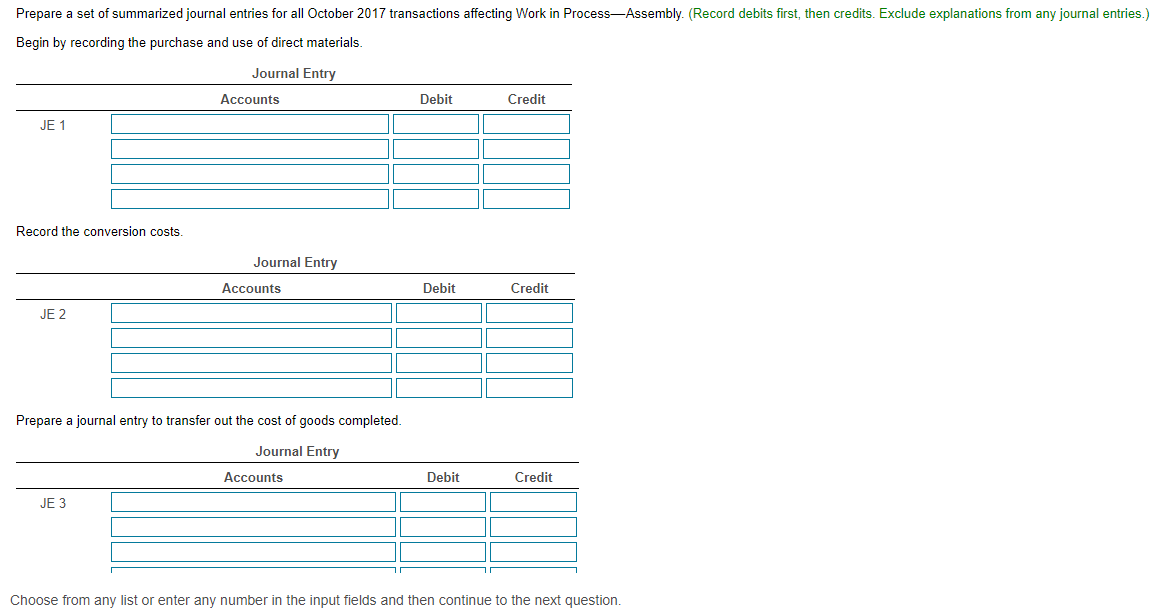

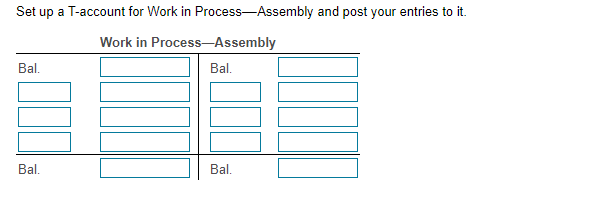

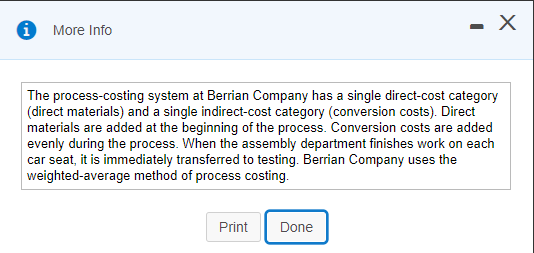

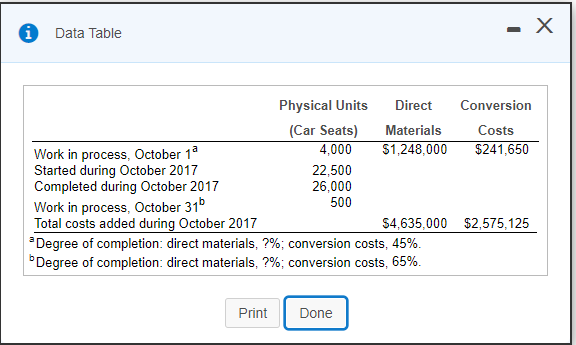

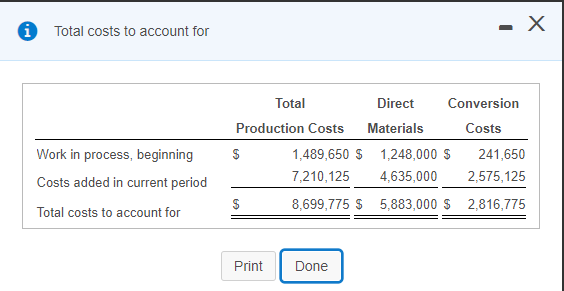

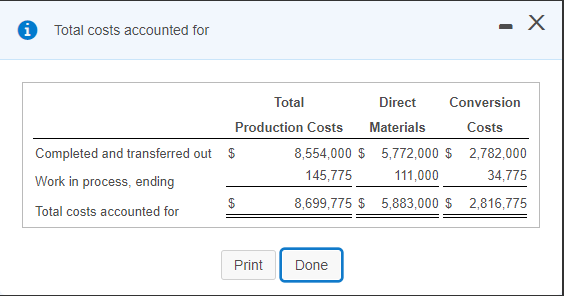

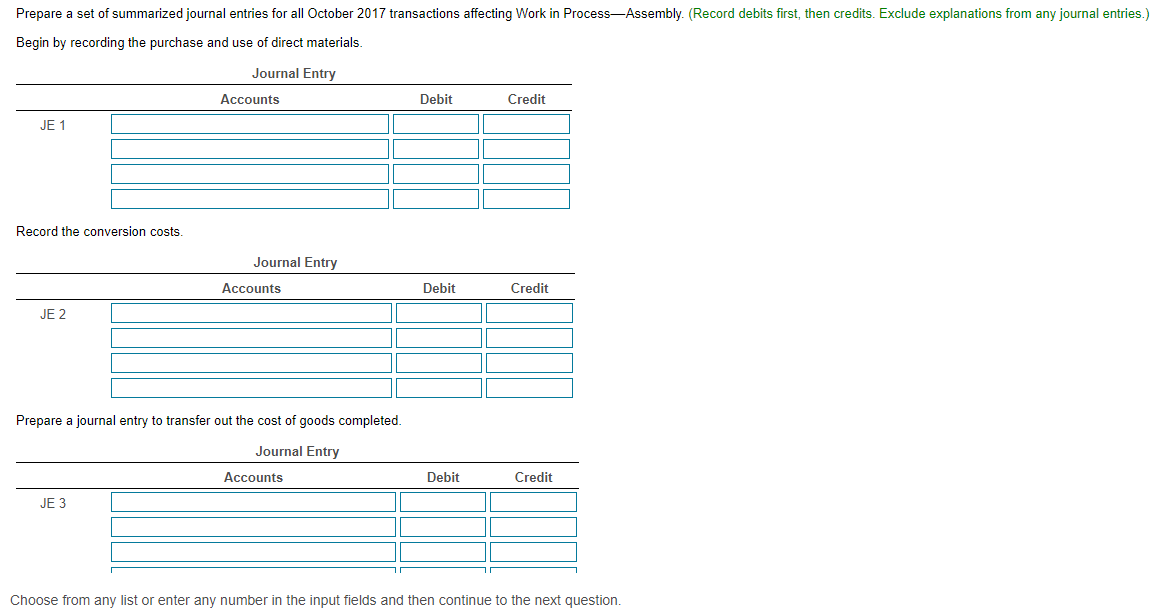

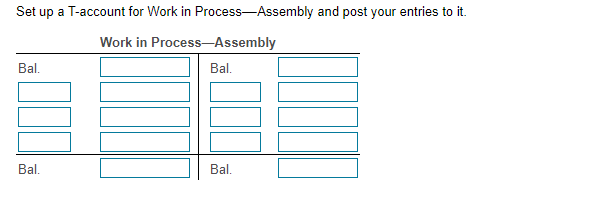

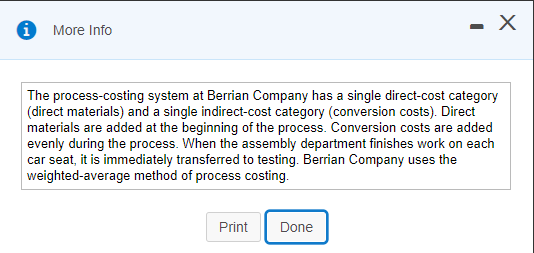

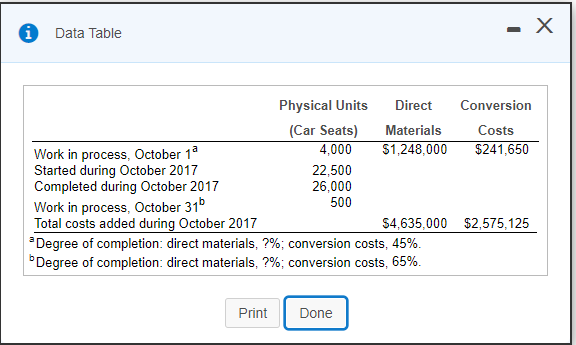

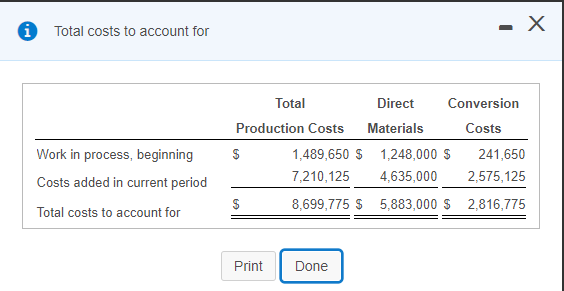

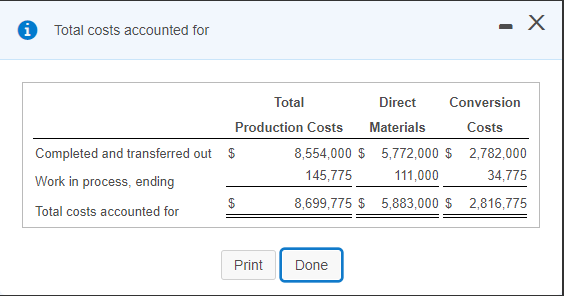

Prepare a set of summarized journal entries for all October 2017 transactions affecting Work in ProcessAssembly (Record debits first, then credits. Exclude explanations from any journal entries.) Begin by recording the purchase and use of direct materials. Journal Entry Accounts Debit Credit JE 1 Record the conversion costs. Journal Entry Accounts Debit Credit JE 2 Prepare a journal entry to transfer out the cost of goods completed. Journal Entry Accounts Debit Credit JE 3 Choose from any list or enter any number in the input fields and then continue to the next question. Set up a T-account for Work in ProcessAssembly and post your entries to it. Work in Process-Assembly Bal. Bal. Bal. Bal. More Info - X The process-costing system at Berrian Company has a single direct-cost category (direct materials) and a single indirect-cost category (conversion costs). Direct materials are added at the beginning of the process. Conversion costs are added evenly during the process. When the assembly department finishes work on each car seat, it is immediately transferred to testing. Berrian Company uses the weighted average method of process costing. Print Done Data Table . Physical Units Direct Conversion (Car Seats) Materials Costs Work in process, October 18 4,000 $1,248,000 $241,650 Started during October 2017 22,500 Completed during October 2017 26,000 Work in process, October 316 500 Total costs added during October 2017 $4,635,000 $2,575,125 Degree of completion: direct materials, ?%; conversion costs, 45%. Degree of completion: direct materials, ?%; conversion costs, 65%. Print Done A Total costs to account for X Work in process, beginning Costs added in current period Total costs to account for Total Direct Conversion Production Costs Materials Costs $ 1,489,650 $ 1,248,000 $ 241,650 7,210,125 4,635,000 2,575,125 $ 8,699,775 $ 5,883,000 $ 2,816,775 Print Done i . X Total costs accounted for Completed and transferred out Work in process, ending Total costs accounted for Total Direct Conversion Production Costs Materials Costs $ 8,554,000 $ 5,772,000 $ 2,782,000 145,775 111,000 34,775 $ 8,699,775 $ 5,883,000 $ 2,816,775 Print Done