Answered step by step

Verified Expert Solution

Question

1 Approved Answer

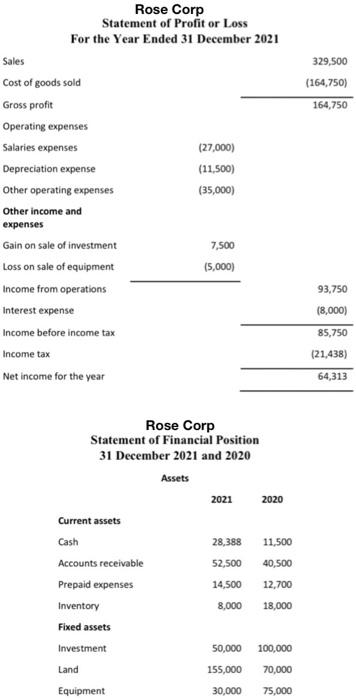

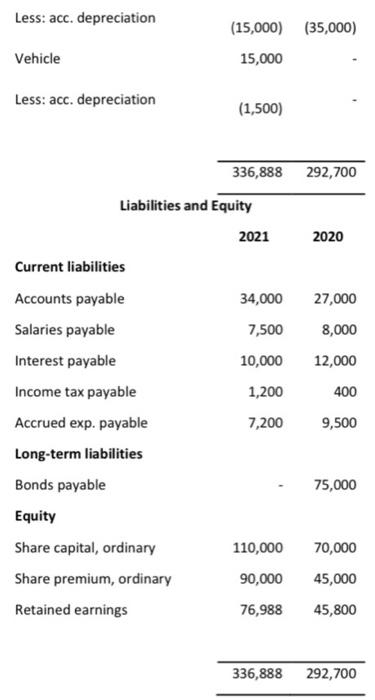

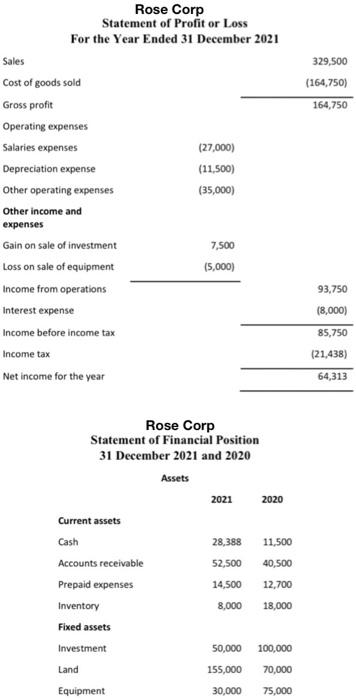

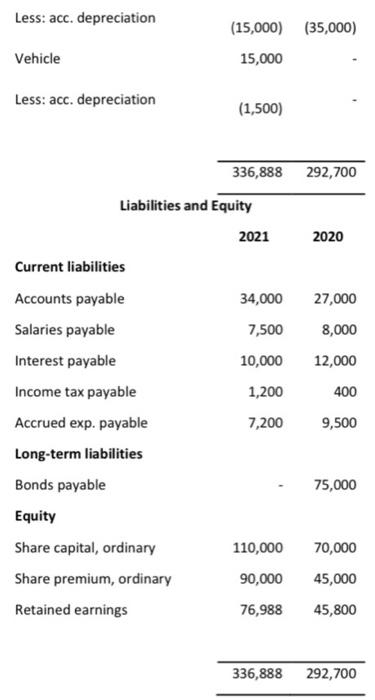

Prepare a cash flow statement for the financial year ending December 31, 2021. The company has prepared a profit and loss statement and a statement

Prepare a cash flow statement for the financial year ending December 31, 2021. The company has prepared a profit and loss statement and a statement of financial position as follows:

329,500 (164,750) 164,750 Rose Corp Statement of Profit or Loss For the Year Ended 31 December 2021 Sales Cost of goods sold Gross profit Operating expenses Salaries expenses (27,000) Depreciation expense (11,500) Other operating expenses (35,000) Other income and expenses Gain on sale of investment 7,500 Loss on sale of equipment (5,000) Income from operations Interest expense Income before income tax Income tax Net income for the year 93,750 (8,000) 85,750 (21,438) 64,313 Rose Corp Statement of Financial Position 31 December 2021 and 2020 Assets 2021 2020 Current assets Cash 28,388 11.500 Accounts receivable 52,500 40,500 Prepaid expenses 14.500 12,700 Inventory 8,000 18,000 Fixed assets Investment 50,000 100,000 Land 155,000 70,000 Equipment 30,000 75,000 Less: acc. depreciation (35,000) (15,000) 15,000 Vehicle Less: acc. depreciation (1,500) 292,700 2020 27,000 8,000 12,000 336,888 Liabilities and Equity 2021 Current liabilities Accounts payable 34,000 Salaries payable 7,500 Interest payable 10,000 Income tax payable 1,200 Accrued exp. payable 7,200 Long-term liabilities Bonds payable Equity Share capital, ordinary 110,000 Share premium, ordinary 90,000 Retained earnings 76,988 400 9,500 75,000 70,000 45,000 45,800 336,888 292,700

Additional information:

1. The decrease in investment and equipment was the result of cash sales. Likewise, vehicle purchases are also made in cash.

2. In August 2021, the company issues new shares to purchase new land.

3. Company pays cash dividend in October 2021

Instructions:

Prepare a cash flow statement for the financial year ended December 31, 2021, for the cash flow portion from operating activities, use the direct method!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started