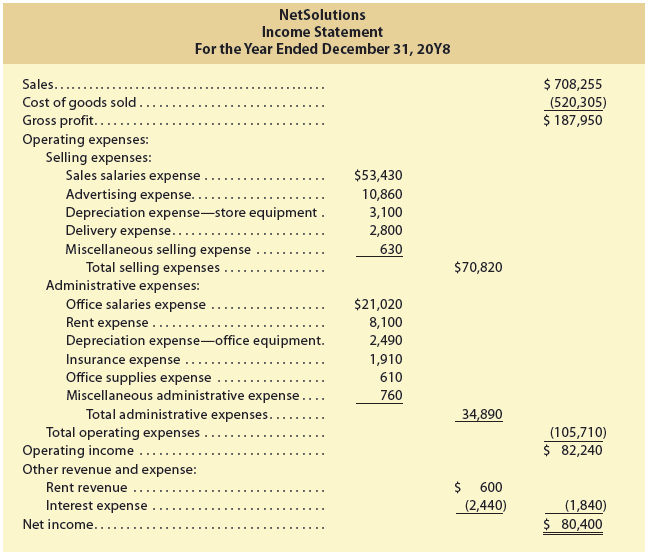

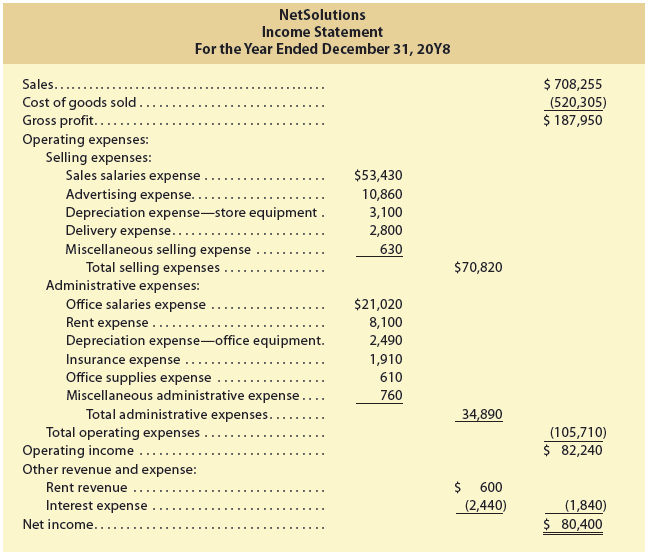

Prepare a multiple-step income statement based on this form.

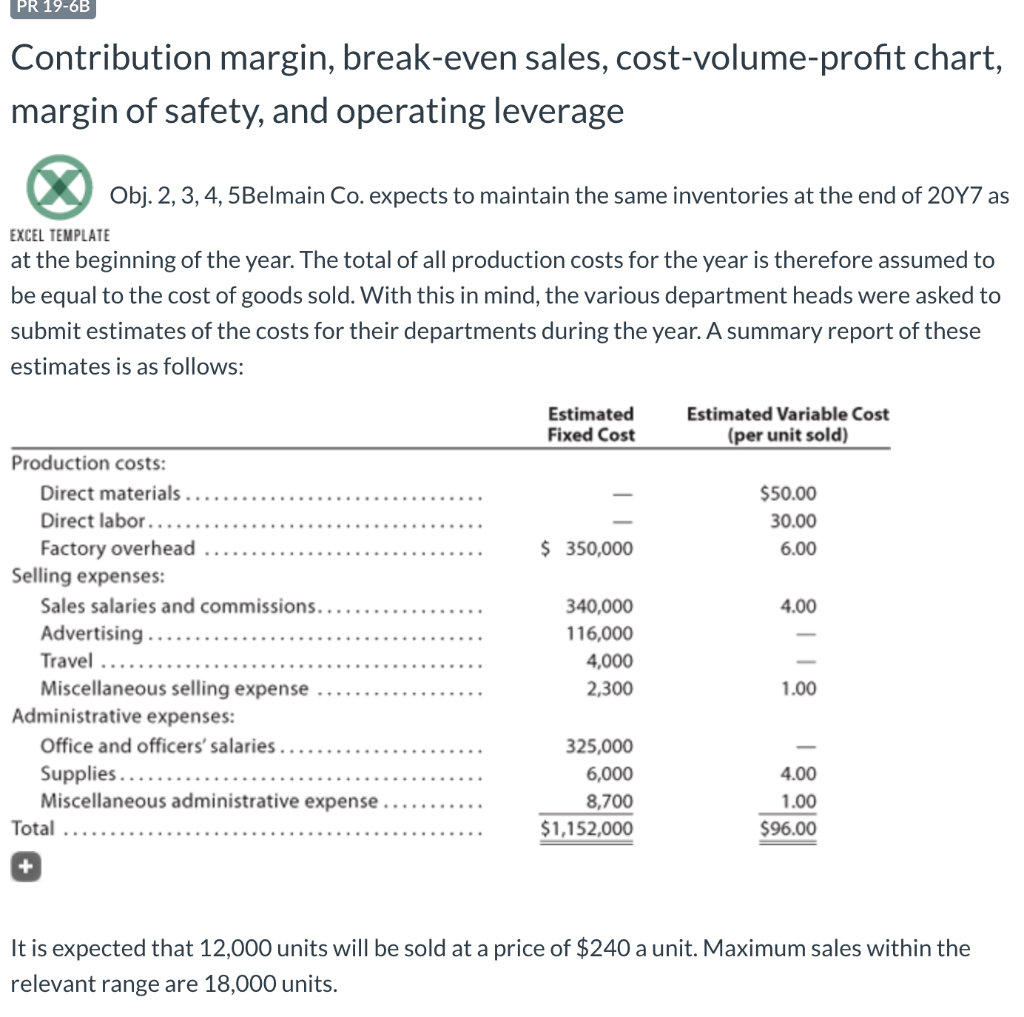

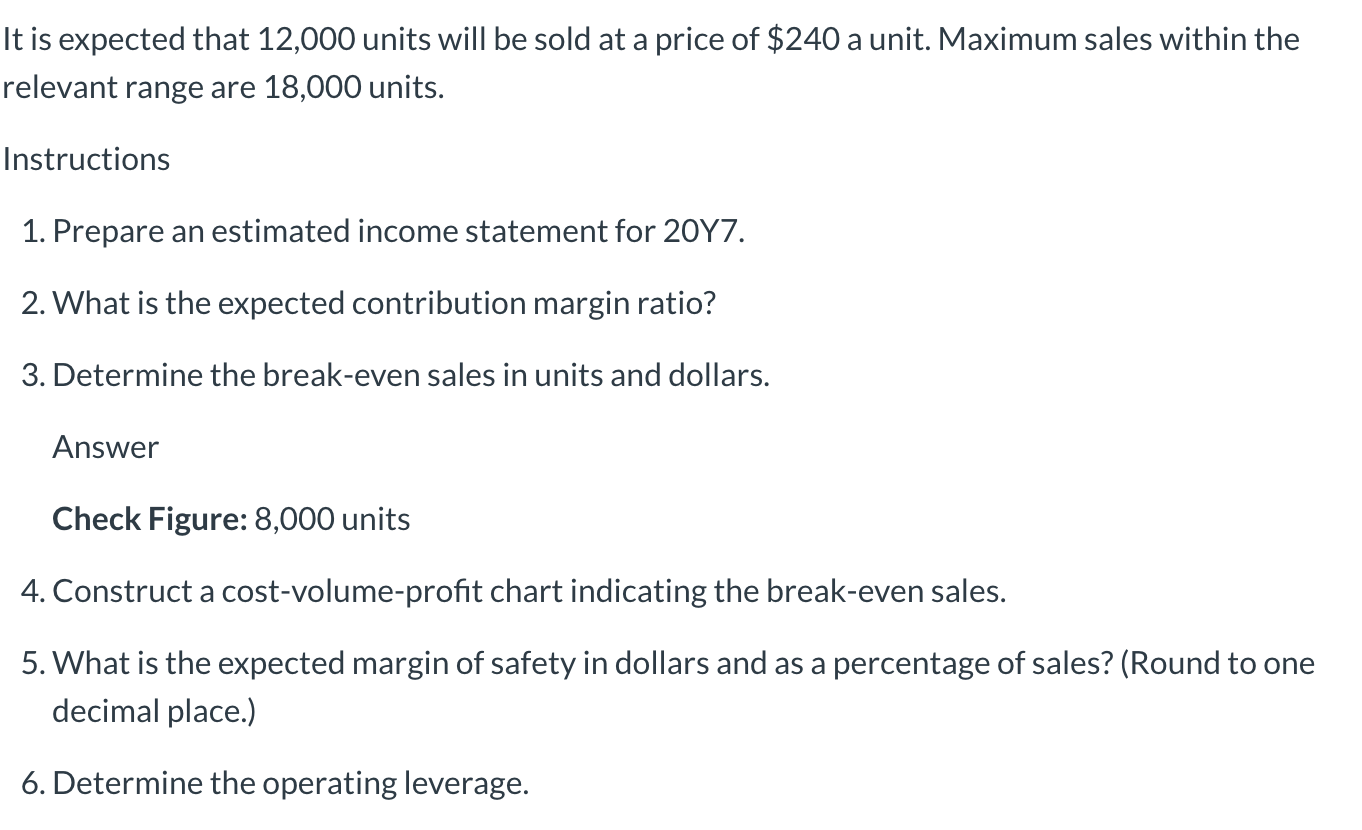

Also, determine: (1) the break-even in units and dollars, (2) explain what the calculated contribution margin means for this company, (3) what is the expected margin of safety in dollars and as a percentage of sales and explain what these numbers mean for the company.

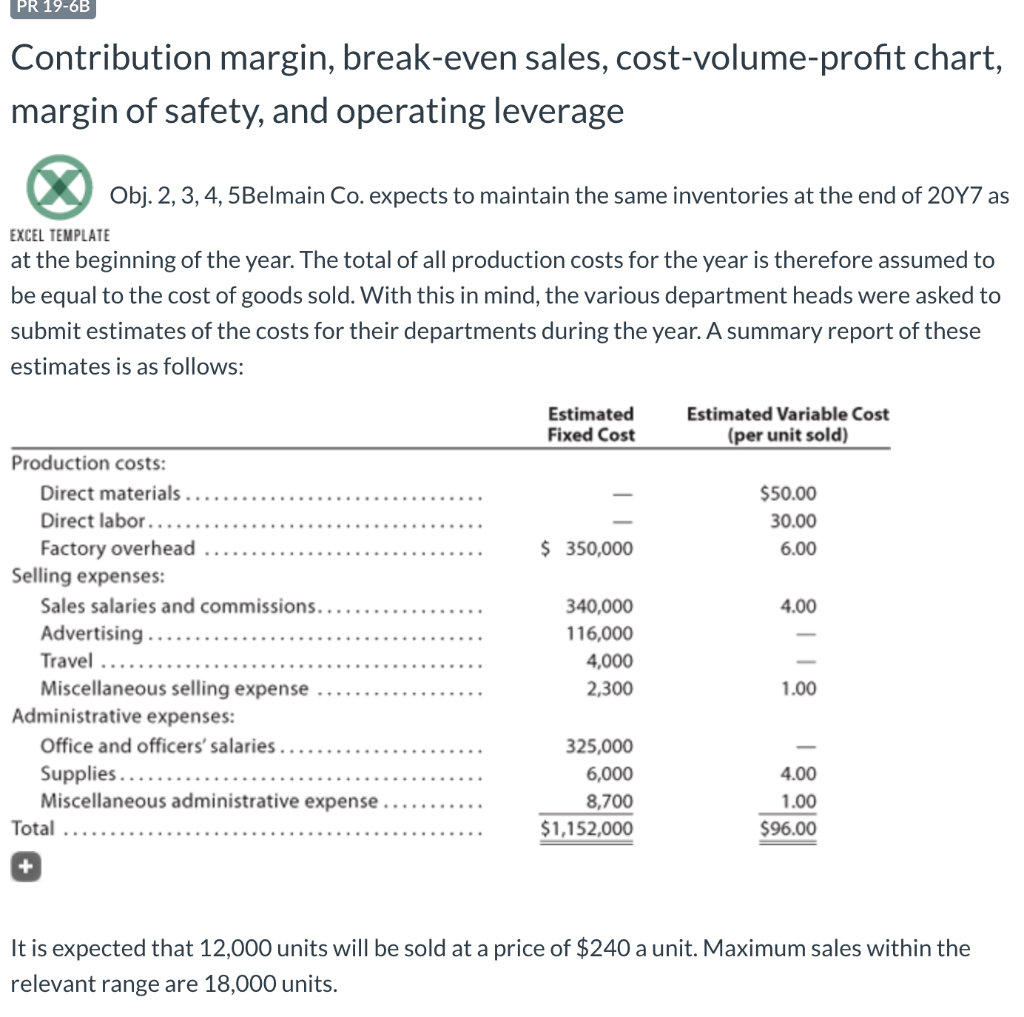

NetSolutions Income Statement For the Year Ended December 31, 2048 $ 708,255 (520,305) $ 187,950 $53,430 10,860 3,100 2,800 630 $70,820 Sales...... Cost of goods sold. Gross profit... Operating expenses: Selling expenses: Sales salaries expense. Advertising expense. Depreciation expense-store equipment. Delivery expense.... Miscellaneous selling expense Total selling expenses Administrative expenses: Office salaries expense Rent expense. Depreciation expense-office equipment. Insurance expense Office supplies expense Miscellaneous administrative expense. Total administrative expenses. Total operating expenses Operating income. Other revenue and expense: Rent revenue ...... Interest expense Net income.. $21,020 8,100 2,490 1,910 610 760 34,890 (105,710) $ 82,240 $ 600 (2,440) (1,840) $ 80,400 PR 19-6B Contribution margin, break-even sales, cost-volume-profit chart, margin of safety, and operating leverage Obj. 2, 3, 4, 5Belmain Co. expects to maintain the same inventories at the end of 2017 as EXCEL TEMPLATE at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows: Estimated Fixed Cost Estimated Variable Cost (per unit sold) $50.00 30.00 6.00 $ 350,000 4.00 Pro iction costs: Direct materials Direct labor... Factory overhead Selling expenses: Sales salaries and commissions. Advertising Travel Miscellaneous selling expense Administrative expenses: Office and officers' salaries .. Supplies..... Miscellaneous administrative expense Total 340,000 116,000 4,000 2,300 1.00 325,000 6,000 8,700 $1,152,000 4.00 1.00 $96.00 It is expected that 12,000 units will be sold at a price of $240 a unit. Maximum sales within the relevant range are 18,000 units. It is expected that 12,000 units will be sold at a price of $240 a unit. Maximum sales within the relevant range are 18,000 units. Instructions 1. Prepare an estimated income statement for 20Y7. 2. What is the expected contribution margin ratio? 3. Determine the break-even sales in units and dollars. Answer Check Figure: 8,000 units 4. Construct a cost-volume-profit chart indicating the break-even sales. 5. What is the expected margin of safety in dollars and as a percentage of sales? (Round to one decimal place.) 6. Determine the operating leverage