Answered step by step

Verified Expert Solution

Question

1 Approved Answer

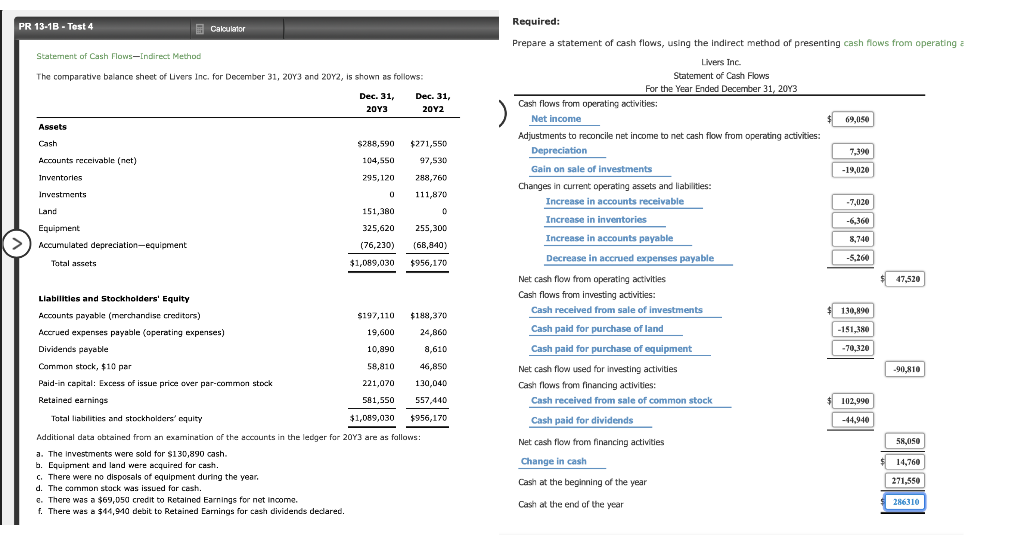

Prepare a statement of cash flows, using indirect method of presenting cash flows from operating activities. use the minus sign to indicate cash out flows,

Prepare a statement of cash flows, using indirect method of presenting cash flows from operating activities. use the minus sign to indicate cash out flows, cash payments, decreases in cash , or any negative adjustments

THE COMPARATIVE BALANCE SHEET OF LIVERS IND. DECEMBER 31,20Y3 AND 20Y2, IS SHOWN AS FOLLOWS:

**WHERE DID I GO WRONG?? PLEASE EXPLAIN (STEP-BY-STEP)***

Required PR 13-1B-Test 4 Caloulator Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating a Statement of Cash Flows-[ndirect Method Livers Inc The comparative balance sheet of Livers Inc. for December 31, 20Y3 and 20Y2, is shown as follows Statement of Cash Flows For the Year Ended December 31, 20Y3 Dec. 31, Dec. 31, Cash flows from operating activities: 20Y3 202 Net income 69,050 Assets Adjustments to reconcile net income to net cash flow from operating activities: $271,550 Cash $288,590 Depreciation 7,390 Accounts receivable (net)) 104,550 97,530 Gain on sale of investments -19,020 Inventories 295,120 288,760 Changes in current operating assets and liabilities: 111,870 Investments Increase in accounts receivable 7,020 Land 151,380 0 Increase in inventories -6,360 Equipment 325,620 255,300 Increase in accounts payable 8.740 Accumulated depreciation-equipment (76,230) (68,840) Decrease in accrued expenses payable -5,260 Total assets $1,089,030 $956,170 Net cash flow from operating activities 47,520 Cash flows from investing activities: Liabilities and Stockholders' Equity Cash received from sale of investments 130,890 $188,370 Accounts payable (merchandise creditars) $197,110 Cash paid for purchase of land -151,380 Accrued expenses payable (operating expenses) 19,600 24,860 Dividends payable Cash paid for purchase of equipment -70,320 10,890 8,610 Common stock, $10 par 58,810 46,850 Net cash flow used for investing activities 90,810 Paid-in capital: Excess of issue price over par-common stock 221,070 130,040 Cash flows from financing activities: 557,440 Retained earnings 581,550 Cash received from sale of common stock 102,990 Total liabilities and stockholders' equity $1,089,030 $956,170 Cash paid for dividends -44,940 Additional data obtained from an examination af the accounts in the ledger far 20Y3 are as fallows Net cash flow from financing activities 58,050 a. The investments were sold for $130,890 cash. b. Equipment and land were acquired for cash Change in cash 14,760 c. There were no disposals of equipment during the year. 271,550 Cash at the beginning of the year d. The cammon stack was issued far cash. e. There was a $69,050 credit to Retained Earn ings for net income. f. There was a $44,910 debit to Retained Earnings for cash dividends dedared Cash at the end of the year 286310Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started