed see See instructions if limited Instructions 80 /9000 Home mortgage Interest not reported to you on Form 1098. See instructions if limited. If paid to the person from whom you bought the home, see instructions and show that person's name, identifying no.. and address Be 9 11 Bb c Points not reported to you on Form 1098. See instructions for special rules 8c d Mortgage Insurance premiums (see instructions) 8d e Add lines Ba through d 79000 9 Investment interest. Attach Form 4952 if required. See Instructions 10 Add lines de and 9 10 79000 Gifts to 11 Gifts by cash or check. If you made any gift of $250 or more, see Charity Instructions 3/ 000 Caution you 12 Other than by cash or check. If you made any gift of $250 or more. made a grand got a benefit see instructions. You must attach Form 8283 it over $500. 12 section 13 Carryover from prior year 14 Add lines 11 through 13 3/ 000 Casualty and 15 Casualty and theft loss(es) from a federally declared disaster (other than net qualified Theft Losses disaster losses). Attach Form 4684 and enter the amount from line 18 of that form. See Instructions 15 Other 16 Other-from list in instructions. List type and amount Itemized Deductions 16 Total 17 Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on Itemized Form 1040 or 1040-SR, line 9 Deductions 18 if you obect to temize deductions even though they are less than your standard deduction, check this box For Paperwork Reduction Act Notice, see the instructions for Forma 1010 and 1040-SR. Gal No. 171450 Schedule A Form 1040 1040-SA) 2013 14 17 70447 form SCHEDULEB OM No 1545-0074 (Form 1040 or 1040 SF Interest and Ordinary Dividends 2019 Department of Tray Go to www.lrs.gov/Schedule for instructions and the latest Information Internal Revenue Service Attach to Form 1040 or 1040-SR. Altachment BONOB Name own onun Your social security number JOHN DOE XXX-XX-track Part 1 1 List name of payer. If any interest is from a seller-financed mortgage and the Amount buyer used the property as a personal residence, see the instructions and list this Interest interest first. Also, show that buyg's social security number and address . X.72 BANK (See Instructions 13700 and the Instructions for Forms 1040 and 1040-SR, are 2b.) Note: If you received a Form 1099-INT, Form 1010-0D, or substitute statement from a brokerage from ist the firm's name as the payer and enter the total interest shown on that 2 Add the amounts on line 1 2 13 700 3 Excludable interest on series EE and I U.S. savings bonds issued after 1989 Attach Form 8815 3 Subtract line 3 from line 2. Enter the result here and on Form 1040 or 1040-SR line 25 4 13700 Note: If line 4 is over $1,500, you must complete Partill Amount Part II 5 Listame of payer Ordinary Dividends (See Instructions and the instructions for Forms 1040 and 1040-SR line 30) Note: If you received a Form 1000-DIVO substitute statement from name as the il the fum's payer and enter the ordinary dividends shown on that form Add the amounts on line 5. Enter the total here and on Form 1040 or 1040-SR, line 3b Note: If line 6 is over $1,500, you must complete Part til Part III You must complete this part if you (a) had over $1,500 of taxable interest or ordinary dividends. (b) had a foreign account, or (c) received a distribution from, or were a grantor of, or a transferorto, a foreign trust Yes No Foreign 7a At any time during 2019, did you have a financial interest in or signature authority over a financial Accounts account (such as a bank account, securities account, or brokerage account) located in a foreign and Trusts country? See instructions.. X Cautionet I "Yes" are you required to file FinCEN Form 114. Report of Foreign Bank and Financial required, failure Accounts (FBAR), to report that financial interest or signature authority? See FinCEN Form 114 sofie FINCEN and its instructions for filing requirements and exceptions to those requirements Form 114 may bif you are required to file FinCEN Form 114, enter the name of the foreign country where the result in substantial financial account is located penalties. See 8 During 2019, did you receive a distribution from, or were you the grantor of, or transferorto, a instructions, foreign trust? "Yes, you may have to file Form 3520. See instructions For Paperwork Reduction Act Notice, see your tax return instructions. Cat No. 171 Schedule B Form 1040 or 1040-SR) 2019 Acrokerage from Information for Canvas Assignment 5 - Basic Individual Tax Return John Doe, Single, age 36 123 Main Street, Knoxville TN 37922 Date of birth - 5/29/83 SSAN 123-45-6789 W-2 Information ( go back to Payroll Accounting on W-2 information if needed) Wages $75,351 Federal withholding $ 9605 Social security wages 75351 Social security withholding 4672 Medicare wages 75,351 Medicare withholding 1093 Other financial information: Interest Income- XYZ Bank - 265; ABC Bank -275, from savings accounts Alimony paid - 650/month for 10 months under 2/21/20 divorce decree - paid to Jane Doe SSAN 987-65-4321 Other 2020 expenses: Home mortgage interest - 7670 Auto loan interest 1325 Credit card interest - 730 Property tax on residence 2342 State income taxes 2050 Unreimbursed hospital bill 6300 Doctor bills 2760 Other qualifying medical exp. 725 Income tax preparation fee 425 Job hunting expense 925 Cash donations to church 885 Casualty loss -Theft of personal property that cost 9000 and had a fair value of 15750 Prepare a 1040 and any necessary schedules, including Schedule A for John Doe for 2020 Prepare a basic individual tax return from the information provided in the module. Refer to the form 1040 and the related instructions. You should work this out manually to gain a better understanding of how the information ties together; do not use TurboTax or any other software where tax liability is automatically calculated from the information input to it. You have sufficient information to calculate gross income, adjusted gross income, tax liability and amount due/refund with the return. Clearly, all lines on the 1040 and its schedules will not be needed, but make any assumptions you need. Department of the Treasury - Revenue Service 1040 1991 U.S. Individual Income Tax Return 2019 OMB No 1545-0074 R Use Only-Do not writerapi Filling Status Single Married fing jointly Marled fling separately Me Head of household OH Qualiting women com Check only St you checked the MFS tok, enter the name of spouse. If you checked the HOH O GW box, enter the child's name it the qualifying person is one box a child but not your dependent Your first name and middle initial Last name Your social security number JOHN Doe XXXXXXXX of joint return, spouse's first name and midde initial Last name Spouse's social security number Xy2 DRAUE "Knoxville TN 37922 Home address number and street. If you have a P.O.box, so instructions Apt. President Election Campaign Check here you, your vering Hanty, ward $3 to go to this tund City. Egal or post office, state, and ZIP code, you have a foreign address, so complete spaced below (see natructional Cracking te bow will not change you korund You Spouse Foreign country name Foreign province/statcounty Foreign postal code more than four dependents son instructions and / here Standard Someone can claim You as a dependent Your spouse as a dependent Deduction Spouse temizes on a separate return or you were a dual-status alien Age/Bindness you were born before January 2, 1955 Are bilind Spouse was born before January 2, 1955 is blind Dependents (see instructions): (2) Social security unter Relation to you (4) liste (1) Feste Lane Chid acred Cest for her dependents O 1 Wages, salaries, tips, etc. Attach Forms) W.2 1 295800 2a Tax-exempt interest 2a b Taxable interest Attach Sch. Bif required 25 23 700 30 3a Qualified dividends Standard 3b b Ordinary Guidends Attach Sch if required Deduction for 4 FA distributions b Taxable amount Segle or Married ting wately Pensions and annuities 4c 4d Taxable amount $12.200 56 Social security benefits Sa Taxable amount . Married ling tyruality 6 Capital gain or loss). Attach Schedule Dt required. If not required, check here 5 widowed). 7a 7a Other income from Schedule 1 Ine 9 24400 Head of Add lines 1, 2, 36, 46, 4, 5, 6, and 7a. This is your total income 7b 209 Son householt. 8a Adustments to income from Schedule 1, line 22 88 47000 +ity Subtract line sa from ine 70. This is your adjusted gross income Bb 768 SOO any bond Standard 9 Standard deduction or itemized deductions from Schedule 20161 Deduction 10 Qualified business income deduction. Attach Form 8905 or Form 8996-A 10 Instructions 1ta Add lines and 10 70462 b Taxable income. Subtract line 11a from line 6b. 1 zero or loss, enter- 111 9.8038 For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, se separate instructions, Cat No. 113200 For 104001 $18.30 you checked 12 14 15 17 instructions, Be Form 1040 (2019 Page 2 120 Tax (see Inst) Check it any trom Formist 18814 2 4972 120/7701 Add Schedule 2. Iine 3, and Ine 12 and enter the total 17701 130 Child tax credit or credit for other dependents 130 Add Schedule 3, line 7, and line 13a and enter the total 136 14 Subtract line 136 from Ine 12b. If zero or less, enter -- 15 Other taxes, including self-employment tax, from Schedule 2 line 10 16 Add lines 14 and 15. This is your total tax 15 17 Federal income tax withheld from Forms W-2 and 1099 20 000 . if you have a 18 Other payments and refundable credits: Qualitying child a Earned income credit (EIC) 18a attach Sch. EIC if you have Additional child tax credit. Attach Schedule 8812 180 nantaxable c American opportunity credit from Form 6863, line 8 186 combat pay, se d Schedule 3, line 14 180 400 Add lines 18a through 18d. These are your total other payments and refundable credits 400 19 Add lines 17 and 16e. These are your total payments 19 20.400 Refund 20 If line 19 is more than line 16, subtract line 16 from line 19. This is the amount you overpeid 20 2499 218 Amount of line 20 you want refunded to you. Form 8888 is attached, check here D 218 2659 Direct depost? Routing number See instructions Type: Checking Savings d Account number 22 Amount of line 20 you want applied to your 2020 estimated tax 22 Amount 23 Amount you owe. Subtract line 19 from line 16. For details on how to pay. See instructions You Owe 24 Estimated tax penalty see instructions) Third Party Do you want to allow another person fother than your paid prepared to discuss this return with the RS? Soe instructions Yes. Complete below. Designee No Other than Designee's Phone Personal Identification paid preparar name sumber (PIN Sign and to of my knowledge and befint. They are fit contact and complete. Declaration of prepare the then tarpeell based on oil information of which prerer has any owledge Here Your signature Date Your occupation If the Set you an identity Protection PIN enter there Joint reum? See Instructions Spouse's signature. If a joint return, both must sign Date Spouse's occupation the IRS sont your spouse an Keep a copy for Identity Protection PIN enter there your records Ise) Phone no Email address Preparer's name Preparer's signature Date PTIN Paid Check it Preparer and Party Designee Finn's name Use Only Phone no Self-employed Firm's address Firm's EIN Go to www.rs powForm 1040 for instructions and the latest information Form 1040 201 00 | 21/68500 Sa SCHEDULE A Itemized Deductions O No. 1545-0074 Form 1040 or 1040-SRO Hey, January 2020 Go to www.ins.gov/Schedule for instructions and the latest Information. Department of the Tury 2019 Attach to Form 1040 or 1040-SR. A Intem outre Serice a Cautione If you are claiming a net Qualified disaster foss on Form 4884, see the instructions for line 18. Segance No 07 Naniely Snown op Form 1040 or 3040-SR Your social security number JOHN DOE XXX-XX-XS Medical Caution: Do not include expenses reimbursed or paid by others. and 1 Medical and dental expenses (see instructions) 12osoo Dental Expenses 3 Multiply line 2 by 7.5% (0.075) 13 12638 4 Subtract line 3 from line 1. If line 3 is more than line 1. enter- 13862 Taxes You 5 State and local taxes. Paid a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5a, but not both. If you elect to include general sales taxes instead of income taxes, check this box 3700 b State and local real estate taxes (see instructions) 5b 2900 e State and local personal property taxes 5c d Add lines 5 through 5c 5d 600 e Enter the smaller of line 5d of $10,000 $5,000 if married filing separately) 5e 6600 6 Other taxes. List type and amount 6 7 Add lines Se and 6 6600 7 Interest 8 Home mortgage Interest and points. If you didn't use all of your home You Paid mortgage loan(s) to buy, buld, or improve your home. tee CautionYou Instructions and check this box delle con may be a Home mortgage Interest and points reported to you on Form 1098 ribed see See instructions if limited Instructions 80 /9000 Home mortgage Interest not reported to you on Form 1098. See instructions if limited. If paid to the person from whom you bought the home, see instructions and show that person's name, identifying no.. and address Be 9 11 Bb c Points not reported to you on Form 1098. See instructions for special rules 8c d Mortgage Insurance premiums (see instructions) 8d e Add lines Ba through d 79000 9 Investment interest. Attach Form 4952 if required. See Instructions 10 Add lines de and 9 10 79000 Gifts to 11 Gifts by cash or check. If you made any gift of $250 or more, see Charity Instructions 3/ 000 Caution you 12 Other than by cash or check. If you made any gift of $250 or more. made a grand got a benefit see instructions. You must attach Form 8283 it over $500. 12 section 13 Carryover from prior year 14 Add lines 11 through 13 3/ 000 Casualty and 15 Casualty and theft loss(es) from a federally declared disaster (other than net qualified Theft Losses disaster losses). Attach Form 4684 and enter the amount from line 18 of that form. See Instructions 15 Other 16 Other-from list in instructions. List type and amount Itemized Deductions 16 Total 17 Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on Itemized Form 1040 or 1040-SR, line 9 Deductions 18 if you obect to temize deductions even though they are less than your standard deduction, check this box For Paperwork Reduction Act Notice, see the instructions for Forma 1010 and 1040-SR. Gal No. 171450 Schedule A Form 1040 1040-SA) 2013 14 17 70447 form SCHEDULEB OM No 1545-0074 (Form 1040 or 1040 SF Interest and Ordinary Dividends 2019 Department of Tray Go to www.lrs.gov/Schedule for instructions and the latest Information Internal Revenue Service Attach to Form 1040 or 1040-SR. Altachment BONOB Name own onun Your social security number JOHN DOE XXX-XX-track Part 1 1 List name of payer. If any interest is from a seller-financed mortgage and the Amount buyer used the property as a personal residence, see the instructions and list this Interest interest first. Also, show that buyg's social security number and address . X.72 BANK (See Instructions 13700 and the Instructions for Forms 1040 and 1040-SR, are 2b.) Note: If you received a Form 1099-INT, Form 1010-0D, or substitute statement from a brokerage from ist the firm's name as the payer and enter the total interest shown on that 2 Add the amounts on line 1 2 13 700 3 Excludable interest on series EE and I U.S. savings bonds issued after 1989 Attach Form 8815 3 Subtract line 3 from line 2. Enter the result here and on Form 1040 or 1040-SR line 25 4 13700 Note: If line 4 is over $1,500, you must complete Partill Amount Part II 5 Listame of payer Ordinary Dividends (See Instructions and the instructions for Forms 1040 and 1040-SR line 30) Note: If you received a Form 1000-DIVO substitute statement from name as the il the fum's payer and enter the ordinary dividends shown on that form Add the amounts on line 5. Enter the total here and on Form 1040 or 1040-SR, line 3b Note: If line 6 is over $1,500, you must complete Part til Part III You must complete this part if you (a) had over $1,500 of taxable interest or ordinary dividends. (b) had a foreign account, or (c) received a distribution from, or were a grantor of, or a transferorto, a foreign trust Yes No Foreign 7a At any time during 2019, did you have a financial interest in or signature authority over a financial Accounts account (such as a bank account, securities account, or brokerage account) located in a foreign and Trusts country? See instructions.. X Cautionet I "Yes" are you required to file FinCEN Form 114. Report of Foreign Bank and Financial required, failure Accounts (FBAR), to report that financial interest or signature authority? See FinCEN Form 114 sofie FINCEN and its instructions for filing requirements and exceptions to those requirements Form 114 may bif you are required to file FinCEN Form 114, enter the name of the foreign country where the result in substantial financial account is located penalties. See 8 During 2019, did you receive a distribution from, or were you the grantor of, or transferorto, a instructions, foreign trust? "Yes, you may have to file Form 3520. See instructions For Paperwork Reduction Act Notice, see your tax return instructions. Cat No. 171 Schedule B Form 1040 or 1040-SR) 2019 Acrokerage from Information for Canvas Assignment 5 - Basic Individual Tax Return John Doe, Single, age 36 123 Main Street, Knoxville TN 37922 Date of birth - 5/29/83 SSAN 123-45-6789 W-2 Information ( go back to Payroll Accounting on W-2 information if needed) Wages $75,351 Federal withholding $ 9605 Social security wages 75351 Social security withholding 4672 Medicare wages 75,351 Medicare withholding 1093 Other financial information: Interest Income- XYZ Bank - 265; ABC Bank -275, from savings accounts Alimony paid - 650/month for 10 months under 2/21/20 divorce decree - paid to Jane Doe SSAN 987-65-4321 Other 2020 expenses: Home mortgage interest - 7670 Auto loan interest 1325 Credit card interest - 730 Property tax on residence 2342 State income taxes 2050 Unreimbursed hospital bill 6300 Doctor bills 2760 Other qualifying medical exp. 725 Income tax preparation fee 425 Job hunting expense 925 Cash donations to church 885 Casualty loss -Theft of personal property that cost 9000 and had a fair value of 15750 Prepare a 1040 and any necessary schedules, including Schedule A for John Doe for 2020