Answered step by step

Verified Expert Solution

Question

1 Approved Answer

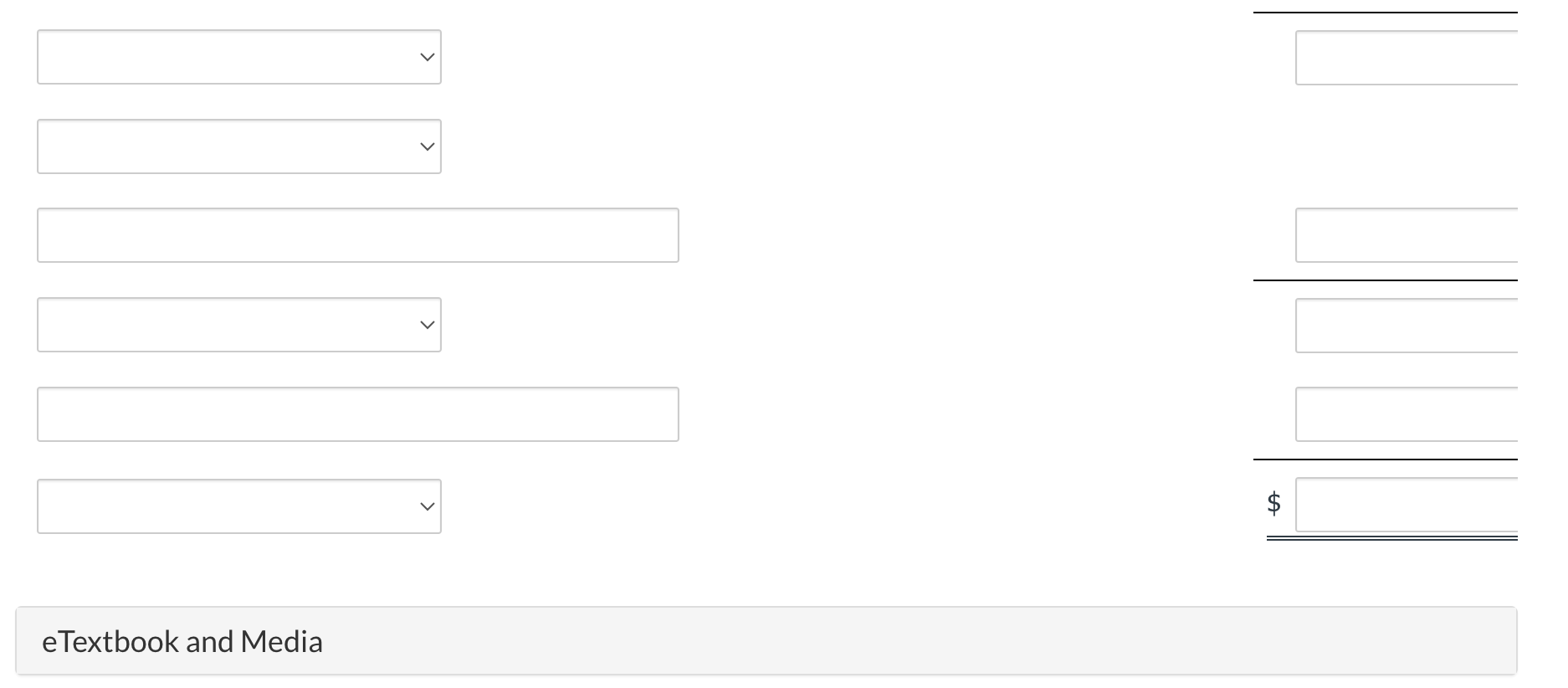

Prepare a retained earnings statement for the year ended December 31, 2025. (List items that increase retained earnings first.) The trial balance of Marin Wholesale

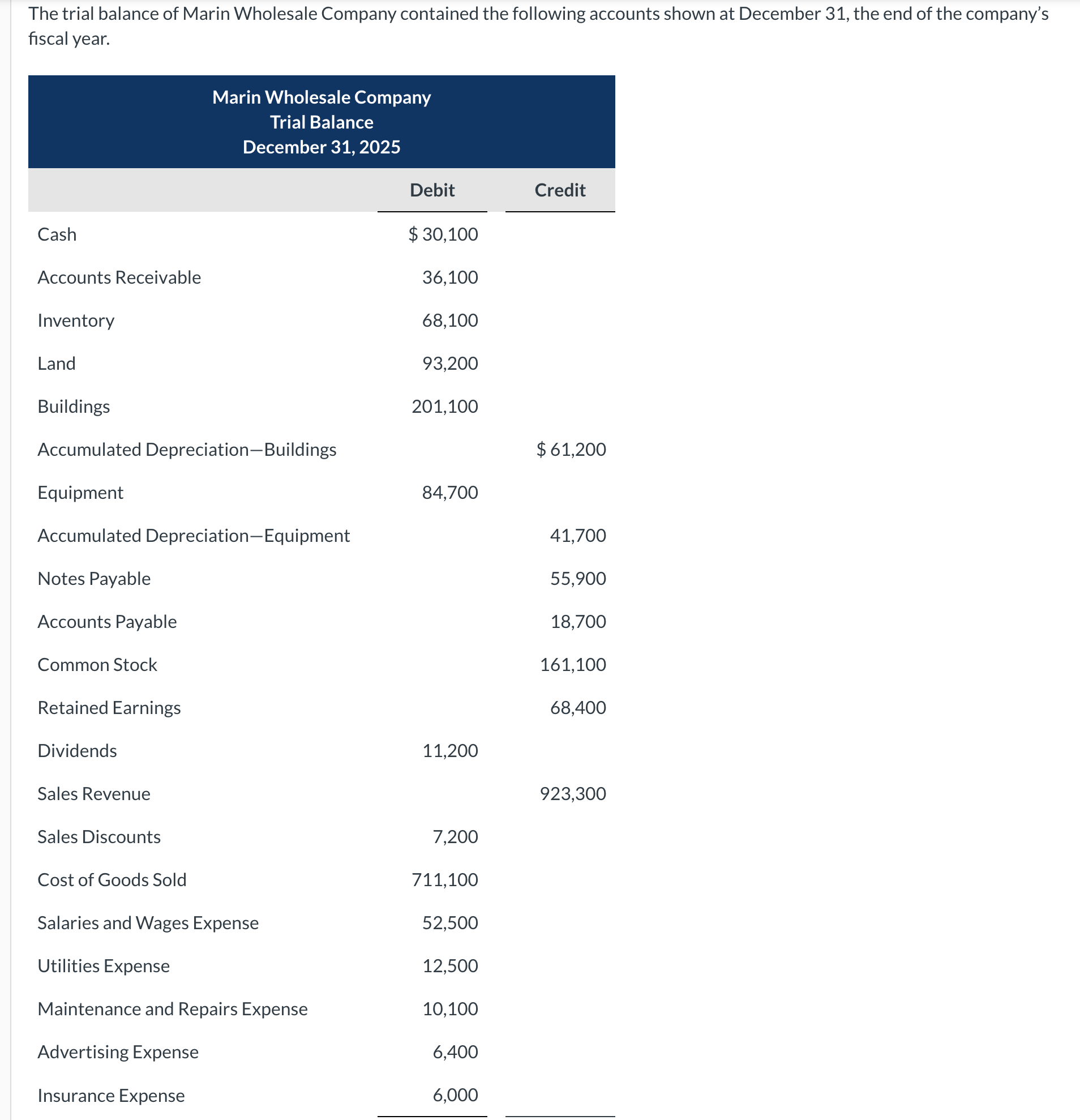

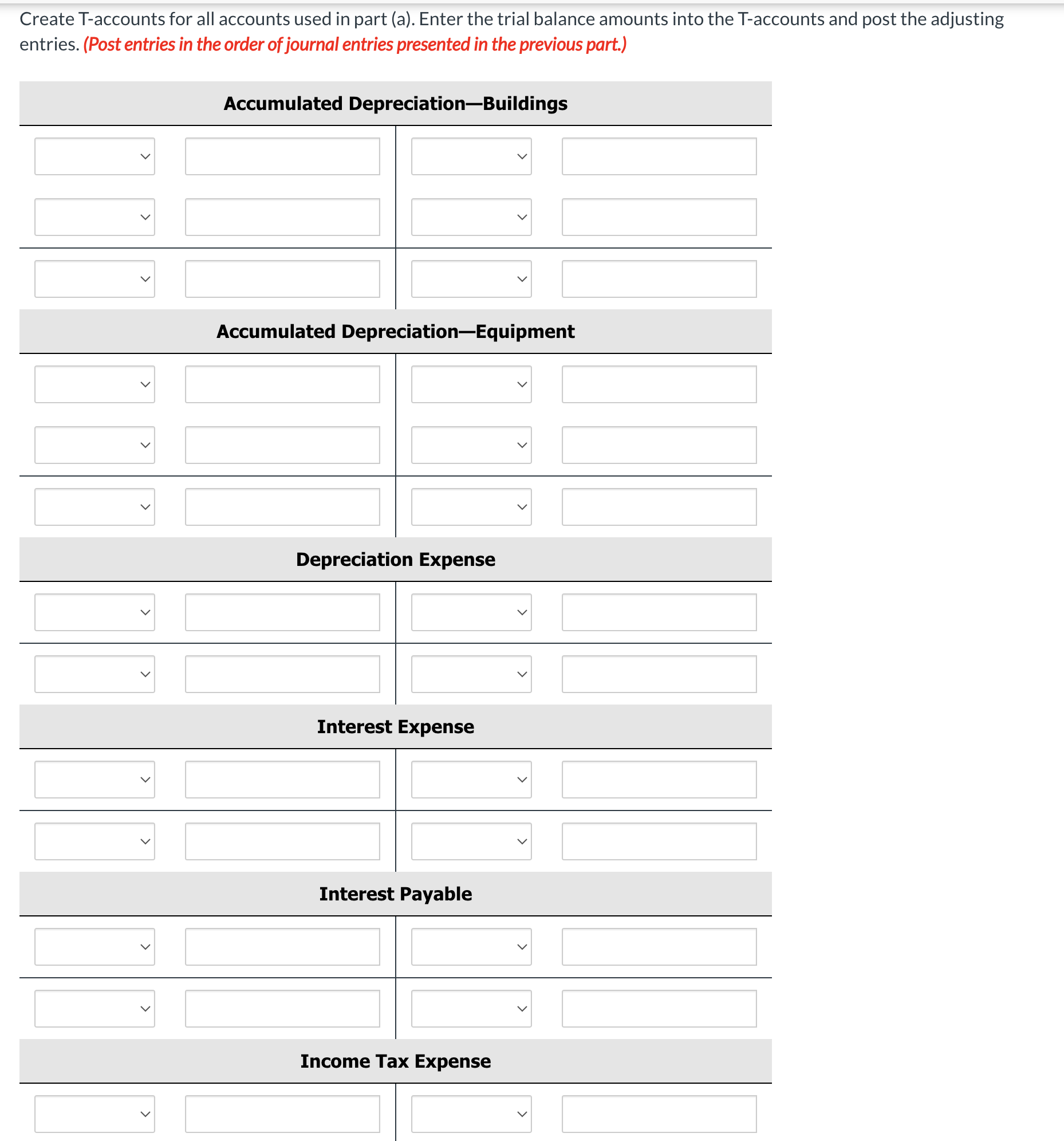

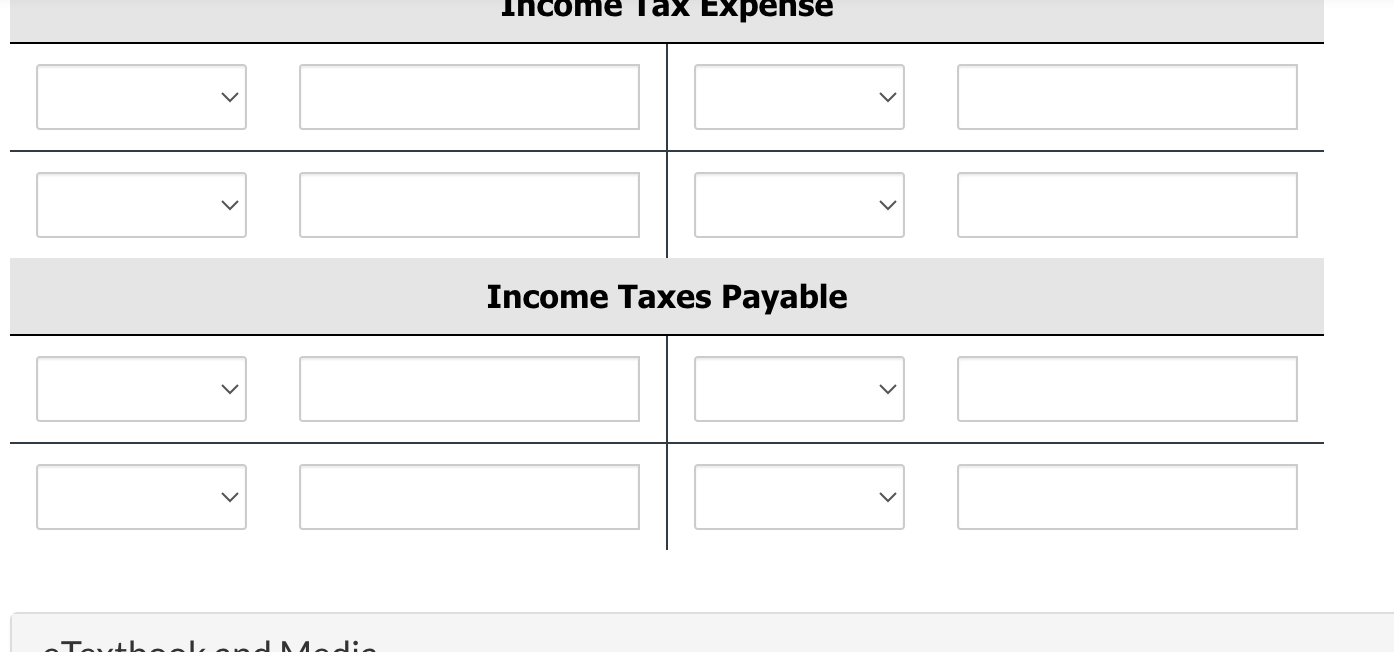

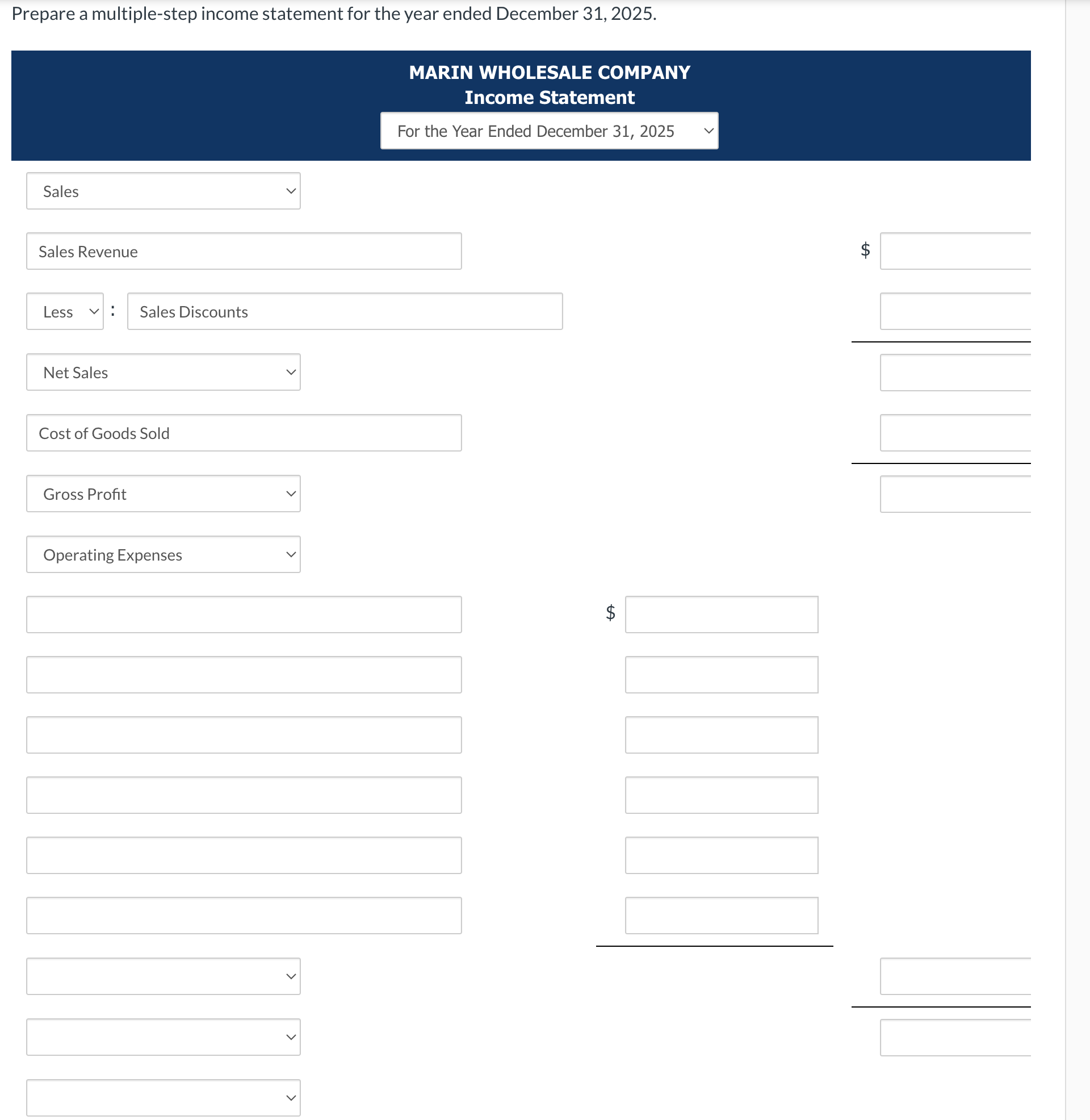

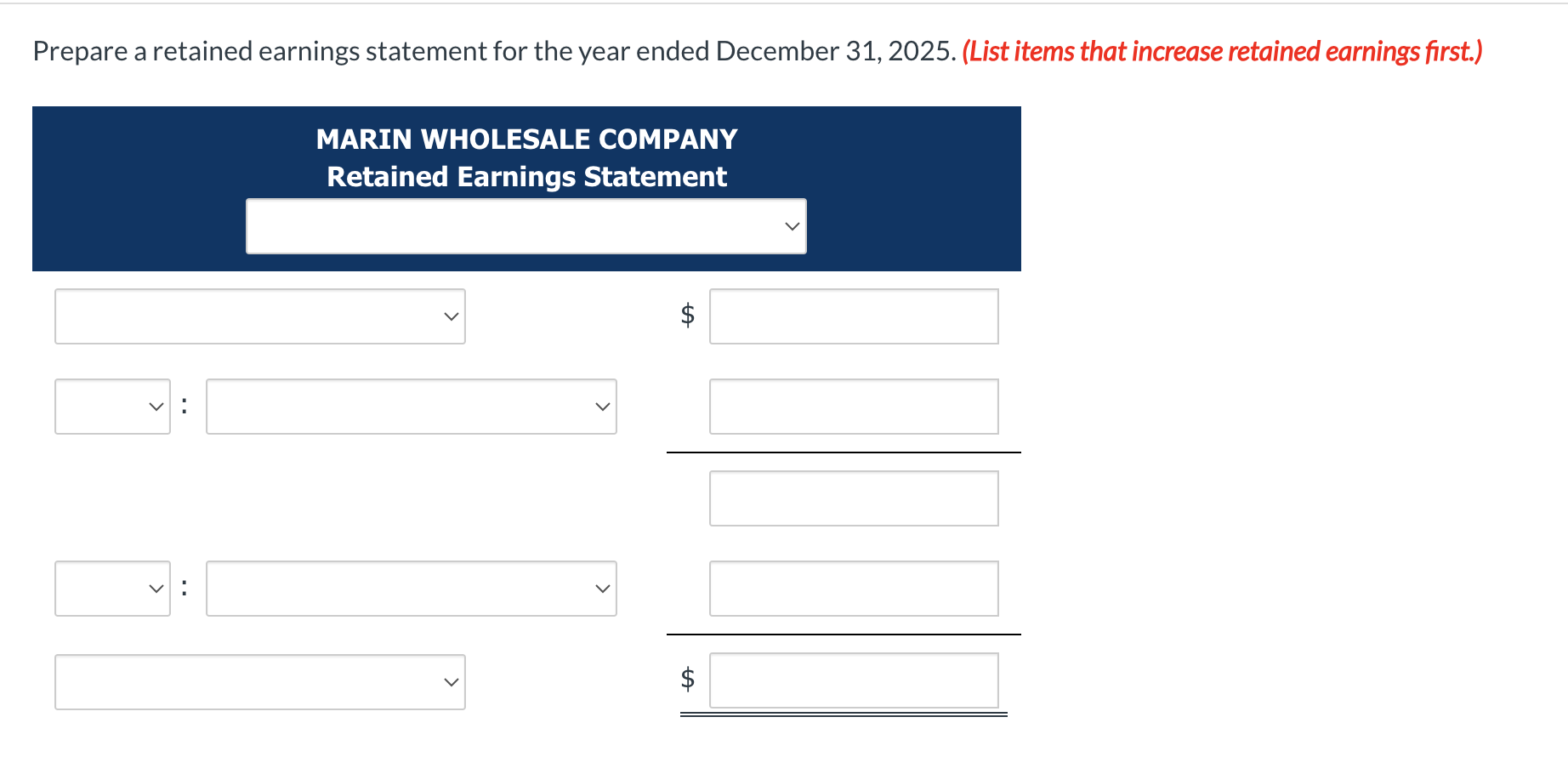

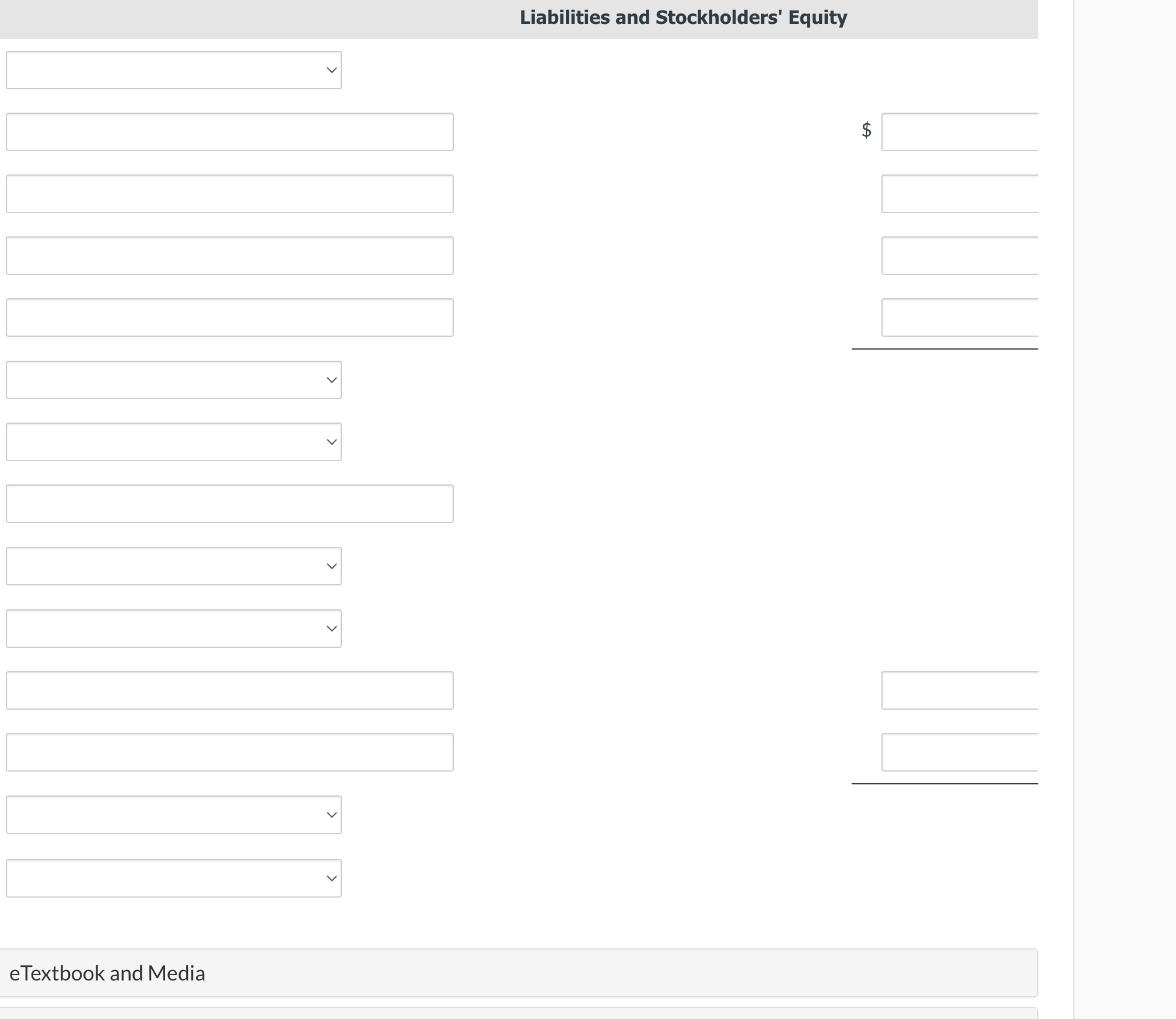

Prepare a retained earnings statement for the year ended December 31, 2025. (List items that increase retained earnings first.) The trial balance of Marin Wholesale Company contained the following accounts shown at December 31, the end of the company's Prepare a classified balance sheet at December 31, 2025. (List current assets in order of liquidity and property, plant, and equipment in order of land, buildings and equipment.) MARIN WHOLESALE COMPANY Balance Sheet Assets $ $ $ Liabilities and Stockholders' Equity Adjustment data: 1. Depreciation is $9,200 on buildings and $8,200 on equipment. (Both are operating expenses.) 2. Interest of $5,700 is due and unpaid on notes payable at December 31 . 3. Income tax due and unpaid at December 31 is $25,200. Dther data: $16,200 of the notes payable are payable next year. Liabilities and Stockholders' Equity $ eTextbook and Media Create T-accounts for all accounts used in part (a). Enter the trial balance amounts into the T-accounts and post the adjusting Income Taxes Payable Prepare a multiple-step income statement for the year ended December 31, 2025

Prepare a retained earnings statement for the year ended December 31, 2025. (List items that increase retained earnings first.) The trial balance of Marin Wholesale Company contained the following accounts shown at December 31, the end of the company's Prepare a classified balance sheet at December 31, 2025. (List current assets in order of liquidity and property, plant, and equipment in order of land, buildings and equipment.) MARIN WHOLESALE COMPANY Balance Sheet Assets $ $ $ Liabilities and Stockholders' Equity Adjustment data: 1. Depreciation is $9,200 on buildings and $8,200 on equipment. (Both are operating expenses.) 2. Interest of $5,700 is due and unpaid on notes payable at December 31 . 3. Income tax due and unpaid at December 31 is $25,200. Dther data: $16,200 of the notes payable are payable next year. Liabilities and Stockholders' Equity $ eTextbook and Media Create T-accounts for all accounts used in part (a). Enter the trial balance amounts into the T-accounts and post the adjusting Income Taxes Payable Prepare a multiple-step income statement for the year ended December 31, 2025 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started