Answered step by step

Verified Expert Solution

Question

1 Approved Answer

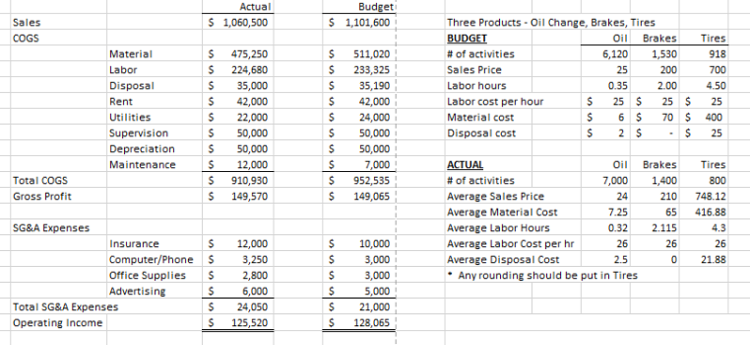

Prepare a segmented income statement for Mike's Auto Center using the 2018 Actual results. Of the fixed expenses, the following can be traced to specific

Prepare a segmented income statement for Mike's Auto Center using the 2018 Actual results. Of the fixed expenses, the following can be traced to specific segments and comment on any areas that require further investigation.

| Oil | Brakes | Tires | |

| Rent | 20% | 30% | 30% |

| Utilities | 10% | 25% | 35% |

| Depreciation | 10% | 25% | 25% |

| Maintenance | 5% | 30% | 30% |

Amounts not assigned to segments are common expenses of the business

Actual $ 1,060,500 Budget 1,101,600 $ Sales COGS Tires 25 $ $ $ $ Material Labor Disposal Rent Utilities Supervision Depreciation Maintenance $ $ $ $ $ $ S $ S $ 475,250 224,680 35,000 42,000 22,000 50,000 50,000 12,000 910,930 149,570 511,020 233,325 35,190 42,000 24,000 50,000 50,000 7,000 952,535 149,065 Three Products - Oil Change, Brakes, Tires BUDGET Oil Brakes # of activities 6,120 1,530 Sales Price 200 Labor hours 0.35 2.00 Labor cost per hour 5 25 S 25 Material cost $ 6 S 70 Disposal cost $ 2 $ . $ $ $ 4.50 25 400 25 $ $ $ $ $ Total COGS Gross Profit ACTUAL Oil Brakes # of activities 7,000 1,400 Average Sales Price 24 210 Average Material Cost 7.25 65 Average Labor Hours 0.32 2.115 Average Labor Cost per hr 26 26 Average Disposal Cost 2.5 0 Any rounding should be put in Tires Tires 800 748.12 416.88 4.3 26 21.88 SG&A Expenses Insurance Computer/Phone Office Supplies Advertising Total SG&A Expenses Operating Income $ 5 $ $ $ $ 12,000 3,250 2,800 6,000 24,050 125,520 $ $ $ $ $ $ 10,000 3,000 3,000 5,000 21,000 128,065

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started