Answered step by step

Verified Expert Solution

Question

1 Approved Answer

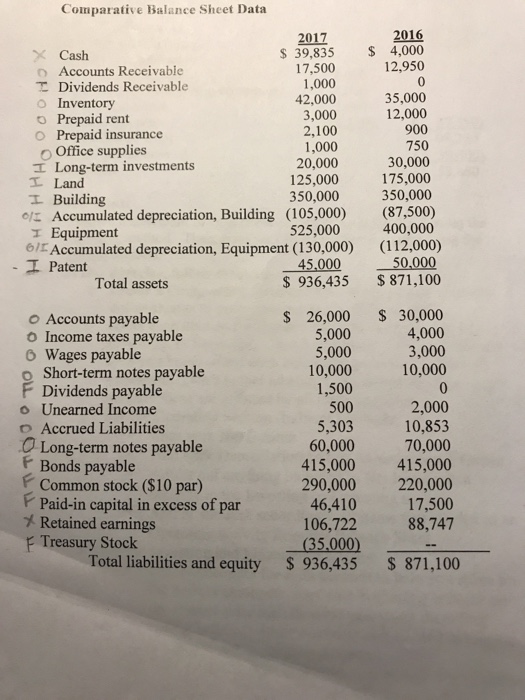

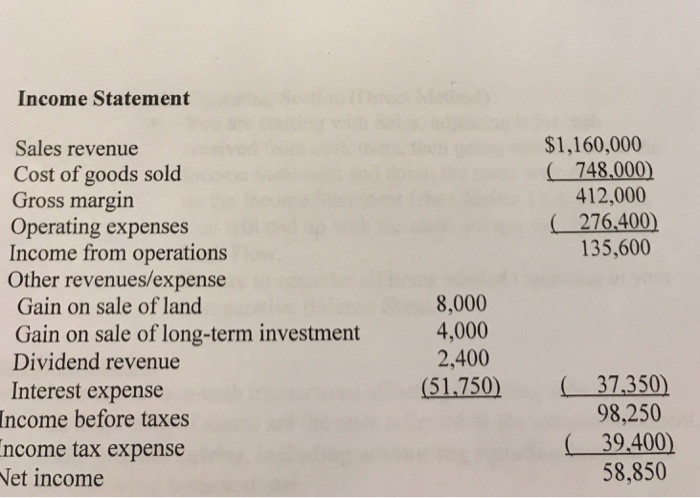

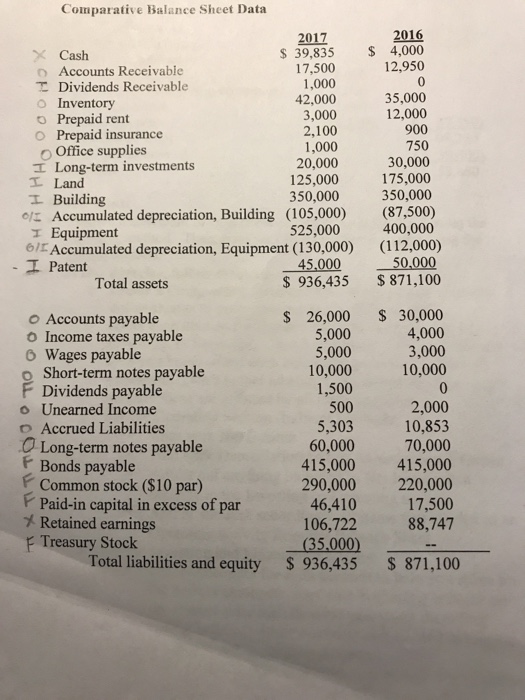

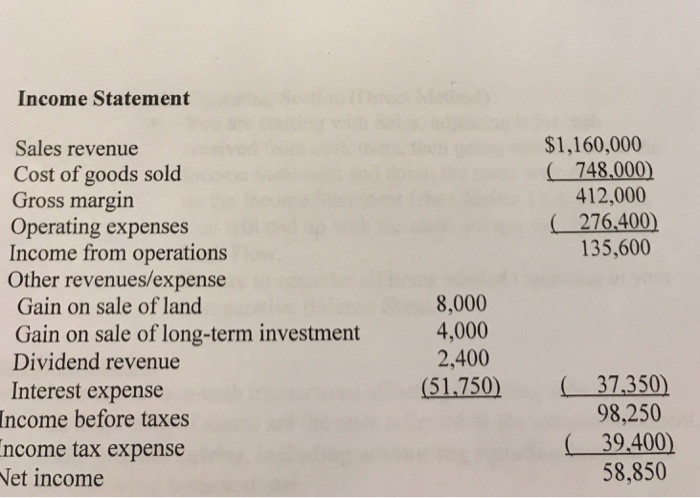

Prepare a statement of cash flow using the indirect and direct method using the comparative balance sheet and the income statement. Comparative Balance Sheet Data

Prepare a statement of cash flow using the indirect and direct method using the comparative balance sheet and the income statement.

Comparative Balance Sheet Data 2016 2017 39,835 4,000 Cash 12,950 17,500 D Accounts Receivable 1,000 T Dividends Receivable 35,000 42,000 Inventory 12,000 3,000 o Prepaid rent 900 2.100 O Prepaid insurance 1,000 750 o Office supplies 30,000 20,000 I Long-term investments 125,000 175,000 Land 350,000 350,000 L Building otz Accumulated depreciation, Building (105,000) (87,500) 400,000 525,000 I Equipment (112,000) Accumulated depreciation, Equipment (130,000) 50 45,000 I Patent 936,435 871,100 Total assets 26,000 30,000 o Accounts payable 4,000 5,000 o Income taxes payable 3,000 5,000 Wages payable 10,000 10,000 o Short-term notes payable F Dividends payable 1,500 500 2,000 o Unearned Income 10,853 5,303 o Accrued Liabilities Long-term notes payable 70,000 0.000 F Bonds payable 415,000 415,000 f common stock ($10 par) 290,000 220,000 Paid-in capital in excess of par 46,410 17,500 Retained earnings 88,747 106,722 F Treasury Stock 35,000 Total liabilities and equity 936,435 871,100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started