prepare a projected cash flow statement for 2018 based on the following:

please show steps/ explain the numbers

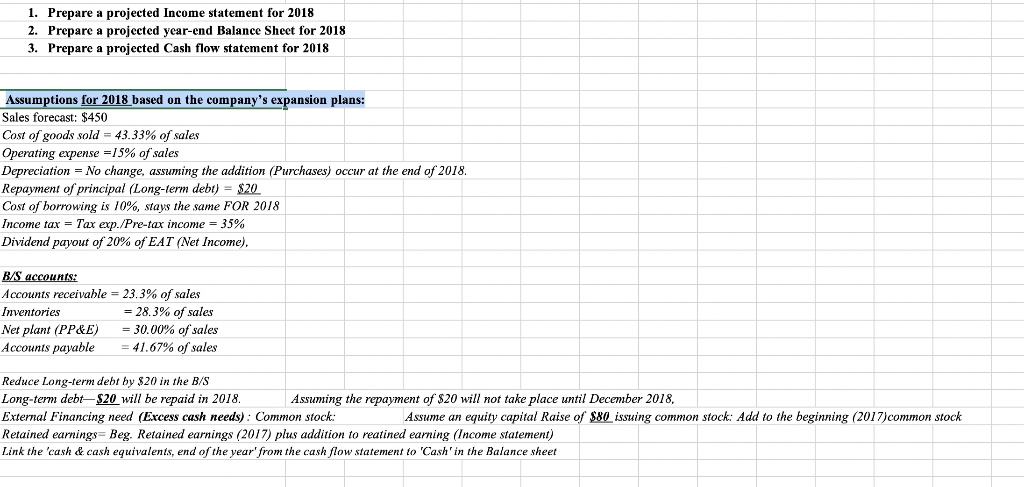

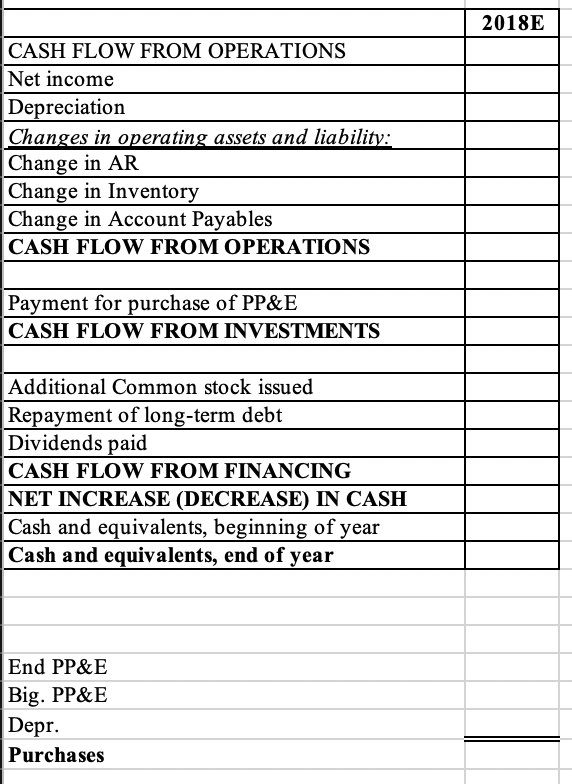

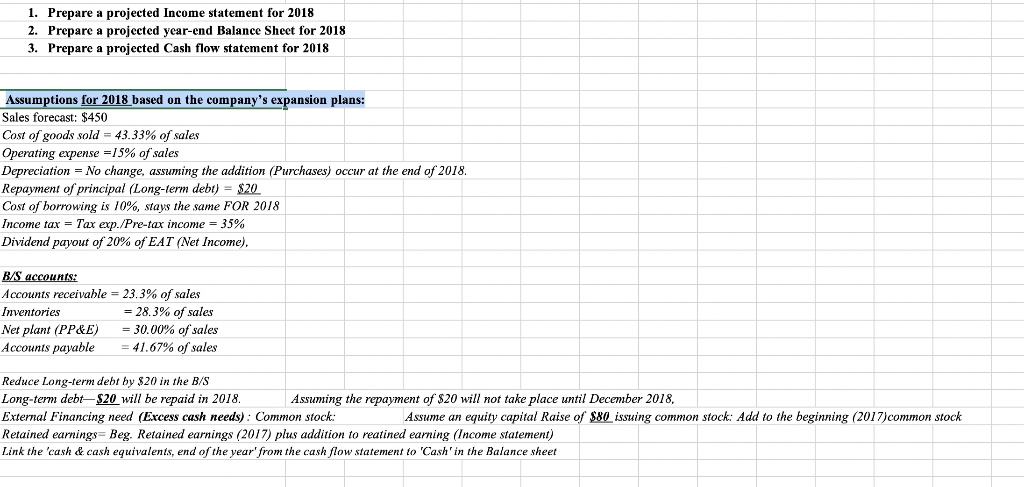

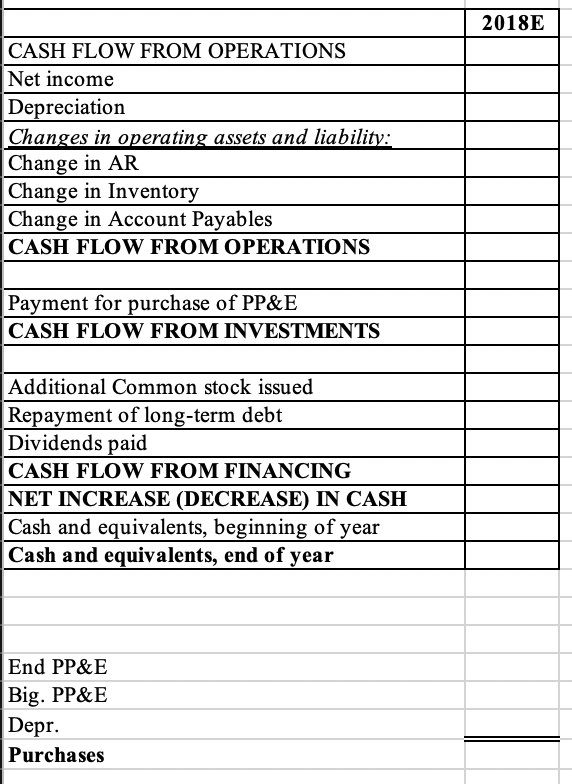

1. Prepare a projected Income statement for 2018 2. Prepare a projected year-end Balance Sheet for 2018 3. Prepare a projected Cash flow statement for 2018 Assumptions for 2018 based on the company's expansion plans: Sales forecast: $450 Cost of goods sold = 43.33% of sales Operating expense = 15% of sales Depreciation = No change, assuming the addition (Purchases) occur at the end of 2018. Repayment of principal (Long-term debt) = $20 Cost of borrowing is 10%, stays the same FOR 2018 Income tax = Tax exp./Pre-tax income = 35% Dividend payout of 20% of EAT (Net Income). B/S accounts: Accounts receivable = 23.3% of sales Inventories = 28.3% of sales Net plant (PP&E) = 30.00% of sales Accounts payable = 41.67% of sales Reduce Long-term debt by $20 in the B/S Long-term debt-$20 will be repaid in 2018. Assuming the repayment of $20 will not take place until December 2018, External Financing need (Excess cash needs): Common stock: Assume an equity capital Raise of $80 issuing common stock: Add to the beginning (2017)common stock Retained earnings Beg. Retained earnings (2017) plus addition to reatined earning (Income statement) Link the 'cash & cash equivalents, end of the year from the cash flow statement to 'Cash' in the Balance sheet 2018E CASH FLOW FROM OPERATIONS Net income Depreciation Changes in operating assets and liability: Change in AR Change in Inventory Change in Account Payables CASH FLOW FROM OPERATIONS Payment for purchase of PP&E CASH FLOW FROM INVESTMENTS Additional Common stock issued Repayment of long-term debt Dividends paid CASH FLOW FROM FINANCING NET INCREASE (DECREASE) IN CASH Cash and equivalents, beginning of year Cash and equivalents, end of year End PP&E Big. PP&E Depr. Purchases 1. Prepare a projected Income statement for 2018 2. Prepare a projected year-end Balance Sheet for 2018 3. Prepare a projected Cash flow statement for 2018 Assumptions for 2018 based on the company's expansion plans: Sales forecast: $450 Cost of goods sold = 43.33% of sales Operating expense = 15% of sales Depreciation = No change, assuming the addition (Purchases) occur at the end of 2018. Repayment of principal (Long-term debt) = $20 Cost of borrowing is 10%, stays the same FOR 2018 Income tax = Tax exp./Pre-tax income = 35% Dividend payout of 20% of EAT (Net Income). B/S accounts: Accounts receivable = 23.3% of sales Inventories = 28.3% of sales Net plant (PP&E) = 30.00% of sales Accounts payable = 41.67% of sales Reduce Long-term debt by $20 in the B/S Long-term debt-$20 will be repaid in 2018. Assuming the repayment of $20 will not take place until December 2018, External Financing need (Excess cash needs): Common stock: Assume an equity capital Raise of $80 issuing common stock: Add to the beginning (2017)common stock Retained earnings Beg. Retained earnings (2017) plus addition to reatined earning (Income statement) Link the 'cash & cash equivalents, end of the year from the cash flow statement to 'Cash' in the Balance sheet 2018E CASH FLOW FROM OPERATIONS Net income Depreciation Changes in operating assets and liability: Change in AR Change in Inventory Change in Account Payables CASH FLOW FROM OPERATIONS Payment for purchase of PP&E CASH FLOW FROM INVESTMENTS Additional Common stock issued Repayment of long-term debt Dividends paid CASH FLOW FROM FINANCING NET INCREASE (DECREASE) IN CASH Cash and equivalents, beginning of year Cash and equivalents, end of year End PP&E Big. PP&E Depr. Purchases