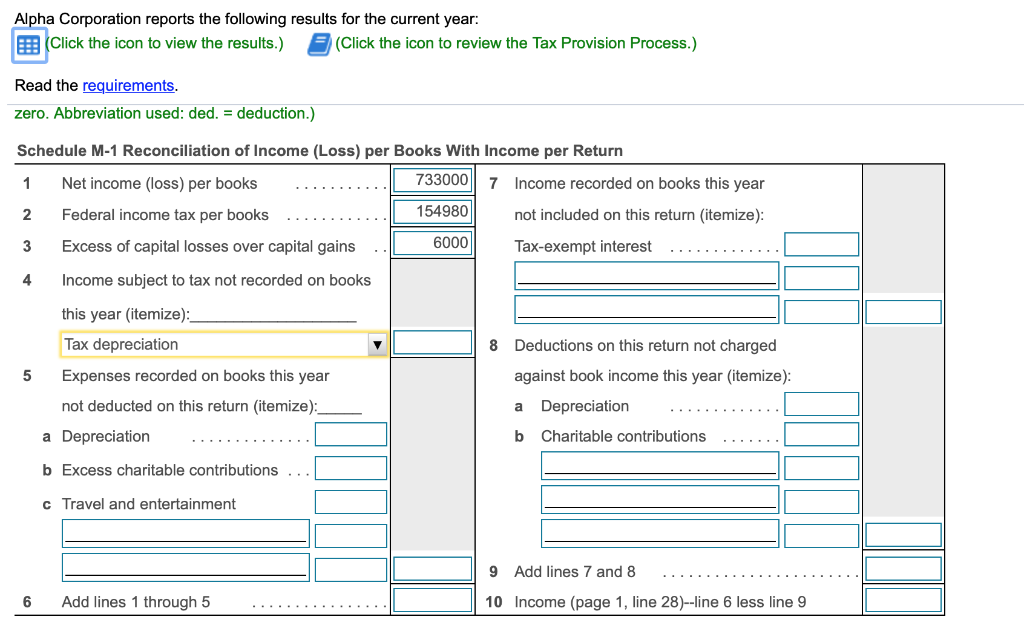

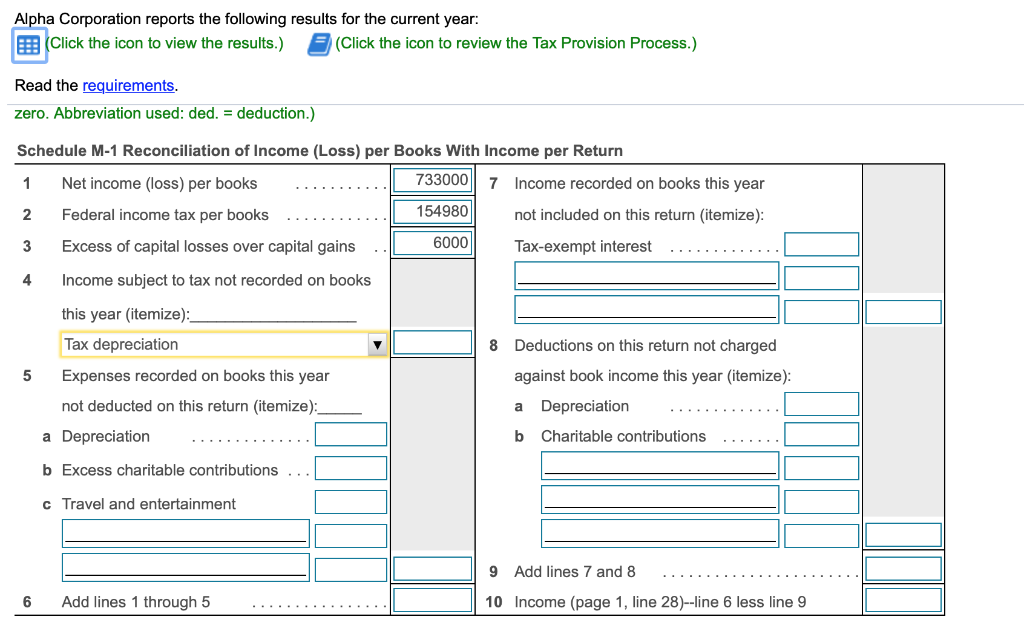

Prepare a reconciliation of Alpha's taxable income before special deductions with its book income. (If an input field is not used in the table, leave the input box empty; do not select a label or enter a zero. Abbreviation used: ded. = deduction.)

Prepare a reconciliation of Alpha's taxable income before special deductions with its book income. (If an input field is not used in the table, leave the input box empty; do not select a label or enter a zero. Abbreviation used: ded. = deduction.)

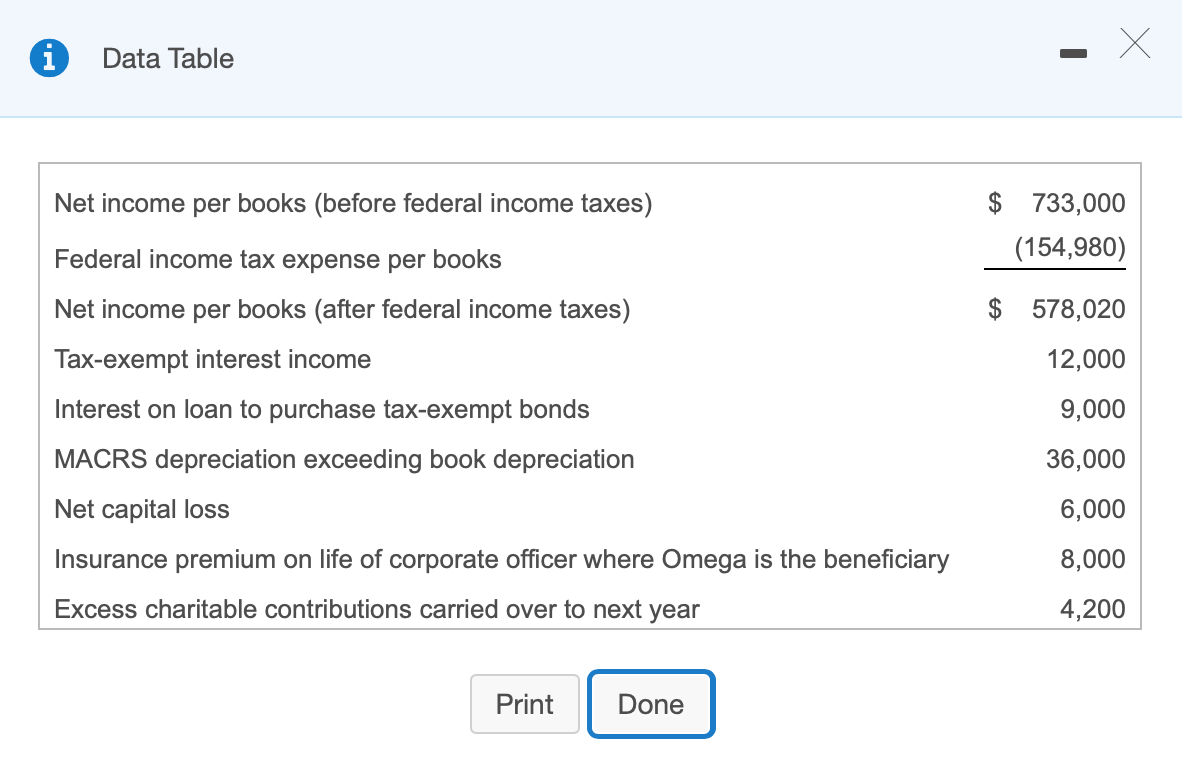

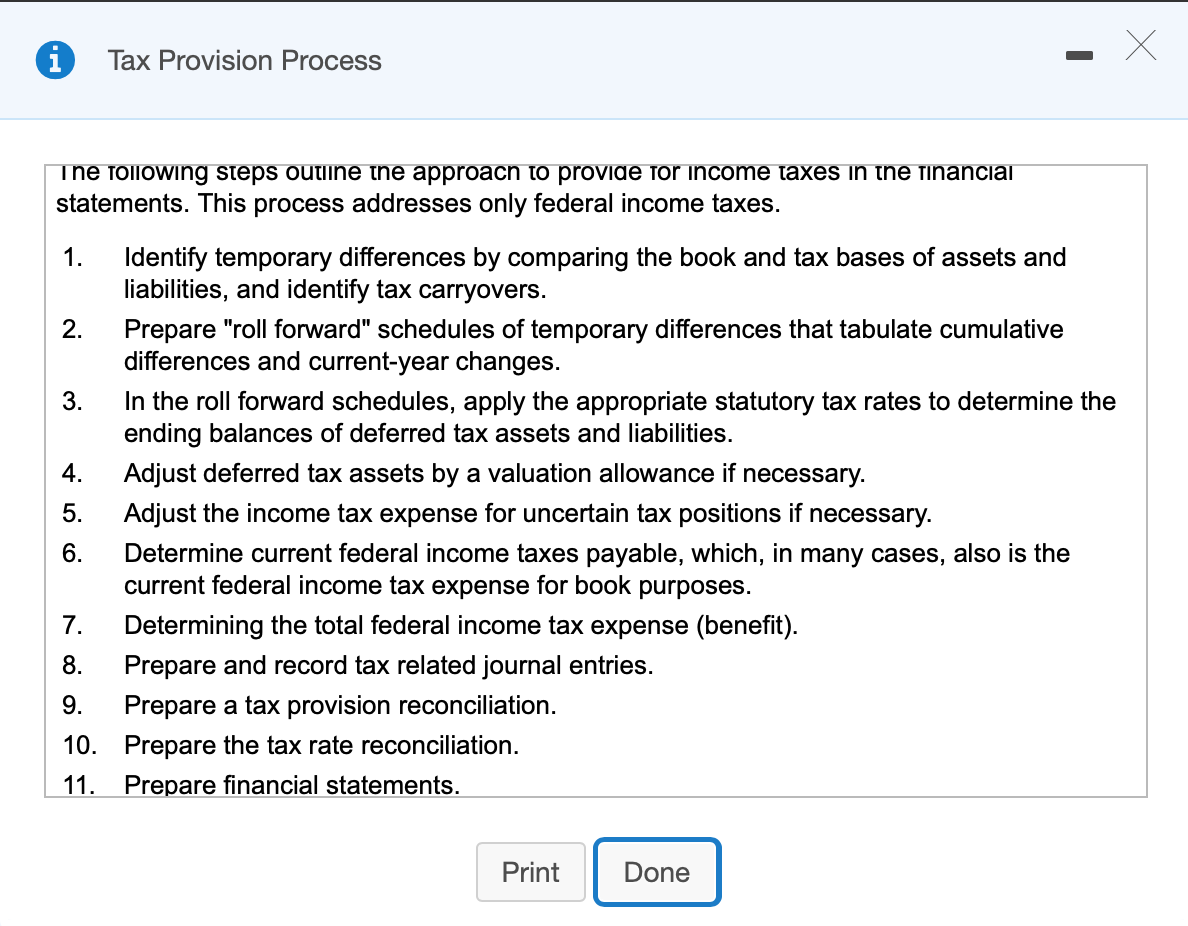

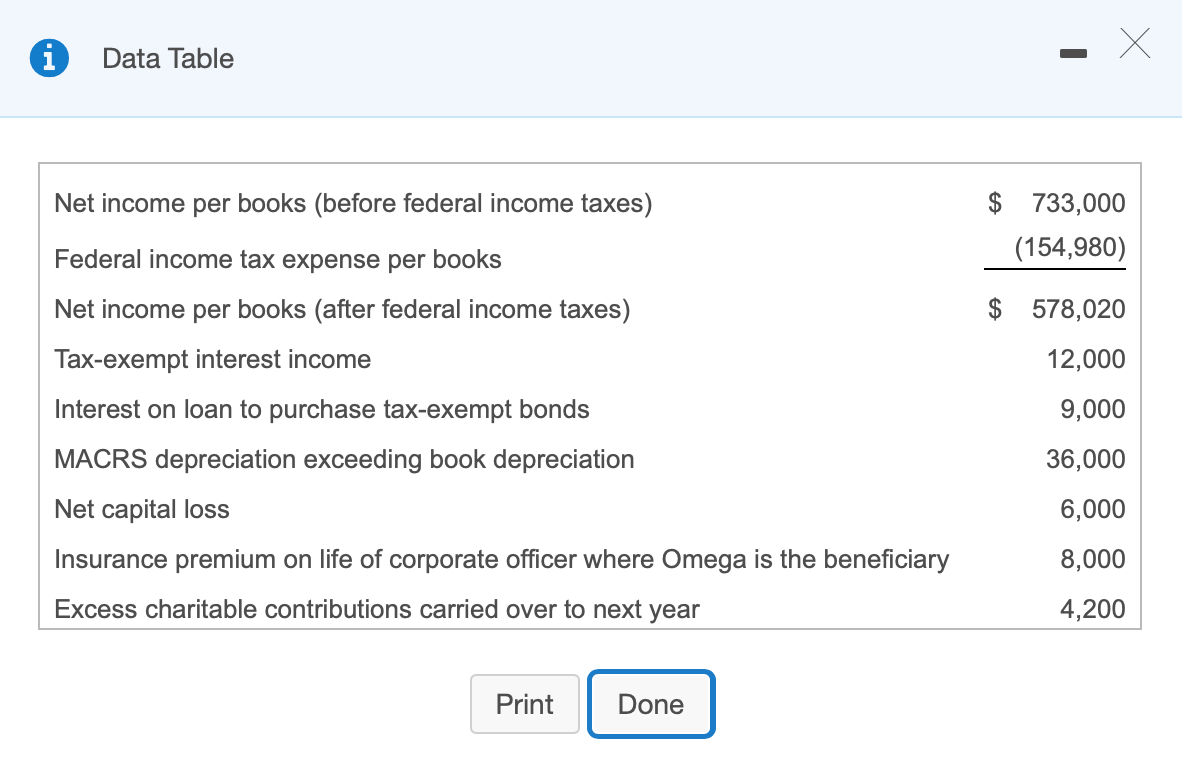

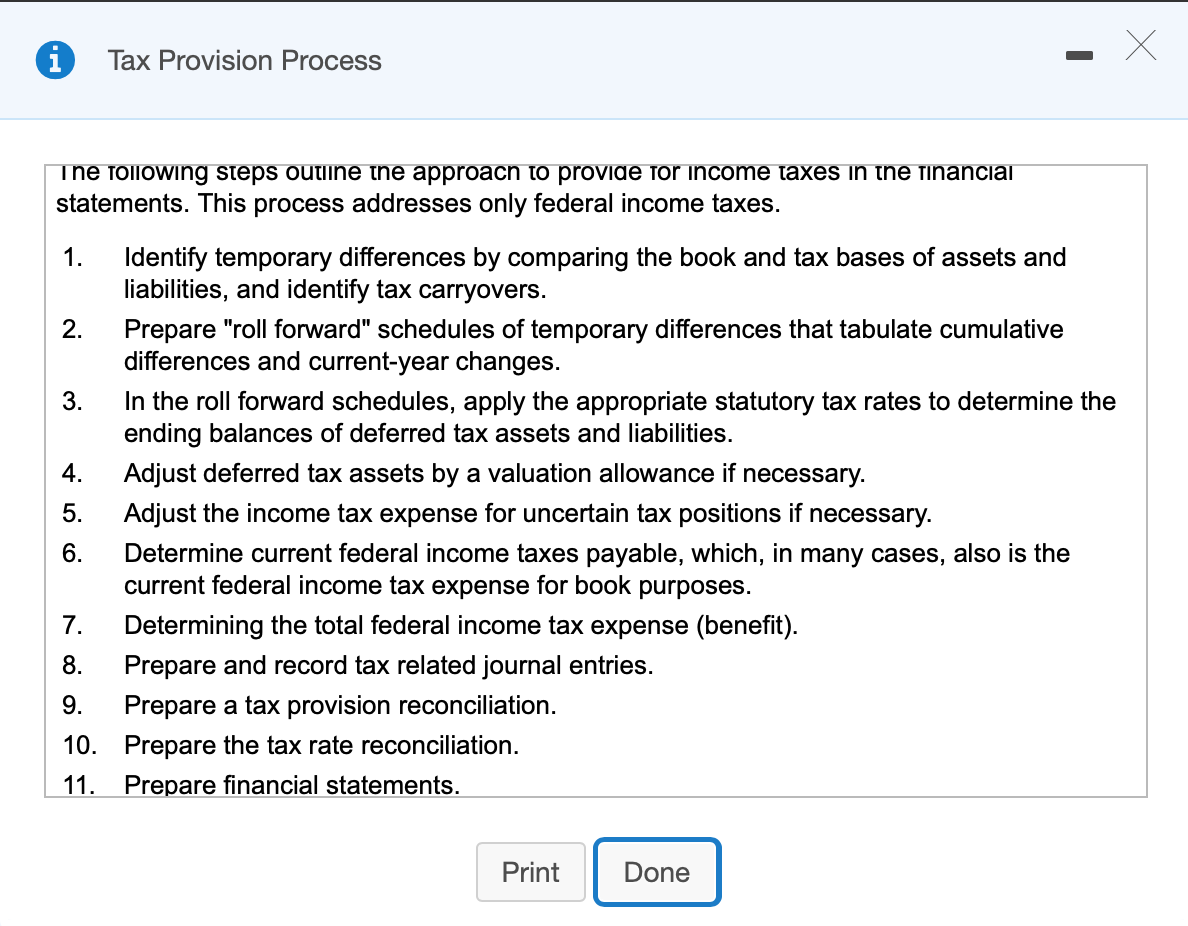

Tax Provision Process ine following steps outline the approach to provide for income taxes in the financial statements. This process addresses only federal income taxes. 1. Identify temporary differences by comparing the book and tax bases of assets and liabilities, and identify tax carryovers. Prepare "roll forward" schedules of temporary differences that tabulate cumulative differences and current-year changes. In the roll forward schedules, apply the appropriate statutory tax rates to determine the ending balances of deferred tax assets and liabilities. Adjust deferred tax assets by a valuation allowance if necessary. Adjust the income tax expense for uncertain tax positions if necessary. 6. Determine current federal income taxes payable, which, in many cases, also is the current federal income tax expense for book purposes. Determining the total federal income tax expense (benefit). 8. Prepare and record tax related journal entries. 9. Prepare a tax provision reconciliation. 10. Prepare the tax rate reconciliation. | 11. Prepare financial statements. ni w two Print Done Alpha Corporation reports the following results for the current year: (Click the icon to view the results.) 3 (Click the icon to review the Tax Provision Process.) Read the requirements. zero. Abbreviation used: ded. = deduction.) Schedule M-1 Reconciliation of Income (Loss) per Books With Income per Return 1 Net income (loss) per books 733000 7 Income recorded on books this year 2 Federal income tax per books ........... 154980||| not included on this return (itemize): 3 Excess of capital losses over capital gains 1 6000 Tax-exempt interest ....... 4 Income subject to tax not recorded on books this year (itemize): Tax depreciation 8 Deductions on this return not charged 5 Expenses recorded on books this year against book income this year (itemize): not deducted on this return (itemize): a Depreciation a Depreciation b Charitable contributions ...... b Excess charitable contributions ... c Travel and entertainment 9 Add lines 7 and 8 6 Add lines 1 through 5 .............. 10 Income (page 1, line 28)--line 6 less line 9 Data Table Net income per books (before federal income taxes) $ 733,000 (154,980) Federal income tax expense per books Net income per books (after federal income taxes) Tax-exempt interest income $ Interest on loan to purchase tax-exempt bonds MACRS depreciation exceeding book depreciation 578,020 12,000 9,000 36,000 6,000 8,000 4,200 Net capital loss Insurance premium on life of corporate officer where Omega is the beneficiary Excess charitable contributions carried over to next year Print Done Tax Provision Process ine following steps outline the approach to provide for income taxes in the financial statements. This process addresses only federal income taxes. 1. Identify temporary differences by comparing the book and tax bases of assets and liabilities, and identify tax carryovers. Prepare "roll forward" schedules of temporary differences that tabulate cumulative differences and current-year changes. In the roll forward schedules, apply the appropriate statutory tax rates to determine the ending balances of deferred tax assets and liabilities. Adjust deferred tax assets by a valuation allowance if necessary. Adjust the income tax expense for uncertain tax positions if necessary. 6. Determine current federal income taxes payable, which, in many cases, also is the current federal income tax expense for book purposes. Determining the total federal income tax expense (benefit). 8. Prepare and record tax related journal entries. 9. Prepare a tax provision reconciliation. 10. Prepare the tax rate reconciliation. | 11. Prepare financial statements. ni w two Print Done Alpha Corporation reports the following results for the current year: (Click the icon to view the results.) 3 (Click the icon to review the Tax Provision Process.) Read the requirements. zero. Abbreviation used: ded. = deduction.) Schedule M-1 Reconciliation of Income (Loss) per Books With Income per Return 1 Net income (loss) per books 733000 7 Income recorded on books this year 2 Federal income tax per books ........... 154980||| not included on this return (itemize): 3 Excess of capital losses over capital gains 1 6000 Tax-exempt interest ....... 4 Income subject to tax not recorded on books this year (itemize): Tax depreciation 8 Deductions on this return not charged 5 Expenses recorded on books this year against book income this year (itemize): not deducted on this return (itemize): a Depreciation a Depreciation b Charitable contributions ...... b Excess charitable contributions ... c Travel and entertainment 9 Add lines 7 and 8 6 Add lines 1 through 5 .............. 10 Income (page 1, line 28)--line 6 less line 9 Data Table Net income per books (before federal income taxes) $ 733,000 (154,980) Federal income tax expense per books Net income per books (after federal income taxes) Tax-exempt interest income $ Interest on loan to purchase tax-exempt bonds MACRS depreciation exceeding book depreciation 578,020 12,000 9,000 36,000 6,000 8,000 4,200 Net capital loss Insurance premium on life of corporate officer where Omega is the beneficiary Excess charitable contributions carried over to next year Print Done

Prepare a reconciliation of Alpha's taxable income before special deductions with its book income. (If an input field is not used in the table, leave the input box empty; do not select a label or enter a zero. Abbreviation used: ded. = deduction.)

Prepare a reconciliation of Alpha's taxable income before special deductions with its book income. (If an input field is not used in the table, leave the input box empty; do not select a label or enter a zero. Abbreviation used: ded. = deduction.)