Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare a net worth statement for David. 20 Family friend, David Robertson, has asked you to help him gain control of his personal finances. Single

Prepare a net worth statement for David.

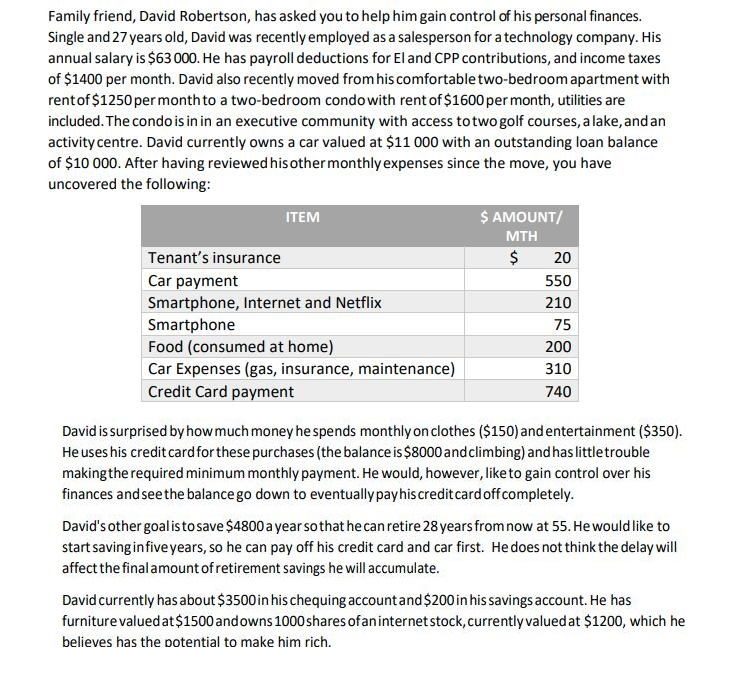

20 Family friend, David Robertson, has asked you to help him gain control of his personal finances. Single and 27 years old, David was recently employed as a salesperson for a technology company. His annual salary is $63 000. He has payroll deductions for Eland CPP contributions, and income taxes of $1400 per month. David also recently moved from his comfortable two-bedroom apartment with rentof$1250 per month to a two-bedroom condo with rent of $1600 per month, utilities are included. The condo is in in an executive community with access to two golf courses, a lake, and an activity centre. David currently owns a car valued at $11 000 with an outstanding loan balance of $10 000. After having reviewed his other monthly expenses since the move, you have uncovered the following: ITEM $ AMOUNT/ MTH Tenant's insurance $ Car payment 550 Smartphone, Internet and Netflix 210 Smartphone 75 Food (consumed at home) 200 Car Expenses (gas, insurance, maintenance) 310 Credit Card payment 740 David is surprised by how much money he spends monthly on clothes ($150) and entertainment ($350). He uses his credit card for these purchases (the balance is $8000 and climbing) and has little trouble making the required minimum monthly payment. He would, however, like to gain control over his finances and see the balance go down to eventually payhis credit cardoffcompletely. David's other goal is to save $4800 a year so that he can retire 28 years from now at 55. He would like to start savinginfive years, so he can pay off his credit card and car first. He does not think the delay will affect the final amount of retirement savings he will accumulate. David currently has about $3500 in his chequing account and $200 in his savings account. He has furniture valued at $1500 andowns 1000 shares of an internet stock, currently valued at $1200, which he believes has the potential to make him richStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started