Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare a statement of cash flows for Shady Inc for the year ended 31 December 20X3, to explain as far as possible the movement

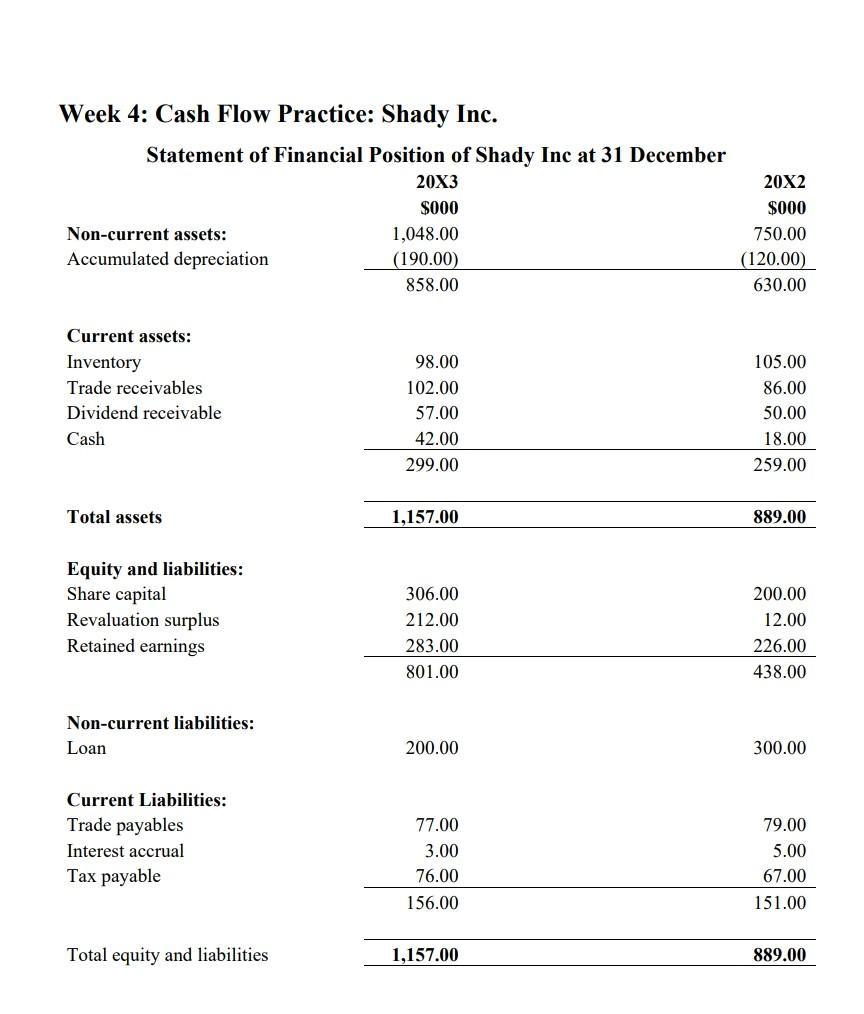

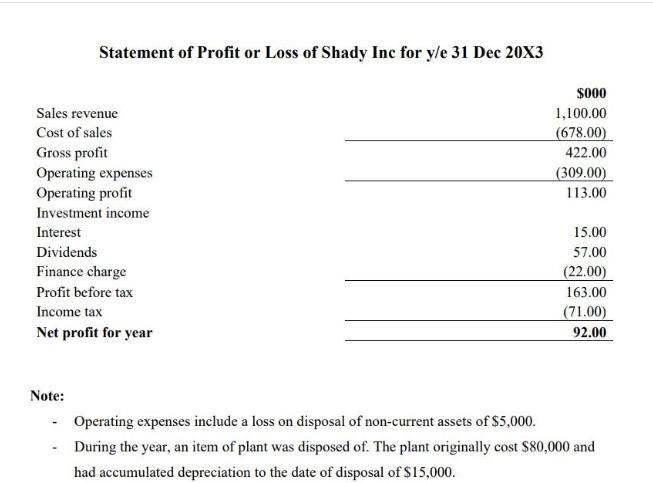

Prepare a statement of cash flows for Shady Inc for the year ended 31 December 20X3, to explain as far as possible the movement in the bank balance. Using the summarised accounts given, and the statement you have just prepared, comment on the position, progress and direction of Shady Inc. Week 4: Cash Flow Practice: Shady Inc. Statement of Financial Position of Shady Inc at 31 December 20X3 $000 Non-current assets: Accumulated depreciation Current assets: Inventory Trade receivables Dividend receivable Cash Total assets Equity and liabilities: Share capital Revaluation surplus Retained earnings Non-current liabilities: Loan Current Liabilities: Trade payables Interest accrual Tax payable Total equity and liabilities 1,048.00 (190.00) 858.00 98.00 102.00 57.00 42.00 299.00 1,157.00 306.00 212.00 283.00 801.00 200.00 77.00 3.00 76.00 156.00 1,157.00 20X2 $000 750.00 (120.00) 630.00 105.00 86.00 50.00 18.00 259.00 889.00 200.00 12.00 226.00 438.00 300.00 79.00 5.00 67.00 151.00 889.00 Statement of Profit or Loss of Shady Inc for y/e 31 Dec 20X3 Sales revenue Cost of sales Gross profit Operating expenses Operating profit Investment income Interest Dividends Finance charge Profit before tax Income tax Net profit for year Note: $000 1,100.00 (678.00) 422.00 (309.00) 113.00 15.00 57.00 (22.00) 163.00 (71.00) 92.00 Operating expenses include a loss on disposal of non-current assets of $5,000. During the year, an item of plant was disposed of. The plant originally cost $80,000 and had accumulated depreciation to the date of disposal of $15,000.

Step by Step Solution

★★★★★

3.45 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Income Statement Item Amount Sales Revenue 110000 Cost of Sales 67800 Gross Profit 42200 Operating Expenses 30900 Operating Income 11300 Investment In...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started