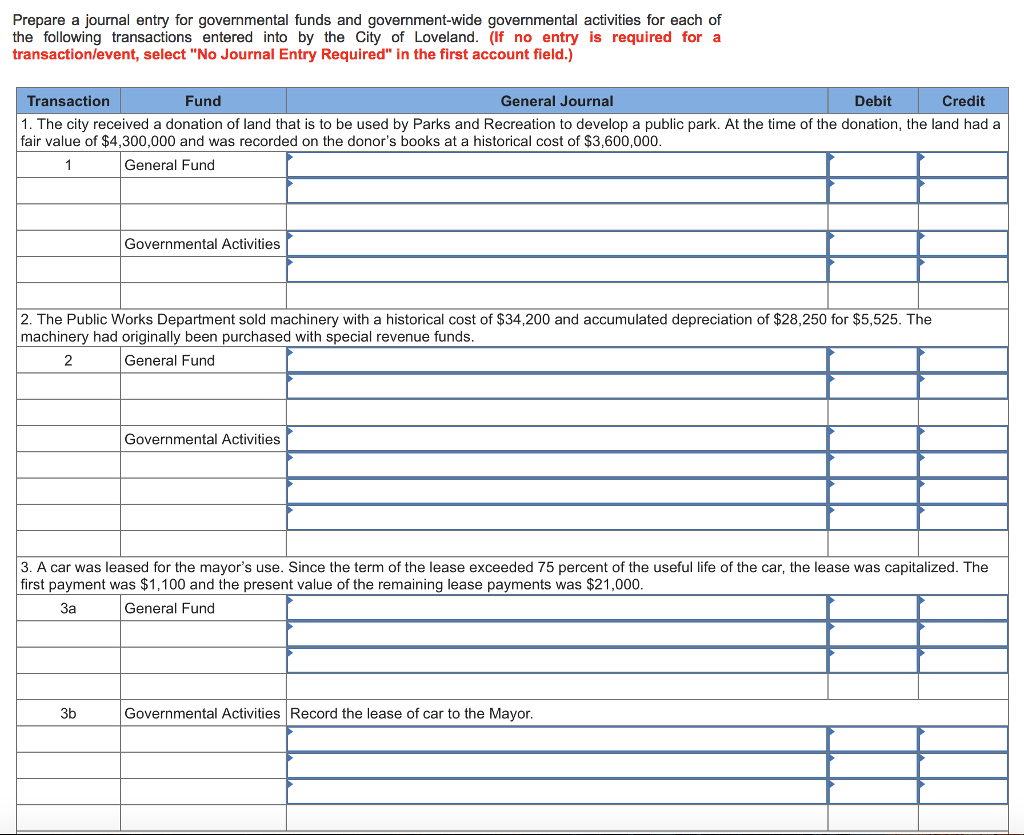

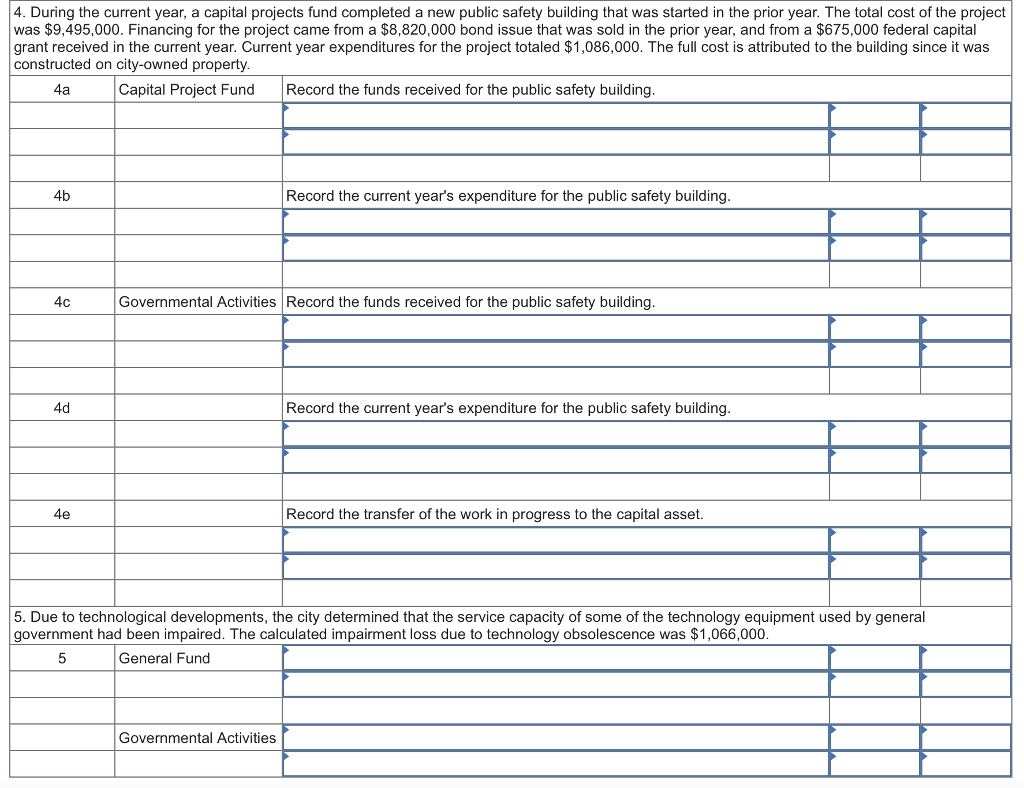

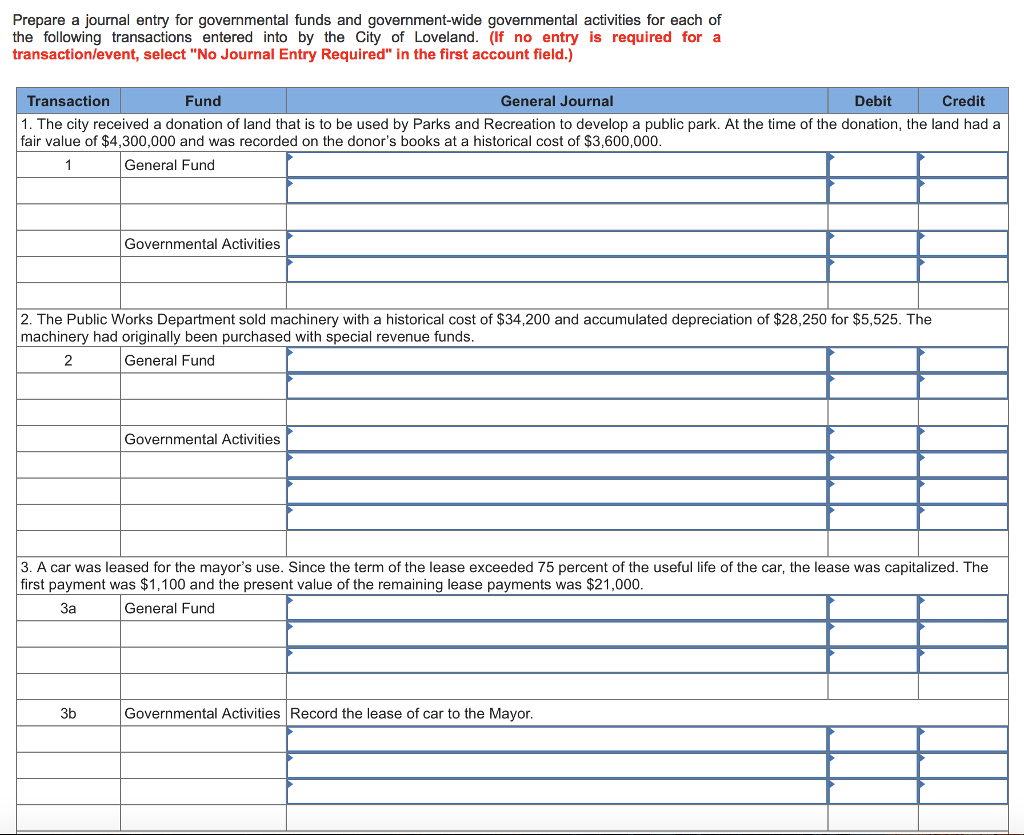

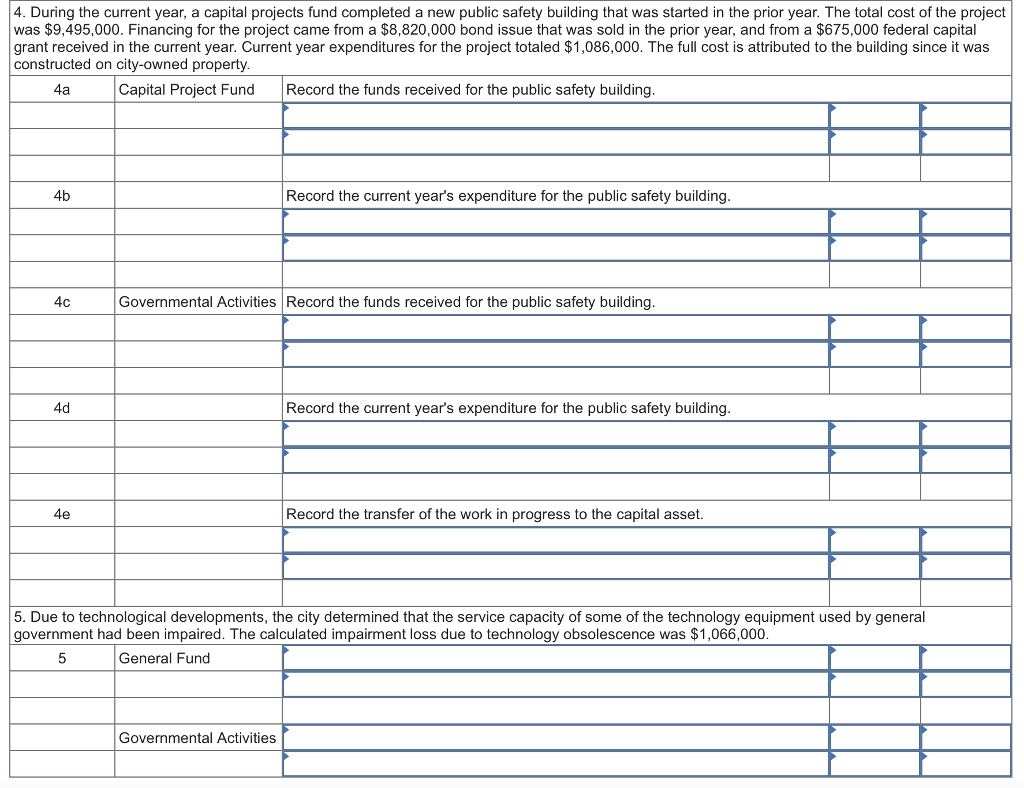

Prepare a journal entry for governmental funds and government-wide governmental activities for each of the following transactions entered into by the City of Loveland. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Transaction Fund General Journal Debit Credit 1. The city received a donation of land that is to be used by Parks and Recreation to develop a public park. At h fair value of $4,300,000 and was recorded on the donor's books at a historical cost of $3,600,000 time of the donation. the and had General Fund Governmental Activities 2. The Public Works Department sold machinery with a historical cost of $34,200 and accumulated depreciation of $28,250 for $5,525. The machinery had originally been purchased with special revenue funds 2 General Fund Governmental Activities 3. A car was leased for the mayor's use. Since the term of the lease exceeded 75 percent of the useful life of the car, the lease was capitalized. The first payment was $1,100 and the present value of the remaining lease payments was $21,000 3a General Fund 3b Governmental Activities Record the lease of car to the Mayor. Prepare a journal entry for governmental funds and government-wide governmental activities for each of the following transactions entered into by the City of Loveland. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Transaction Fund General Journal Debit Credit 1. The city received a donation of land that is to be used by Parks and Recreation to develop a public park. At h fair value of $4,300,000 and was recorded on the donor's books at a historical cost of $3,600,000 time of the donation. the and had General Fund Governmental Activities 2. The Public Works Department sold machinery with a historical cost of $34,200 and accumulated depreciation of $28,250 for $5,525. The machinery had originally been purchased with special revenue funds 2 General Fund Governmental Activities 3. A car was leased for the mayor's use. Since the term of the lease exceeded 75 percent of the useful life of the car, the lease was capitalized. The first payment was $1,100 and the present value of the remaining lease payments was $21,000 3a General Fund 3b Governmental Activities Record the lease of car to the Mayor