Answered step by step

Verified Expert Solution

Question

1 Approved Answer

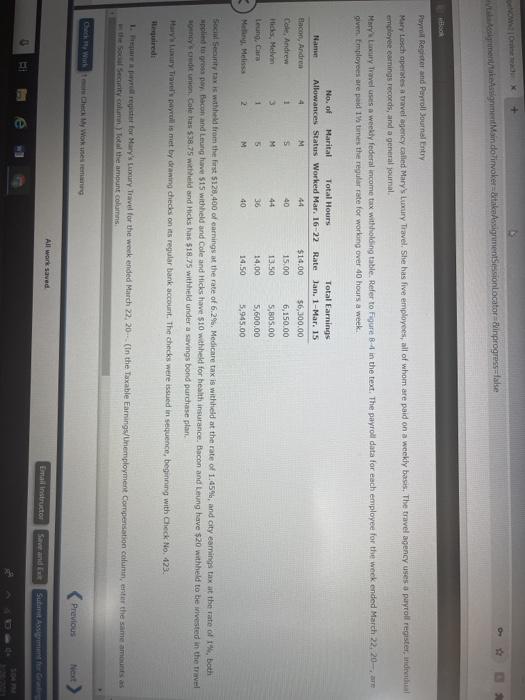

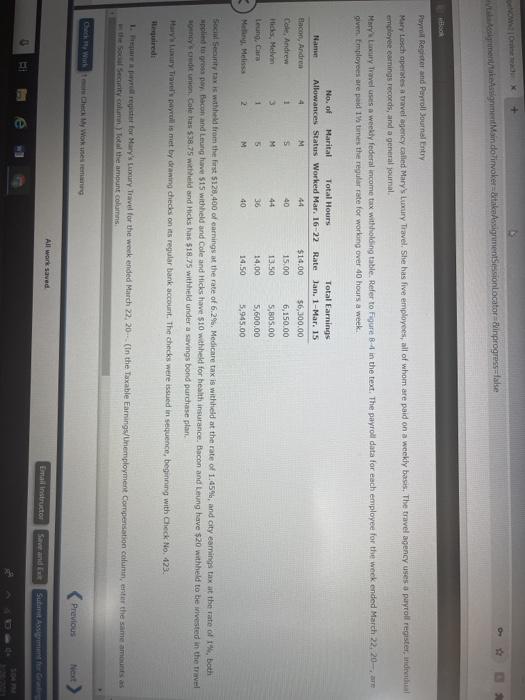

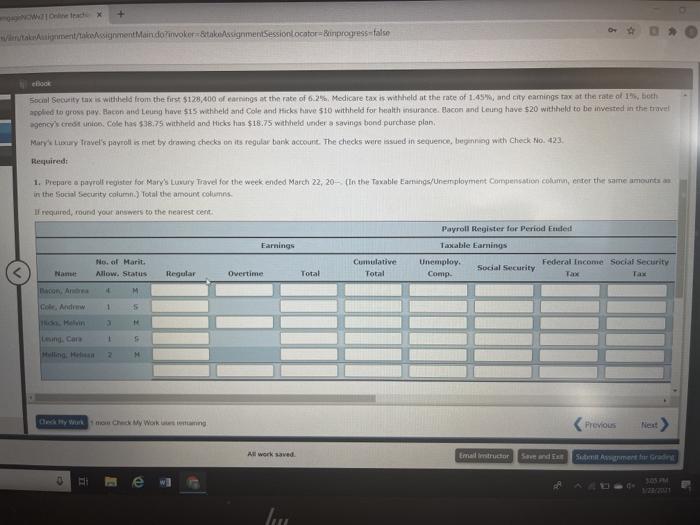

prepare a payroll register for mary's luxury travel for the week ended march 22, 20 + rentassignment Main doinvokertakassignmentSessionLocatorinprogress-lase Payroll Register and Payroll Journal Entry

prepare a payroll register for mary's luxury travel for the week ended march 22, 20

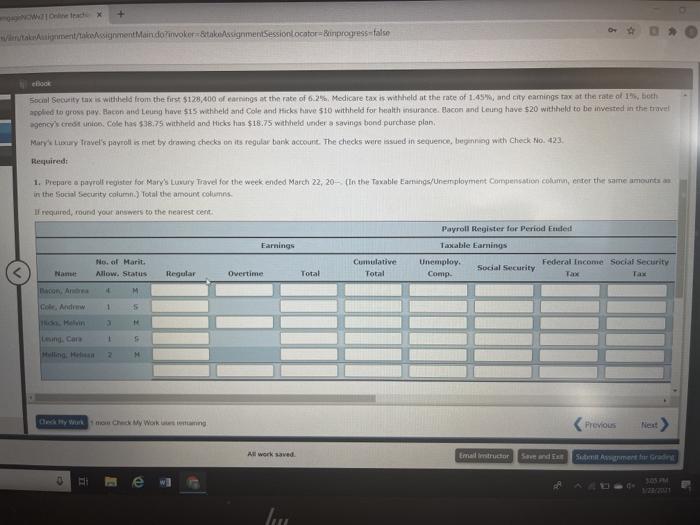

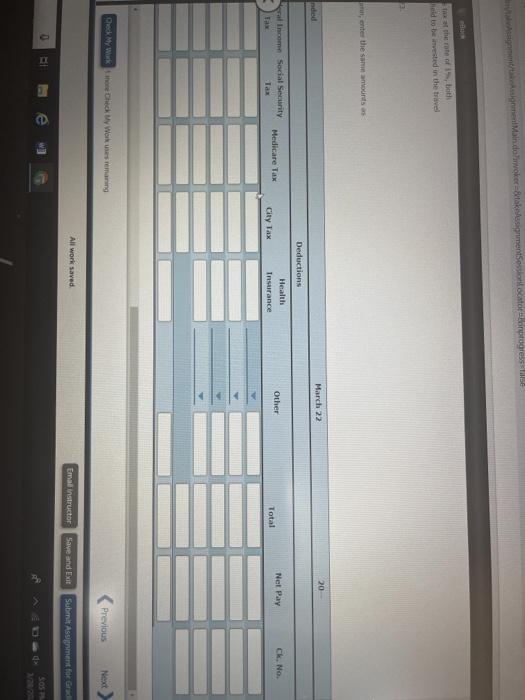

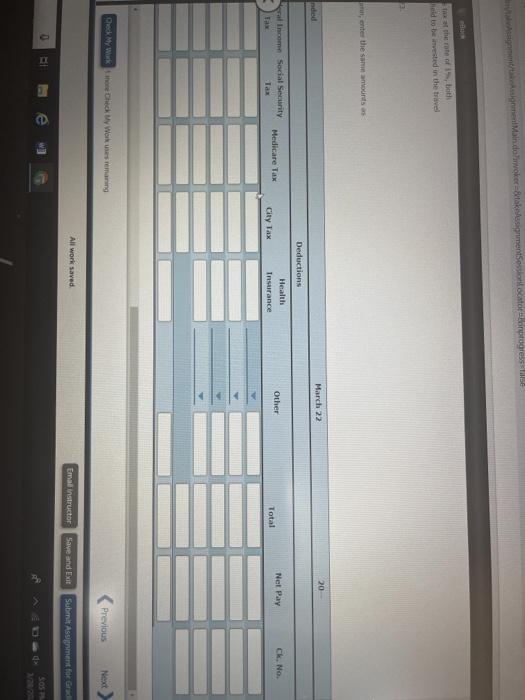

+ rentassignment Main doinvokertakassignmentSessionLocatorinprogress-lase Payroll Register and Payroll Journal Entry Mary tosch operates a travel agency called Mary's Luxury Travel. She has five employees, all of whom are paid on a weekly basis. The travel agency uses a payroll register, indeacha! employee earnings records, and a general joumal Mary Luxury Travel is a weekly federal income tax withholding tible. Refer to figure B-4 in the text. The payroll data for each employee for the week ended March 22, 20- given Employees are paid 1 times the regular rate for working over 40 hours a week. Nam Bacon, Andrea Cole, Andrew Hid, Melv Leung, Cara Men, Melissa No. of Marital Total Hours Total Earnings Allowances Status Worked Mar. 16-22 Rate Jan. 1-Mar. 15 M 44 $14.00 $6,300.00 1 5 40 15.00 6,150.00 M 44 13.50 5,805.00 1 36 14.00 5,600.00 2 M 40 14.50 5,945.00 Social Security taxis withheld from the first $128.400 of earnings at the rate of 6.2%. Medicare tax is withheld at the rate of 1.459, and city earnings tax at the rate of both applied to gross poy. Bacon and Leung have 15 withheld and Cole and Hicks have $10 withheld for health insurance Bacon and Leung have $20 withheld to be wivested in the Travel dit union Cole has 538.75 withheld and Hickshas 518.75 withheld under a savings bond purchase plan Maysary Travely pyroll is met by deaining checks on its regular bank account. The checks were issued in sequence, beginning with Check No 123 1. register for Mary's Luxury Travel for the week ended March 22, 20. (In the Taxable Earnings/Unemployment Compensation column, enter the same amounts as the Social Security column) Total the amount columns DOW Previous All work saved Emtal instructor Save and Sunt Assim 0 . timent/bigment Main doinvokera&takossignmentSessionLocator Sinprogress-false Social Security tax is withheld from the first $128.400 of earnings at the rate of 62% Medicare tax is withheld at the rate of 1.45%, and city earnings tax at the rate of both applied to gross paylacon and Leung have $15 withheld and Cole and Hicks have $10 withheld for health insurance Bacon and Leung have $20 withheld to be invested in the travel gency's creatinio. Cole has $38.75 withheld and Hicks has $18.75 withheld under a savings bond purchase plan Mary Luxury Travel's payrolles met by drawing checks on its regular bank account. The checks were issued in sequence, beginning with Check No. 423. Required: 1. Prepare a payroll register for Mary's Luxury Travel for the week ended March 22, 20- (In the Taxable Earings/Unemployment Compensation column, enter the same amountaan in the Social Security column) Total the amount columns If required, round your answers to the nearest cent Payroll Register for Period brated Earnings Taxable Earnings No. of Marit Cumulative Unemploy, Federal Income Social Security Social Security Allow. Status Regular Overtime Total Total Comp. Nam con Anar 1 M 1 5 Go Mar Main Car 1 M Onday Chew Working (revious > All werk saved Email instructor Summer Gradient RE A lum progresse menten Mindowokertakerment held to be invested in the travel enter the same amounts March 22 20 nded Deductions al income Social Security Tax Medicare Tax Health Insurance Other Net Pay ck. No, City Tax Total Check wy Works remaining Previous Next All work saved Emal instructor Save and Exit Submit Assignment for Grad SOST W202 + rentassignment Main doinvokertakassignmentSessionLocatorinprogress-lase Payroll Register and Payroll Journal Entry Mary tosch operates a travel agency called Mary's Luxury Travel. She has five employees, all of whom are paid on a weekly basis. The travel agency uses a payroll register, indeacha! employee earnings records, and a general joumal Mary Luxury Travel is a weekly federal income tax withholding tible. Refer to figure B-4 in the text. The payroll data for each employee for the week ended March 22, 20- given Employees are paid 1 times the regular rate for working over 40 hours a week. Nam Bacon, Andrea Cole, Andrew Hid, Melv Leung, Cara Men, Melissa No. of Marital Total Hours Total Earnings Allowances Status Worked Mar. 16-22 Rate Jan. 1-Mar. 15 M 44 $14.00 $6,300.00 1 5 40 15.00 6,150.00 M 44 13.50 5,805.00 1 36 14.00 5,600.00 2 M 40 14.50 5,945.00 Social Security taxis withheld from the first $128.400 of earnings at the rate of 6.2%. Medicare tax is withheld at the rate of 1.459, and city earnings tax at the rate of both applied to gross poy. Bacon and Leung have 15 withheld and Cole and Hicks have $10 withheld for health insurance Bacon and Leung have $20 withheld to be wivested in the Travel dit union Cole has 538.75 withheld and Hickshas 518.75 withheld under a savings bond purchase plan Maysary Travely pyroll is met by deaining checks on its regular bank account. The checks were issued in sequence, beginning with Check No 123 1. register for Mary's Luxury Travel for the week ended March 22, 20. (In the Taxable Earnings/Unemployment Compensation column, enter the same amounts as the Social Security column) Total the amount columns DOW Previous All work saved Emtal instructor Save and Sunt Assim 0 . timent/bigment Main doinvokera&takossignmentSessionLocator Sinprogress-false Social Security tax is withheld from the first $128.400 of earnings at the rate of 62% Medicare tax is withheld at the rate of 1.45%, and city earnings tax at the rate of both applied to gross paylacon and Leung have $15 withheld and Cole and Hicks have $10 withheld for health insurance Bacon and Leung have $20 withheld to be invested in the travel gency's creatinio. Cole has $38.75 withheld and Hicks has $18.75 withheld under a savings bond purchase plan Mary Luxury Travel's payrolles met by drawing checks on its regular bank account. The checks were issued in sequence, beginning with Check No. 423. Required: 1. Prepare a payroll register for Mary's Luxury Travel for the week ended March 22, 20- (In the Taxable Earings/Unemployment Compensation column, enter the same amountaan in the Social Security column) Total the amount columns If required, round your answers to the nearest cent Payroll Register for Period brated Earnings Taxable Earnings No. of Marit Cumulative Unemploy, Federal Income Social Security Social Security Allow. Status Regular Overtime Total Total Comp. Nam con Anar 1 M 1 5 Go Mar Main Car 1 M Onday Chew Working (revious > All werk saved Email instructor Summer Gradient RE A lum progresse menten Mindowokertakerment held to be invested in the travel enter the same amounts March 22 20 nded Deductions al income Social Security Tax Medicare Tax Health Insurance Other Net Pay ck. No, City Tax Total Check wy Works remaining Previous Next All work saved Emal instructor Save and Exit Submit Assignment for Grad SOST W202

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started