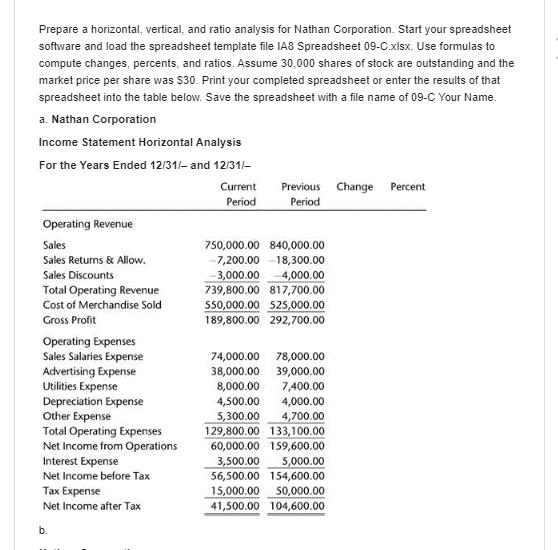

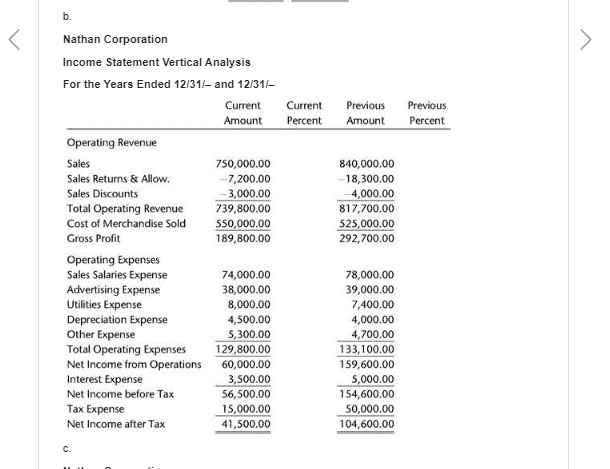

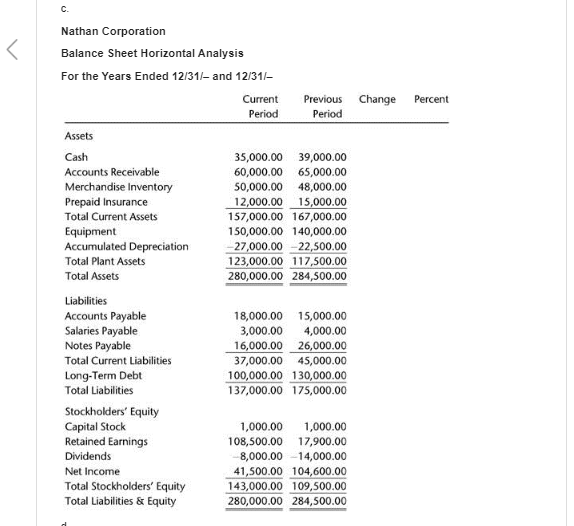

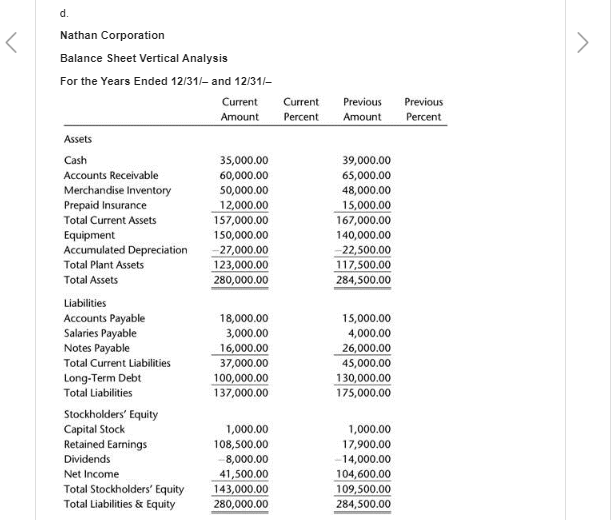

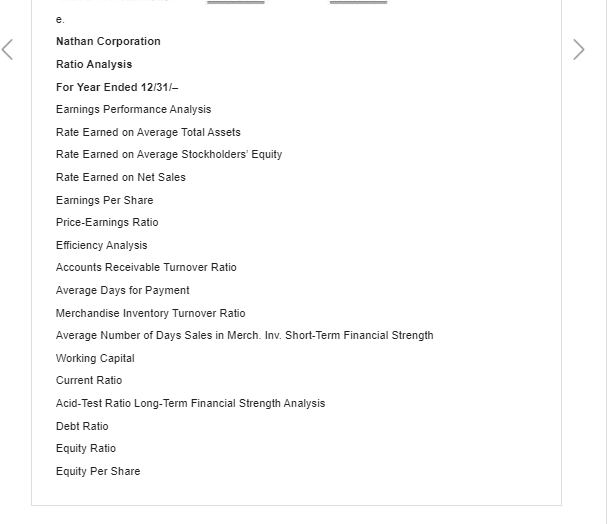

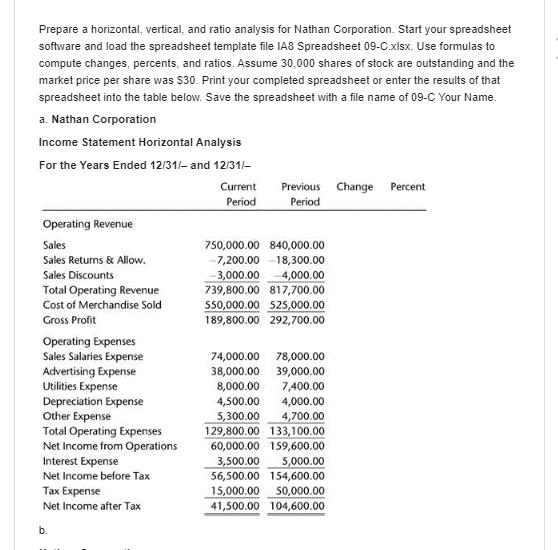

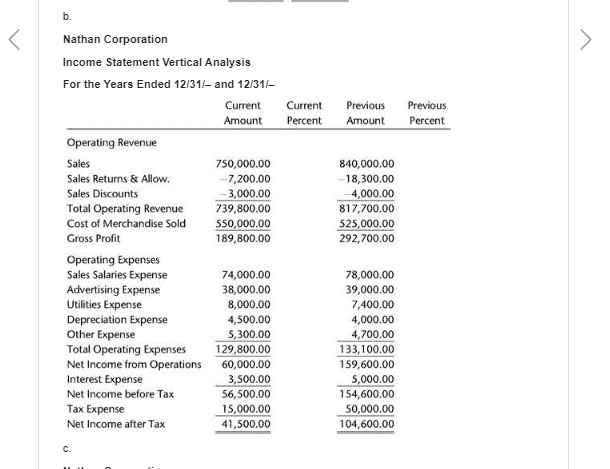

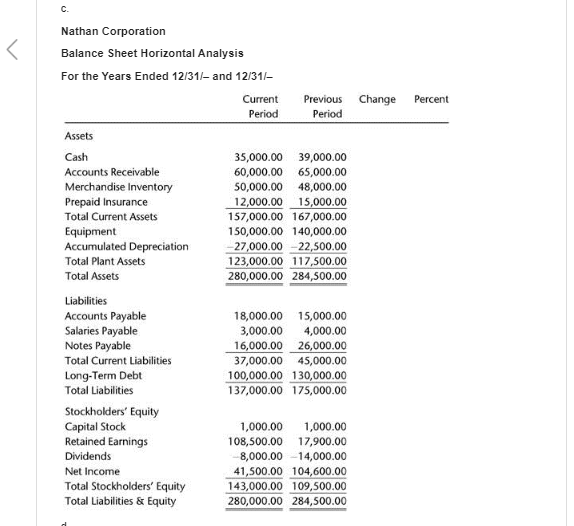

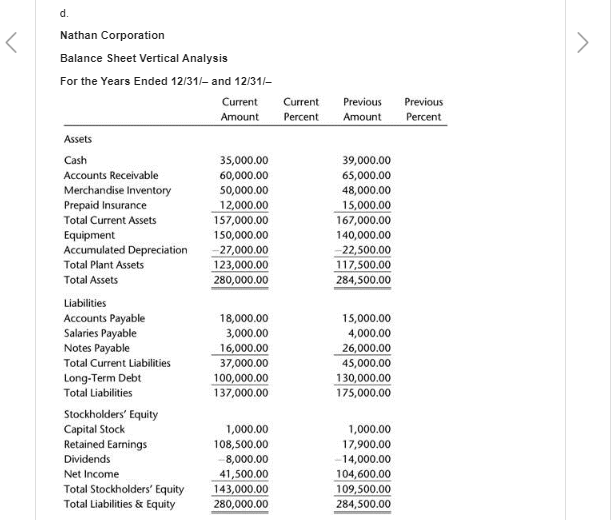

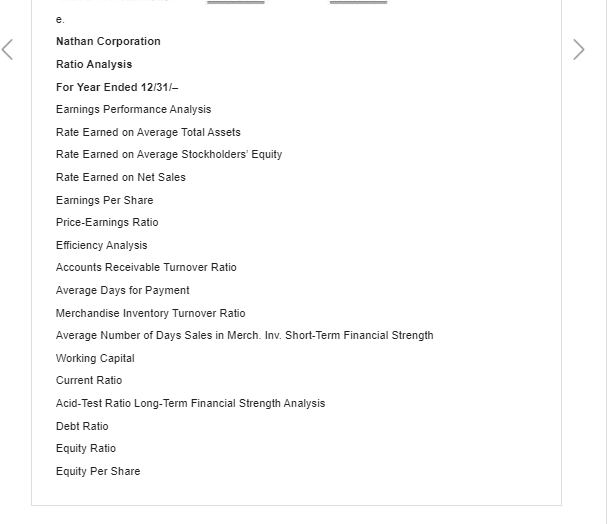

Prepare a horizontal, vertical, and ratio analysis for Nathan Corporation. Start your spreadsheet software and load the spreadsheet template file IAS Spreadsheet 09-C.xlsx. Use formulas to compute changes, percents, and ratios. Assume 30,000 shares of stock are outstanding and the market price per share was $30. Print your completed spreadsheet or enter the results of that spreadsheet into the table below. Save the spreadsheet with a file name of 09-C Your Name. a. Nathan Corporation Change Percent Income Statement Horizontal Analysis For the Years Ended 12/31 - and 12/31- Current Previous Period Period Operating Revenue Sales 750,000.00 840,000.00 Sales Returns & Allow. 7,200.00 -18,300.00 Sales Discounts -3,000.00 4,000.00 Total Operating Revenue 739,800.00 817,700.00 Cost of Merchandise Sold 550,000.00 525,000.00 Gross Profit 189,800.00 292,700.00 Operating Expenses Sales Salaries Expense 74,000.00 78,000.00 Advertising Expense 38,000.00 39,000.00 Utilities Expense 8,000.00 7,400.00 Depreciation Expense 4,500.00 4,000.00 Other Expense 5,300.00 4,700.00 Total Operating Expenses 129,800.00 133,100.00 Net Income from Operations 60,000.00 159,600.00 Interest Expense 3,500.00 5,000.00 Net Income before Tax 56,500.00 154,600.00 Tax Expense 15,000.00 50,000.00 Net Income after Tax 41,500.00 104,600.00 Current Percent Previous Amount Previous Percent Nathan Corporation Income Statement Vertical Analysis For the Years Ended 12/31/- and 12/311- Current Amount Operating Revenue Sales 750,000.00 Sales Returns & Allow. -7,200.00 Sales Discounts - 3,000.00 Total Operating Revenue 739,800.00 Cost of Merchandise Sold 550,000.00 Gross Profit 189,800.00 840,000.00 18,300.00 4,000.00 817,700.00 525,000.00 292,700.00 Operating Expenses Sales Salaries Expense Advertising Expense Utilities Expense Depreciation Expense Other Expense Total Operating Expenses Net Income from Operations Interest Expense Net Income before Tax Tax Expense Net Income after Tax 74,000.00 38,000.00 8,000.00 4,500.00 5,300.00 129,800.00 60,000.00 3,500.00 56,500.00 15,000.00 41,500.00 78,000.00 39,000.00 7,400.00 4,000.00 4,700.00 133,100.00 159,600.00 5,000.00 154,600.00 50,000.00 104,600.00 Nathan Corporation Balance Sheet Horizontal Analysis For the Years Ended 12/31 - and 12/311- Current Period Previous Period Change Percent Assets Cash Accounts Receivable Merchandise Inventory Prepaid Insurance Total Current Assets Equipment Accumulated Depreciation Total Plant Assets Total Assets 35,000.00 39,000.00 60,000.00 65,000.00 50,000.00 48,000.00 12,000.00 15,000.00 157,000.00 167,000.00 150,000.00 140,000.00 27,000.00 -22,500.00 123,000.00 117,500.00 280,000.00 284,500.00 18,000.00 15,000.00 3,000.00 4,000.00 16,000.00 26,000.00 37,000.00 45,000.00 100,000.00 130,000.00 137,000.00 175,000.00 Liabilities Accounts Payable Salaries Payable Notes Payable Total Current Liabilities Long-Term Debt Total Liabilities Stockholders' Equity Capital Stock Retained Earnings Dividends Net Income Total Stockholders' Equity Total Liabilities & Equity 1,000.00 1,000.00 108,500.00 17,900.00 8,000.00 -14,000.00 41,500.00 104,600.00 143,000.00 109,500.00 280,000.00 284,500.00 Nathan Corporation Balance Sheet Vertical Analysis For the Years Ended 12/31 - and 12/31/- Current Amount Current Percent Previous Amount Previous Percent Assets Cash Accounts Receivable Merchandise Inventory Prepaid Insurance Total Current Assets Equipment Accumulated Depreciation Total Plant Assets Total Assets 35,000.00 60,000.00 50,000.00 12,000.00 157,000.00 150,000.00 - 27,000.00 123,000.00 280,000.00 39,000.00 65,000.00 48,000.00 15,000.00 167,000.00 140,000.00 -22,500.00 117,500.00 284,500.00 18,000.00 3,000.00 16,000.00 37,000.00 100,000.00 137,000.00 15,000.00 4,000.00 26,000.00 45,000.00 130,000.00 175,000.00 Liabilities Accounts Payable Salaries Payable Notes Payable Total Current Liabilities Long-Term Debt Total Liabilities Stockholders' Equity Capital Stock Retained Earnings Dividends Net Income Total Stockholders' Equity Total Liabilities & Equity 1,000.00 108,500.00 8,000.00 41,500.00 143,000.00 280,000.00 1,000.00 17,900.00 -14,000.00 104,600.00 109,500.00 284,500.00 Nathan Corporation Ratio Analysis For Year Ended 12/31/- Earnings Performance Analysis Rate Earned on Average Total Assets Rate Earned on Average Stockholders' Equity Rate Earned on Net Sales Earnings Per Share Price-Earnings Ratio Efficiency Analysis Accounts Receivable Turnover Ratio Average Days for Payment Merchandise Inventory Turnover Ratio Average Number of Days Sales in Merch. Inv. Short-Term Financial Strength Working Capital Current Ratio Acid-Test Ratio Long-Term Financial Strength Analysis Debt Ratio Equity Ratio Equity Per Share