Answered step by step

Verified Expert Solution

Question

1 Approved Answer

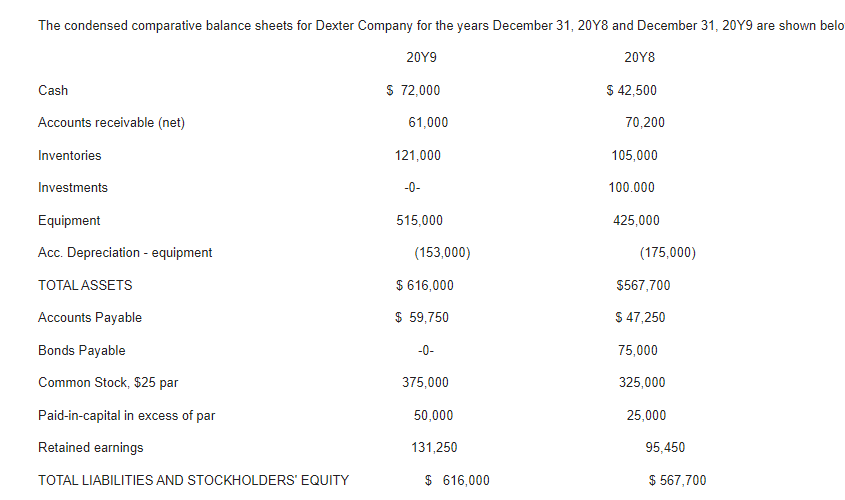

Prepare a cash flow The condensed comparative balance sheets for Dexter Company for the years December 31, 20Y8 and December 31,20Y9 are shown belo CashAccountsreceivable(net)InventoriesInvestmentsEquipmentAcc.Depreciation-equipmentTOTALASSETSAccountsPayableBondsPayableCommonStock,$25parPaid-in-capitalinexcessofparRetainedearningsTOTALLIABILITIESANDSTOCKHOLDERSEQUITY20Y9$72,00061,000121,0000515,000(153,000)$616,000$59,7500375,00050,000131,250$616,00020Y8$42,50070,200105,000100,000425,000(175,000)$567,700$47,25075,000325,00025,00095,450$567,700

Prepare a cash flow

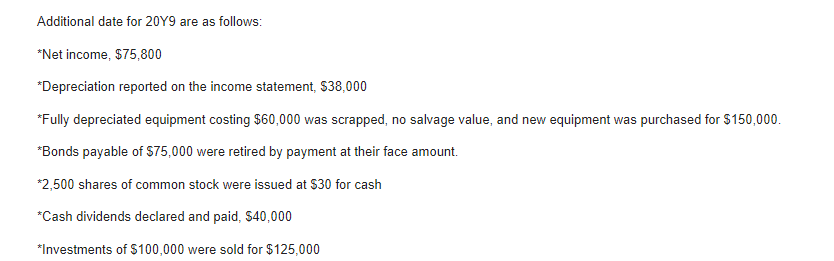

The condensed comparative balance sheets for Dexter Company for the years December 31, 20Y8 and December 31,20Y9 are shown belo CashAccountsreceivable(net)InventoriesInvestmentsEquipmentAcc.Depreciation-equipmentTOTALASSETSAccountsPayableBondsPayableCommonStock,$25parPaid-in-capitalinexcessofparRetainedearningsTOTALLIABILITIESANDSTOCKHOLDERSEQUITY20Y9$72,00061,000121,0000515,000(153,000)$616,000$59,7500375,00050,000131,250$616,00020Y8$42,50070,200105,000100,000425,000(175,000)$567,700$47,25075,000325,00025,00095,450$567,700 Additional date for 20Y9 are as follows: Net income, $75,800 *Depreciation reported on the income statement, $38,000 F ully depreciated equipment costing $60,000 was scrapped, no salvage value, and new equipment was purchased for $150,000. *Bonds payable of $75,000 were retired by payment at their face amount. 2,500 shares of common stock were issued at $30 for cash Cash dividends declared and paid, $40,000 Investments of $100,000 were sold for $125,000

The condensed comparative balance sheets for Dexter Company for the years December 31, 20Y8 and December 31,20Y9 are shown belo CashAccountsreceivable(net)InventoriesInvestmentsEquipmentAcc.Depreciation-equipmentTOTALASSETSAccountsPayableBondsPayableCommonStock,$25parPaid-in-capitalinexcessofparRetainedearningsTOTALLIABILITIESANDSTOCKHOLDERSEQUITY20Y9$72,00061,000121,0000515,000(153,000)$616,000$59,7500375,00050,000131,250$616,00020Y8$42,50070,200105,000100,000425,000(175,000)$567,700$47,25075,000325,00025,00095,450$567,700 Additional date for 20Y9 are as follows: Net income, $75,800 *Depreciation reported on the income statement, $38,000 F ully depreciated equipment costing $60,000 was scrapped, no salvage value, and new equipment was purchased for $150,000. *Bonds payable of $75,000 were retired by payment at their face amount. 2,500 shares of common stock were issued at $30 for cash Cash dividends declared and paid, $40,000 Investments of $100,000 were sold for $125,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started