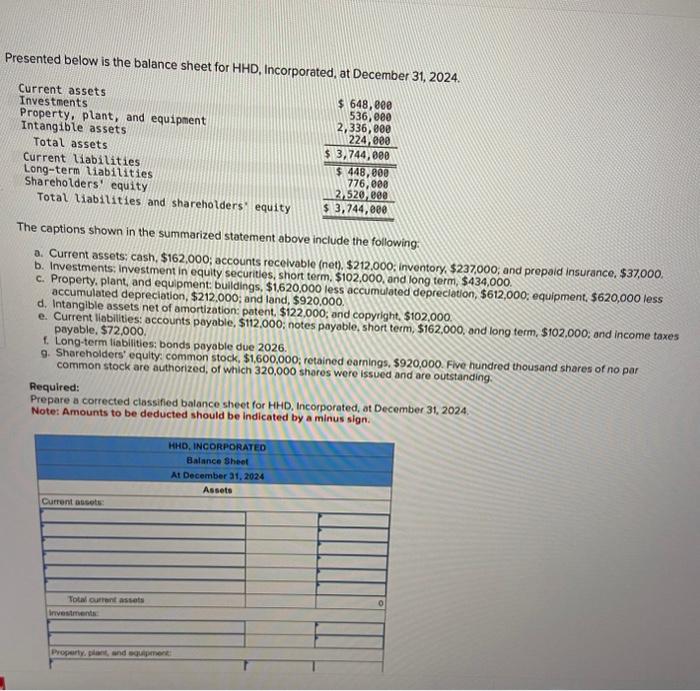

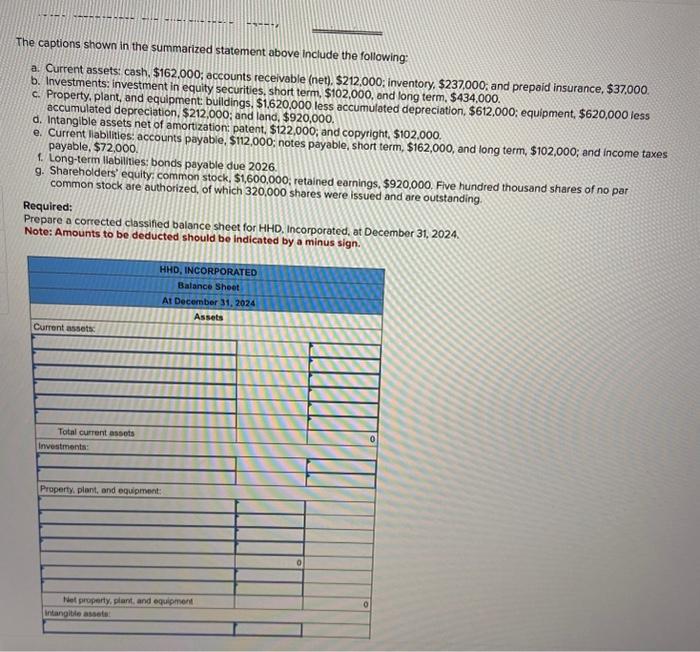

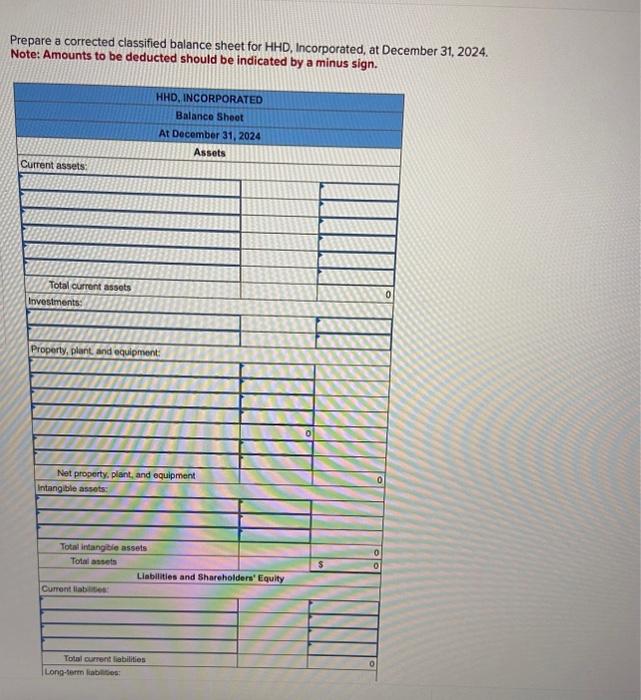

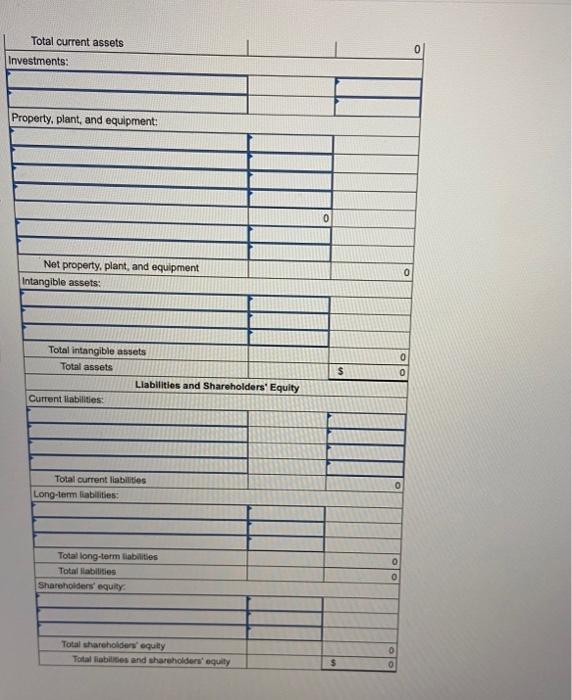

Prepare a corrected classified balance sheet for HHD, Incorporated, at December 31, 2024. Note: Amounts to be deducted should be indicated by a minus sian. The captions shown in the summarized statement above include the following: a. Current assets: cash, $162,000; accounts recelvable (net), $212,000; inventory, $237,000, and prepaid insurance, $37,000. b. Investments: investment in equity securities, short term, $102,000, ond long term, $434,000. c. Property, plant, and equipment: buildings, $1,620,000 less accumulated depreciation, $612,000; equipment, $620,000 less accumulated depreciation, $212,000; and land, $920,000. d. Intangible assets net of amortization: patent, $122,000; and copyright, $102,000. e. Current liabilities: accounts payable, $112,000; notes payable, short term, $162,000, and long term, $102,000; and income taxes payable, $72,000. 1. Long-term llabilities: bonds payable due 2026 9. Shareholders' equity; common stock, $1,600,000; retained earnings, $920,000. Five hundred thousand shares of no par common stock are authorized, of which 320,000 shares were issued and are outstanding Required: Prepare a corrected classified balance sheet for HHD, Incorporated, at December 31, 2024. Note: Amounts to be deducted should be indicated by a minus sign. Presented below is the balance sheet for HHD, Incorporated. at Decemher 31,2024. b. Investments; investment in equity securites, short term, $102,000, and long term, $434,000. c. Property, plant, and equipment: buildings, $1,620,000 less accumulated depreclation, $612,000; equipment, $620,000 less accumulated depreciation, $212,000; and land, $920,000. d. Intangible assets net of amortization: patent, $122,000; and copyright, $102,000 e. Current liabilities: accounts payable, $112,000; notes payable, short term, $162,000, and long term, \$102,000; and income taxes payable, $72,000. f. Long-term liabilities: bonds payable due 2026. 9. Shareholders' equity: common stock, $1,600,000; retained earnings, $920,000. Five hundred thousand shares of no par common stock are authorized, of which 320,000 shores were issued and are outstanding Required: Prepare a corrected classified balance sheet for HHD, Incorporated, at December 31, 2024 Note: Amounts to be deducted should be indicated by a minus sign. Prepare a corrected classified balance sheet for HHD, Incorporated, at December 31, 2024. Note: Amounts to be deducted should be indicated by a minus sian. The captions shown in the summarized statement above include the following: a. Current assets: cash, $162,000; accounts recelvable (net), $212,000; inventory, $237,000, and prepaid insurance, $37,000. b. Investments: investment in equity securities, short term, $102,000, ond long term, $434,000. c. Property, plant, and equipment: buildings, $1,620,000 less accumulated depreciation, $612,000; equipment, $620,000 less accumulated depreciation, $212,000; and land, $920,000. d. Intangible assets net of amortization: patent, $122,000; and copyright, $102,000. e. Current liabilities: accounts payable, $112,000; notes payable, short term, $162,000, and long term, $102,000; and income taxes payable, $72,000. 1. Long-term llabilities: bonds payable due 2026 9. Shareholders' equity; common stock, $1,600,000; retained earnings, $920,000. Five hundred thousand shares of no par common stock are authorized, of which 320,000 shares were issued and are outstanding Required: Prepare a corrected classified balance sheet for HHD, Incorporated, at December 31, 2024. Note: Amounts to be deducted should be indicated by a minus sign. Presented below is the balance sheet for HHD, Incorporated. at Decemher 31,2024. b. Investments; investment in equity securites, short term, $102,000, and long term, $434,000. c. Property, plant, and equipment: buildings, $1,620,000 less accumulated depreclation, $612,000; equipment, $620,000 less accumulated depreciation, $212,000; and land, $920,000. d. Intangible assets net of amortization: patent, $122,000; and copyright, $102,000 e. Current liabilities: accounts payable, $112,000; notes payable, short term, $162,000, and long term, \$102,000; and income taxes payable, $72,000. f. Long-term liabilities: bonds payable due 2026. 9. Shareholders' equity: common stock, $1,600,000; retained earnings, $920,000. Five hundred thousand shares of no par common stock are authorized, of which 320,000 shores were issued and are outstanding Required: Prepare a corrected classified balance sheet for HHD, Incorporated, at December 31, 2024 Note: Amounts to be deducted should be indicated by a minus sign