Prepare a simplified balance sheet with three sub-headings in the assets and three subheadings in the equity and liabilities and Compute the working capital, working capital need and net cash

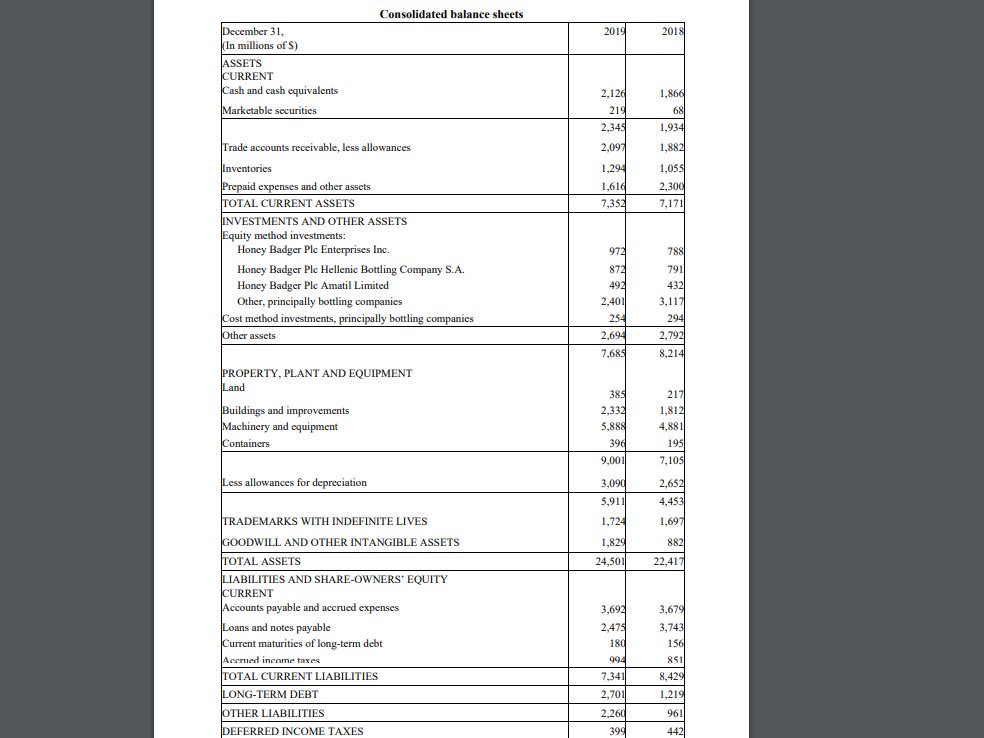

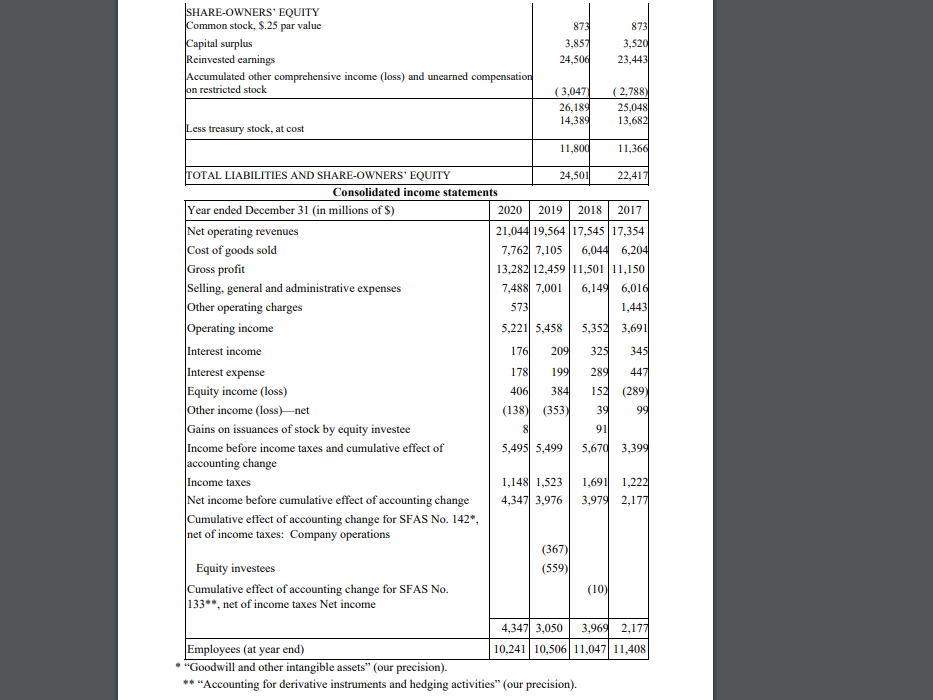

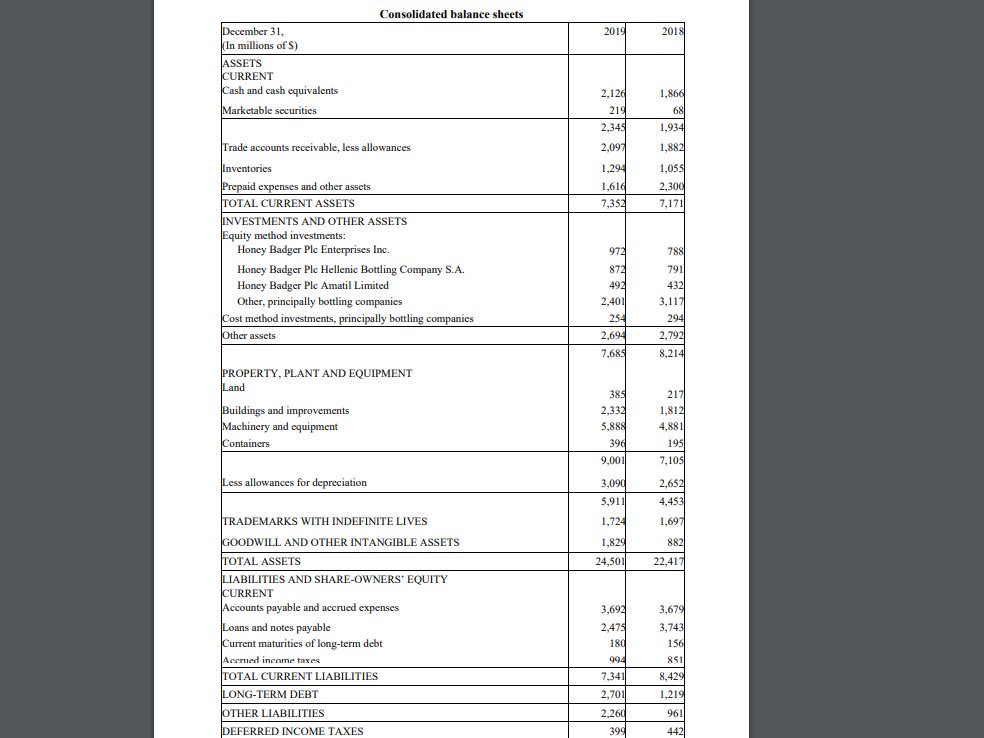

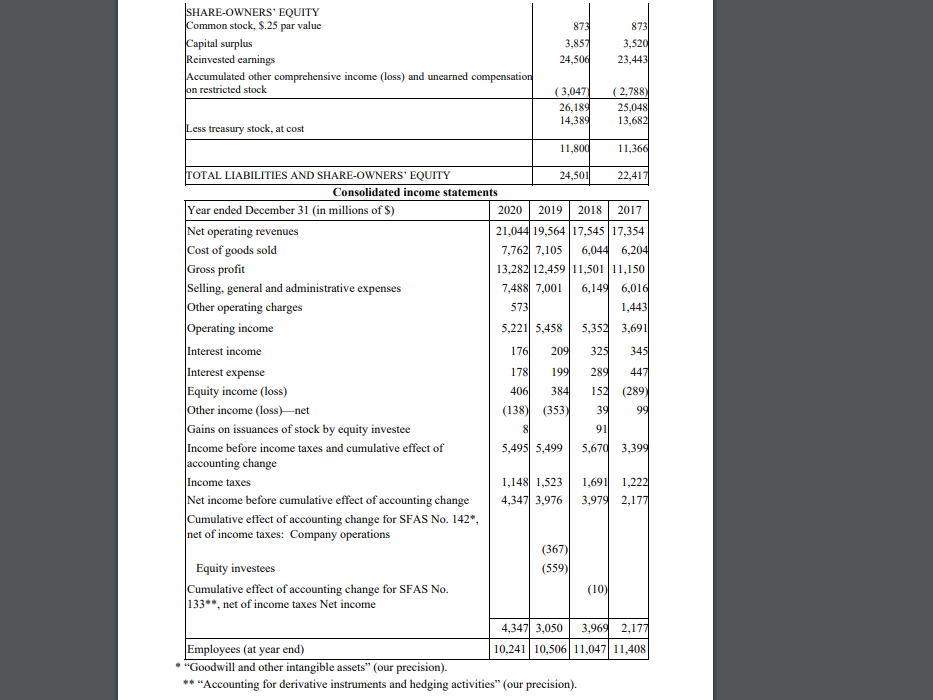

Consolidated balance sheets 2019 2018 December 31, (In millions of S) ASSETS CURRENT Cash and cash equivalents Marketable securities 1,860 2,124 219 2,345 68 1,934 2,0971 1,882 1,294 1,610 1,055 2,300 7,171 7,357 Trade accounts receivable, less allowances Inventories Prepaid expenses and other assets TOTAL CURRENT ASSETS INVESTMENTS AND OTHER ASSETS Equity method investments Honey Badger Ple Enterprises Inc. Honey Badger Plc Hellenic Bottling Company S.A. Honey Badger Plc Amatil Limited Other, principally bottling companies Cost method investments, principally bottling companies Other assets 972 872 492 2,4011 254 2,694 7,685 7881 7911 432 3,1171 294 2,792 8,214 PROPERTY, PLANT AND EQUIPMENT Land Buildings and improvements Machinery and equipment Containers 384 2,337 5,888 394 9,001 2171 1,8121 4,881 195 7,105 Less allowances for depreciation 3,090 5,9111 2,652 4,453 TRADEMARKS WITH INDEFINITE LIVES 1,724 1,697 1,829 882 24,501 22,417 3,692 3,679 GOODWILL AND OTHER INTANGIBLE ASSETS TOTAL ASSETS LIABILITIES AND SHARE-OWNERS' EQUITY CURRENT Accounts payable and accrued expenses Loans and notes payable Current maturities of long-term debt Accruel income taxes TOTAL CURRENT LIABILITIES LONG-TERM DEBT 2,478 180 994 3,743 156 851 8,429 1,219 7,341 2,701 961 OTHER LIABILITIES DEFERRED INCOME TAXES 2,260 399 442 SHARE-OWNERS' EQUITY Common stock, $.25 par value Capital surplus Reinvested earnings Accumulated other comprehensive income (loss) and unearned compensation on restricted stock 873 3,857 24,500 873 3,520 23,443 (3,047) 26,189 14,389 (2,788) 25,048 13,682 Less treasury stock, at cost 11,800 11,366 TOTAL LIABILITIES AND SHARE-OWNERS' EQUITY 24,5011 22,417 Consolidated income statements Year ended December 31 (in millions of $) 2020 2019 2018 2017 Net operating revenues 21.044 19,564 17, 17,354 Cost of goods sold 7,762 7,105 6,044 6,204 Gross profit 13,282 12,459 11,501 11,150 Selling, general and administrative expenses 7,488 7,001 6,149 6,016 Other operating charges 573 1,443 Operating income 5,221 5,458 5,352 3,691 Interest income 176 209 325 345 Interest expense 1781 199 289 447 Equity income (loss) 406 384 152 (289) Other income (loss)-net (138) (353) 39 99 Gains on issuances of stock by equity investee 8 91 Income before income taxes and cumulative effect of 5,495 5,499 5,670 3,399 accounting change Income taxes 1,148 1,523 1.691 1,222 Net income before cumulative effect of accounting change 4,347 3,976 3,979 2,177 Cumulative effect of accounting change for SFAS No. 142", net of income taxes: Company operations (367) Equity investees (559) Cumulative effect of accounting change for SFAS No. (10) 133**, net of income taxes Net income 4,347 3,050 3,969 2,177 Employees (at year end) 10,241 10,506 11,047 11,408 "Goodwill and other intangible assets" (our precision). ** "Accounting for derivative instruments and hedging activities (our precision)