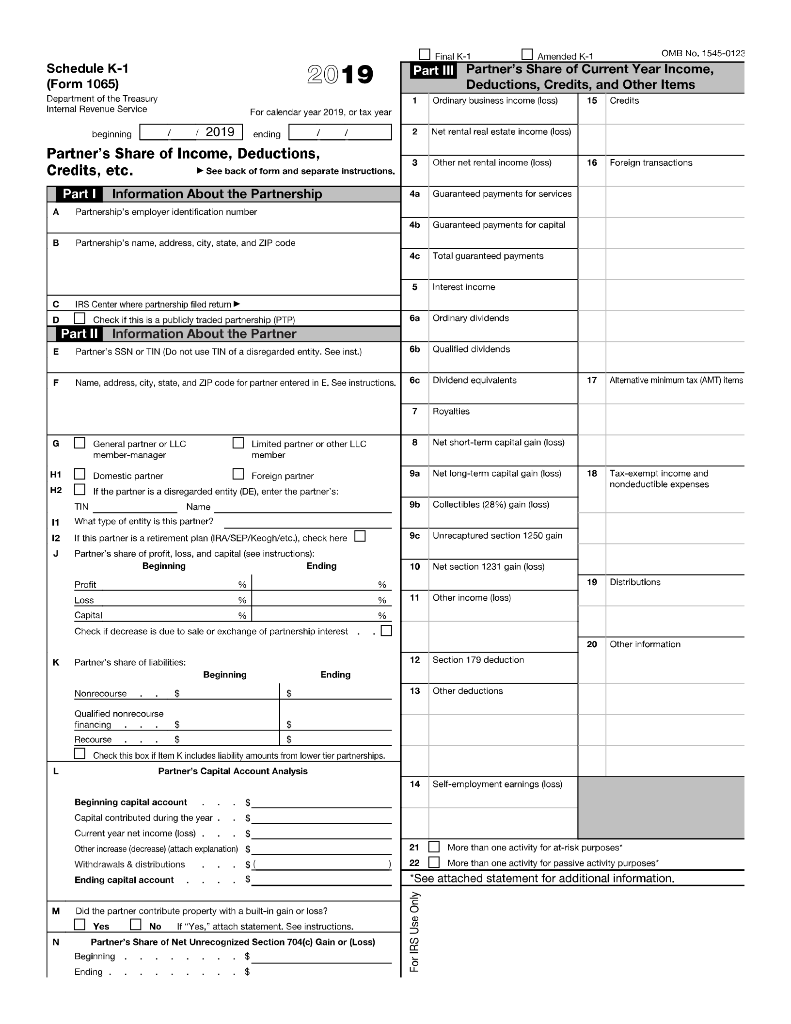

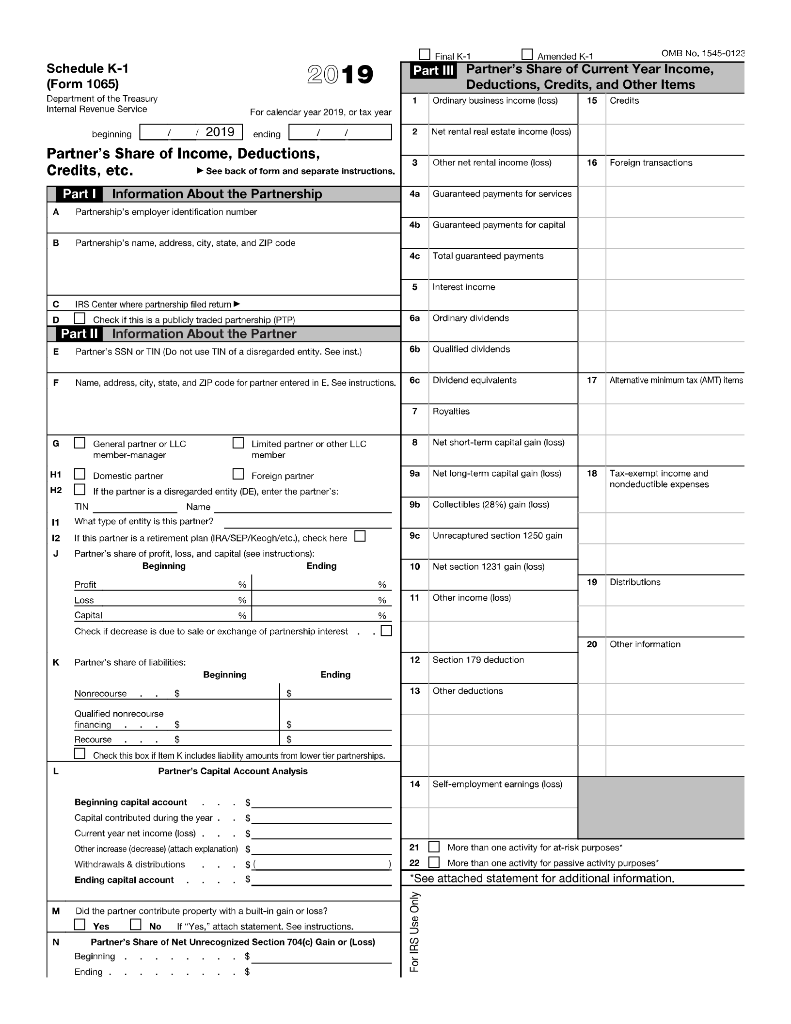

Prepare a Schedule K-1 (Form 1065) for the attached problem.

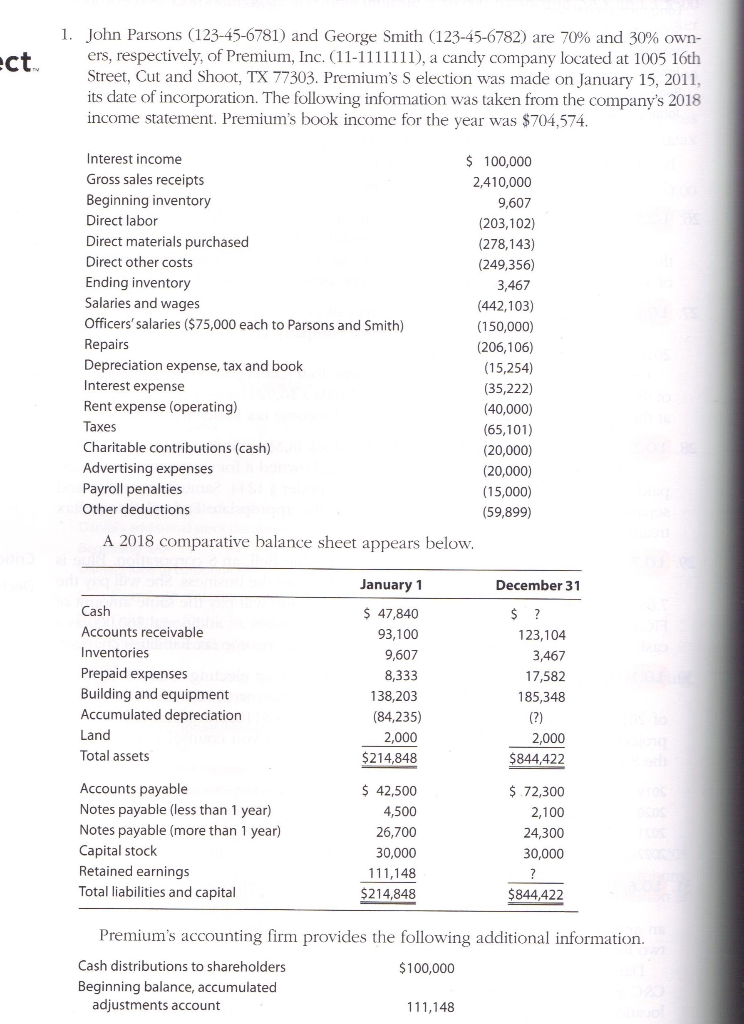

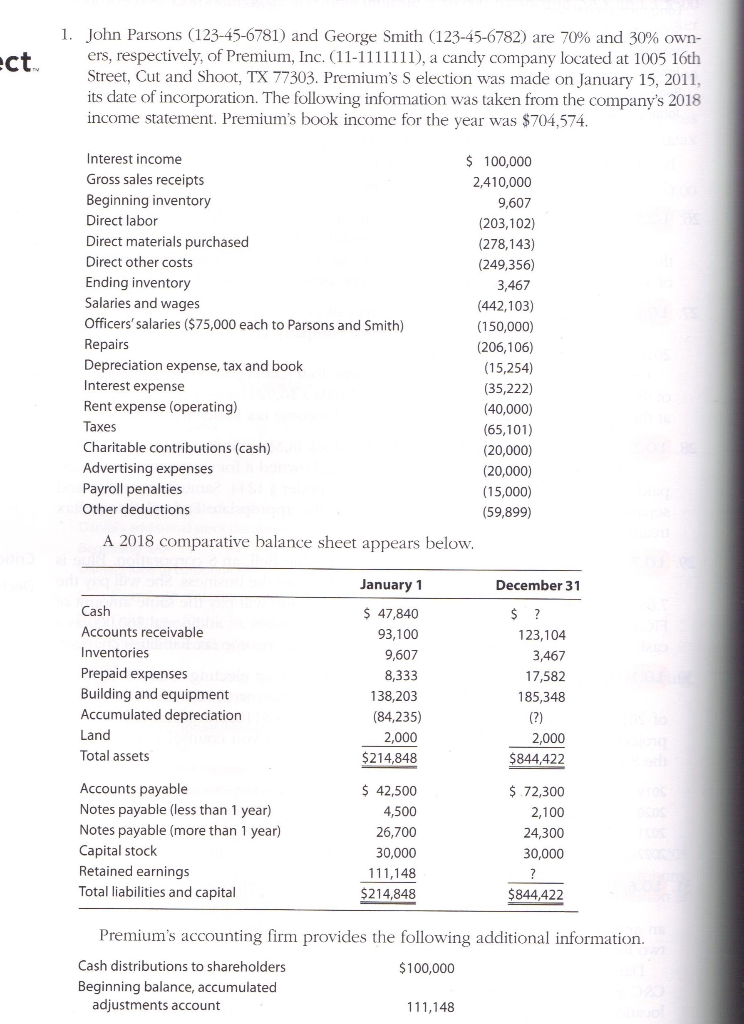

Final K-1 Amended K-1 OMB No. 1545-0128 Part II Partner's Share of Current Year Income, Deductions, Credits, and Other Items 1 Ordinary business income loss) 15 Credits 2 Net rental real estate income loss) Schedule K-1 2019 (Form 1065) Department of the Treasury Internal Revenue Service For calendar year 2019, or tax year beginning D 2019 ending D Partner's Share of Income, Deductions, Credits, etc. See back of form and separate Instructions. Part 1 Information About the Partnership A Partnership's employer identification number 3 Other net rental income (loss) 16 Foreign transactions 4a Guaranteed payments for services 4b Guaranteed payments for capital B Partnership's name, address, city, state, and ZIP code 4c Total guaranteed payments 5 Interest Income C 6a Ordinary dividends IRS Center where partnership filed return D D Check if this is a publicly traded partnership (PTP) Part II Information About the Partner E Partner's SSN or TIN (Do not use TIN of a disregarded entity. See inst.) 6b Qualified dividends F Name, address, city, state, and ZIP code for partner entered in E. See instructions. 6c Dividend ecuivalents 17 Alternative minimum tax (AMT) itens 7 Royalties 8 Net short-term capital gain (loss! Net long-term capital gain (loss) 18 Tax-exempt income and nondeductible expenses 96 Collectibles (28%) gain floss) G D General partner or LLC Limited partner or other LLC member-manager member H1 Domestic partner Foreign partner H2 D If the partner is a disregarded entity (DE), enter the partner's: TIN Name 11 What type of entity is this partner? If this partner is a retirement plan (RA SEP/Keoghvetc.), check here U J Partner's share of profit, loss, and capital (see instructions): Beginning Ending Profit Loss Capital Check if decrease is due to sale or exchange of partnership interest, 9c Unrecaptured section 1250 gain 10 Net section 1231 gain (loss) 19 Distributions % 11 Other income loss) O 20 Other information K 12 Section 179 deduct on 13 Other deductions Partner's share of abilities: Beginning Ending Nonrecourse . S Qualified nonrecourse financing . . . S Recourse . . . S U Check this box if Item k includes liablity amounts from lower tier partnerships Partner's Capital Account Analysis 14 Self-employment earnings loss Beginning capital account . . . $_ Capital contributed during the year. S Current year net income (loss S Other increase (decrease (attach explanation) Withdrawals & distributions . ..SI Ending capital account. . . 21 U More than one activity for at-risk purposes 22 D More than one activity for passive activity purposes See attached statement for additional information. Did the partner contribute property with a built-in gain or loss? Yes No f "Yes," attach statement. See instructions. Partner's Share of Net Unrecognized Section 704(c) Gain or (Loss) Beginning . . . . . . . . $ Ending . . . . . . . . . $ For IRS Use Only ct 1. John Parsons (123-45-6781) and George Smith (123-45-6782) are 70% and 30% own- ers, respectively, of Premium, Inc. (11-1111111), a candy company located at 1005 16th Street, Cut and Shoot, TX 77303. Premium's Selection was made on January 15, 2011, its date of incorporation. The following information was taken from the company's 2018 income statement. Premium's book income for the year was $704,574. Interest income Gross sales receipts Beginning inventory Direct labor Direct materials purchased Direct other costs Ending inventory Salaries and wages Officers' salaries ($75,000 each to Parsons and Smith) Repairs Depreciation expense, tax and book Interest expense Rent expense (operating) Taxes Charitable contributions (cash) Advertising expenses Payroll penalties Other deductions $ 100,000 2,410,000 9,607 (203,102) (278,143) (249,356) 3,467 (442,103) (150,000) (206,106) (15,254) (35,222) (40,000) (65,101) (20,000) (20,000) (15,000) (59,899) A 2018 comparative balance sheet appears below. January 1 December 31 Cash Accounts receivable Inventories Prepaid expenses Building and equipment Accumulated depreciation Land Total assets $ 47,840 93,100 9,607 8,333 138,203 (84,235) 2,000 $214,848 $ ? 123,104 3,467 17,582 185,348 (?) 2,000 $844,422 Accounts payable Notes payable (less than 1 year) Notes payable (more than 1 year) Capital stock Retained earnings Total liabilities and capital $ 42,500 4,500 26,700 30,000 111,148 $214,848 $ 72,300 2,100 24,300 30,000 $844,422 Premium's accounting firm provides the following additional information. Cash distributions to shareholders $100,000 Beginning balance, accumulated adjustments account 111,148