Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Boost Corporation is authorized to issue 30,000 shares of common stock, $1 par, of which 16,000 are outstand- ing; issue price $8 per share.

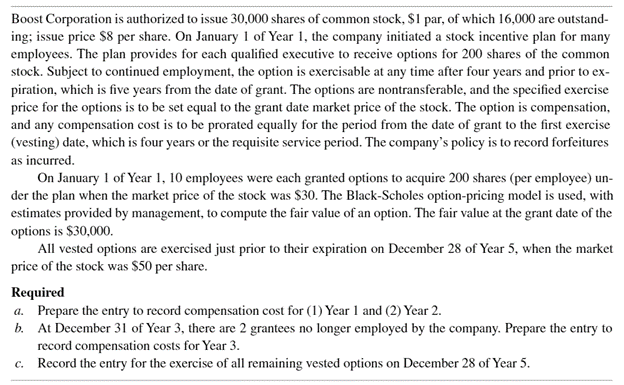

Boost Corporation is authorized to issue 30,000 shares of common stock, $1 par, of which 16,000 are outstand- ing; issue price $8 per share. On January 1 of Year 1, the company initiated a stock incentive plan for many employees. The plan provides for each qualified executive to receive options for 200 shares of the common stock. Subject to continued employment, the option is exercisable at any time after four years and prior to ex- piration, which is five years from the date of grant. The options are nontransferable, and the specified exercise price for the options is to be set equal to the grant date market price of the stock. The option is compensation, and any compensation cost is to be prorated equally for the period from the date of grant to the first exercise (vesting) date, which is four years or the requisite service period. The company's policy is to record forfeitures as incurred. On January 1 of Year 1, 10 employees were each granted options to acquire 200 shares (per employee) un- der the plan when the market price of the stock was $30. The Black-Scholes option-pricing model is used, with estimates provided by management, to compute the fair value of an option. The fair value at the grant date of the options is $30,000. All vested options are exercised just prior to their expiration on December 28 of Year 5, when the market price of the stock was $50 per share. Required a. Prepare the entry to record compensation cost for (1) Year 1 and (2) Year 2. b. At December 31 of Year 3, there are 2 grantees no longer employed by the company. Prepare the entry to record compensation costs for Year 3. c. Record the entry for the exercise of all remaining vested options on December 28 of Year 5.

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Entry to record compensation cost for Year 1 Date January 1 Year 1 Debit Compensation Expense 1500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started