Question

Prepare a data input section in the exact order as given below. Naming of the input 'sheet' should be INPUT . Do NOT cellprotect the

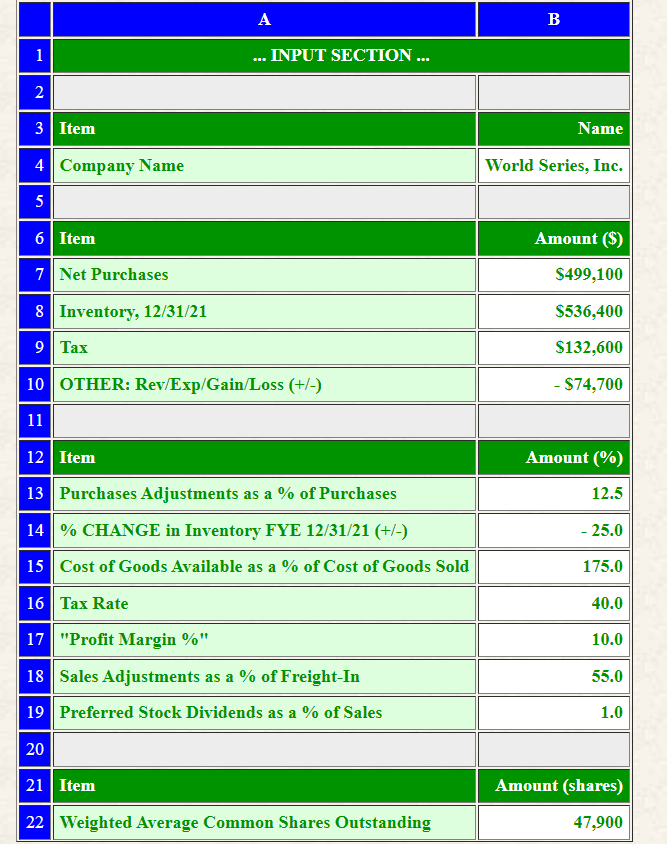

Prepare a data input section in the exact order as given below. Naming of the input 'sheet' should be "INPUT". Do NOT cellprotect the numeric data of this section, as you must allow for the possibility of change to this information. Use the amounts given as a test of your output. Enter Pct as the %, not decimal (80% entered as 80, not 0.80). Your input should be placed in the following rows/columns (the heading "INPUT SECTION" should be centered over all columns to which it relates):

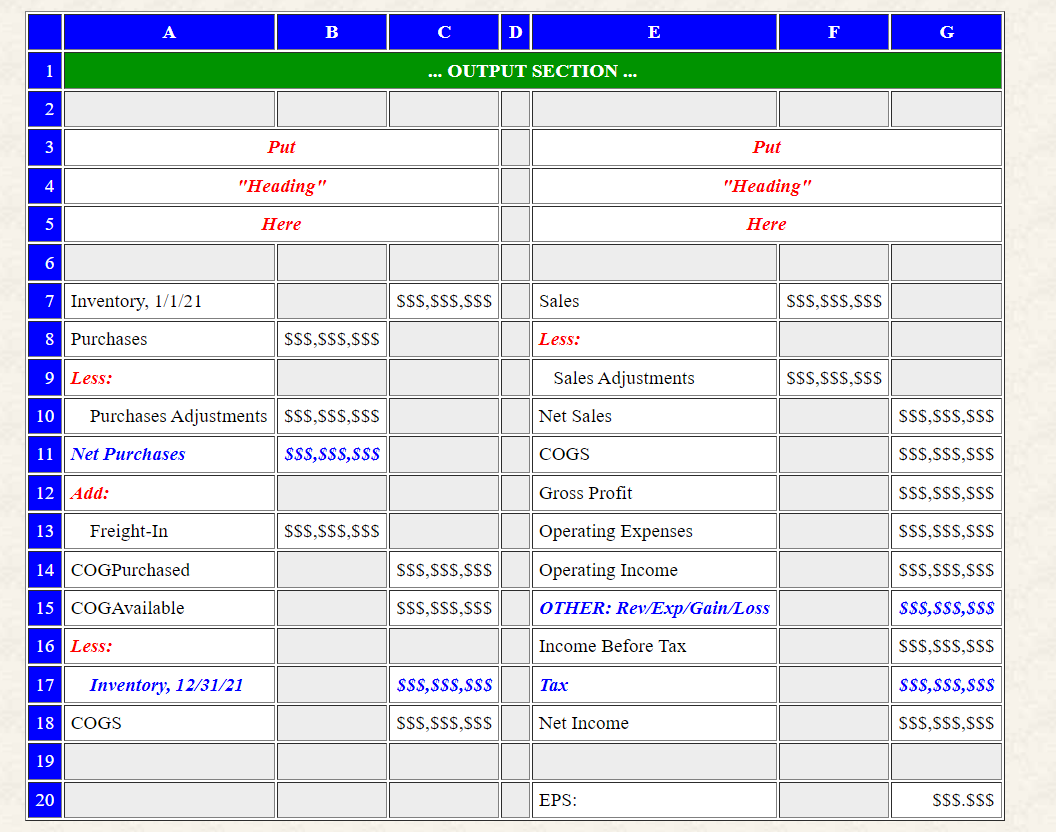

Prepare an output section that produces the following items: 1) "COGS Schedule", and 2) "Income Statement". The reporting period is for the calendar year of 2021. The output items should be placed on a separate 'sheet' (the heading "OUTPUT SECTION" should be centered over all columns to which it relates: [A1..G1]). Naming of the output 'sheet' should be "OUTPUT". No number (dollar amount, shares, or percentage) or company name (the company name should be shown in a "script" font) should be typed (hard coded) directly into any cell in the output section, as this would prevent your output from being correct when the input is changed. Instead, the output section must reference the appropriate amounts (shares, dollars, and percents) and name from the input and/or output sections. Your output should be placed in the following spreadsheet rows/columns, using the color scheme as shown, where $$$ represent dollar amounts (the "SHADED" cells should be blank, but don't shade them):

Do NOT cellprotect any portion of the output section. Use good form with respect to the creation of the output. This includes heading rules; appearance; alignment; proper use of commas, rulings, $; etc. All dollar amounts should be ROUNDED to the nearest dollar (see note below) and FORMATTED to show whole dollars only (no cents). Exception is for EPS in cell [G20], which should be ROUNDED to nearest tenth of a cent: ($$$.$$$). COGS should be computed one time, in cell [C18], and then transferred to cell [G11]. The caption "OTHER: Rev/Gain/Exp/Loss", which includes other revenues/expenses/gains/losses, could be a net positive or negative, and thus should be shown as such. Refer to the CLASSROOM:HANDOUTS link on class webpage for help with the COGS Schedule and CHAPTER 4 in the text for help with the income statement.

A schedule's and statement's "HEADING" should be centered over all columns in the output for which it relates, and shown in BOLD, ITALICS, and in RED; both the Names and amounts ($$$) that are taken from the input section should be shown in BOLD, ITALICS, and in BLUE. The captions "Add:" and "Less:" should be shown in BOLD, ITALICS, and in RED, with the amounts associated with the caption "Less:" shown as positive numbers, and then subtracted. (see above)

All labels in columns "A" and column "E" are to be left-aligned, except for the descriptions shown "indented". The amounts shown in columns "B", "C", "F", and "G" are to be right-aligned. The "Headings" [A3..C5] and [E3..G5] should all be centered.

No item should be shown on the speadsheet in a "box" (no grid lines). The diagram above is an illustration showing in what CELL [row/col] items are to be place, and which cells should be blank.

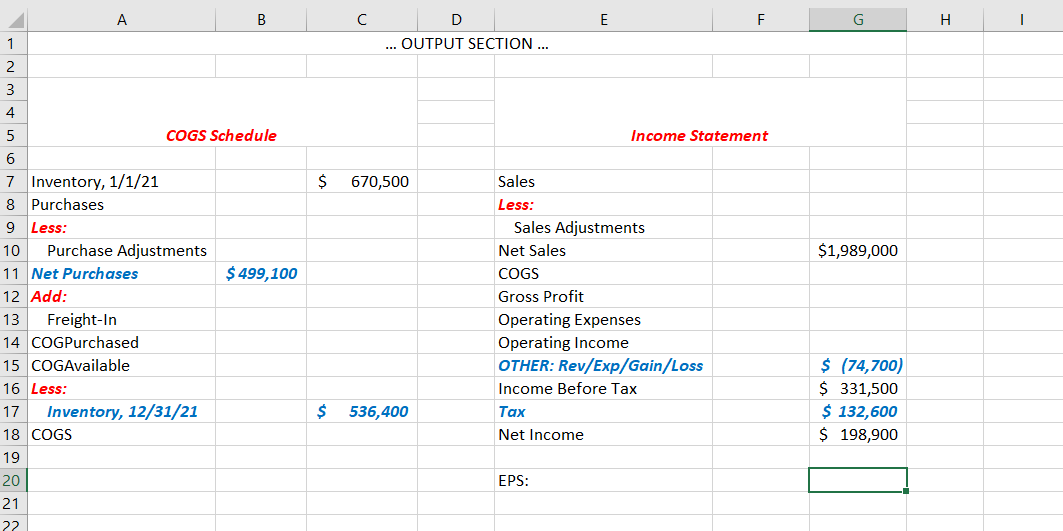

This is all that I have so far:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started