Answered step by step

Verified Expert Solution

Question

1 Approved Answer

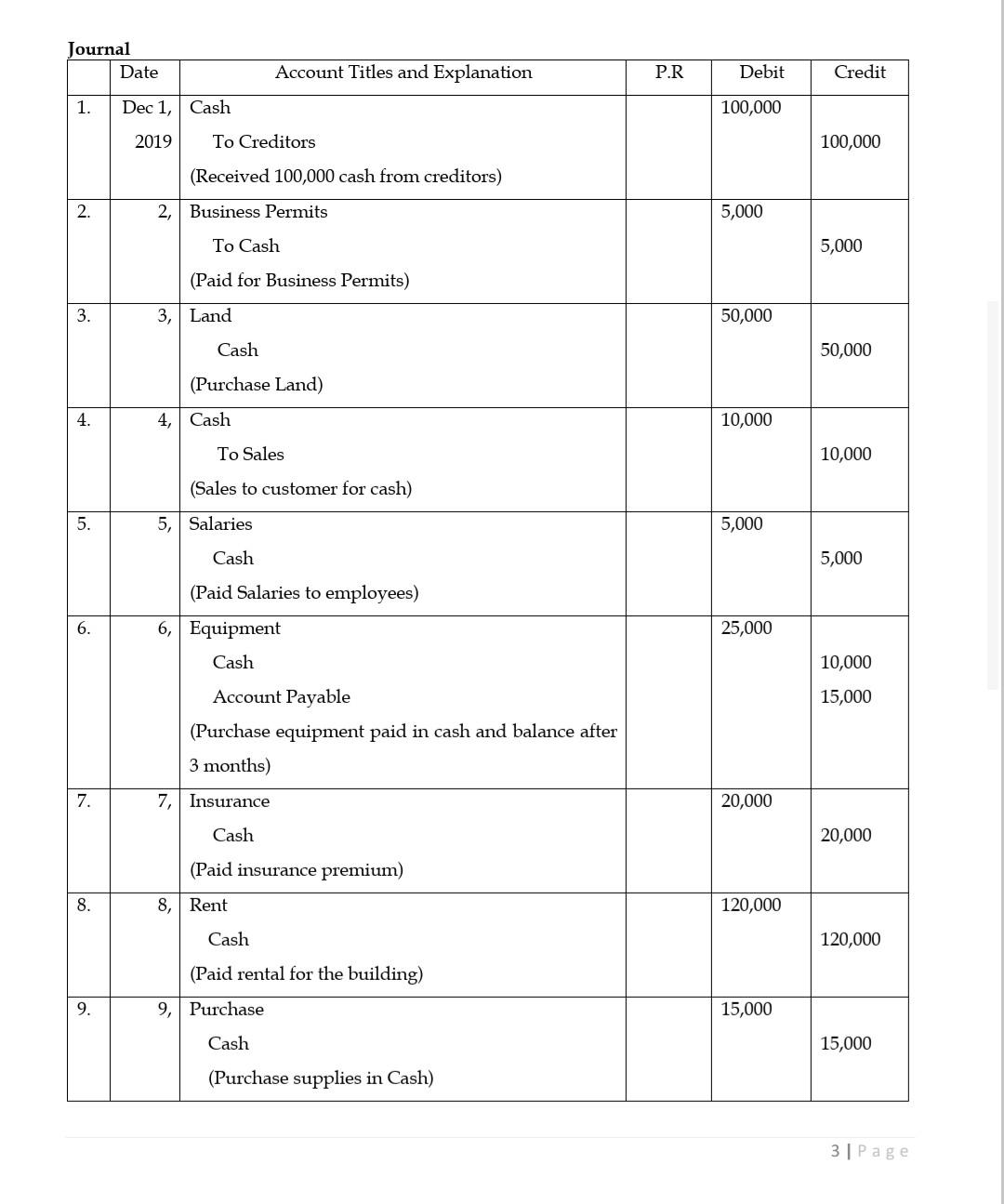

Prepare a Ledger Account Journal Date Account Titles and Explanation P.R Debit Credit 1. Dec 1, Cash 100,000 2019 To Creditors 100,000 (Received 100,000 cash

Prepare a

Ledger Account

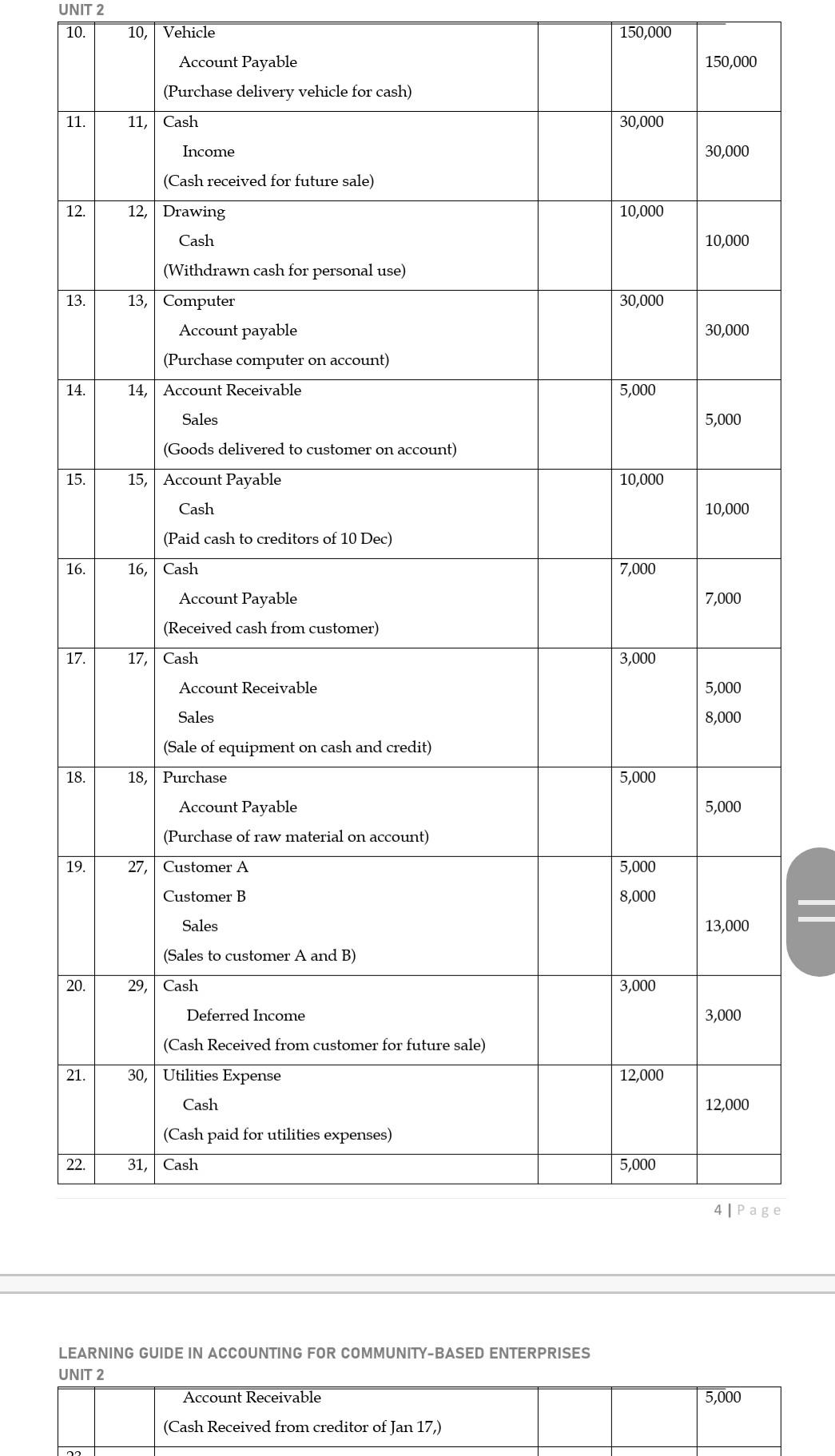

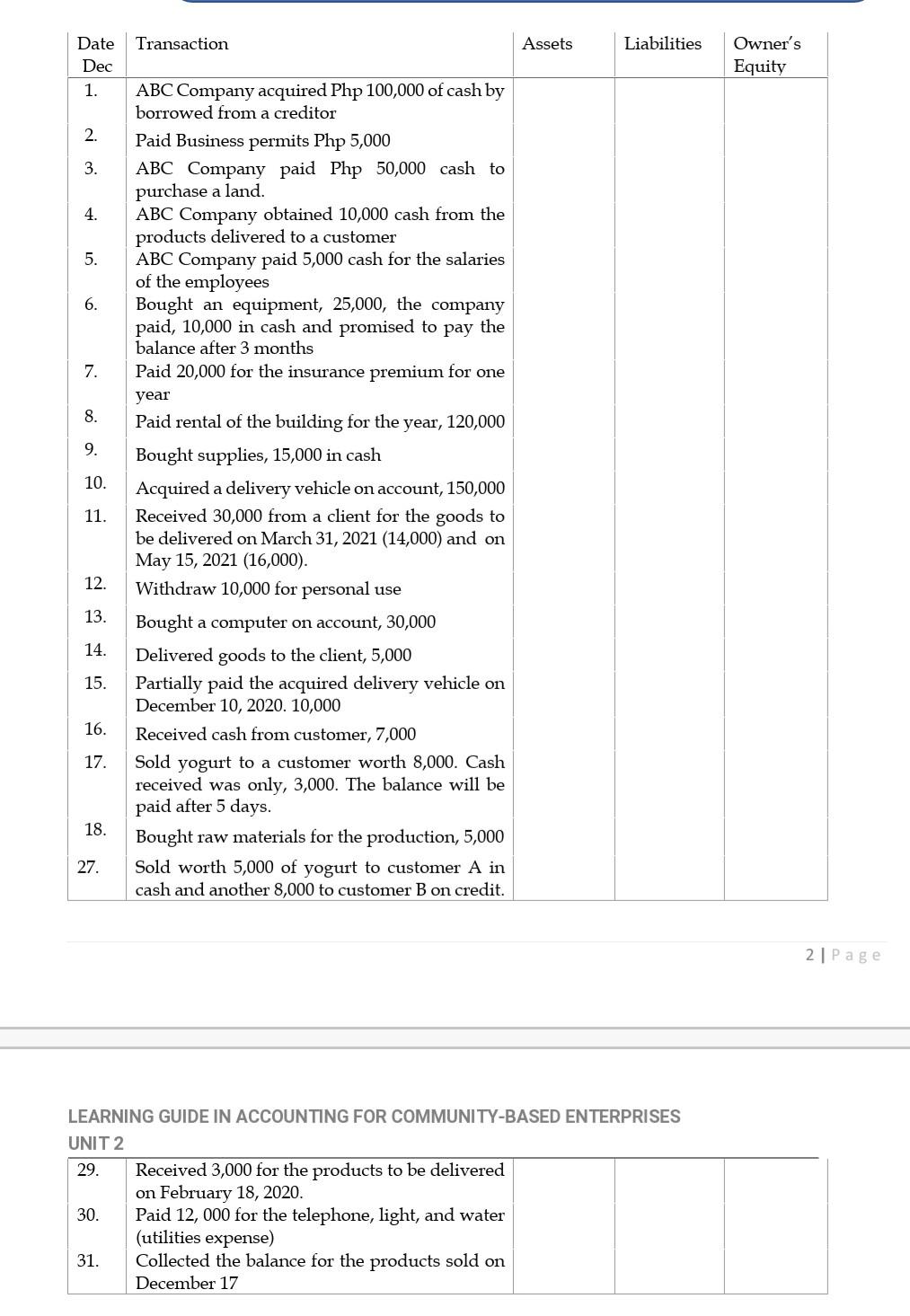

Journal Date Account Titles and Explanation P.R Debit Credit 1. Dec 1, Cash 100,000 2019 To Creditors 100,000 (Received 100,000 cash from creditors) 2. 2, Business Permits 5,000 To Cash 5,000 (Paid for Business Permits) 3. 3, Land 50,000 Cash 50,000 (Purchase Land) 4. 4, Cash 10,000 To Sales 10,000 (Sales to customer for cash) 5. 5, Salaries 5,000 Cash 5,000 (Paid Salaries to employees) 6, Equipment Cash 25,000 10,000 15,000 Account Payable (Purchase equipment paid in cash and balance after 3 months) 7. 7, Insurance 20,000 Cash 20,000 (Paid insurance premium) 8. 8, Rent 120,000 Cash 120,000 (Paid rental for the building) 9. 9, Purchase 15,000 Cash 15,000 (Purchase supplies in Cash) 3 Page UNIT 2 10. 10, Vehicle 150,000 150,000 Account Payable (Purchase delivery vehicle for cash) 11. 11, Cash 30,000 Income 30,000 (Cash received for future sale) 12. 12, Drawing 10,000 Cash 10,000 13. 30,000 (Withdrawn cash for personal use) 13, Computer Account payable (Purchase computer on account) 14, Account Receivable 30,000 14. 5,000 Sales 5,000 (Goods delivered to customer on account) 15. 15, Account Payable 10,000 Cash 10,000 (Paid cash to creditors of 10 Dec) 16. 16, Cash 7,000 7,000 Account Payable (Received cash from customer) 17. 17, Cash 3,000 Account Receivable 5,000 Sales 8,000 (Sale of equipment on cash and credit) 18, Purchase 18. 5,000 Account Payable 5,000 (Purchase of raw material on account) 19. 27, Customer A 5,000 Customer B 8,000 Sales 13,000 (Sales to customer A and B) 20. 29, Cash 3,000 Deferred Income 3,000 21. 12,000 (Cash Received from customer for future sale) 30, Utilities Expense Cash (Cash paid for utilities expenses) 12,000 22. . 31, Cash 5,000 4 Page LEARNING GUIDE IN ACCOUNTING FOR COMMUNITY-BASED ENTERPRISES UNIT 2 Account Receivable 5,000 (Cash Received from creditor of Jan 17) Transaction Assets Liabilities Date Dec Owner's Equity 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. ABC Company acquired Php 100,000 of cash by borrowed from a creditor Paid Business permits Php 5,000 ABC Company paid Php50,000 cash to purchase a land. ABC Company obtained 10,000 cash from the products delivered to a customer ABC Company paid 5,000 cash for the salaries of the employees Bought an equipment, 25,000, the company paid, 10,000 in cash and promised to pay the balance after 3 months Paid 20,000 for the insurance premium for one year Paid rental of the building for the year, 120,000 Bought supplies, 15,000 in cash Acquired a delivery vehicle on account, 150,000 Received 30,000 from a client for the goods to be delivered on March 31, 2021 (14,000) and on May 15, 2021 (16,000). Withdraw 10,000 for personal use Bought a computer on account, 30,000 Delivered goods to the client, 5,000 Partially paid the acquired delivery vehicle on December 10, 2020. 10,000 Received cash from customer, 7,000 Sold yogurt to a customer worth 8,000. Cash received was only, 3,000. The balance will be paid after 5 days. Bought raw materials for the production, 5,000 Sold worth 5,000 of yogurt to customer A in cash and another 8,000 to customer B on credit. 11. 12. 13. 14. 15. 16. 17. 18. 27. 2 Page LEARNING GUIDE IN ACCOUNTING FOR COMMUNITY-BASED ENTERPRISES UNIT 2 29. Received 3,000 for the products to be delivered on February 18, 2020. 30. Paid 12,000 for the telephone, light, and water (utilities expense) 31. Collected the balance for the products sold on December 17Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started