Question

Prepare a projected statements of cash ows for MSC for Year 8Year 12. Also forecast the nancial statements for each of these years under three

Prepare a projected statements of cash ows for MSC for Year 8Year 12. Also forecast the nancial statements for each of these years under three scenarios: (1) best case, (2) most likely, and (3) worst case.

MSCs other competitive advantages are the high efciency and unique features of its woodstoves. MSC equips its woodstoves with a catalytic combustor, which reburns gases emit-ted from burning wood. This reburning not only increases the heat generated by the stoves, but also reduces pollutants in the air. MSC offers a woodstove with inlaid soapstone. This soap-stone heats up and provides warmth even after the re in the stove has dwindled. The soapstone also adds to the attractiveness of the stove as a piece of furniture. MSCs customer base includes many middle- and upper-income individuals.

MSC believes that protable growth of woodstove sales beyond gross revenues of $3 million a year in the mail-order niche is unlikely. However, no one is selling gas appliances by mail order. Many of MSCs customers and prospects have asked whether MSC plans to produce agas stove.

Management of MSC is contemplating the development of several gas appliances to sell by mail order. There are compelling reasons for MSC to do this, as well as some good reasons to be cautious.

Availability of Space MSC owns a 25,000-square-foot building but occupies only 15,000 square feet. MSC leases the remaining 10,000 square feet to two tenants. The tenants pay rent plus their share of insurance, property taxes, and maintenance costs. The addition of gas appliances to its product line would require MSC to use 5,000 square feet of the space currently rented to one of its tenants. MSC would have to give the tenant six months notice to cancel its lease.

Availability of Capital MSC has its own internal funds for product development and inventory, as well as an unused line of credit. But it will lose interest income (or incur interest expense) if it invests these funds in development and increased inventory.

Existing Demand MSC receives approximately 50,000 requests for catalogs each year and has a mailing list of approximately 220,000 active prospects and 15,000 recent owners of woodstoves. There is anecdotal evidence of sufcient demand so that MSC could introduce its gas stoves with little or no additional marketing expense, other than the cost of printing some additional catalog pages each year. MSCs management worries about the risk of the gas stove sales cannibalizing its existing woodstove sales. Also, if the current base of woodstove sales is eroded through mismanagement, inattention, or cannibalization, attempts to grow the business through expansion into gas appliances will be self-defeating.

Vacant Market Niche No other manufacturer is selling gas stoves by mail order. Because the entry costs are high and the unit volume is small, it is unlikely that another producer will enter the niche. MSC has had the mail-order market for woodstoves to itself for approximately seven years. MSC believes that this lack of existing competition will give it additional time to develop new products. However, management also believes that a timely entry will help solidify its position in this niche.

Suppliers MSC has existing relationships with many of the suppliers necessary to manufacture new gas products. The foundry that produces MSCs woodstove castings is one of the largest suppliers of gas heating appliances in central Europe. On the other hand, MSC would be a small, new customer for the vendors that provide the ceramic logs and gas burners. This could lead to problems with price, delivery, or service for these parts.

Synergies in Marketing and Manufacturing MSC would sell gas appliances through its existing direct-mail marketing efforts. It would incur additional marketing expenses for photography, printing, and customer service. MSCs existing plant can manufacture the shell of the gas units. It would require additional expertise to assemble reboxes for the gas units (valves, burners, and log sets). MSC would have to increase its space and the number of employees to process and paint the metal parts of the new gas stoves. The gross margin for the gas products should be like that of the woodstoves.

Lack of Management Experience Managing new product development, larger production levels and inventories, and a more complex business would require MSC to hire more management expertise. MSC also would have to institute a new organizational structure for its more complex business and dene responsibilities and accountability more carefully. Up to now, MSC has operated with a loose organizational philosophy.

Development Costs MSC plans to develop two gas stove models, but not concurrently. It will develop the rst gas model during Year 8 and begin selling it during Year 9. It will develop the second gas model during Year 9 and begin selling it during Year 10. MSC will capitalize the development costs in the year incurred (Year 8 and Year 9) and amortize them straight-line over ve years, beginning with the year the stove is initially sold (Year 9 and Year 10). Estimated development cost for each stove are as follows: Best Case: $100,000

Most Likely Case: $120,000

Worst Case: $160,000

Capital Expenditures Capital expenditures, other than development costs, will be as follows: Year 8, $20,000; Year 9, $30,000; Year 10, $30,000; Year 11, $25,000; Year 12, $25,000. Assume a six-year depreciable life, straight-line depreciation, and a full year of depreciation in the year of acquisition

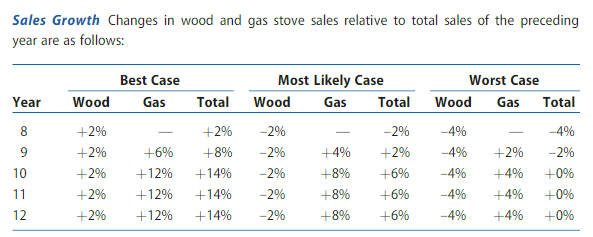

Sales Growth Changes in wood and gas stove sales relative to total sales of the preceding year are as follows:

Because sales of gas stoves will start at zero, the projections of sales should use the preceding growth rates in total sales. The growth rates shown for woodstove sales and gas stove sales simply indicate the components of the total sales increase. Cost of Goods Sold Manufacturing costs of the gas stoves will equal 50% of sales, the same as for woodstoves.

Depreciation will increase for the amortization of the product development costs on the gas stoves and depreciation of additional capital expenditures.

Facilities Rental Income and Facilities Costs Facilities rental income will decrease by 50%beginning in Year 9 when MSC takes over 5,000 square feet of its building now rented to another company and will remain at that reduced level for Year 10Year 12. Facilities costs will increase by $30,000 beginning in Year 9 for facilities costs now paid by a tenant and for additional facilities costs required by gas stove manufacturing. These costs will remain at that increased level for Year 10Year 12

Administrative Expenses Administrative expenses will increase by $30,000 in Year 8, $30,000in Year 9, and $20,000 in Year 10, and then will remain at the Year 10 level in Years 11 and 12.

Interest Income MSC will earn 5% interest on the average balance in cash each year.

Interest Expense The interest rate on interest-bearing debt will be 6.8% on the average amount of debt outstanding each year.

Income Tax Expense MSC is subject to an income tax rate of 28%.

Accounts Receivable and Inventories Accounts receivable and inventories will increase at the growth rate in sales.

Property, Plant, and Equipment Property, plant, and equipment at cost will increase each year by the amounts of capital expenditures and expenditures on development costs. Accumulated depreciation will increase each year by the amount of depreciation and amortization expense.

Accounts Payable and Other Current Liabilities Accounts payable will increase with the growth rate in inventories. Other current liabilities include primarily advances by customers for stoves manufactured soon after the year-end. Other current liabilities will increase with the growth rate in sales.

Current Portion of Long-Term Debt Scheduled repayments of long-term debt are as follows: Year 8, $27,036; Year 9, $29,200; Year 10, $31,400; Year 11, $33,900; Year 12, $36,600; Year 13, $39,500.

Deferred Income Taxes Deferred income taxes relate to the use of accelerated depreciation for tax purposes and the straight-line method for nancial reporting. Assume that deferred income taxes will not change.

Shareholders Equity Assume that there will be no changes in the contributed capital of MSC. Retained earnings will change each year in the amount of net income.

PLEASE DO NOT USE ANY DATA THAT HAS ALREADY BEEN SUBMITTED FOR THIS QUESTION PREVIOUSLY. ONLY NEW & ORIGINAL WORK. THANK YOU!

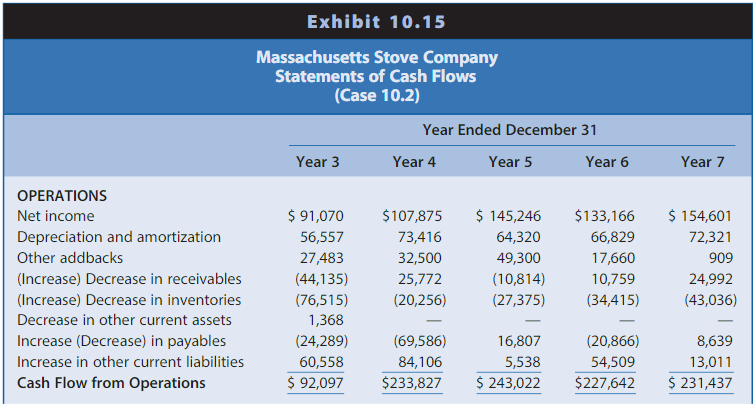

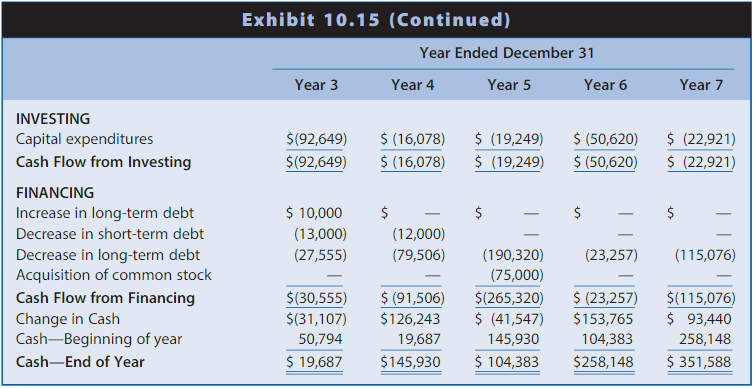

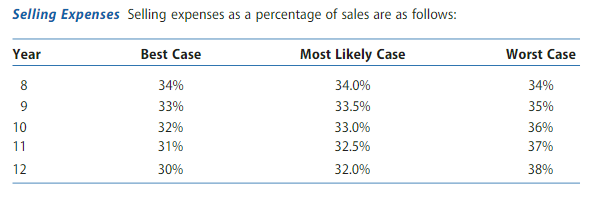

Exhibit 10.15 Sales Growth Changes in wood and gas stove sales relative to total sales of the preceding year are as follows: Selling Expenses Selling expenses as a percentage of sales are as follows: Exhibit 10.15 Sales Growth Changes in wood and gas stove sales relative to total sales of the preceding year are as follows: Selling Expenses Selling expenses as a percentage of sales are as followsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started