Answered step by step

Verified Expert Solution

Question

1 Approved Answer

prepare a post closing trial balance at July 31 (b) Prepare a trial balance at July 31 on a worksheet. Enter the following adjustments on

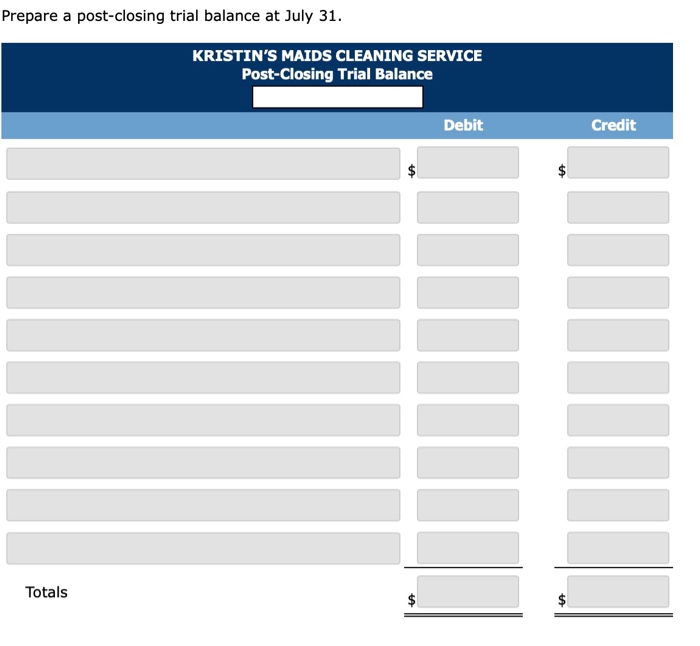

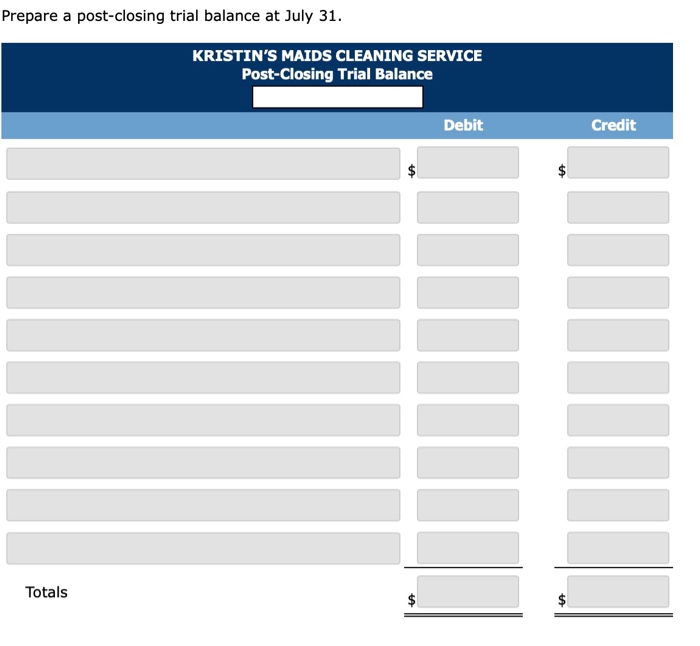

prepare a post closing trial balance at July 31

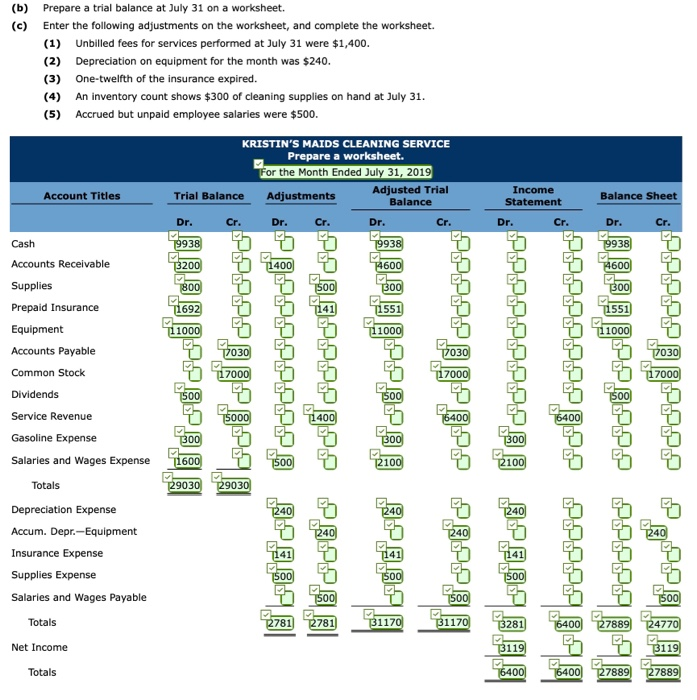

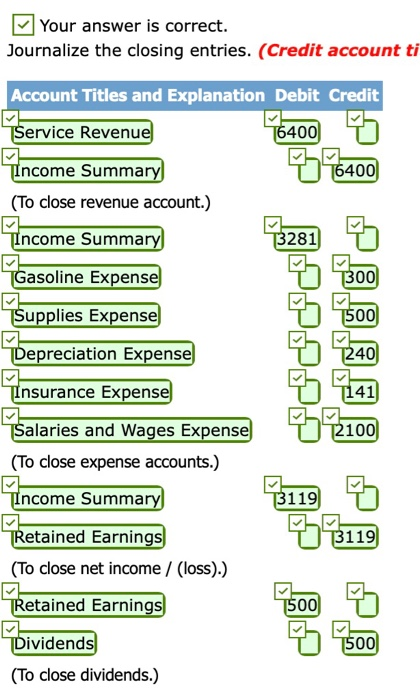

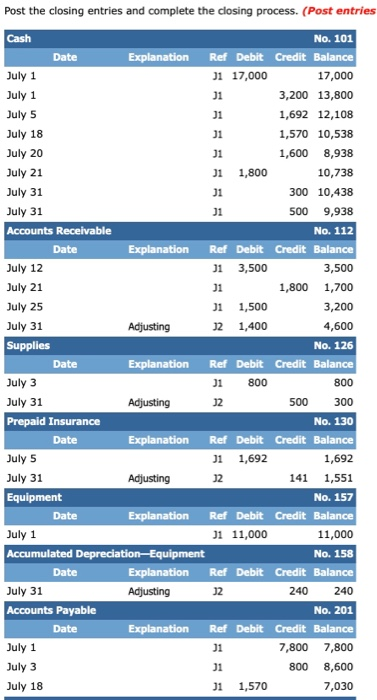

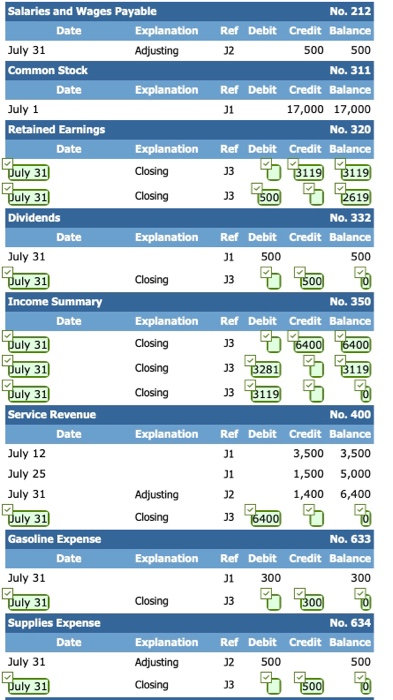

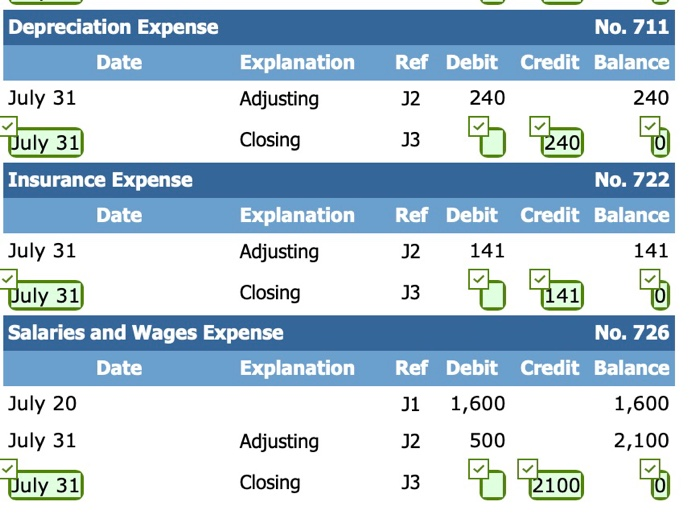

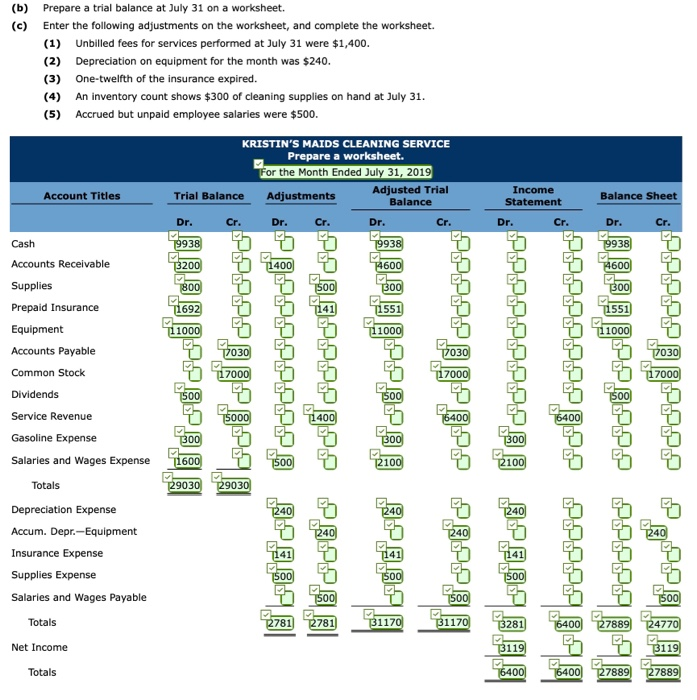

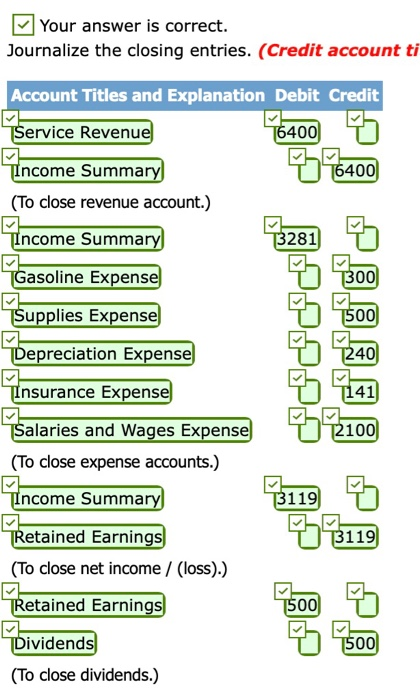

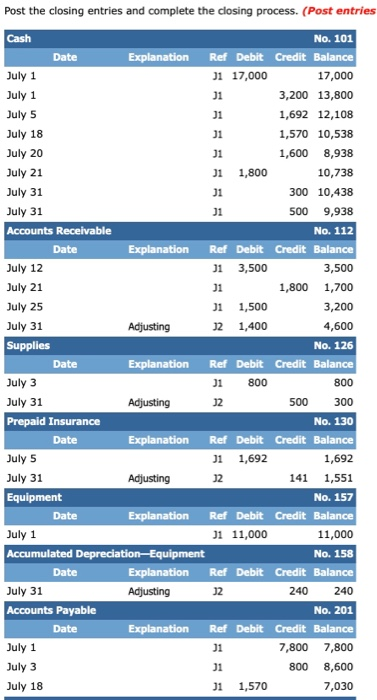

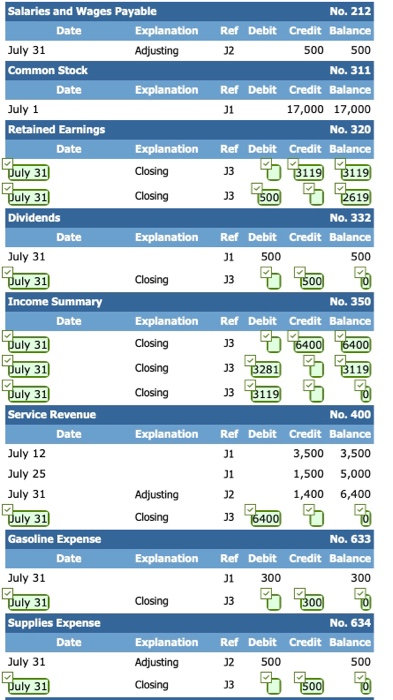

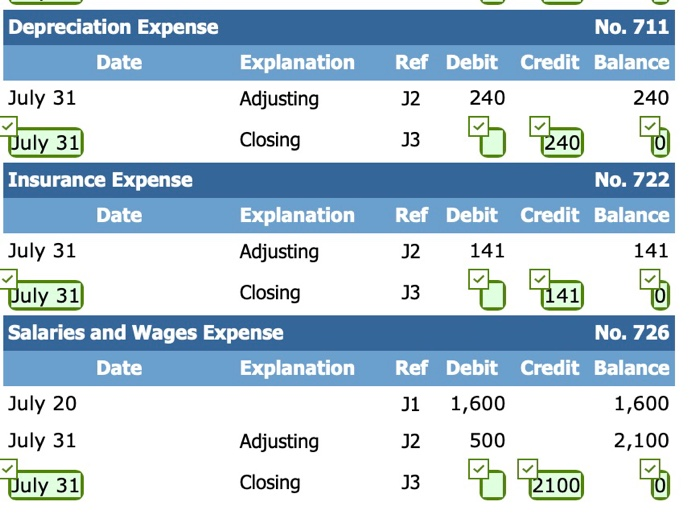

(b) Prepare a trial balance at July 31 on a worksheet. Enter the following adjustments on the worksheet, and complete the worksheet. (1) Unbilled fees for services performed at July 31 were $1,400. (2) Depreciation on equipment for the month was $240. (3) One-twelfth of the insurance expired. An inventory count shows $300 of cleaning supplies on hand at July 31. (5) Accrued but unpaid employee salaries were $500. KRISTIN'S MAIDS CLEANING SERVICE Prepare a worksheet. For the Month Ended July 31, 2019 Trial Balance Adjustments Adjusted Trial Balance Account Titles Income Statement Balance Sheet Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. 19938 19938 19938) 1400 13200 14600 14600 800 300 300 T1551 11551 11692 111000 111000 11000 7030 17030 7030 17000 117000 17000 500 1500 5000 11400 6400 6400 Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accounts Payable Common Stock Dividends Service Revenue Gasoline Expense Salaries and Wages Expense Totals Depreciation Expense Accum. Depr.- Equipment Insurance Expense Supplies Expense Salaries and Wages Payable Totals ||state deceities 300 300 1300 11600 1500 12100 21001 29030 129030 P9 Jeg boede do peREESE FREE 240 7240 240 240 1240 1141 1141 150C 1500 1500) 1500 1500 2781 2781 31170 21170 13281) 16400 27889 124770 Net Income 31191 31191 Totals 16400 16400 127889 727889) Your answer is correct. Journalize the closing entries. (Credit account ti Account Titles and Explanation Debit Credit Service Revenue 16400 776400 Income Summary (To close revenue account.) Income Summary 13281) Gasoline Expense 1300 Supplies Expense 1500) Depreciation Expense 1240) Insurance Expense 1141 37 12100 Salaries and Wages Expense (To close expense accounts.) Income Summary Retained Earnings (To close net income / (loss).) 13119) 33119 TRetained Earnings 1500 1500 Dividends (To close dividends.) Date Post the closing entries and complete the closing process. (Post entries Cash No. 101 Explanation Ref Debit Credit Balance July 1 J1 17,000 17,000 July 1 J1 3,200 13,800 July 5 31 1,692 12,108 July 18 J1 1,570 10,538 July 20 J1 1,600 8,938 July 21 31 1,800 10,738 July 31 J1 300 10,438 July 31 J1 500 9,938 Accounts Receivable No. 112 Date Explanation Ref Debit Credit Balance July 12 J1 3,500 3,500 July 21 J1 1,800 1,700 July 25 1 1,500 3,200 July 31 Adjusting 12 1,400 4,600 Supplies No. 126 Date Explanation Ref Debit Credit Balance July 3 31 800 July 31 Adjusting 12 500 300 Prepaid Insurance No. 130 Date Explanation Ref Debit Credit Balance July 5 1 1,692 1,692 July 31 Adjusting 12 141 1,551 Equipment No. 157 Date Explanation Ref Debit Credit Balance July 1 J1 11,000 11,000 Accumulated Depreciation Equipment No. 158 Date Explanation Ref Debit Credit Balance July 31 Adjusting 12 240 Accounts Payable No. 201 Date Explanation Ref Debit Credit Balance July 1 J1 7,800 7,800 July 3 800 8,600 July 18 J1 1,570 7,030 800 240 J1 No. 212 Ref Debit Credit Balance J2 500 500 No. 311 Ref Debit Credit Balance J1 17,000 17,000 No. 320 Ref Debit Credit Balance 133119 3119 13 1500 No. 332 Ref Debit Credit Balance J1 500 500 13 No. 350 Ref Debit Credit Balance J3 6400 6400 2619 Salaries and Wages Payable Date Explanation July 31 Adjusting Common Stock Date Explanation July 1 Retained Earnings Date Explanation Duly 31 Closing Duly 31 Closing Dividends Date Explanation July 31 July 31 Closing Income Summary Date Explanation Duly 31 Closing Closing ET Puly 31 Closing Service Revenue Date Explanation July 12 July 25 July 31 Adjusting Duly 31 Closing Gasoline Expense Date Explanation July 31 "Puly 31 Closing Supplies Expense Date Explanation July 31 Adjusting - Puly 31 Closing 1500 July 31 J3 3281 3119 33 3119 No. 400 Ref Debit Credit Balance J1 3,500 3,500 J1 1,500 5,000 J2 1,400 6,400 J3 16400 No. 633 Ref Debit Credit Balance J1 300 300 135 1300 No. 634 Ref Debit Credit Balance J2 500 500 13 500 Depreciation Expense No. 711 Ref Debit Credit Balance Date Explanation Adjusting July 31 J2 240 240 Puly 31) Closing J3 (240) No. 722 Insurance Expense Date Ref Debit Credit Balance Explanation Adjusting July 31 J2 141 141 141 Puly 31) Closing Salaries and Wages Expense Date Explanation July 20 July 31 Adjusting 13 T141) No. 726 Ref Debit Credit Balance J1 1,600 1,600 J2 500 2,100 Puly 31) Closing 13 2100 o Prepare a post-closing trial balance at July 31. KRISTIN'S MAIDS CLEANING SERVICE Post-Closing Trial Balance Debit Credit $ Totals

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started