Prepare a schedule to determine the amortization and allocation amounts and allocation to controlling and noncontrolling interests.

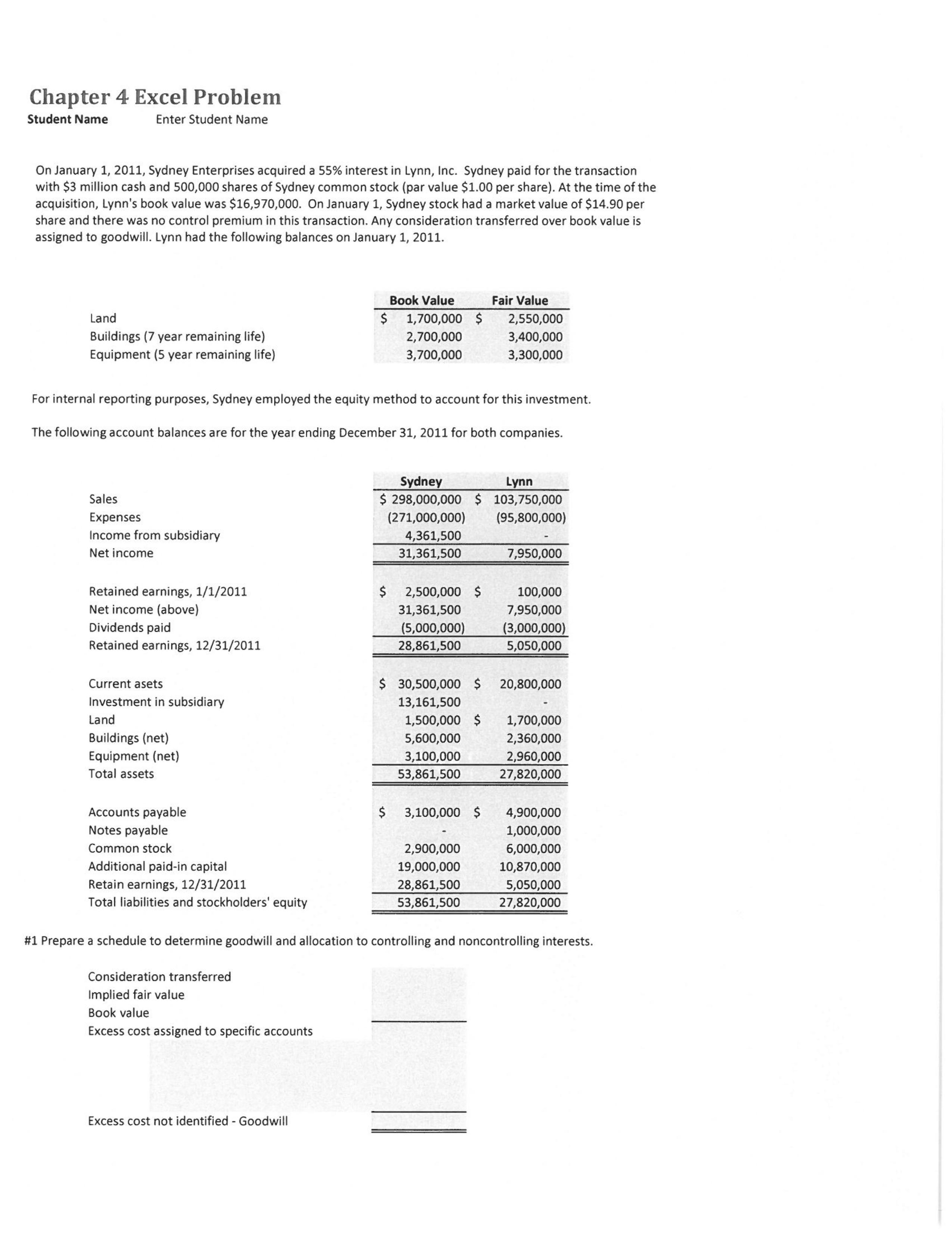

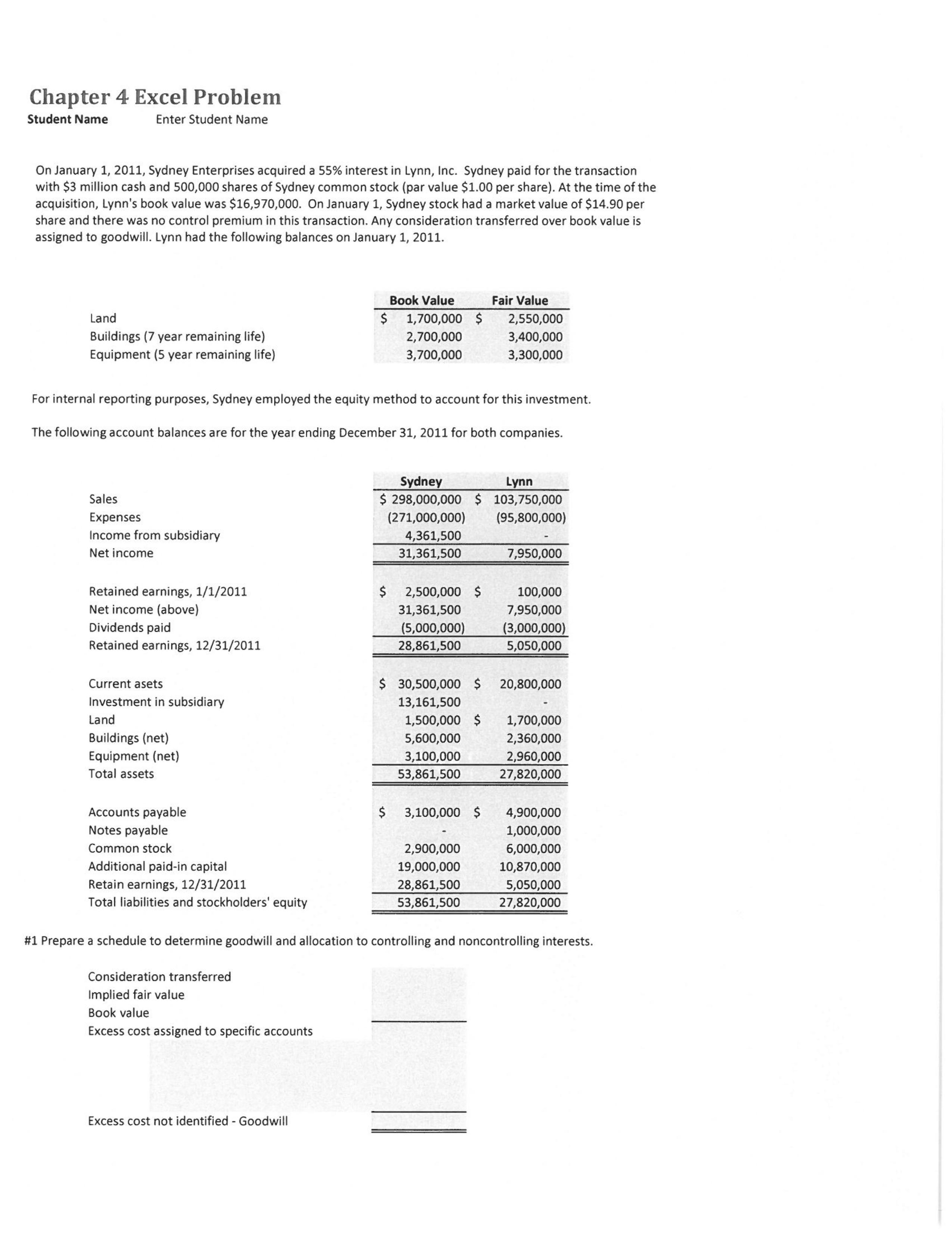

On January 1, 2011, Sydney Enterprises acquired a 55% interest in Lynn, Inc. Sydney paid for the transaction with $3 million cash and 500,000 shares of Sydney common stock (par value $1.00 per share). At the time of the acquisition, Lynn's book value was $16,970,000. On January 1, Sydney stock had a market value of $14.90 per share and there was no control premium in this transaction. Any consideration transferred over book value is assigned to goodwill. Lynn had the following balances on January 1, 2011. Land Buildings (7 year remaining life) Equipment (5 year remaining life) For internal reporting purposes, Sydney employed the equity method to account for this investment The following account balances are for the year ending December 31, 2011 for both companies. Sales Expenses Income from subsidiary Net income Retained earnings, 1/1/2011 Net income (above) Dividends paid Retained earnings, 12/31/2011 Current asset Investment in subsidiary Land Buildings (net) Equipment (net) Total assets Accounts payable Notes payable Common stock Additional paid-in capital Retain earnings, 12/31/2011 Total liabilities and stockholders' equity #1 Prepare a schedule to determine goodwill and allocation to controlling and noncontrolling interests. Consideration transferred Implied fair value Book value Excess cost assigned to specific accounts Excess cost not identified - Goodwill On January 1, 2011, Sydney Enterprises acquired a 55% interest in Lynn, Inc. Sydney paid for the transaction with $3 million cash and 500,000 shares of Sydney common stock (par value $1.00 per share). At the time of the acquisition, Lynn's book value was $16,970,000. On January 1, Sydney stock had a market value of $14.90 per share and there was no control premium in this transaction. Any consideration transferred over book value is assigned to goodwill. Lynn had the following balances on January 1, 2011. Land Buildings (7 year remaining life) Equipment (5 year remaining life) For internal reporting purposes, Sydney employed the equity method to account for this investment The following account balances are for the year ending December 31, 2011 for both companies. Sales Expenses Income from subsidiary Net income Retained earnings, 1/1/2011 Net income (above) Dividends paid Retained earnings, 12/31/2011 Current asset Investment in subsidiary Land Buildings (net) Equipment (net) Total assets Accounts payable Notes payable Common stock Additional paid-in capital Retain earnings, 12/31/2011 Total liabilities and stockholders' equity #1 Prepare a schedule to determine goodwill and allocation to controlling and noncontrolling interests. Consideration transferred Implied fair value Book value Excess cost assigned to specific accounts Excess cost not identified - Goodwill