Question

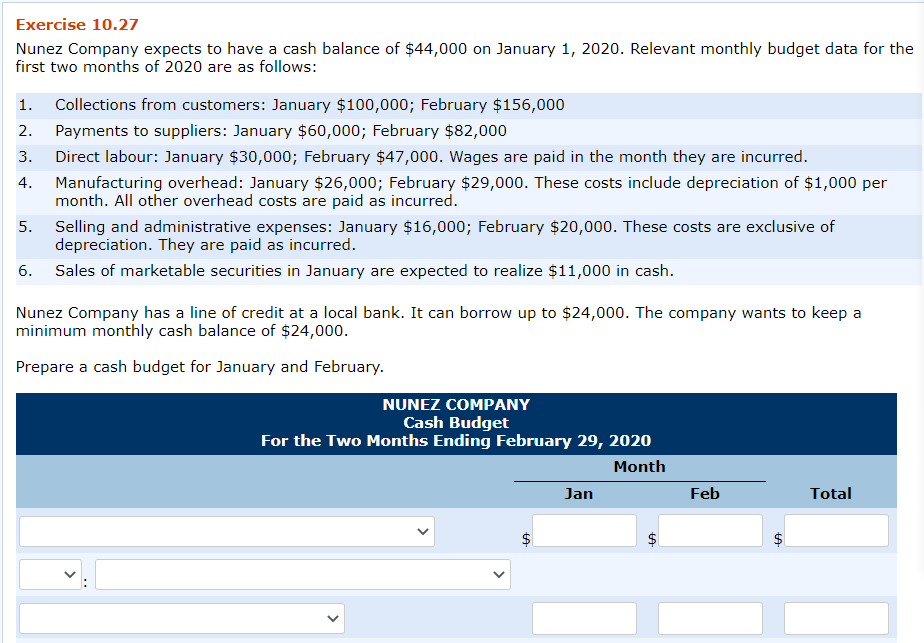

Prepare a cash budget for January and February. NUNEZ COMPANY Cash Budget For the Two Months Ending February 29, 2020 Month Jan Feb Total Total

Prepare a cash budget for January and February.

Prepare a cash budget for January and February.

| NUNEZ COMPANY Cash Budget For the Two Months Ending February 29, 2020 | |||||||

| Month | |||||||

| Jan | Feb | Total | |||||

| Total Available CashExcess of Available Cash Over Cash DisbursementsDisbursementsEnding Cash BalanceTotal DisbursementsBeginning Cash BalanceFinancingCash ReceiptsTotal ReceiptsTotal Financing | $ | $ | $ | ||||

| AddLess :Cash ReceiptsBeginning Cash BalanceExcess of Available Cash Over Cash DisbursementsTotal FinancingFinancingEnding Cash BalanceTotal ReceiptsTotal Available Cash | |||||||

| Selling And Administrative Expenses Collection Of Notes Receivable Repayment Sale Of Marketable Securities Direct Materials Purchase Of Land Direct Labour Manufacturing Overhead Collection From Customers Income Tax Expense Borrowing | |||||||

| Direct Materials Direct Labour Selling And Administrative Expenses Collection From Customers Manufacturing Overhead Income Tax Expense Purchase Of Land Repayment Collection Of Notes Receivable Sale Of Marketable Securities Borrowing | |||||||

| Total Available Cash Total Receipts Beginning Cash Balance Disbursements Total Financing Cash Receipts Excess of Available Cash Over Cash Disbursements Financing Ending Cash Balance Total Disbursements | |||||||

| Total Available CashExcess of Available Cash Over Cash DisbursementsTotal DisbursementsTotal ReceiptsEnding Cash BalanceDisbursementsFinancingBeginning Cash BalanceCash ReceiptsTotal Financing | |||||||

| AddLess :Total Available CashExcess of Available Cash Over Cash DisbursementsTotal DisbursementsTotal FinancingBeginning Cash BalanceEnding Cash BalanceDisbursementsFinancing | |||||||

| Repayment Sale Of Marketable Securities Collection From Customers Direct Materials Selling And Administrative Expenses Direct Labour Collection Of Notes Receivable Manufacturing Overhead Income Tax Expense Borrowing Purchase Of Land | |||||||

| Collection Of Notes Receivable Purchase Of Land Manufacturing Overhead Direct Materials Direct Labour Selling And Administrative Expenses Income Tax Expense Repayment Sale Of Marketable Securities Borrowing Collection From Customers | |||||||

| Collection Of Notes Receivable Sale Of Marketable Securities Direct Materials Selling And Administrative Expenses Repayment Manufacturing Overhead Income Tax Expense Purchase Of Land Direct Labour Borrowing Collection From Customers | |||||||

| Collection Of Notes Receivable Purchase Of Land Sale Of Marketable Securities Collection From Customers Direct Materials Borrowing Direct Labour Manufacturing Overhead Repayment Selling And Administrative Expenses Income Tax Expense | |||||||

| Total Financing Total Disbursements Excess of Available Cash Over Cash Disbursements Disbursements Financing Beginning Cash Balance Ending Cash Balance Total Available Cash | |||||||

| Ending Cash BalanceExcess of Available Cash Over Cash DisbursementsCash ReceiptsBeginning Cash BalanceDisbursementsTotal ReceiptsTotal Available CashFinancingTotal DisbursementsTotal Financing | |||||||

| FinancingTotal ReceiptsDisbursementsExcess of Available Cash Over Cash DisbursementsTotal Available CashCash ReceiptsBeginning Cash BalanceEnding Cash BalanceTotal DisbursementsTotal Financing : | |||||||

| Purchase Of Land Selling And Administrative Expenses Collection Of Notes Receivable Direct Labour Repayment Sale Of Marketable Securities Direct Materials Manufacturing Overhead Income Tax Expense Borrowing Collection From Customers | |||||||

| Income Tax Expense Sale Of Marketable Securities Direct Materials Collection Of Notes Receivable Repayment Collection From Customers Selling And Administrative Expenses Borrowing Purchase Of Land Direct Labour Manufacturing Overhead | |||||||

| Cash Receipts Financing Total Disbursements Total Financing Total Receipts Total Available Cash Excess of Available Cash Over Cash Disbursements Beginning Cash Balance Ending Cash Balance Disbursements | |||||||

| Total DisbursementsTotal FinancingFinancingTotal Available CashTotal ReceiptsCash ReceiptsBeginning Cash BalanceExcess of Available Cash Over Cash DisbursementsDisbursementsEnding Cash Balance | $ | $ | $ | ||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started