Answered step by step

Verified Expert Solution

Question

1 Approved Answer

prepare a revised income statement for 2016 reflecting the additional facts use a multi-step format assume that an income tax rate of 30% applies to

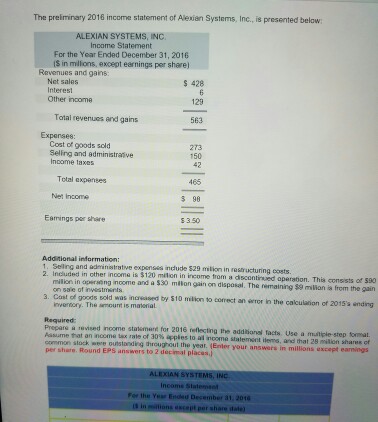

prepare a revised income statement for 2016 reflecting the additional facts use a multi-step format assume that an income tax rate of 30% applies to all income statement items and that 28 million shares of common stock are outstanding throughout the year

The preliminary 2016 income statement of Alexian systems, Inc., is presented below ALEXIAN SYSTEMS, INC. Statement For the Year Ended December 31, 2016 isin mllons, except earnings per share) ues and gains Net sales 428 other income Total revenues and gains Cost of goods sold Selling and administrasve Total expenses 465 90 Earnings per share S350 Additional information 2. Selling and admi istrative indude S29 restructuring costs Included in other income is $120 milion in income from operation. This conssts of ion in operteng income and a $30 milon gain on disposal. The remaining milion is from gain the 3. Cost of goods sold was in avased by S10 miionto correct an error in the calculation of 2015's ending inventory. The eviend income for 2016 addhional facts. Use step that an income tax rate of 30% to a income that 2B Million shal oommon stock outstanding throughout the year. (Enter your answers in millions except earnings nswers to 2 detimal places he Year Ended December a 2018Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started