Answered step by step

Verified Expert Solution

Question

1 Approved Answer

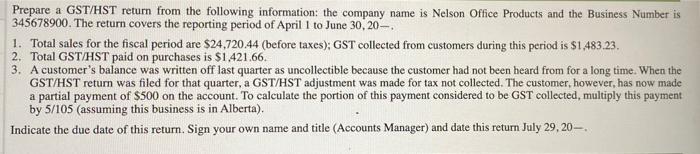

Prepare a GST/HST return from the following information: the company name is Nelson Office Products and the Business Number is 345678900. The return covers the

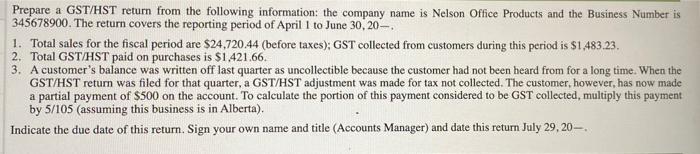

Prepare a GST/HST return from the following information: the company name is Nelson Office Products and the Business Number is 345678900. The return covers the reporting period of April 1 to June 30, 20- 1. Total sales for the fiscal period are $24,720.44 (before taxes): GST collected from customers during this period is $1,483.23. 2. Total GST/HST paid on purchases is $1.421.66. 3. A customer's balance was written off last quarter as uncollectible because the customer had not been heard from for a long time. When the GST/HST return was filed for that quarter, a GST/HST adjustment was made for fax not collected. The customer, however, has now made a partial payment of $500 on the account. To calculate the portion of this payment considered to be GST collected, multiply this payment by 5/105 (assuming this business is in Alberta), Indicate the due date of this return. Sign your own name and title (Accounts Manager) and date this return July 29,20

Prepare a GST/HST return from the following information: the company name is Nelson Office Products and the Business Number is 345678900. The return covers the reporting period of April 1 to June 30, 20- 1. Total sales for the fiscal period are $24,720.44 (before taxes): GST collected from customers during this period is $1,483.23. 2. Total GST/HST paid on purchases is $1.421.66. 3. A customer's balance was written off last quarter as uncollectible because the customer had not been heard from for a long time. When the GST/HST return was filed for that quarter, a GST/HST adjustment was made for fax not collected. The customer, however, has now made a partial payment of $500 on the account. To calculate the portion of this payment considered to be GST collected, multiply this payment by 5/105 (assuming this business is in Alberta), Indicate the due date of this return. Sign your own name and title (Accounts Manager) and date this return July 29,20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started