Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare a schedule of cost of goods manufactured and explain its purpose and links to financial statements. I need help with this problem, and please

Prepare a schedule of cost of goods manufactured and explain its purpose and links to financial statements.

I need help with this problem, and please explain your steps

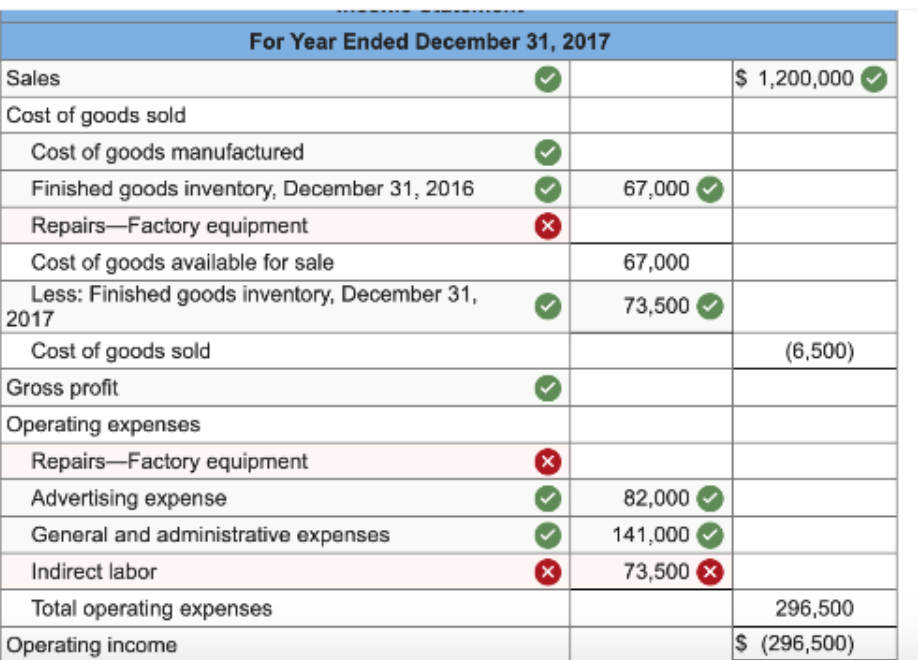

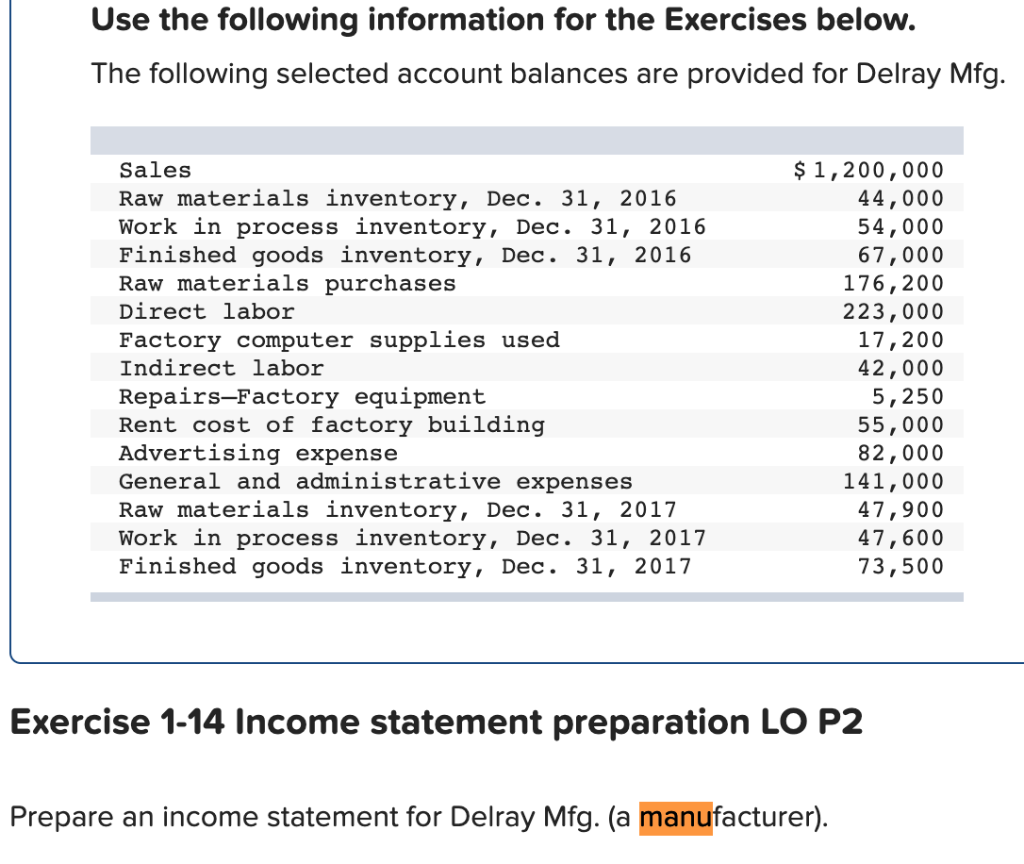

For Year Ended December 31, 2017 $1,200,000 Sales Cost of goods sold Cost of goods manufactured 67,000 Finished goods inventory, December 31, 2016 Repairs-Factory equipment Cost of goods available for sale Less: Finished goods inventory, December 31, 2017 67,000 73,500 (6,500) Cost of goods sold Gross profit Operating expenses Repairs-Factory equipment Advertising expense 82,000 General and administrative expenses 141,000 73,500X Indirect labor Total operating expenses 296,500 $ (296,500) Operating income Use the following information for the Exercises below. The following selected account balances are provided for Delray Mfg. $ 1,200,000 44,000 54,000 67,000 176,200 Sales Raw materials inventory, Dec. Work in process inventory, Finished goods inventory, Dec. 31, 2016 Raw materials purchases 31, 2016 Dec. 31, 2016 Direct labor 223,000 17,200 42,000 5,250 Factory computer supplies used Indirect labor Repairs-Factory equipment Rent cost of factory building Advertising expense General and administrative expenses 55,000 82,000 141,000 47,900 47,600 73,500 Raw materials inventory, Dec. 31, 2017 Work in process inventory, Dec. 31, 2017 Finished goods inventory, Dec. 31, 2017 Exercise 1-14 Income statement preparation LO P2 Prepare an income statement for Delray Mfg. (a manufacturer)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started