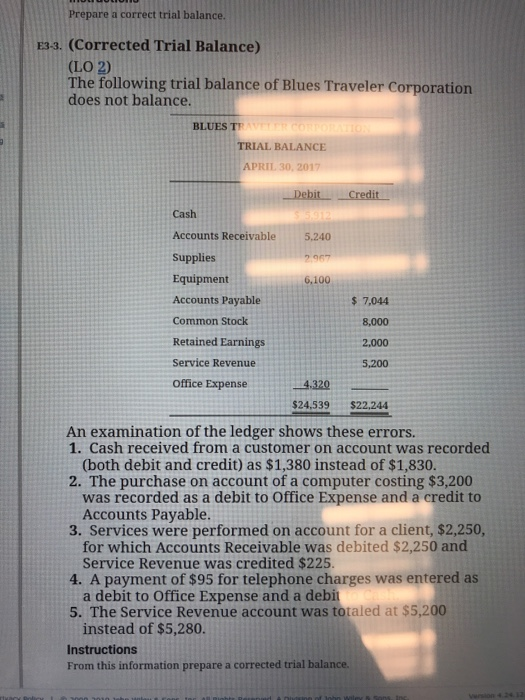

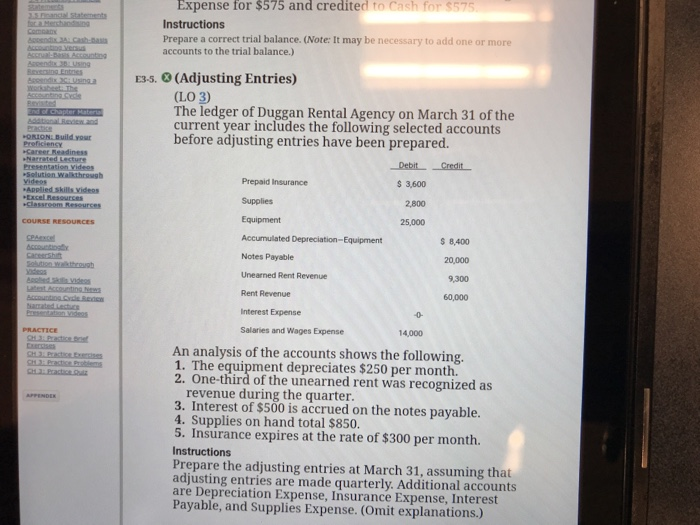

Prepare a correct trial balance E3-3. (Corrected Trial Balance) (LO 2) The following trial balance of Blues Traveler Corporation does not balance. BLUES T TRIAL BALANCE APRIL 30, 2017 Cash Accounts Receivable Supplies Equipment Accounts Payable Common Stock Retained Earnings Service Revenue Office Expense 5.240 $ 7,044 8,000 2,000 5,200 4.320 $24,539 $22,244 An examination of the ledger shows these errors 1. Cash received from a customer on account was recorded (both debit and credit) as $1,380 instead of $1,830. 2. The purchase on account of a computer costing $3,200 3. Services were performed on account for a client, $2,250, 4. A payment of $95 for telephone charges was entered as 5. The Service Revenue account was totaled at $5,200 Instructions was recorded as a debit to Office Expense and a credit to Accounts Payable for which Accounts Receivable was debited $2,250 and Service Revenue was credited $225 a debit to Office Expense and a debi instead of $5,280. From this information prepare a corrected trial balance. Expense for $575 and credited to Cash for $575 Instructions Prepare a correct trial balance. (Note: It may be necessary to add one or more accounts to the trial balance.) E3-5. (Adjusting Entries) (LO 3) The ledger of Duggan Rental Agency on March 31 of the current year includes the following selected accounts before adjusting entries have been prepared. onions Bild ygur Proficiency Career Readiness Narrated Lecture esentation Ydtes $3,600 2,800 25,000 Prepaid Insurance Supplies Equipment Accumulated Depreciation-Equipment Notes Payable Unearned Rent Revenue Rent Revenue Interest Expense Salaries and Wages Expense Applied skills videos 8,400 20,000 9,300 60,000 14,000 An analysis of the accounts shows the following. 1. The equipment depreciates $250 per month. 2. One-third of the unearned rent was recognized as revenue during the quarter 3. Interest of $500 is accrued on the notes payable. 4. Supplies on hand total $850 S. Insurance expires at the rate of $300 per month Instructions Prepare the adjusting entries at March 31, assuming that adjusting entries are made quarterly. Additional accounts are Depreciation Expense, Insurance Expense, Interest Payable, and Supplies Expense. (Omit explanations.)