Question

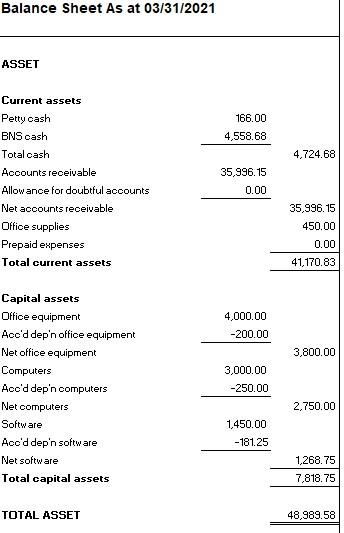

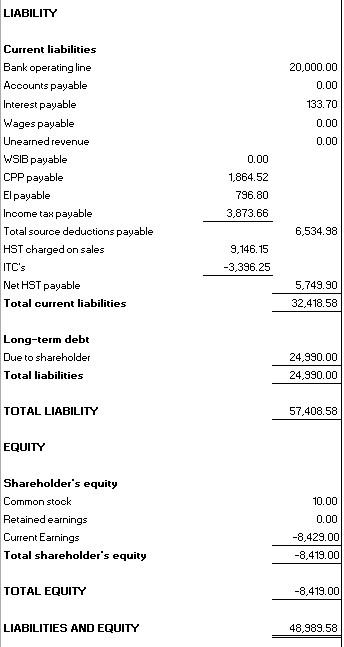

Prepare a Pro-forma income statement, and balance sheet and cash budget statement , for your company, on a monthly bases for the 2 nd quarter,

Prepare a Pro-forma income statement, and balance sheet and cash budget statement , for your company, on a monthly bases for the 2nd quarter, and a total column for the quarter, based on the following assumptions:

- Sales will increase by 50% over Q1 and are equally spread out over the 3 months. All sales are on credit. The collection pattern is 20% in the month of sale, 50% in the month following sale and the balance in the 2nd month following sale.

- All of the A/R outstanding at March 31st will be received in the 2nd quarter as follows; 80% in April and the balance in May.

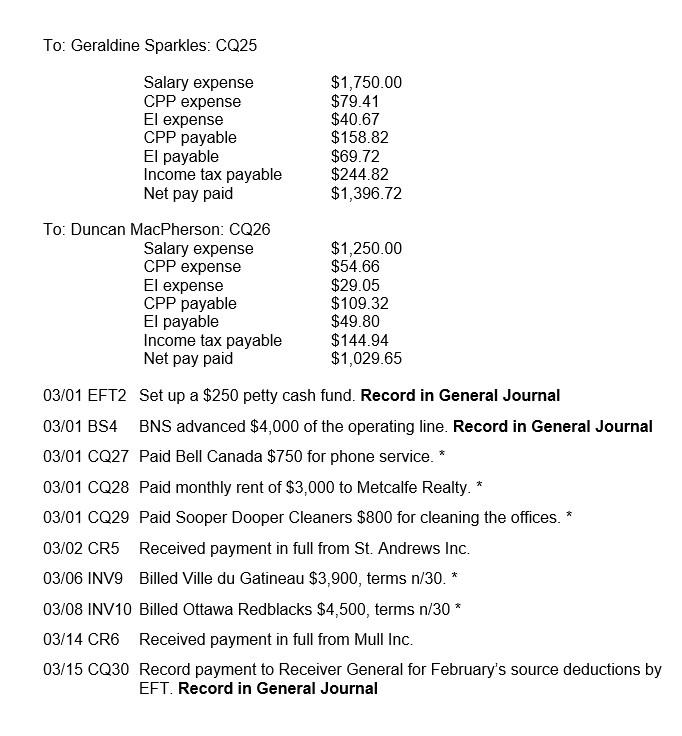

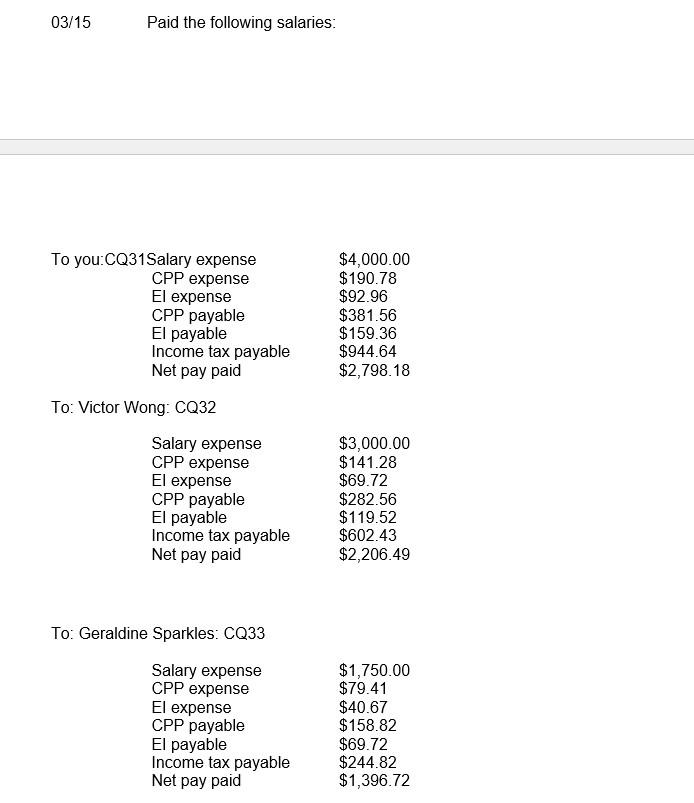

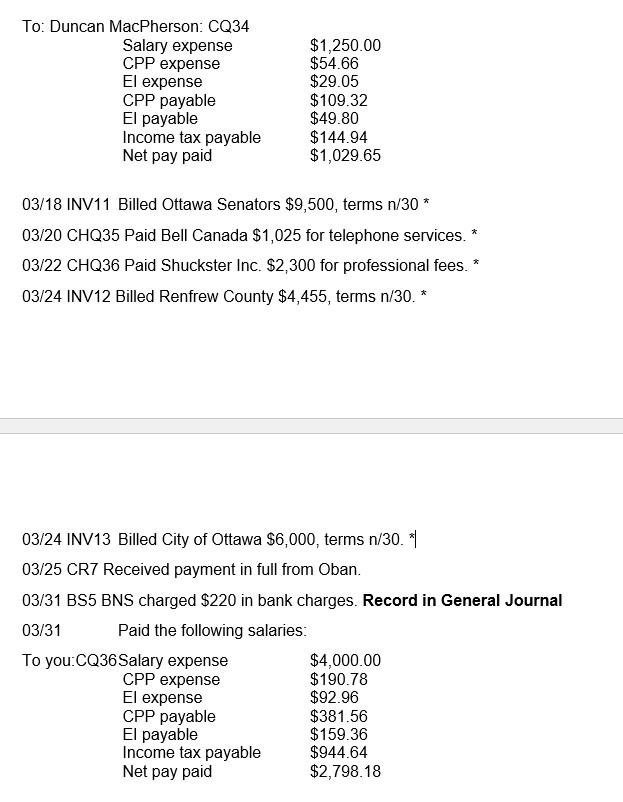

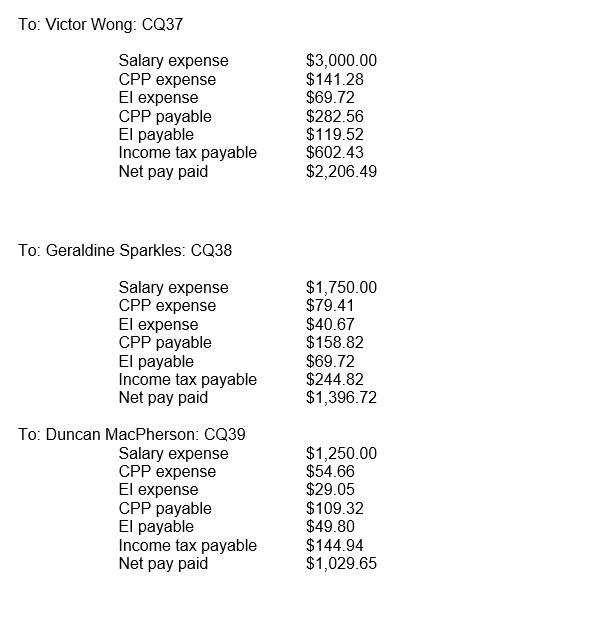

- The employees will be the four employees who worked on the March 31st payroll (in Assignment 2). Their wages and source deductions remain the same. Source deductions must be paid on the 15th of the following month.

- Rent will be the same; telephone expense which will be $800 per month (+HST).

- The business will buy computer equipment on April 1 for $1,000 plus HST.

- HST is paid on the 15th of the month following the end of the quarter.

- Accrued interest will be paid on April 1st and interest will have to be accrued monthly. It will be paid on July 2nd. Bank charges paid to the bank are $200 per month.

- Office expenses will be $100 per month, plus HST.

- Depreciation expense will have to be calculated monthly.

- Supplies of $200 (plus HST) per month will be purchased as they are used.

- The prepaid airline ticket will be used in May.

- Monthly maintenance is $800 per month + HST

- There are no professional fees incurred in this quarter.

- Ignore WSIB expense and income tax expense

- When preparing your cash budget, there is no minimum cash balance required.

No need to answer the transactions for journal entries. No journal entries are needed.

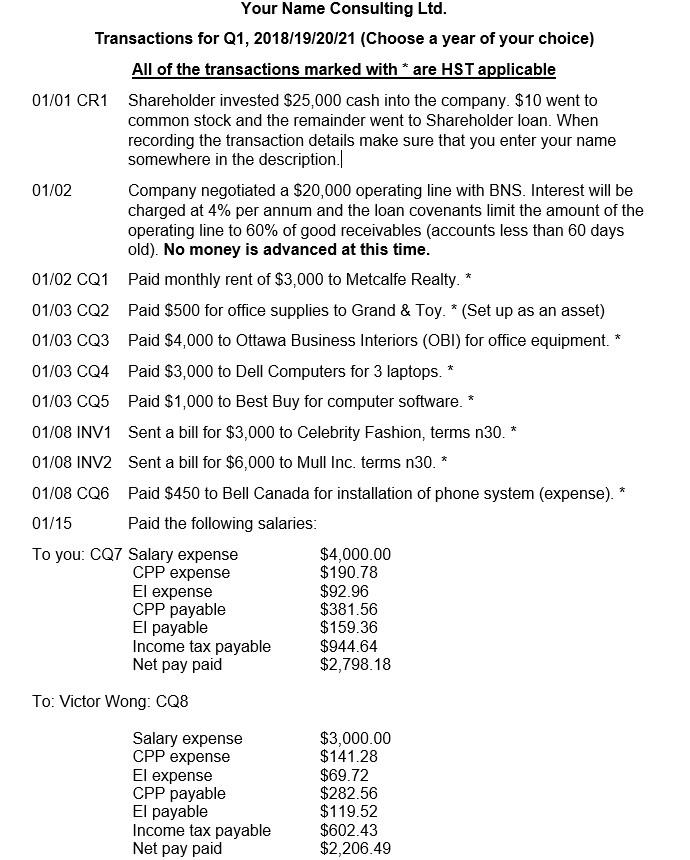

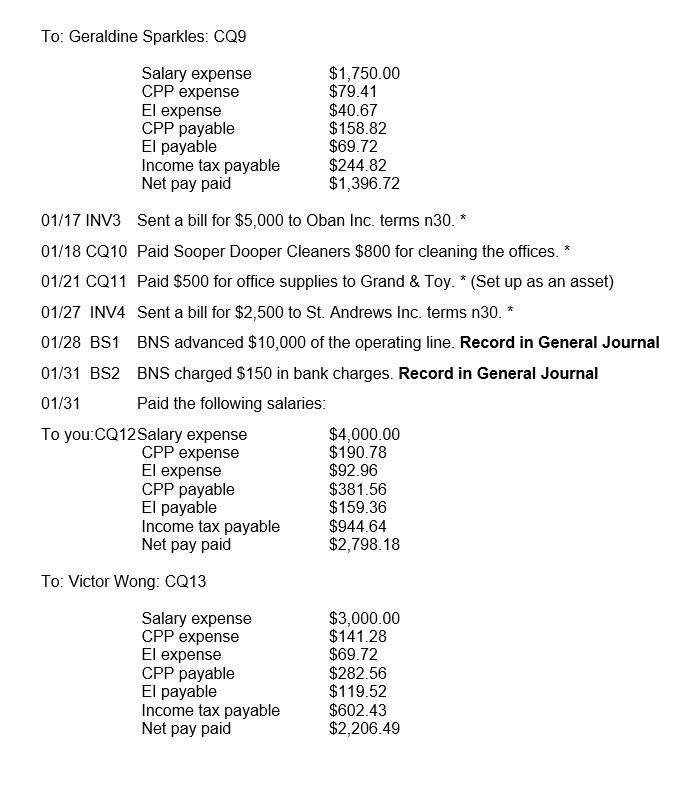

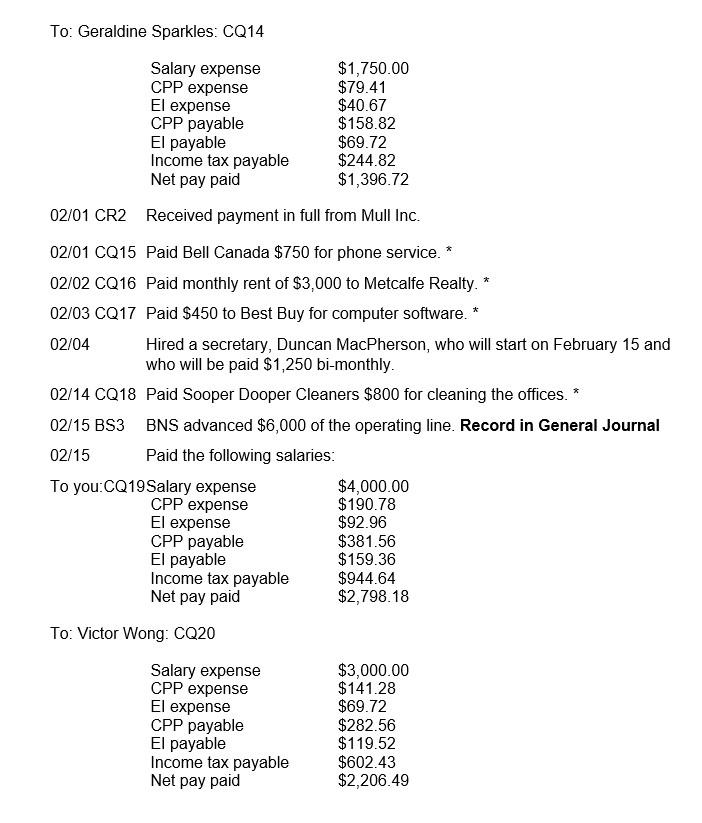

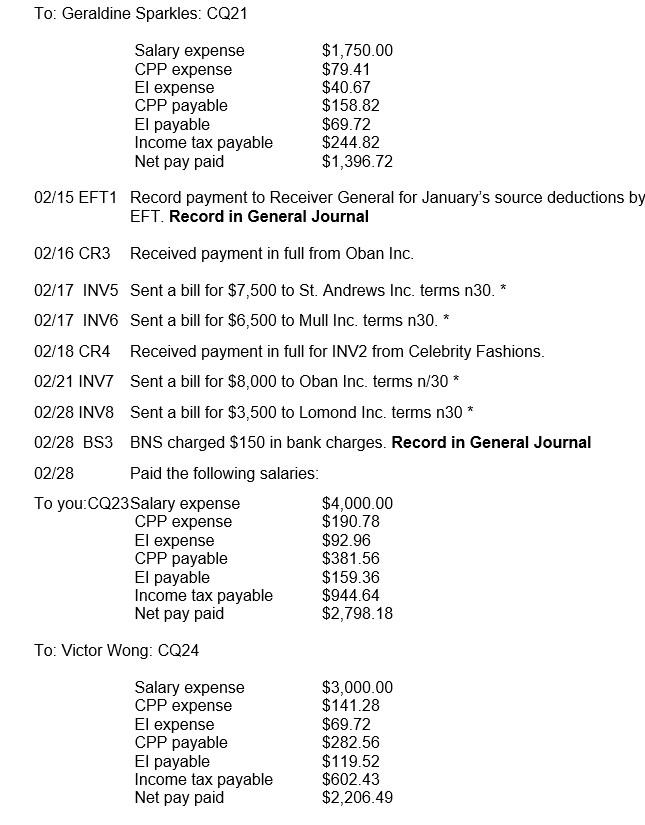

All the transactions have arrived at the results in the given balance sheet and income statement photos above.

All I need is the Pro-forma income statement, and balance sheet and cash budget statement.

Photos of transactions are for reference only. In this problem, the transactions in the images are solved already, and The income statement and balance sheet are the final results and amounts of the transactions entered. So the final net income after entering the transactions is the loss of (8,429.00).

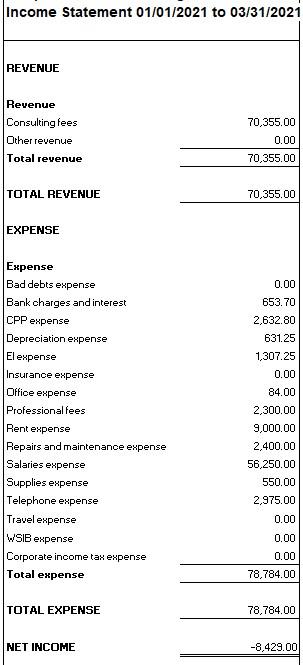

* * Your Name Consulting Ltd. Transactions for Q1, 2018/19/20/21 (Choose a year of your choice) All of the transactions marked with * are HST applicable 01/01 CR1 Shareholder invested $25,000 cash into the company. $10 went to common stock and the remainder went to Shareholder loan. When recording the transaction details make sure that you enter your name somewhere in the description. 01/02 Company negotiated a $20,000 operating line with BNS. Interest will be charged at 4% per annum and the loan covenants limit the amount of the operating line to 60% of good receivables (accounts less than 60 days old). No money is advanced at this time. 01/02 CQ1 Paid monthly rent of $3,000 to Metcalfe Realty. * 01/03 CQ2 Paid $500 for office supplies to Grand & Toy. * (Set up as an asset) 01/03 CQ3 Paid $4,000 to Ottawa Business Interiors (OBI) for office equipment. * 01/03 CQ4 Paid $3,000 to Dell Computers for 3 laptops. * 01/03 CQ5 Paid $1,000 to Best Buy for computer software. * 01/08 INV1 Sent a bill for $3,000 to Celebrity Fashion, terms n30. * 01/08 INV2 Sent a bill for $6,000 to Mull Inc. terms n30. * 01/08 CQ6 Paid $450 to Bell Canada for installation of phone system (expense).* 01/15 Paid the following salaries: To you: CQ7 Salary expense $4,000.00 CPP expense $190.78 El expense $92.96 CPP payable $381.56 El payable $159.36 Income tax payable $944.64 Net pay paid $2,798.18 To: Victor Wong: CQ8 Salary expense $3,000.00 CPP expense $141.28 El expense $69.72 CPP payable $282.56 El payable $119.52 Income tax payable $602.43 Net pay paid $2,206.49 * * To: Geraldine Sparkles: CQ9 Salary expense $1,750.00 CPP expense $79.41 El expense $40.67 CPP payable $158.82 El payable $69.72 Income tax payable $244.82 Net pay paid $1,396.72 01/17 INV3 Sent a bill for $5,000 to Oban Inc. terms n30.* 01/18 CQ10 Paid Sooper Dooper Cleaners $800 for cleaning the offices. * 01/21 CQ11 Paid $500 for office supplies to Grand & Toy. * (Set up as an asset) 01/27 INV4 Sent a bill for $2,500 to St. Andrews Inc. terms n30.* 01/28 BS1 BNS advanced $10,000 of the operating line. Record in General Journal 01/31 BS2 BNS charged $150 in bank charges. Record in General Journal 01/31 Paid the following salaries: To you: CQ12 Salary expense $4,000.00 CPP expense $190.78 El expense $92.96 CPP payable $381.56 El payable $159.36 Income tax payable $944.64 Net pay paid $2,798.18 To: Victor Wong: CQ13 Salary expense CPP expense El expense CPP payable El payable Income tax payable Net pay paid $3,000.00 $141.28 $69.72 $282.56 $119.52 $602.43 $2,206.49 To: Geraldine Sparkles: CQ14 Salary expense CPP expense El expense CPP payable El payable Income tax payable Net pay paid $1,750.00 $79.41 $40.67 $158.82 $69.72 $244.82 $1,396.72 02/01 CR2 Received payment in full from Mull Inc. 02/01 CQ15 Paid Bell Canada $750 for phone service. * 02/02 CQ16 Paid monthly rent of $3,000 to Metcalfe Realty. * 02/03 CQ17 Paid $450 to Best Buy for computer software. * 02/04 Hired a secretary, Duncan MacPherson, who will start on February 15 and who will be paid $1,250 bi-monthly. 02/14 CQ18 Paid Sooper Dooper Cleaners $800 for cleaning the offices. * 02/15 BS3 BNS advanced $6,000 of the operating line. Record in General Journal 02/15 Paid the following salaries: To you:CQ19 Salary expense $4,000.00 CPP expense $190.78 El expense $92.96 CPP payable $381.56 El payable $159.36 Income tax payable $944.64 Net pay paid $2,798.18 To: Victor Wong: CQ20 Salary expense CPP expense El expense CPP payable El payable Income tax payable Net pay paid $3,000.00 $141.28 $69.72 $282.56 $119.52 $602.43 $2,206.49 To: Geraldine Sparkles: CQ21 Salary expense $1,750.00 CPP expense $79.41 El expense $40.67 CPP payable $158.82 El payable $69.72 Income tax payable $244.82 Net pay paid $1,396.72 02/15 EFT1 Record payment to Receiver General for January's source deductions by EFT. Record in General Journal 02/16 CR3 Received payment in full from Oban Inc. 02/17 INV5 Sent a bill for $7,500 to St. Andrews Inc. terms n30.* 02/17 INV6 Sent a bill for $6,500 to Mull Inc. terms n30.* 02/18 CR4 Received payment in full for INV2 from Celebrity Fashions. 02/21 INVT Sent a bill for $8,000 to Oban Inc. terms n/30* 02/28 INV8 Sent a bill for $3,500 to Lomond Inc. terms n30 * 02/28 BS3 BNS charged $150 in bank charges. Record in General Journal 02/28 Paid the following salaries: To you: CQ23Salary expense $4,000.00 CPP expense $190.78 El expense $92.96 CPP payable $381.56 El payable $159.36 Income tax payable $944.64 Net pay paid $2,798.18 To: Victor Wong: CQ24 Salary expense CPP expense El expense CPP payable El payable Income tax payable Net pay paid $3,000.00 $141.28 $69.72 $282.56 $119.52 $602.43 $2,206.49 To: Geraldine Sparkles: CQ25 $1,750.00 $79.41 $40.67 $158.82 $69.72 $244.82 $1,396.72 Salary expense CPP expense El expense CPP payable El payable Income tax payable Net pay paid To: Duncan MacPherson: CQ26 Salary expense CPP expense El expense CPP payable El payable Income tax payable Net pay paid $1,250.00 $54.66 $29.05 $109.32 $49.80 $144.94 $1,029.65 03/01 EFT2 Set up a $250 petty cash fund. Record in General Journal 03/01 BS4 BNS advanced $4,000 of the operating line. Record in General Journal 03/01 CQ27 Paid Bell Canada $750 for phone service.* 03/01 CQ28 Paid monthly rent of $3,000 to Metcalfe Realty. * 03/01 CQ29 Paid Sooper Dooper Cleaners $800 for cleaning the offices. 03/02 CR5 Received payment in full from St. Andrews Inc. 03/06 INV9 Billed Ville du Gatineau $3,900, terms n/30. * 03/08 INV10 Billed Ottawa Redblacks $4,500, terms n/30 * 03/14 CR6 Received payment in full from Mull Inc. 03/15 CQ30 Record payment to Receiver General for February's source deductions by EFT. Record in General Journal * 03/15 Paid the following salaries: To you:CQ31Salary expense CPP expense El expense CPP payable El payable Income tax payable Net pay paid $4,000.00 $190.78 $92.96 $381.56 $159.36 $944.64 $2,798.18 To: Victor Wong: CQ32 Salary expense CPP expense El expense CPP payable El payable Income tax payable Net pay paid $3,000.00 $141.28 $69.72 $282.56 $119.52 $602.43 $2,206.49 To: Geraldine Sparkles: CQ33 Salary expense CPP expense El expense CPP payable El payable Income tax payable Net pay paid $1,750.00 $79.41 $40.67 $158.82 $69.72 $244.82 $1,396.72 To: Duncan MacPherson: CQ34 Salary expense CPP expense El expense CPP payable El payable Income tax payable Net pay paid $1,250.00 $54.66 $29.05 $109.32 $49.80 $144.94 $1,029.65 * 03/18 INV11 Billed Ottawa Senators $9,500, terms n/30* 03/20 CHQ35 Paid Bell Canada $1,025 for telephone services. * 03/22 CHQ36 Paid Shuckster Inc. $2,300 for professional fees. * 03/24 INV12 Billed Renfrew County $4,455, terms n/30.* 03/24 INV13 Billed City of Ottawa $6,000, terms n/30.4 03/25 CR7 Received payment in full from Oban. 03/31 BS5 BNS charged $220 in bank charges. Record in General Journal 03/31 Paid the following salaries: To you:CQ36 Salary expense $4,000.00 CPP expense $190.78 El expense $92.96 CPP payable $381.56 El payable $159.36 Income tax payable $944.64 Net pay paid $2,798.18 To: Victor Wong: CQ37 Salary expense CPP expense El expense CPP payable El payable Income tax payable Net pay paid $3,000.00 $141.28 $69.72 $282.56 $119.52 $602.43 $2,206.49 To: Geraldine Sparkles: CQ38 $1,750.00 $79.41 $40.67 $158.82 $69.72 $244.82 $1,396.72 Salary expense CPP expense El expense CPP payable El payable Income tax payable Net pay paid To: Duncan MacPherson: CQ39 Salary expense CPP expense El expense CPP payable El payable Income tax payable Net pay paid $1,250.00 $54.66 $29.05 $109.32 $49.80 $144.94 $1,029.65 Balance Sheet As at 03/31/2021 ASSET 166.00 4,558.68 4,724.68 Current assets Petty cash BNS cash Total cash Accounts receivable Allowance for doubtful accounts Net accounts receivable Office supplies Prepaid expenses Total current assets 35,996.15 0.00 35,996.15 450.00 0.00 41,170.83 4,000.00 -200.00 3,800.00 Capital assets Office equipment Acc'd dep'n office equipment Net office equipment Computers Accddep ngoTiputers Net computers Software Acc'd dep'n software Net software Total capital assets 3,000.00 -250.00 2.750.00 1,450.00 -181.25 1,268.75 7,818.75 TOTAL ASSET 48,989.58 LIABILITY 20,000.00 0.00 133.70 0.00 0.00 0.00 Current liabilities Bank operating line Accounts payable Interest payable Wages payable Unearned revenue WSIB payable CPP payable El payable Income tax payable Total source deductions payable HST charged on sales ITC's Net HST payable Total current liabilities 1,864.52 796.80 3,873.66 34.98 9.146.15 -3,396.25 5,749.90 32,418.58 Long-term debt Due to shareholder Total liabilities 24,990.00 24,990.00 TOTAL LIABILITY 57,408.58 EQUITY Shareholder's equity Common stock Retained earnings Current Earnings Total shareholder's equity 10.00 0.00 -8,429.00 -8,419.00 TOTAL EQUITY -8,419.00 LIABILITIES AND EQUITY 48,989.58 Income Statement 01/01/2021 to 03/31/2021 REVENUE Revenue Consulting fees Other revenue Total revenue 70,355.00 0.00 70,355.00 TOTAL REVENUE 70,355.00 EXPENSE Expense Bad debts expense Bank charges and interest CPP expense Depreciation expense El expense Insurance expense Office expense Professional fees Rent expense Repairs and maintenance expense Salaries expense Supplies expense Telephone expense Travel expense WSIB expense Corporate income tax expense Total expense 0.00 653.70 2,632.80 631.25 1,307.25 0.00 84.00 2,300.00 9,000.00 2,400.00 56,250.00 550.00 2,975.00 0.00 0.00 0.00 78,784.00 TOTAL EXPENSE 78,784.00 NET INCOME -8,429.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started