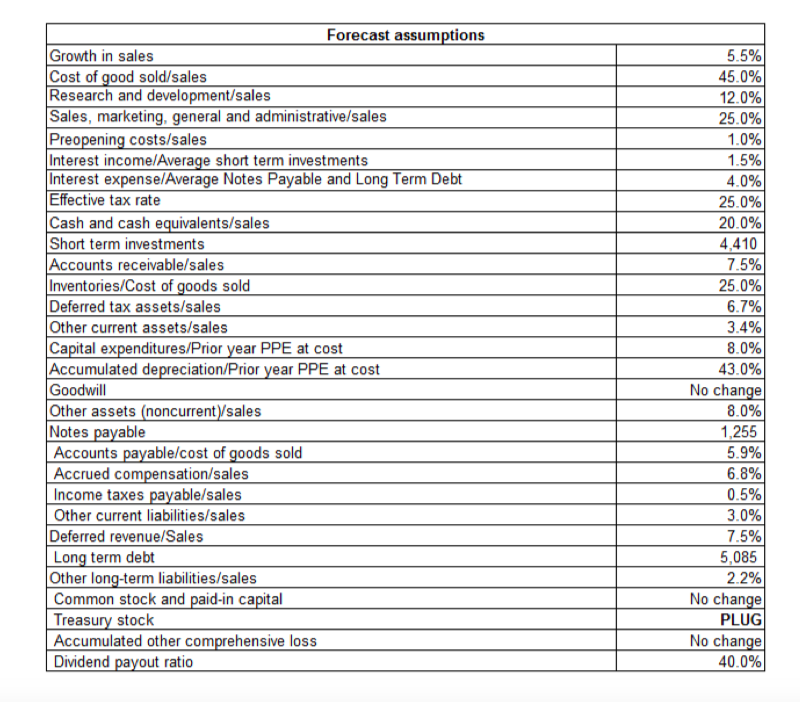

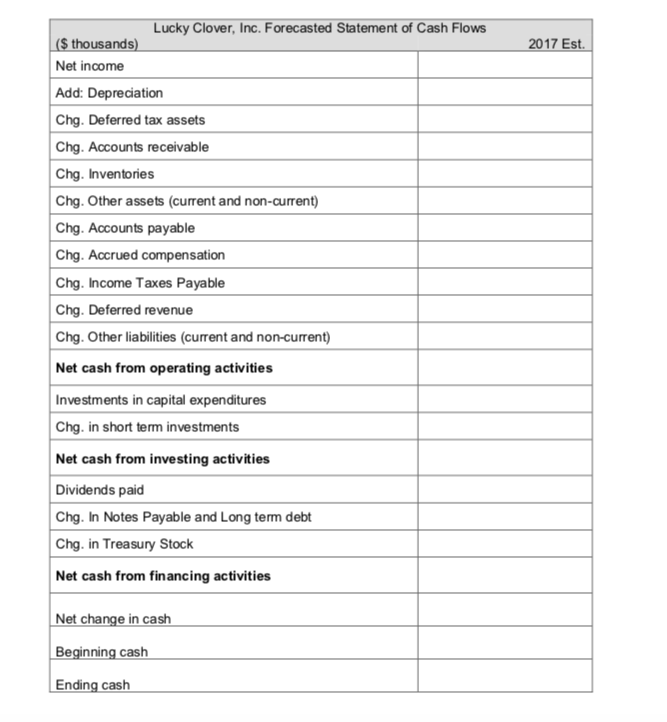

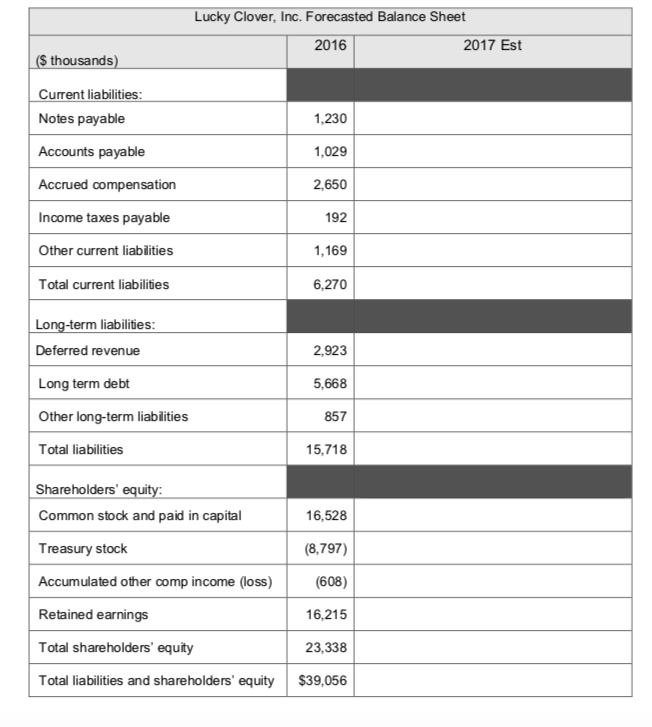

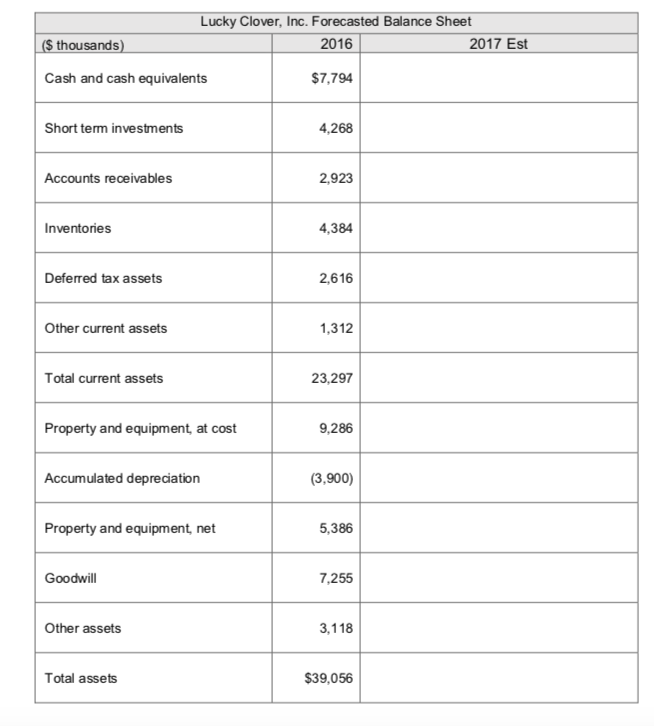

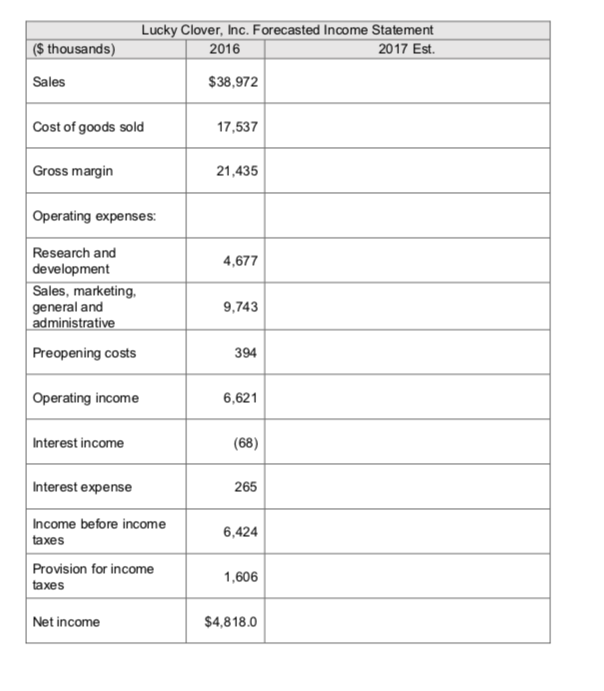

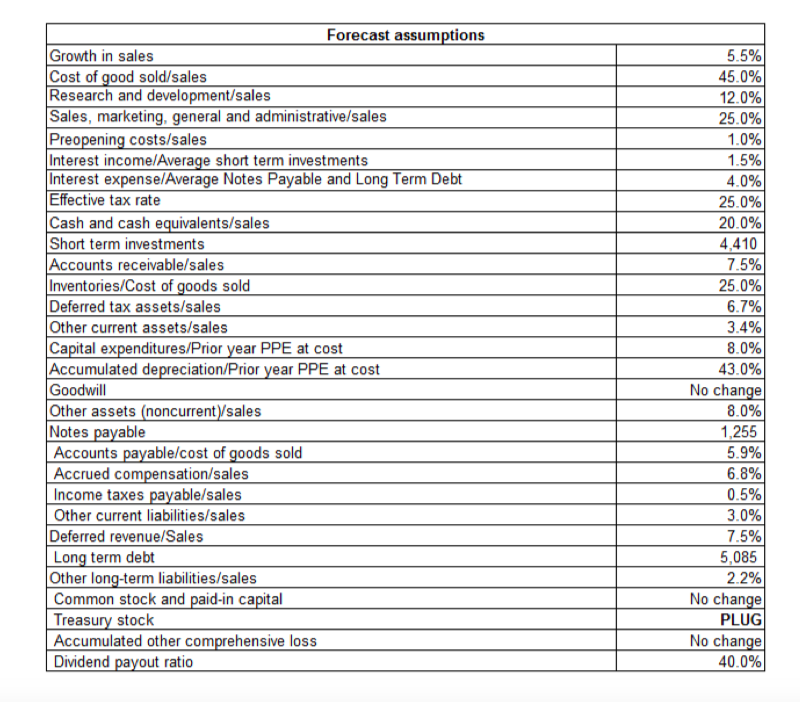

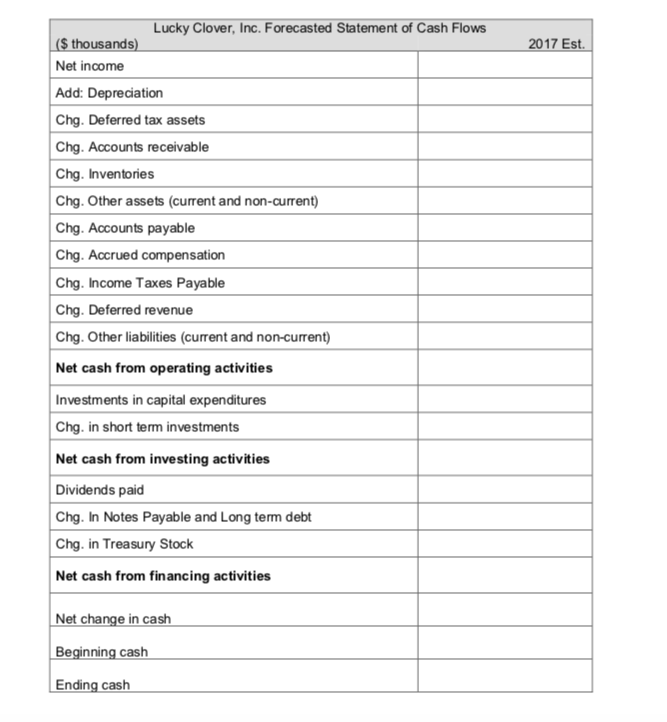

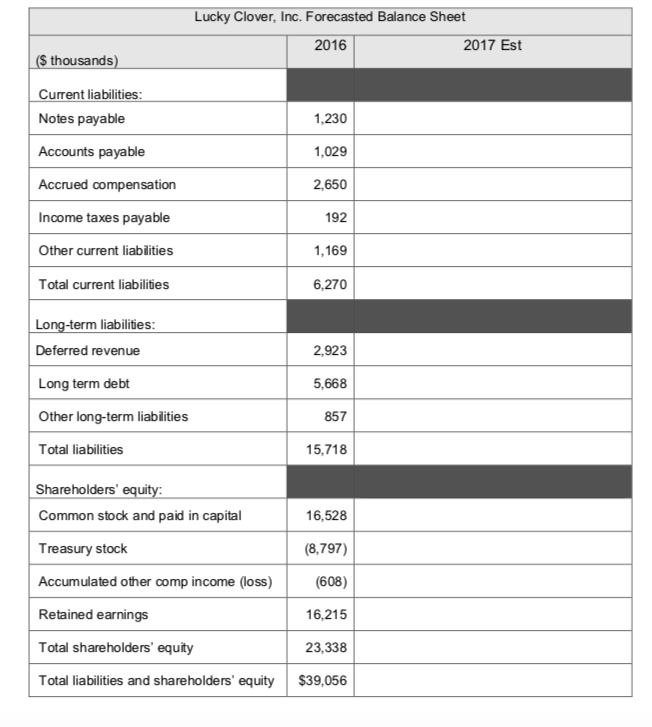

Prepare a forecasted income statement, balance sheet, and statement of cash flows for the company for the next year (2017). For accounts that are not included in the list below, assume that the amount will not change for the forecasted year. Show equations/formulas

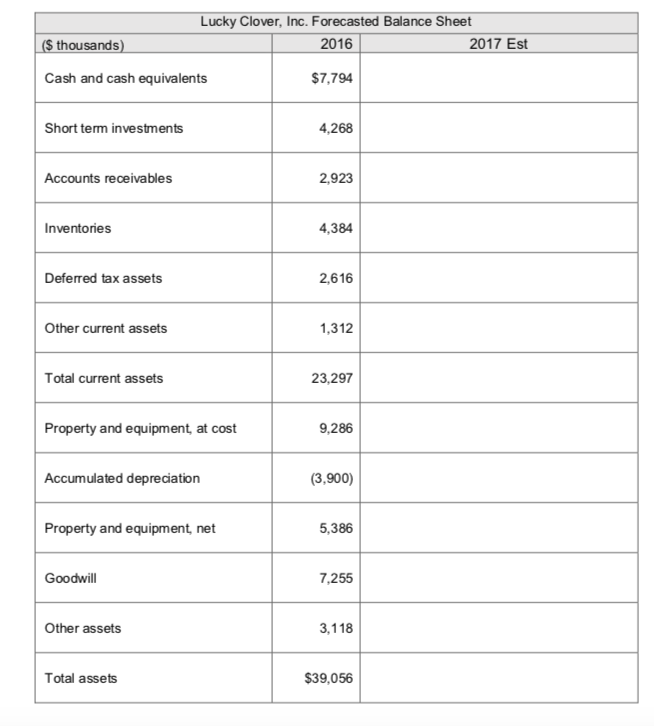

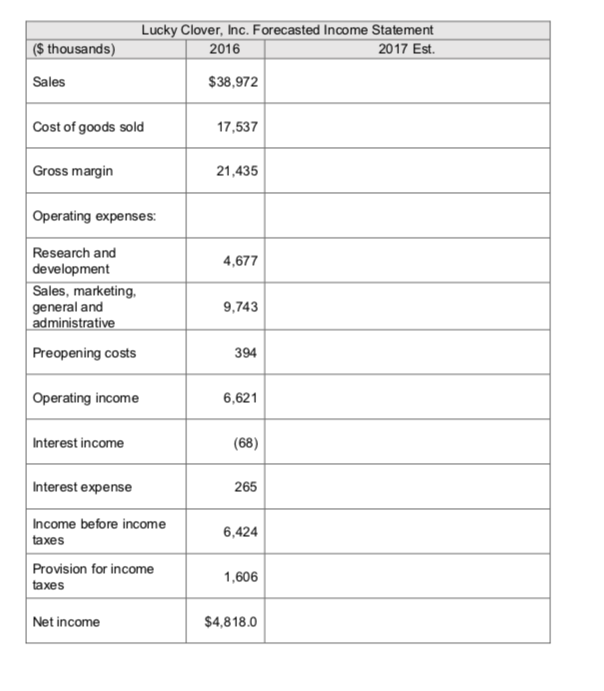

Forecast assumptions Growth in sales Cost of Research and development/sales Sales, marketing, general and administrative/sales Preopening costs/sales Interest income/Average short term investments Interest expense/Average Notes Payable and Long Term Debt Effective tax rate Cash and cash equivalents/sales Short term investments Accounts receivable/sales Inventories/Cost of goods sold Deferred tax assets/sales Other current assets/sales Capital expenditures/Prior vear PPE at cost Accumulated depreciation/Prior year PPE at cost Goodwill Other assets (noncurrent/sales Notes payable Accounts payable/cost of goods sold Accrued compensation/sales Income taxes payable/sales Other current liabilities/sales Deferred revenue/Sales Long term debt Other long-term liabilities/sales Common stock and paid-in capital Treasury stock Accumulated other comprehensive loss Dividend 5.5% 45 096 12 0% 25 0% 1.0% 1.5% 4.0% 25 0% 20 096 4,410 75% 25096 67% 3.4% 80% 43 0% No change 8 096 1,255 5 9% 6 8% 0.5% 3 096 1591 5,085 2.2% No change PLUG No change 40 0% sold/sales ratio Lucky Clover, Inc. Forecasted Statement of Cash Flows 2017 Est. thousands Net income Add: Depreciation Chg. Deferred tax assets Chg. Accounts receivable Chg. Inventories Chg. Other assets (current and non-current) Chg. Accounts payable Chg. Accrued compensation Chg. Income Taxes Payable Chg. Deferred revenue Chg. Other liabilities (current and non-current) Net cash from operating activities Investments in capital expenditures Chg. in short term investments Net cash from investing activities Dividends paid Chg. In Notes Payable and Long term debt Chg. in Treasury Stock Net cash from financing activities Net change in cash Beginning cash Ending cash Lucky Clover, Inc. Forecasted Balance Sheet 2016 2017 Est thousands Current liabilities Notes payable Accounts payable Accrued compensation Income taxes payable Other current liabilities Total current liabilities 1,230 1,029 2,650 192 1,169 6,270 Long-term liabilities Deferred revenue Long term debt Other long-term liabilities Total liabilities 2,923 5,668 857 15,718 Shareholders Common stock and paid in capital Treasury stock Accumulated other comp income (loss) Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 16,528 (8,797) (608) 16,215 23,338 $39,056 Lucky Clover, Inc. Forecasted Balance Sheet 2016 $ thousands 2017 Est Cash and cash equivalents $7,794 Short term investments 4,268 Accounts receivables 2,923 Inventories 4,384 Deferred tax assets 2,616 Other current assets 1,312 Total current assets 23,297 Property and equipment, at cost 9.286 Accumulated depreciation (3,900) Property and equipment, net 5,386 Goodwill 7,255 Other assets 3,118 Total assets $39,056 Lucky Clover, Inc. Forecasted Income Statement 2017 Est. $ thousands) 2016 Sales $38,972 Cost of goods sold 17,537 Gross margin 21,435 Operating expenses: Research and development 4,677 Sales, marketing. general and administrative 9,743 Preopening costs 394 Operating income 6,621 Interest income (68) Interest expense 265 Income before income taxes 6,424 Provision for income taxes 1,606 Net income $4,818.0 Forecast assumptions Growth in sales Cost of Research and development/sales Sales, marketing, general and administrative/sales Preopening costs/sales Interest income/Average short term investments Interest expense/Average Notes Payable and Long Term Debt Effective tax rate Cash and cash equivalents/sales Short term investments Accounts receivable/sales Inventories/Cost of goods sold Deferred tax assets/sales Other current assets/sales Capital expenditures/Prior vear PPE at cost Accumulated depreciation/Prior year PPE at cost Goodwill Other assets (noncurrent/sales Notes payable Accounts payable/cost of goods sold Accrued compensation/sales Income taxes payable/sales Other current liabilities/sales Deferred revenue/Sales Long term debt Other long-term liabilities/sales Common stock and paid-in capital Treasury stock Accumulated other comprehensive loss Dividend 5.5% 45 096 12 0% 25 0% 1.0% 1.5% 4.0% 25 0% 20 096 4,410 75% 25096 67% 3.4% 80% 43 0% No change 8 096 1,255 5 9% 6 8% 0.5% 3 096 1591 5,085 2.2% No change PLUG No change 40 0% sold/sales ratio Lucky Clover, Inc. Forecasted Statement of Cash Flows 2017 Est. thousands Net income Add: Depreciation Chg. Deferred tax assets Chg. Accounts receivable Chg. Inventories Chg. Other assets (current and non-current) Chg. Accounts payable Chg. Accrued compensation Chg. Income Taxes Payable Chg. Deferred revenue Chg. Other liabilities (current and non-current) Net cash from operating activities Investments in capital expenditures Chg. in short term investments Net cash from investing activities Dividends paid Chg. In Notes Payable and Long term debt Chg. in Treasury Stock Net cash from financing activities Net change in cash Beginning cash Ending cash Lucky Clover, Inc. Forecasted Balance Sheet 2016 2017 Est thousands Current liabilities Notes payable Accounts payable Accrued compensation Income taxes payable Other current liabilities Total current liabilities 1,230 1,029 2,650 192 1,169 6,270 Long-term liabilities Deferred revenue Long term debt Other long-term liabilities Total liabilities 2,923 5,668 857 15,718 Shareholders Common stock and paid in capital Treasury stock Accumulated other comp income (loss) Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 16,528 (8,797) (608) 16,215 23,338 $39,056 Lucky Clover, Inc. Forecasted Balance Sheet 2016 $ thousands 2017 Est Cash and cash equivalents $7,794 Short term investments 4,268 Accounts receivables 2,923 Inventories 4,384 Deferred tax assets 2,616 Other current assets 1,312 Total current assets 23,297 Property and equipment, at cost 9.286 Accumulated depreciation (3,900) Property and equipment, net 5,386 Goodwill 7,255 Other assets 3,118 Total assets $39,056 Lucky Clover, Inc. Forecasted Income Statement 2017 Est. $ thousands) 2016 Sales $38,972 Cost of goods sold 17,537 Gross margin 21,435 Operating expenses: Research and development 4,677 Sales, marketing. general and administrative 9,743 Preopening costs 394 Operating income 6,621 Interest income (68) Interest expense 265 Income before income taxes 6,424 Provision for income taxes 1,606 Net income $4,818.0