Prepare a cash flow statement

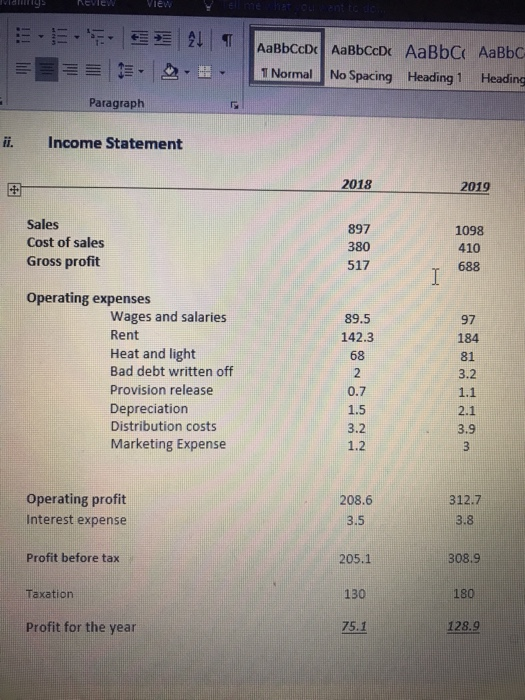

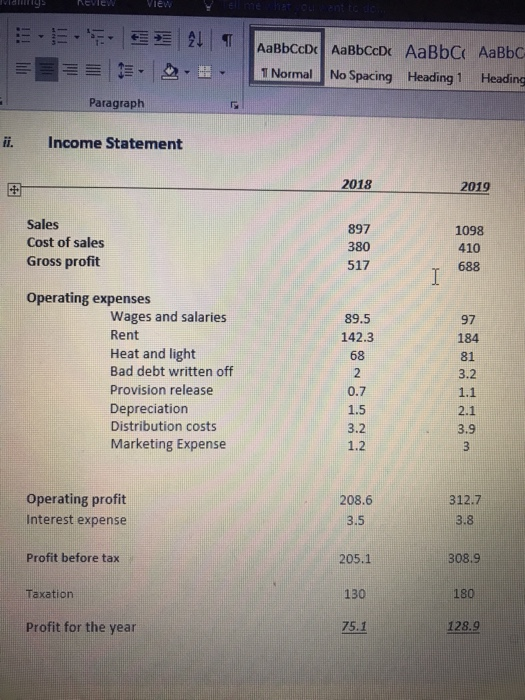

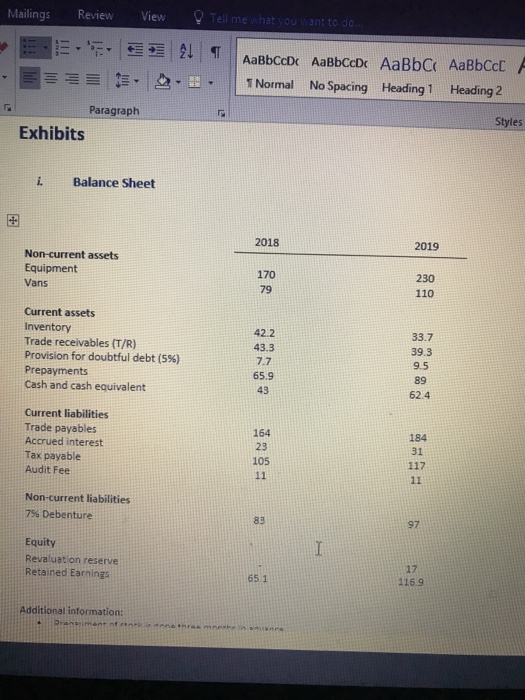

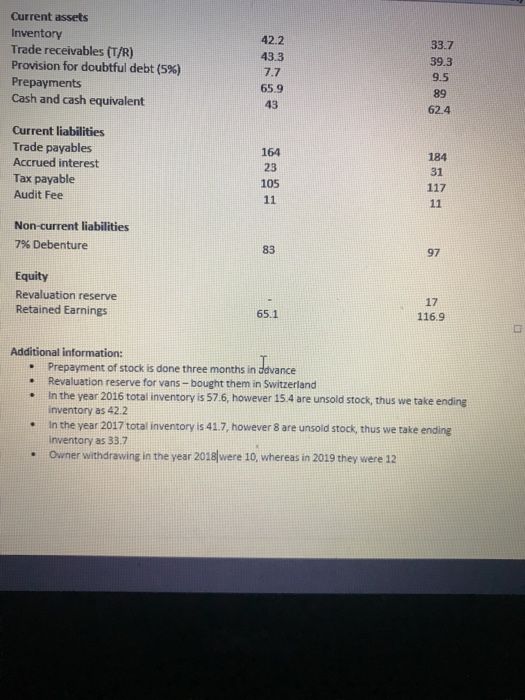

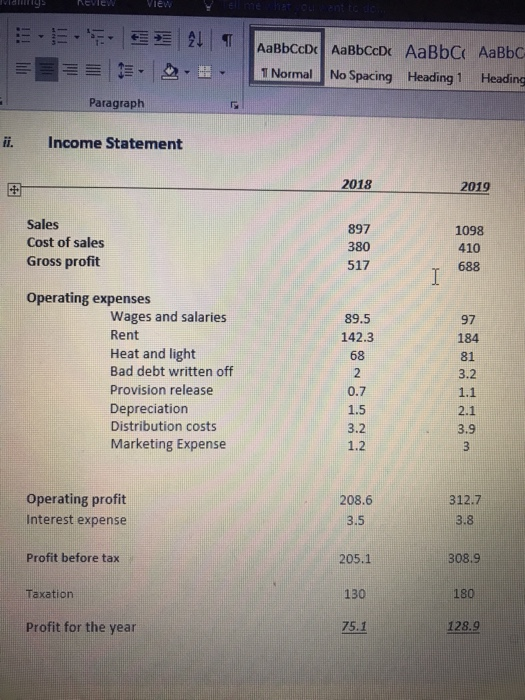

Jay REVIEW View BLUE Hatchentim E. 21 AaBCCD AaBbccDc AaBbc AaBbc 1 Normal No Spacing Heading 1 Heading Paragraph ii. Income Statement 2018 2019 Sales Cost of sales Gross profit 1098 410 688 89.5 142.3 Operating expenses Wages and salaries Rent Heat and light Bad debt written off Provision release Depreciation Distribution costs Marketing Expense Operating profit Interest expense 208.6 3.5 312.7 3.8 Profit before tax 205.1 308.9 Taxation 130 180 Profit for the year 75.1 128.9 Mailings Review View O Tell me what you want to do... 2 - E S - AaBbCcDc AaBbCcDc AaBbc AaBbc Normal No Spacing Heading 1 Heading 2 > - Paragraph Exhibits Styles i. Balance Sheet 2018 2019 Non-current assets Equipment Vans 170 230 110 Current assets Inventory Trade receivables (T/R) Provision for doubtful debt (5%) Prepayments Cash and cash equivalent 42.2 43.3 33.7 39.3 7.7 65.9 89 62.4 Current liabilities Trade payables Accrued interest Tax payable Audit Fee Non-current liabilities 7% Debenture Equity Revaluation reserve Retained Earnings 65.1 116.9 Additional information: Braniment nathramekoman Current assets Inventory Trade receivables (T/R) Provision for doubtful debt (5%) Prepayments Cash and cash equivalent 33.7 39.3 9.5 89 62.4 Current liabilities Trade payables Accrued interest Tax payable Audit Fee Non-current liabilities 7% Debenture Equity Revaluation reserve Retained Earnings 116.9 Additional information: Prepayment of stock is done three months in devance Revaluation reserve for vans-bought them in Switzerland In the year 2016 total inventory is 57.6, however 15.4 are unsold stock, thus we take ending inventory as 42.2 In the year 2017 total inventory is 41.7, however 8 are unsold stock, thus we take ending inventory as 33.7 Owner withdrawing in the year 2018 were 10, whereas in 2019 they were 12 Jay REVIEW View BLUE Hatchentim E. 21 AaBCCD AaBbccDc AaBbc AaBbc 1 Normal No Spacing Heading 1 Heading Paragraph ii. Income Statement 2018 2019 Sales Cost of sales Gross profit 1098 410 688 89.5 142.3 Operating expenses Wages and salaries Rent Heat and light Bad debt written off Provision release Depreciation Distribution costs Marketing Expense Operating profit Interest expense 208.6 3.5 312.7 3.8 Profit before tax 205.1 308.9 Taxation 130 180 Profit for the year 75.1 128.9 Mailings Review View O Tell me what you want to do... 2 - E S - AaBbCcDc AaBbCcDc AaBbc AaBbc Normal No Spacing Heading 1 Heading 2 > - Paragraph Exhibits Styles i. Balance Sheet 2018 2019 Non-current assets Equipment Vans 170 230 110 Current assets Inventory Trade receivables (T/R) Provision for doubtful debt (5%) Prepayments Cash and cash equivalent 42.2 43.3 33.7 39.3 7.7 65.9 89 62.4 Current liabilities Trade payables Accrued interest Tax payable Audit Fee Non-current liabilities 7% Debenture Equity Revaluation reserve Retained Earnings 65.1 116.9 Additional information: Braniment nathramekoman Current assets Inventory Trade receivables (T/R) Provision for doubtful debt (5%) Prepayments Cash and cash equivalent 33.7 39.3 9.5 89 62.4 Current liabilities Trade payables Accrued interest Tax payable Audit Fee Non-current liabilities 7% Debenture Equity Revaluation reserve Retained Earnings 116.9 Additional information: Prepayment of stock is done three months in devance Revaluation reserve for vans-bought them in Switzerland In the year 2016 total inventory is 57.6, however 15.4 are unsold stock, thus we take ending inventory as 42.2 In the year 2017 total inventory is 41.7, however 8 are unsold stock, thus we take ending inventory as 33.7 Owner withdrawing in the year 2018 were 10, whereas in 2019 they were 12