Answered step by step

Verified Expert Solution

Question

1 Approved Answer

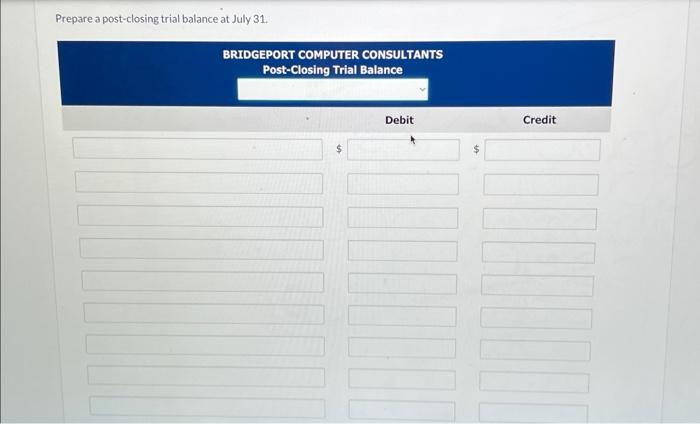

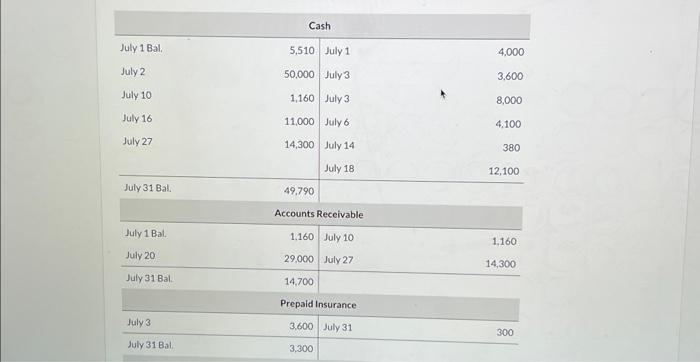

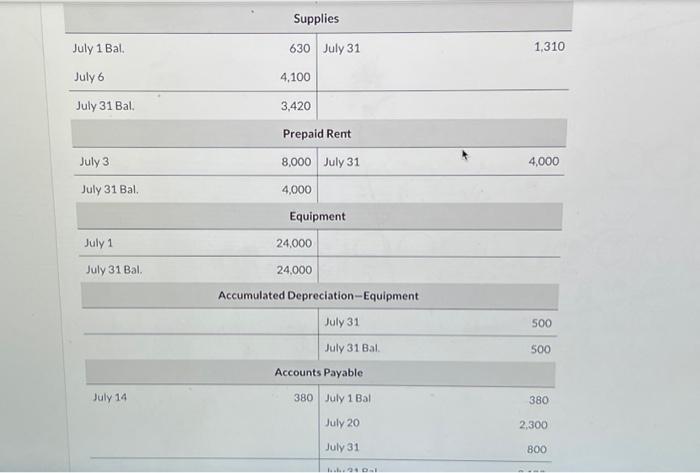

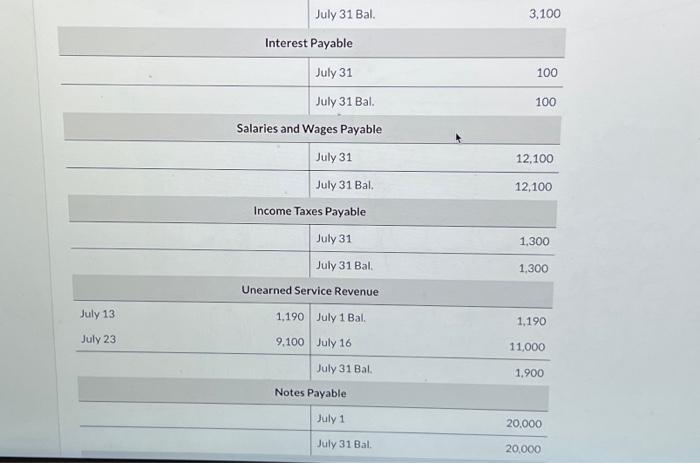

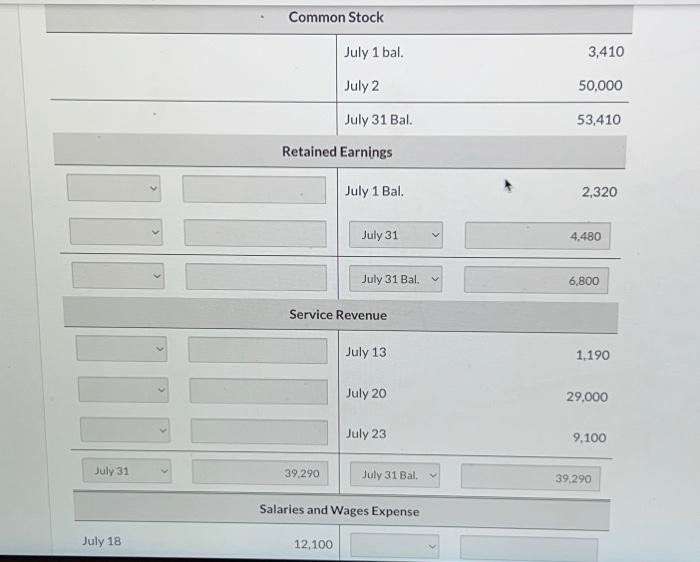

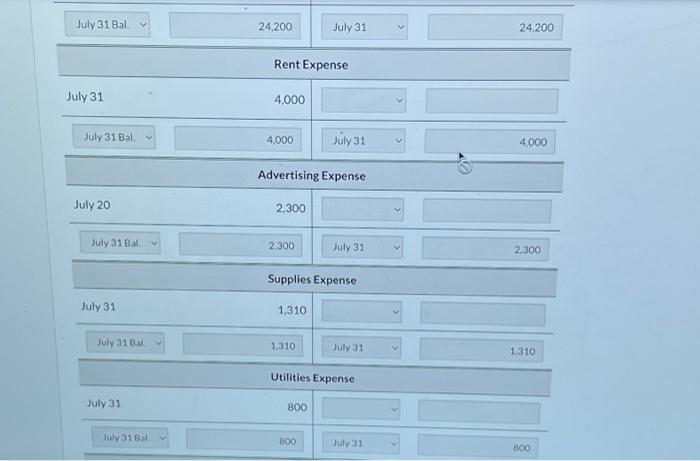

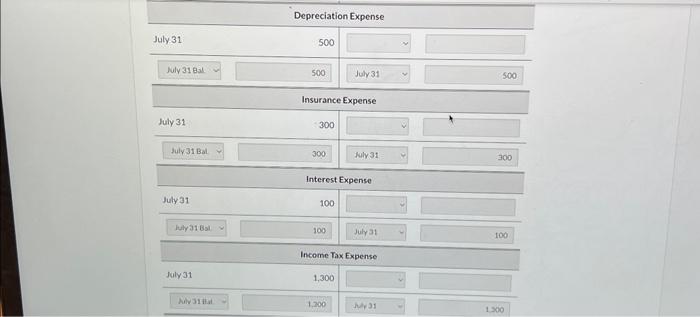

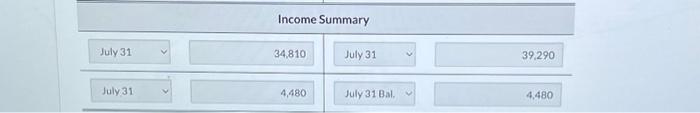

Prepare a post-closing trial balance at July 31 . Totals begin{tabular}{|c|c|c|c|c|} hline multicolumn{5}{|c|}{ Cash } hline July 1Bal. & 5,510 & July 1 &

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started