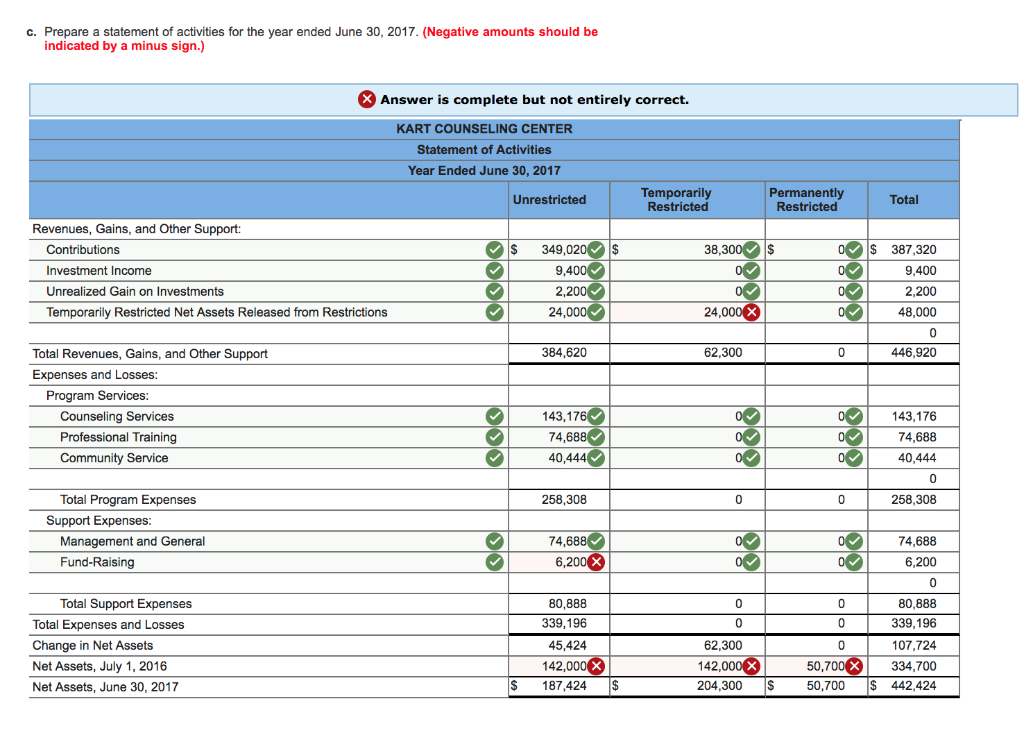

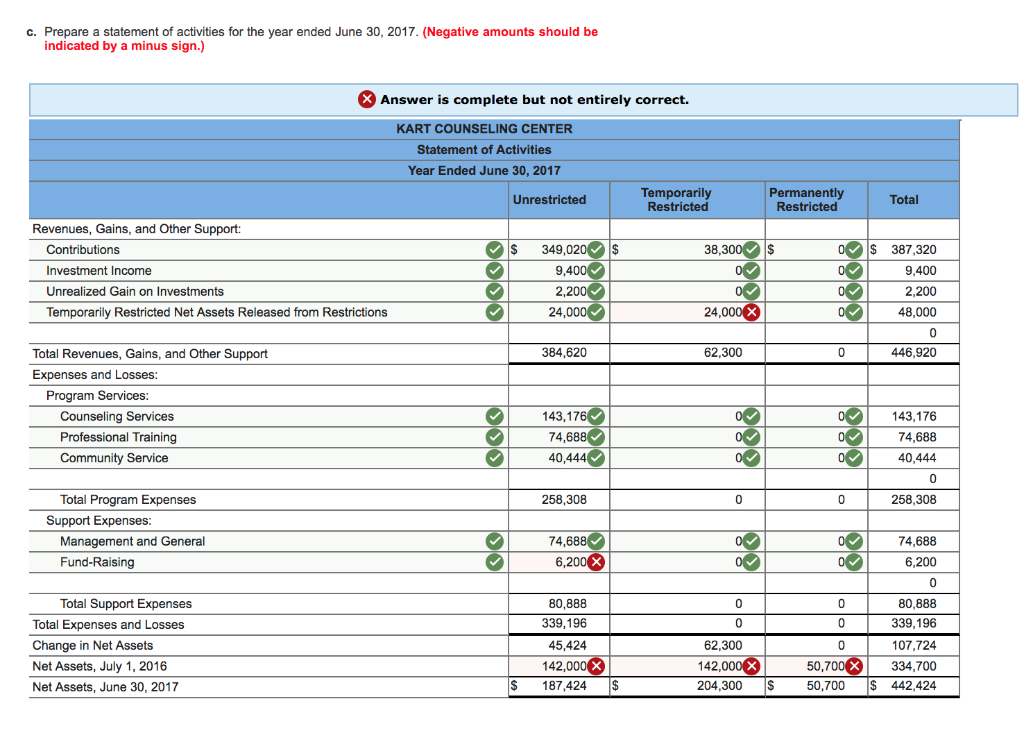

| Prepare a statement of activities for the year ended June 30, 2017. |

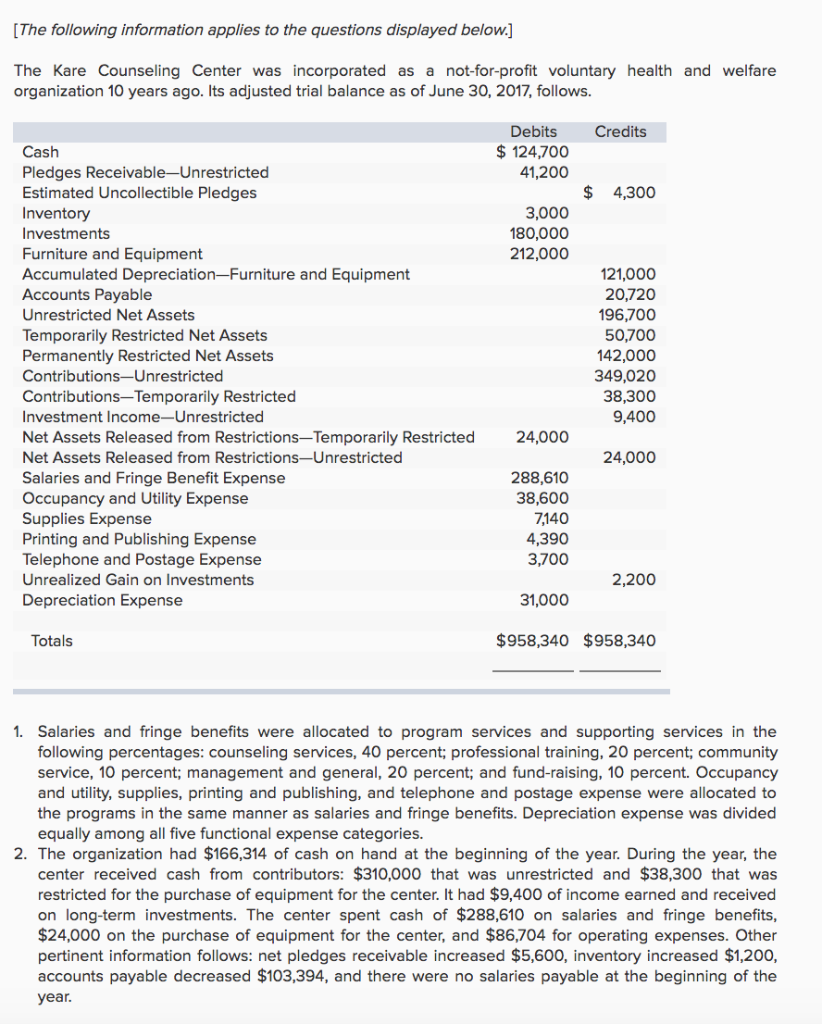

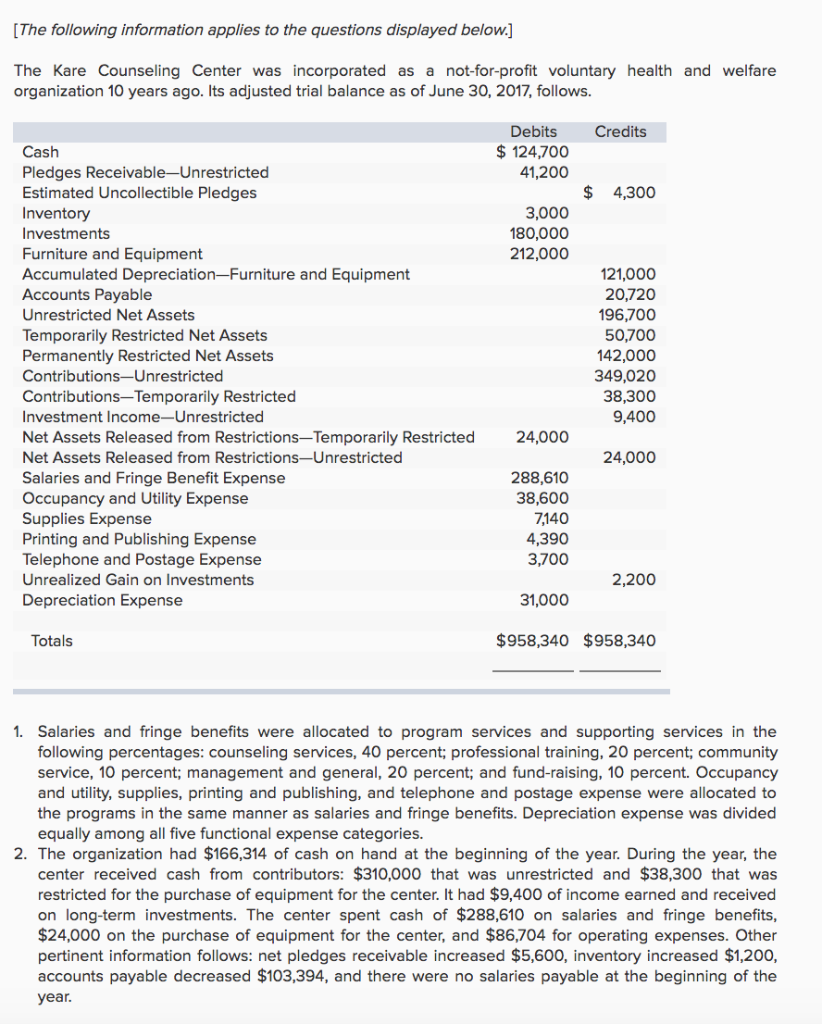

[The following information applies to the questions displayed below.] The Kare Counseling Center was incorporated as a not-for-profit voluntary health and welfare organization 10 years ago. Its adjusted trial balance as of June 30, 2017, follows. Debits Credits $124,700 41,200 Cash Pledges Receivable-Unrestricted Estimated Uncollectible Pledges Inventory Investments Furniture and Equipment Accumulated Depreciation-Furniture and Equipment Accounts Payable Unrestricted Net Assets Temporarily Restricted Net Assets Permanently Restricted Net Assets Contributions-Unrestricted Contributions-Temporarily Restrictec Investment Income-Unrestricted Net Assets Released from Restrictions-Temporarily Restricted24,000 Net Assets Released from Restrictions-Unrestricted Salaries and Fringe Benefit Expense Occupancy and Utility Expense Supplies Expense Printing and Publishing Expense Telephone and Postage Expense Unrealized Gain on Investments Depreciation Expense $ 4,300 3,000 180,000 212,000 121,000 20,720 196,700 50,700 142,000 349,020 38,300 9,400 24,000 288,610 38,600 7140 4,390 3,700 2,200 31,000 Totals $958,340 $958,340 1. Salaries and fringe benefits were allocated to program services and supporting services in the following percentages: counseling services, 40 percent; professional training, 20 percent; community service, 10 percent; management and general, 20 percent; and fund-raising, 10 percent. Occupancy and utility, supplies, printing and publishing, and telephone and postage expense were allocated to the programs in the same manner as salaries and fringe benefits. Depreciation expense was divided equally among all five functional expense categories. 2. The organization had $166,314 of cash on hand at the beginning of the year. During the year, the center received cash from contributors: $310,000 that was unrestricted and $38,300 that was restricted for the purchase of equipment for the center. It had $9,400 of income earned and received on long-term investments. The center spent cash of $288,610 on salaries and fringe benefits, $24,000 on the purchase of equipment for the center, and $86,704 for operating expenses. Other pertinent information follows: net pledges receivable increased $5,600, inventory increased $1,200, accounts payable decreased $103,394, and there were no salaries payable at the beginning of the year c. Prepare a statement of activities for the year ended June 30, 2017. (Negative amounts should be indicated by a minus sign.) Answer is complete but not entirely correct. KART COUNSELING CENTER Statement of Activities Year Ended June 30, 2017 Temporarily Restricted Permanently Restricted Unrestricted Total Revenues, Gains, and Other Support: s20s $ 349,0 38,300S Contributions Investment Income Unrealized Gain on Investments Temporarily Restricted Net Assets Released from Restrictions 9,400 2,200 24,000 $ 387,320 09,400 0D1 2.200 48,000 24,000 384,620 62,300 446,920 Total Revenues, Gains, and Other Support Expenses and Losses Program Services: Counseling Services Professional Training Community Service 143,176 74,688 40,444 143,176 74,688 40,444 0 258,308 Total Program Expenses 258,308 0 Support Expenses 74,688 6,200 74,688 6,200 0 80,888 339,196 107,724 334,700 204,300 50,700 442,424 Management and General Fund-Raising 80,888 339,196 45,424 142,000 Total Support Expenses 0 0 Total Expenses and Losses Change in Net Assets Net Assets, July 1, 2016 Net Assets, June 30, 2017 62,300 142 50,700 $187,424 S