Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare a Cash Budget showing the balance of cash at the end of each month and Comment briefly on the companys cash flow forecast and

Prepare a Cash Budget showing the balance of cash at the end of each month and Comment briefly on the companys cash flow forecast and suggest possible action to improve the company future cash flow.

Full explanation including formulas

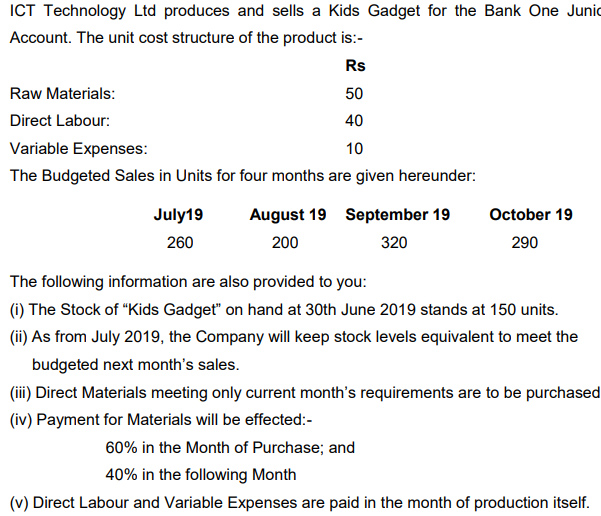

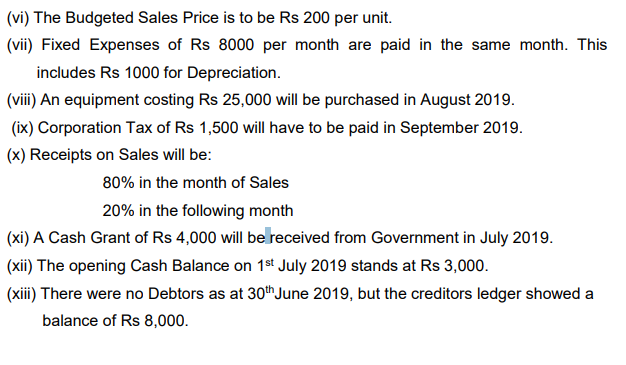

ICT Technology Ltd produces and sells a Kids Gadget for the Bank One Juni Account. The unit cost structure of the product is:- Rs Raw Materials: Direct Labour: 40 Variable Expenses: 10 The Budgeted Sales in Units for four months are given hereunder: 50 July19 260 August 19 September 19 200 320 October 19 290 The following information are also provided to you: (i) The Stock of Kids Gadget" on hand at 30th June 2019 stands at 150 units. (ii) As from July 2019, the Company will keep stock levels equivalent to meet the budgeted next month's sales. (ii) Direct Materials meeting only current month's requirements are to be purchased (iv) Payment for Materials will be effected:- 60% in the Month of Purchase; and 40% in the following Month (v) Direct Labour and Variable Expenses are paid in the month of production itself. (vi) The Budgeted Sales Price is to be Rs 200 per unit. (vii) Fixed Expenses of Rs 8000 per month are paid in the same month. This includes Rs 1000 for Depreciation. (viii) An equipment costing Rs 25,000 will be purchased in August 2019. (ix) Corporation Tax of Rs 1,500 will have to be paid in September 2019. (x) Receipts on Sales will be: 80% in the month of Sales 20% in the following month (xi) A Cash Grant of Rs 4,000 will be received from Government in July 2019. (xii) The opening Cash Balance on 1st July 2019 stands at Rs 3,000. (xiii) There were no Debtors as at 30th June 2019, but the creditors ledger showed a balance of Rs 8,000. ICT Technology Ltd produces and sells a Kids Gadget for the Bank One Juni Account. The unit cost structure of the product is:- Rs Raw Materials: Direct Labour: 40 Variable Expenses: 10 The Budgeted Sales in Units for four months are given hereunder: 50 July19 260 August 19 September 19 200 320 October 19 290 The following information are also provided to you: (i) The Stock of Kids Gadget" on hand at 30th June 2019 stands at 150 units. (ii) As from July 2019, the Company will keep stock levels equivalent to meet the budgeted next month's sales. (ii) Direct Materials meeting only current month's requirements are to be purchased (iv) Payment for Materials will be effected:- 60% in the Month of Purchase; and 40% in the following Month (v) Direct Labour and Variable Expenses are paid in the month of production itself. (vi) The Budgeted Sales Price is to be Rs 200 per unit. (vii) Fixed Expenses of Rs 8000 per month are paid in the same month. This includes Rs 1000 for Depreciation. (viii) An equipment costing Rs 25,000 will be purchased in August 2019. (ix) Corporation Tax of Rs 1,500 will have to be paid in September 2019. (x) Receipts on Sales will be: 80% in the month of Sales 20% in the following month (xi) A Cash Grant of Rs 4,000 will be received from Government in July 2019. (xii) The opening Cash Balance on 1st July 2019 stands at Rs 3,000. (xiii) There were no Debtors as at 30th June 2019, but the creditors ledger showed a balance of Rs 8,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started