Prepare a comparative balance sheet calculating the difference in accounts between the four most recent years.

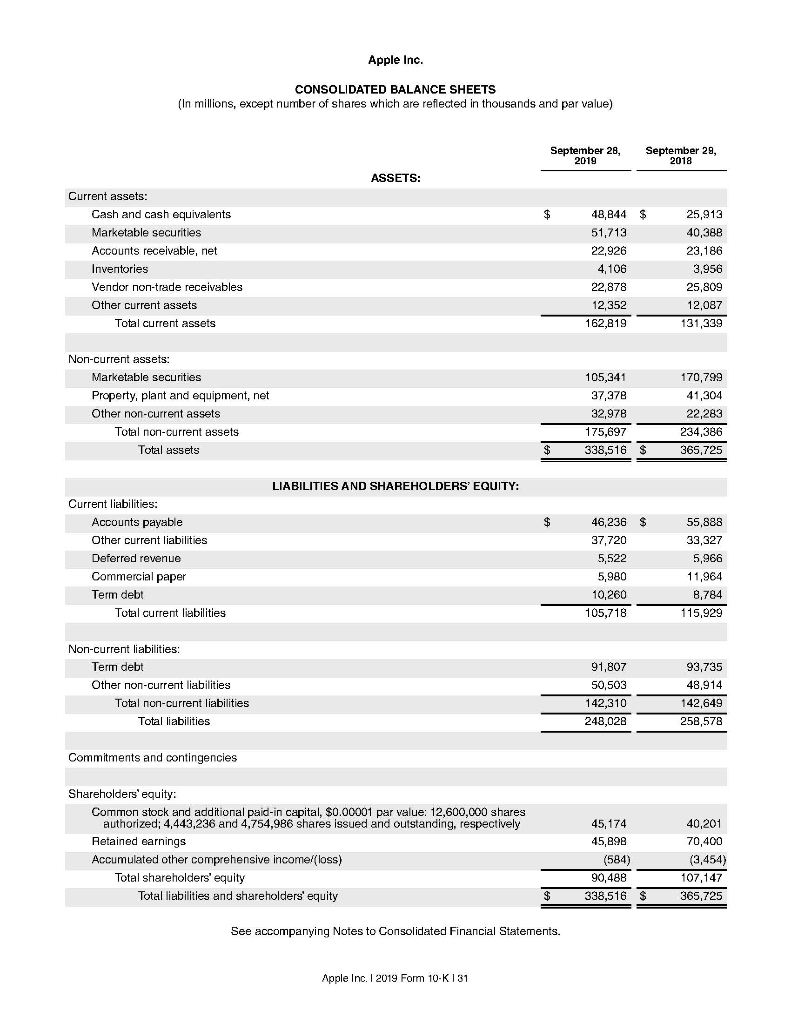

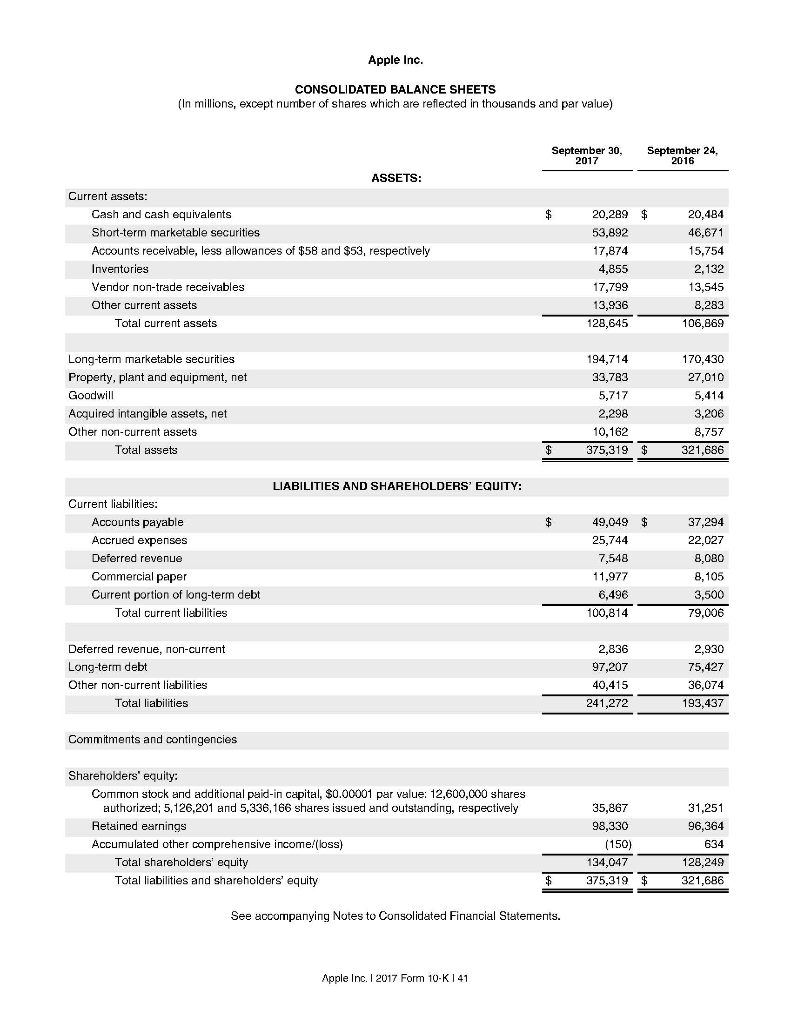

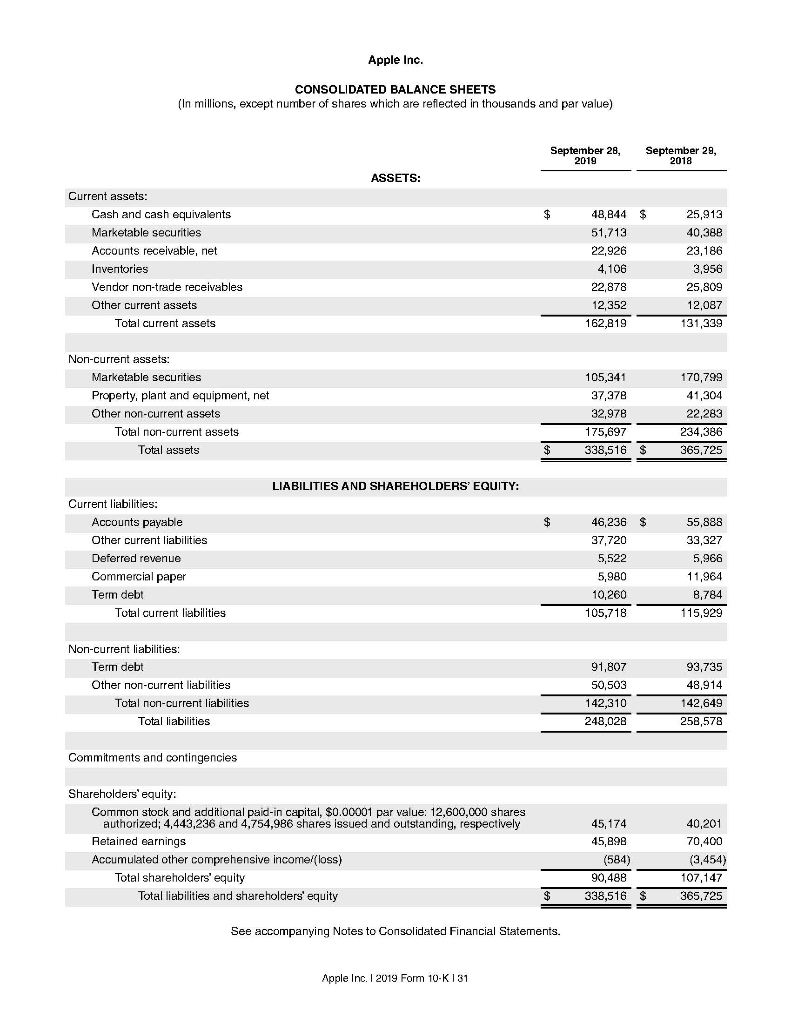

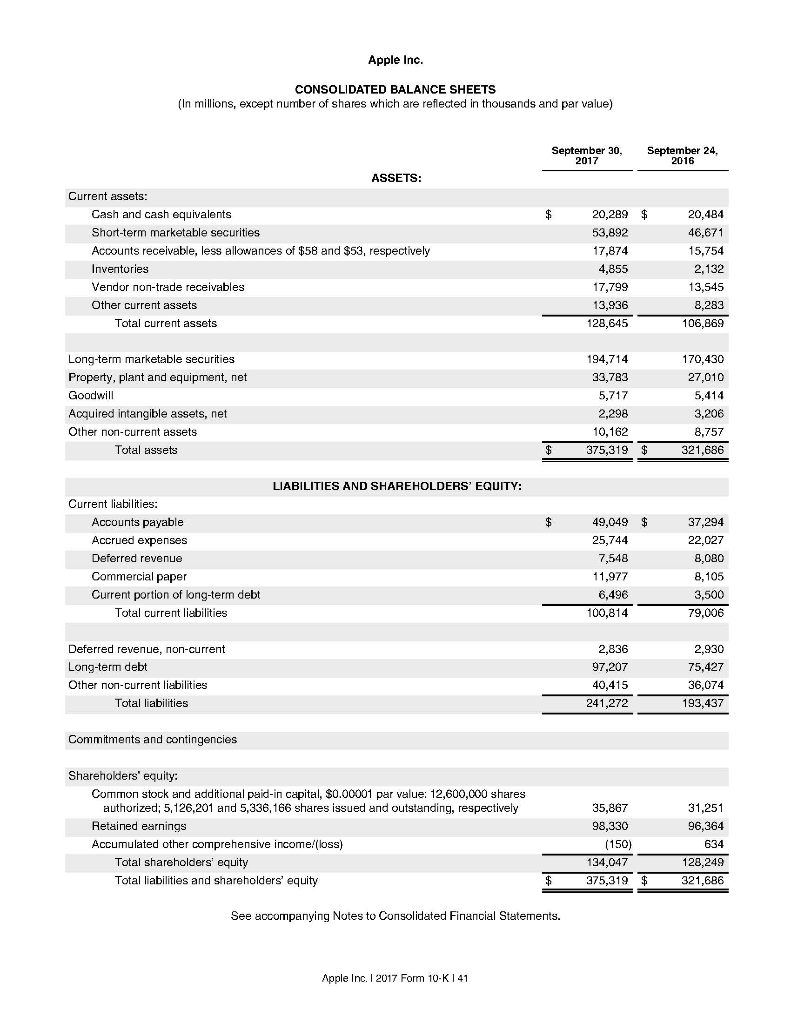

Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 28, 2019 September 29, 2018 ASSETS: $ Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net Inventories Vendor non-trade receivables Other current assets Total current assets 48,844 $ 51,713 22,926 4,106 22,878 12,352 162,819 25,913 40,388 23,186 3,956 25,809 12,087 131,339 Non-current assets: Marketable securities Property, plant and equipment, net Other non-current assets Total non-current assets Total assets 105,341 37,378 32,978 175,697 338,516 170,799 41,304 22.283 234,386 365,725 $ LIABILITIES AND SHAREHOLDERS' EQUITY: $ Current liabilities: Accounts payable Other current liabilities Deferred revenue Commercial paper Term debt Total current liabilities 46,236 $ 37,720 5,522 5,980 10,260 105,718 55,888 33,327 5,966 11,964 8,784 115,929 Non-current liabilities: Term debt Other non-current liabilities Total non-current liabilities Total liabilities 91,807 50.503 93,735 48,914 142,649 258,578 142,310 248,028 Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value: 12,600,000 shares authorized; 4,443,236 and 4,754,986 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income (loss) Total shareholders' equity Total liabilities and shareholders' equity 45,174 45,898 (584) 90,488 338,516 $ 40,201 70,400 (3.454) 107,147 365,725 $ See accompanying Notes to Consolidated Financial Statements. Apple Inc. I 2019 Form 10-K 131 Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 30, 2017 September 24, 2016 $ ASSETS: Current assets: Cash and cash equivalents Short-term marketable securities Accounts receivable, less allowances of $58 and $53, respectively Inventories Vendor non-trade receivables Other current assets Total current assets 20,289 $ 53,892 17,874 4,855 17,799 13,936 128,645 20,484 46,671 15,754 2,132 13,545 8,283 106,869 Long-term marketable securities Property, plant and equipment, net Goodwill Acquired intangible assets, net Other non-current assets Total assets 194,714 33,783 5,717 2,298 10,162 375,319 $ 170,430 27,010 5,414 3,206 8,757 321,686 $ LIABILITIES AND SHAREHOLDERS' EQUITY: $ Current liabilities: Accounts payable Accrued expenses Deferred revenue Commercial paper Current portion of long-term debt Total current liabilities 49,049 $ 25,744 7,548 11,977 6,496 100,814 37,294 22,027 8,0BO 8,105 3,500 79,006 Deferred revenue, non-current Long-term debt Other non-current liabilities Total liabilities 2,836 97,207 40,415 241,272 2,930 75,427 36,074 193,437 Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value: 12,600,000 shares authorized; 5,126,201 and 5,336,166 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income!(loss) Total shareholders' equity Total liabilities and shareholders' equity 35,867 98,330 (150) 134,047 375,319 $ 31,251 96,364 634 128,249 321,686 See accompanying Notes to Consolidated Financial Statements. Apple Inc. I 2017 Form 10-K 141