Answered step by step

Verified Expert Solution

Question

1 Approved Answer

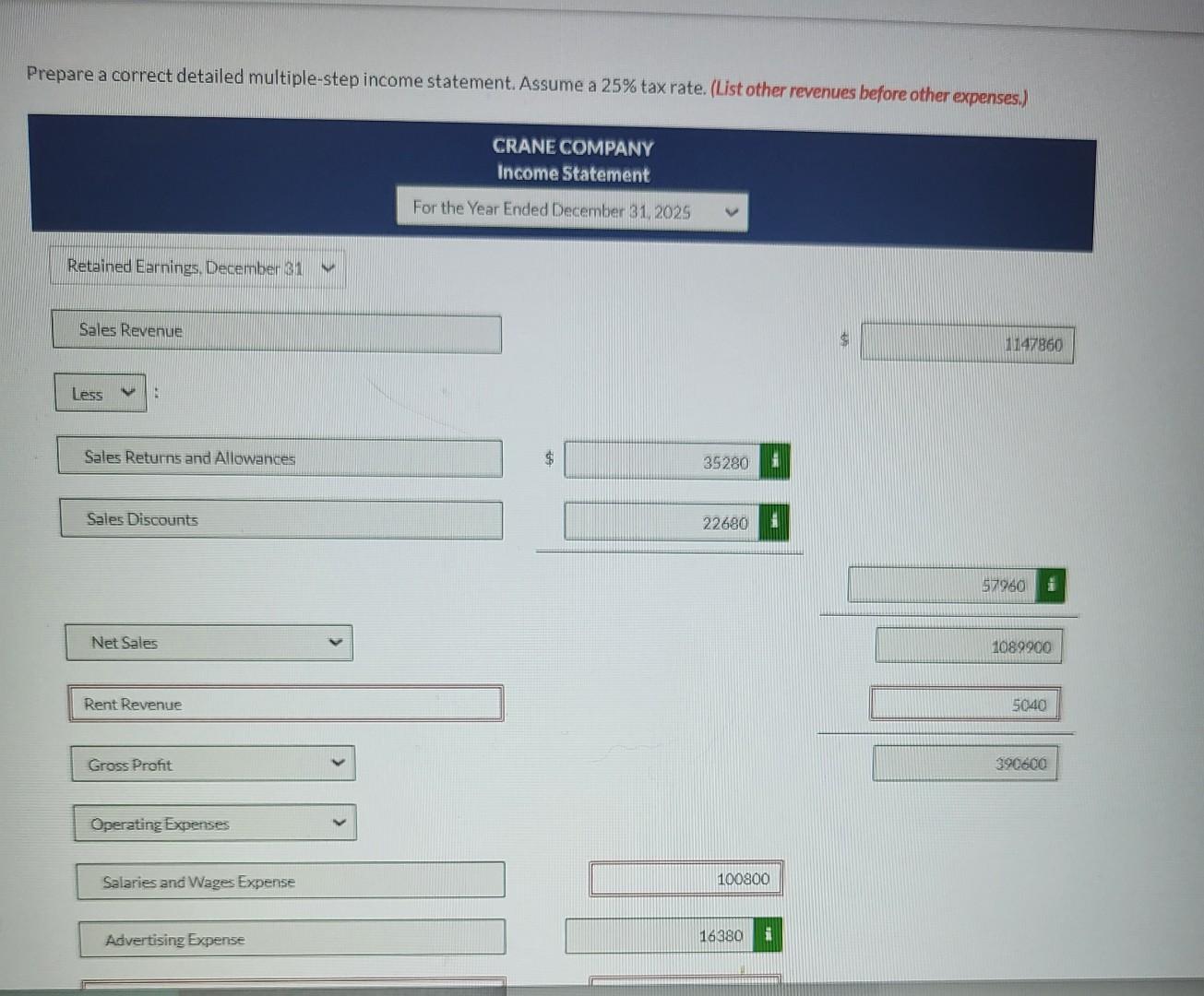

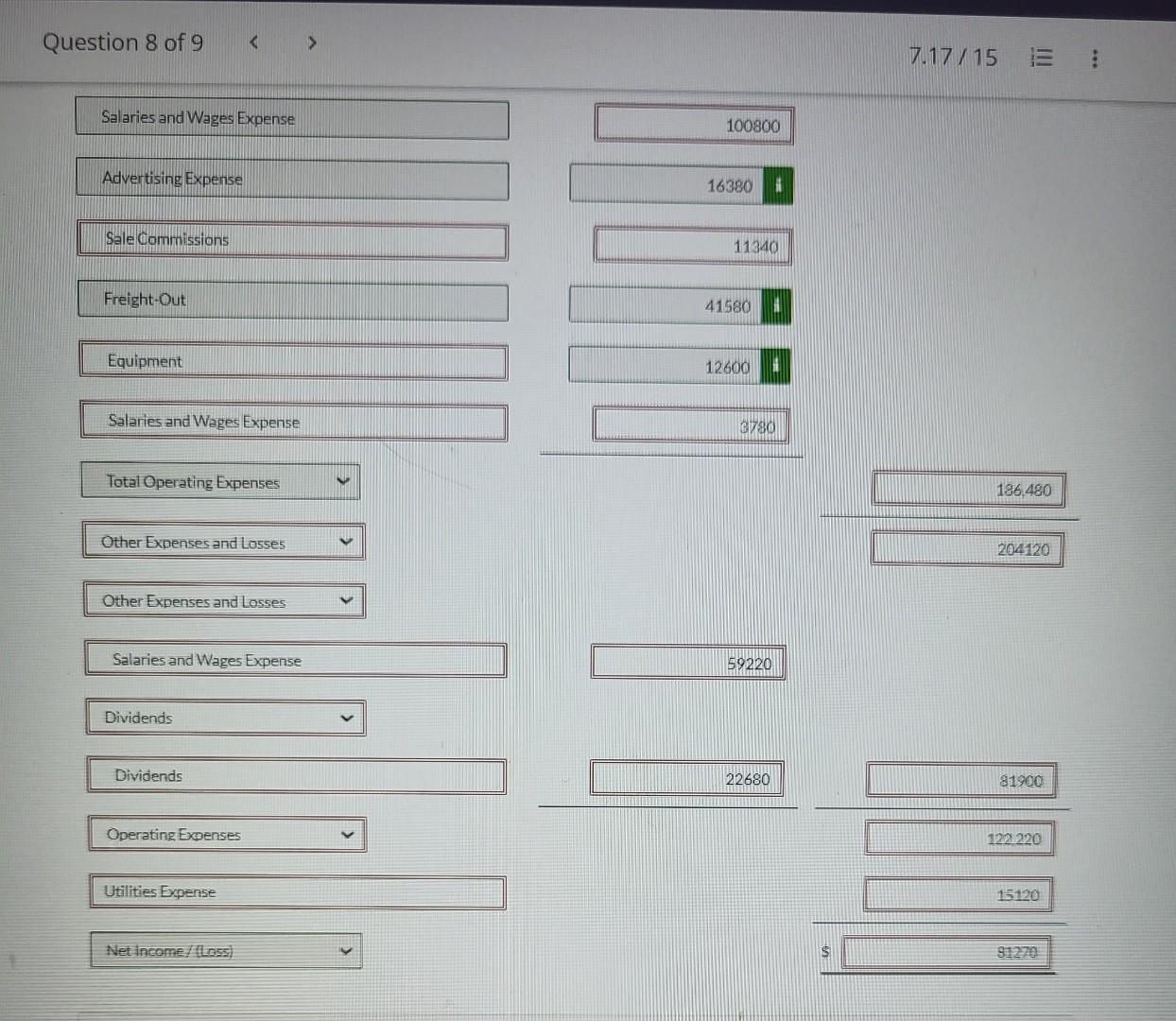

Prepare a correct detailed multiple-step income statement. Assume a 25% tax rate. (List other revenues before other expenses.) CRANE COMPANY Income Statement For the Year

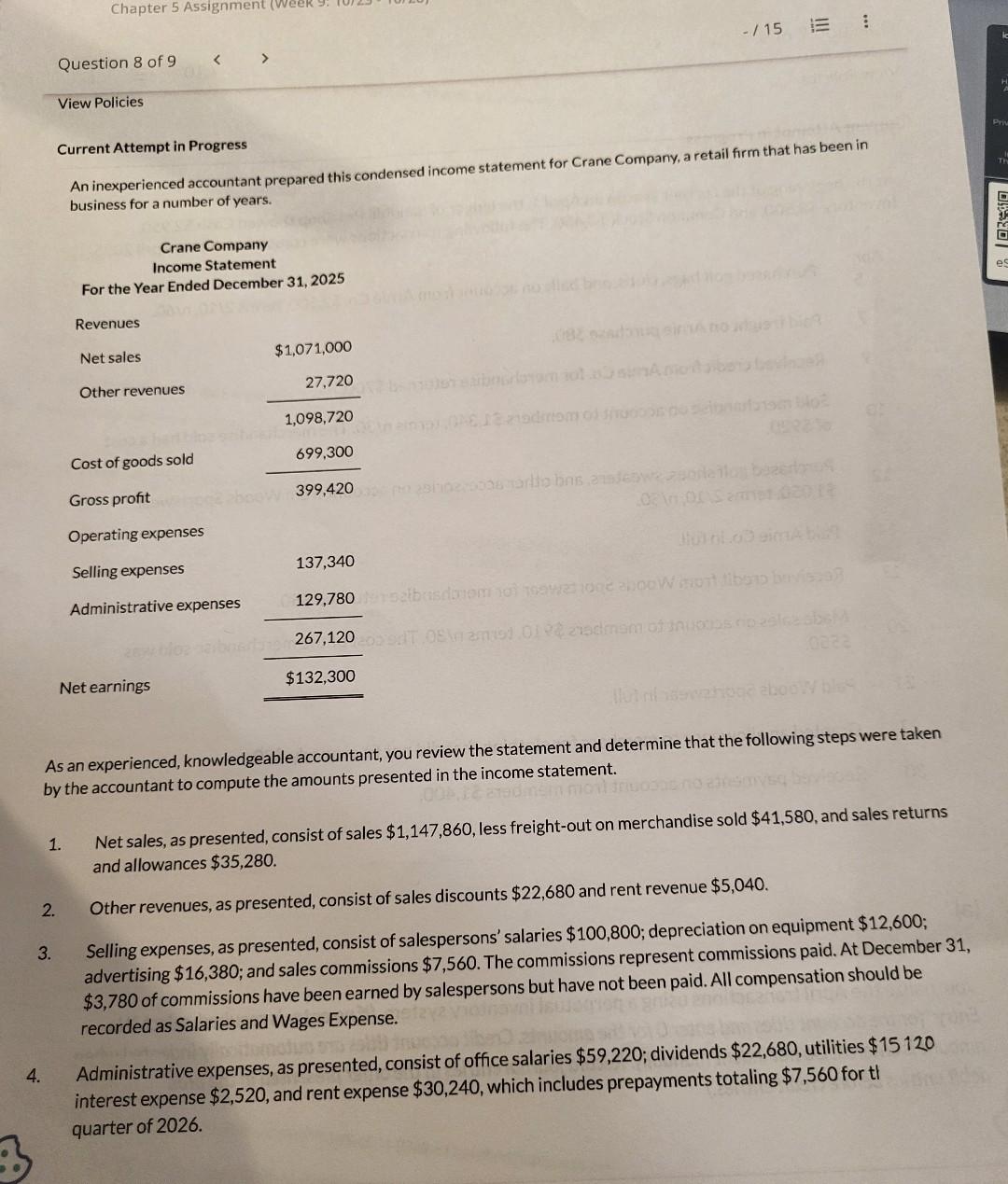

Prepare a correct detailed multiple-step income statement. Assume a 25\% tax rate. (List other revenues before other expenses.) CRANE COMPANY Income Statement For the Year Ended December 31, 2025 Retained Earnings, December 31 Sales Revenue Less \$ 1147860 Sales Returns and Allowances Sales Discounts Net Sales Rent Revenue Gross Profit Operating Expenses Salaries and Wages Expense Advertising Expense $ \begin{tabular}{|r|r|} \hline 35280 & i \\ \hline 22680 & i \\ \hline \end{tabular} 57960 i 1089900 5040 390600 \begin{tabular}{|r|r|} \hline & 100800 \\ \hline & \\ \hline 16380 & 1 \\ \hline \end{tabular} Question 8 of 9 \begin{tabular}{|c|c|c|} \hline Salaries and Wages Expense & 100800 & \\ \hline Advertising Expense & 16380i & \\ \hline Sale Commissions & 11340 & \\ \hline Freight-Out & & \\ \hline Equipment & & \\ \hline Salaries and Wages Expense & 3780 & \\ \hline Total Operating Expenses v & & 186,480 \\ \hline Other Expenses and Losses & & 204120 \\ \hline Other Expenses and Losses v & & \\ \hline Salaries and Wages Expense & 59220 & \\ \hline Dividends & & \\ \hline Dividends & 22680 & 81900 \\ \hline Operating Expenses & & 122220 \\ \hline \begin{tabular}{l} Utilities Experse \\ \end{tabular} & & 15120 \\ \hline Net income/ /loss) & & 81270 \\ \hline \end{tabular} Current Attempt in Progress An inexperienced accountant prepared this condensed income statement for Crane Company, a retail firm that has been in business for a number of years. As an experienced, knowledgeable accountant, you review the statement and determine that the following steps were taken by the accountant to compute the amounts presented in the income statement. 1. Net sales, as presented, consist of sales $1,147,860, less freight-out on merchandise sold $41,580, and sales returns and allowances $35,280. 2. Other revenues, as presented, consist of sales discounts $22,680 and rent revenue $5,040. 3. Selling expenses, as presented, consist of salespersons' salaries $100,800; depreciation on equipment $12,600; advertising $16,380; and sales commissions $7,560. The commissions represent commissions paid. At December 31 , $3,780 of commissions have been earned by salespersons but have not been paid. All compensation should be recorded as Salaries and Wages Expense. 4. Administrative expenses, as presented, consist of office salaries $59,220; dividends $22,680, utilities $15120 interest expense $2,520, and rent expense $30,240, which includes prepayments totaling $7,560 for t l quarter of 2026. Prepare a correct detailed multiple-step income statement. Assume a 25\% tax rate. (List other revenues before other expenses.) CRANE COMPANY Income Statement For the Year Ended December 31, 2025 Retained Earnings, December 31 Sales Revenue Less \$ 1147860 Sales Returns and Allowances Sales Discounts Net Sales Rent Revenue Gross Profit Operating Expenses Salaries and Wages Expense Advertising Expense $ \begin{tabular}{|r|r|} \hline 35280 & i \\ \hline 22680 & i \\ \hline \end{tabular} 57960 i 1089900 5040 390600 \begin{tabular}{|r|r|} \hline & 100800 \\ \hline & \\ \hline 16380 & 1 \\ \hline \end{tabular} Question 8 of 9 \begin{tabular}{|c|c|c|} \hline Salaries and Wages Expense & 100800 & \\ \hline Advertising Expense & 16380i & \\ \hline Sale Commissions & 11340 & \\ \hline Freight-Out & & \\ \hline Equipment & & \\ \hline Salaries and Wages Expense & 3780 & \\ \hline Total Operating Expenses v & & 186,480 \\ \hline Other Expenses and Losses & & 204120 \\ \hline Other Expenses and Losses v & & \\ \hline Salaries and Wages Expense & 59220 & \\ \hline Dividends & & \\ \hline Dividends & 22680 & 81900 \\ \hline Operating Expenses & & 122220 \\ \hline \begin{tabular}{l} Utilities Experse \\ \end{tabular} & & 15120 \\ \hline Net income/ /loss) & & 81270 \\ \hline \end{tabular} Current Attempt in Progress An inexperienced accountant prepared this condensed income statement for Crane Company, a retail firm that has been in business for a number of years. As an experienced, knowledgeable accountant, you review the statement and determine that the following steps were taken by the accountant to compute the amounts presented in the income statement. 1. Net sales, as presented, consist of sales $1,147,860, less freight-out on merchandise sold $41,580, and sales returns and allowances $35,280. 2. Other revenues, as presented, consist of sales discounts $22,680 and rent revenue $5,040. 3. Selling expenses, as presented, consist of salespersons' salaries $100,800; depreciation on equipment $12,600; advertising $16,380; and sales commissions $7,560. The commissions represent commissions paid. At December 31 , $3,780 of commissions have been earned by salespersons but have not been paid. All compensation should be recorded as Salaries and Wages Expense. 4. Administrative expenses, as presented, consist of office salaries $59,220; dividends $22,680, utilities $15120 interest expense $2,520, and rent expense $30,240, which includes prepayments totaling $7,560 for t l quarter of 2026

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started