With the following two statements of financial position, prepare a statement of cash flows. Circulating Cash Box Banks' Temporary investments Accounts receivable Customers' Salary

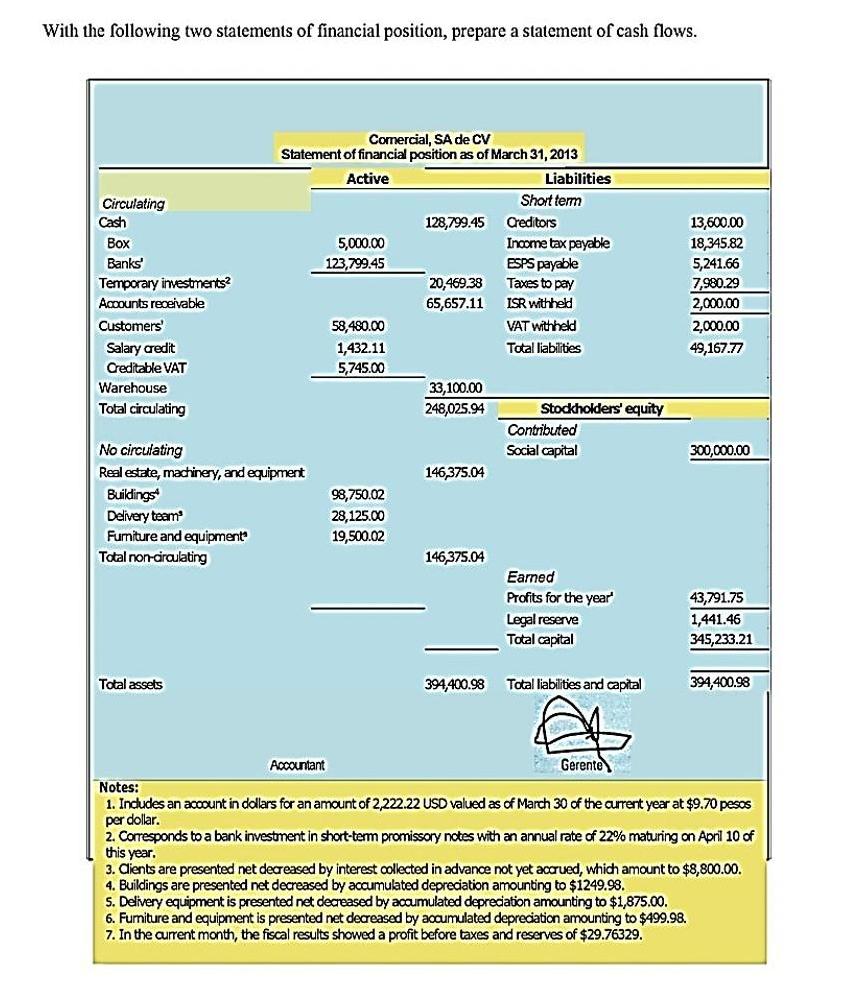

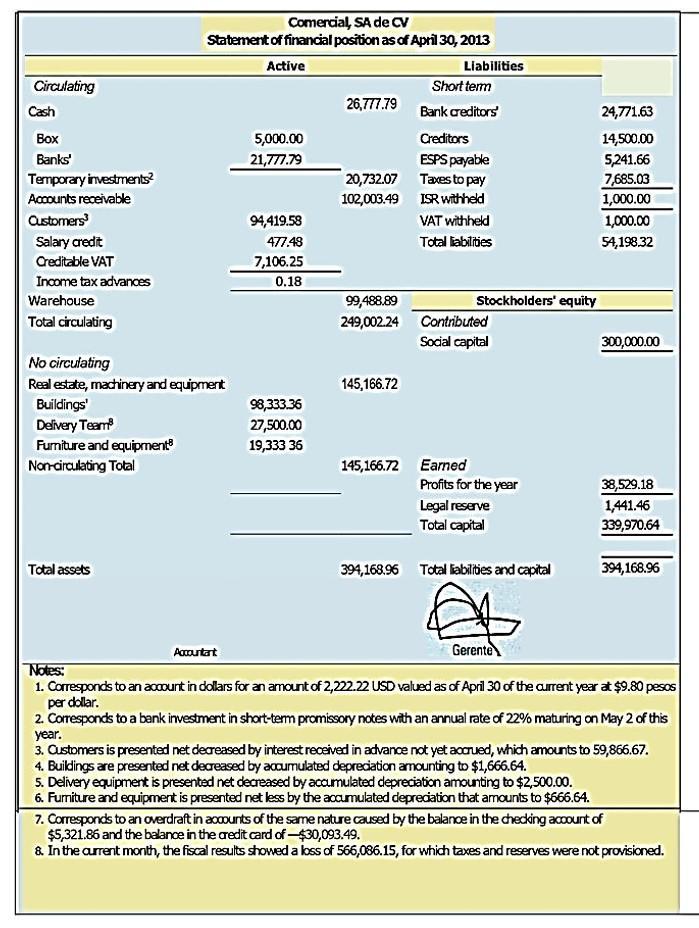

With the following two statements of financial position, prepare a statement of cash flows. Circulating Cash Box Banks' Temporary investments Accounts receivable Customers' Salary credit Creditable VAT Warehouse Total circulating No circulating Real estate, machinery, and equipment Buildings* Delivery team Furniture and equipment Total non-circulating Comercial, SA de CV Statement of financial position as of March 31, 2013 Active Total assets 5,000.00 123,799.45 Accountant 58,480.00 1,432.11 5,745.00 98,750.02 28,125.00 19,500.02 128,799.45 20,469.38 65,657.11 33,100.00 248,025.94 146,375.04 146,375.04 394,400.98 Liabilities Short term Creditors Income tax payable ESPS payable Taxes to pay ISR withheld VAT withheld Total liabilities Stockholders' equity Contributed Social capital Earned Profits for the year' Legal reserve Total capital Total liabilities and capital 13,600.00 18,345.82 5,241.66 7,980.29 2,000.00 2,000.00 49,167.77 300,000.00 43,791.75 1,441.46 345,233.21 394,400.98 Pie Gerente Notes: 1. Includes an account in dollars for an amount of 2,222.22 USD valued as of March 30 of the current year at $9.70 pesos per dollar. 2. Corresponds to a bank investment in short-term promissory notes with an annual rate of 22% maturing on April 10 of this year. 3. Clients are presented net decreased by interest collected in advance not yet accrued, which amount to $8,800.00. 4. Buildings are presented net decreased by accumulated depreciation amounting to $1249.98. 5. Delivery equipment is presented net decreased by accumulated depreciation amounting to $1,875.00. 6. Furniture and equipment is presented net decreased by accumulated depreciation amounting to $499.98. 7. In the current month, the fiscal results showed a profit before taxes and reserves of $29.76329.

Step by Step Solution

3.56 Rating (180 Votes )

There are 3 Steps involved in it

Step: 1

Cash flow from Operating Activities Net Income 222222 DepreciationAmortizat...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started