Answered step by step

Verified Expert Solution

Question

1 Approved Answer

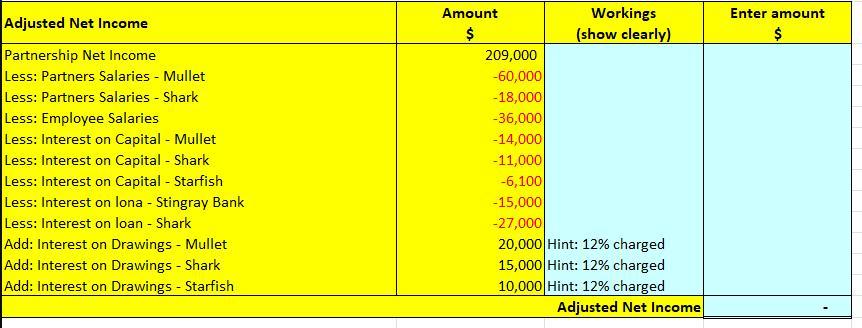

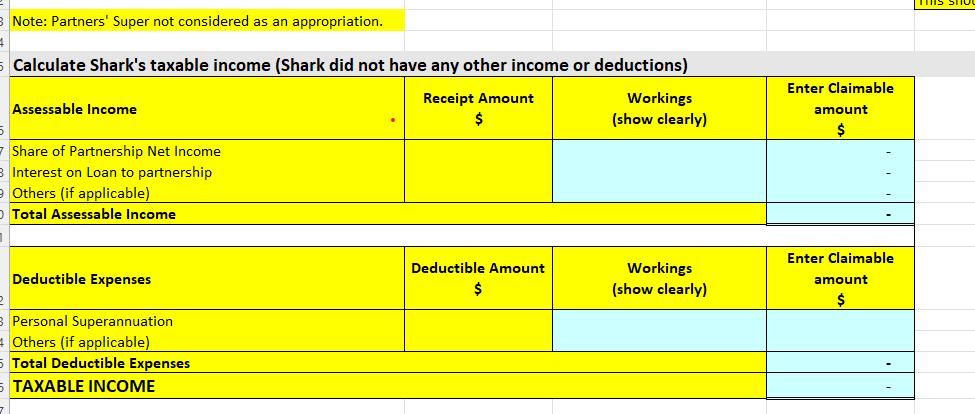

Prepare a partnership distribution statement. Calculate Shark's taxable income (Shark did not have any other income or deduction). I need shark's taxable income part completed.

Prepare a partnership distribution statement. Calculate Shark's taxable income (Shark did not have any other income or deduction).

I need shark's taxable income part completed.

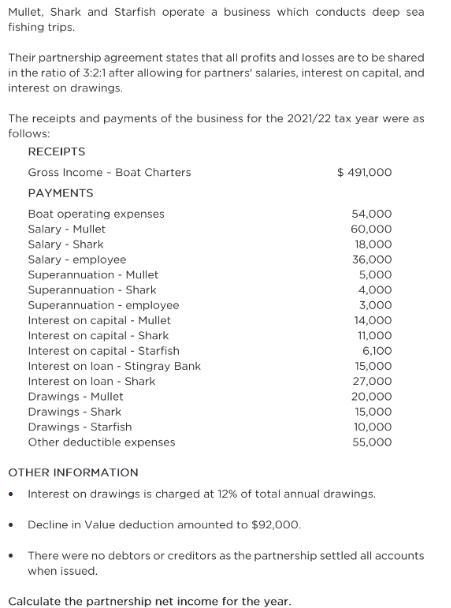

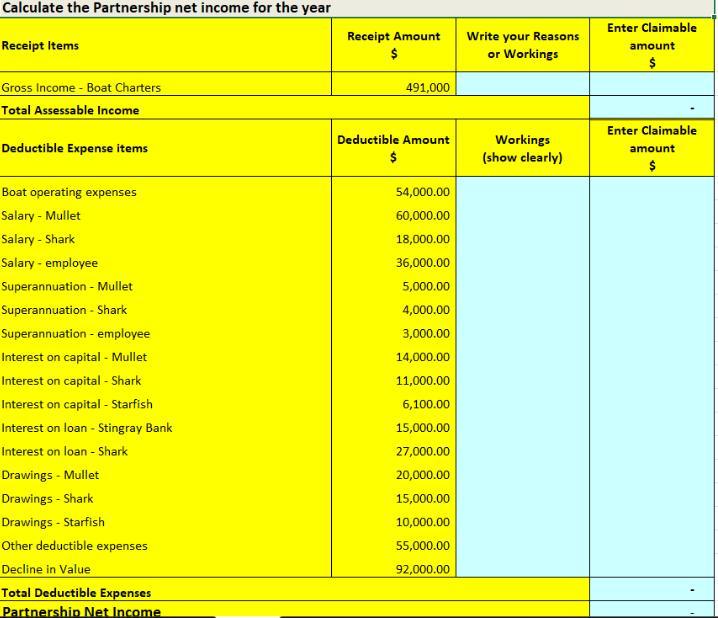

Mullet, Shark and Starfish operate a business which conducts deep sea fishing trips. Their partnership agreement states that all profits and losses are to be shared in the ratio of 3:2:1 after allowing for partners' salaries, interest on capital, and interest on drawings. The receipts and payments of the business for the 2021/22 tax year were as follows: RECEIPTS Gross Income - Boat Charters PAYMENTS Boat operating expenses Salary - Mullet Salary Shark Salary - employee Superannuation- Mullet Superannuation - Shark Superannuation - employee Interest on capital - Mullet Interest on capital - Shark Interest on capital - Starfish Interest on loan - Stingray Bank Interest on loan - Shark Drawings Mullet Drawings - Shark Drawings - Starfish Other deductible expenses $ 491,000 54,000 60,000 18,000 36,000 5,000 4,000 3,000 14,000 11,000 6,100 15,000 27,000 20,000 15,000 10,000 55,000 OTHER INFORMATION Interest on drawings is charged at 12% of total annual drawings. Decline in Value deduction amounted to $92,000. There were no debtors or creditors as the partnership settled all accounts when issued. Calculate the partnership net income for the year.

Step by Step Solution

★★★★★

3.55 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started