Answered step by step

Verified Expert Solution

Question

1 Approved Answer

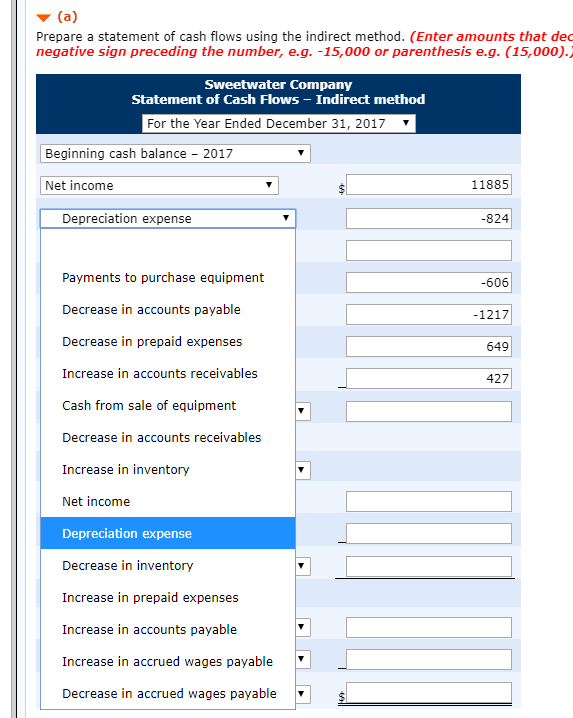

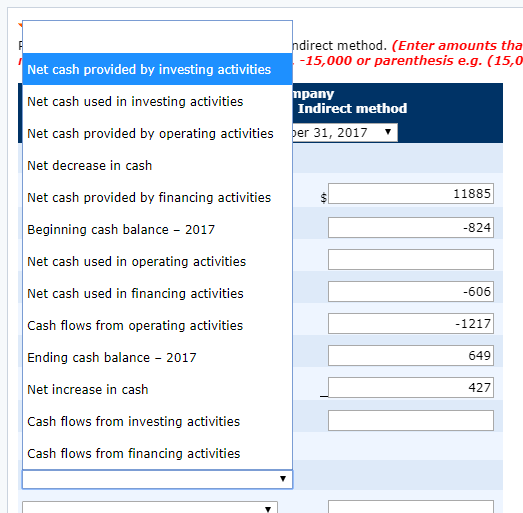

Prepare a statement of cash flows using the direct method. (a) Prepare a statement of cash flows using the indirect method. (Enter amounts that dec

Prepare a statement of cash flows using the direct method.

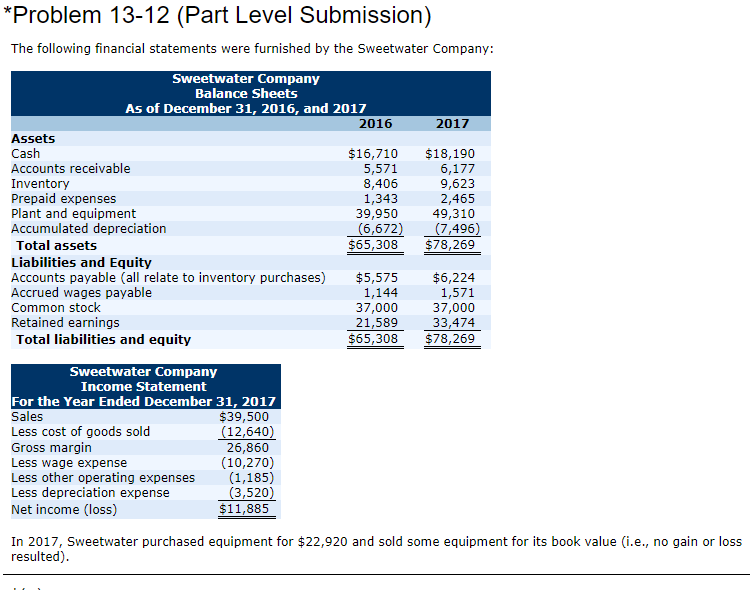

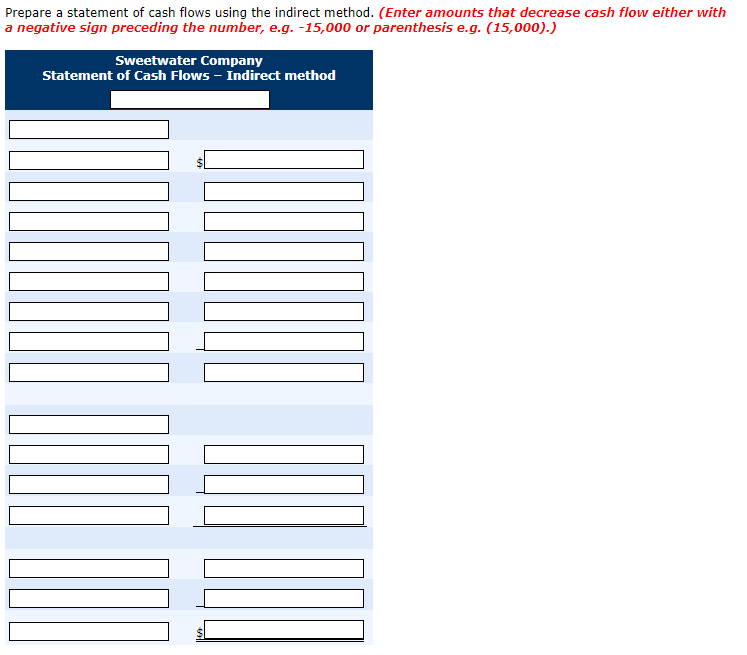

(a) Prepare a statement of cash flows using the indirect method. (Enter amounts that dec negative sign preceding the number, e.g. -15,000 or parenthesis e.g. (15,000). Sweetwater Company Statement of Cash Flows Indirect method For the Year Ended December 31, 20177 Beginning cash balance - 2017 11885 Net income 824 Depreciation expense Payments to purchase equipment Decrease in accounts payable Decrease in prepaid expenses Increase in accounts receivables Cash from sale of equipment Decrease in accounts receivables Increase in inventory Net income Depreciation expense Decrease in inventory Increase in prepaid expenses Increase in accounts payable Increase in accrued wages payable Decrease in accrued wages payable -606 1217 649 427 direct method. (Enter amounts tha 15,000 or parenthesis e.g. (15,0 Net cash provided by investing activities Net cash used in investing activities Net cash provided by operating activiies er 31, 2017 Net decrease in cash Net cash provided by financing activities Beginning cash balance - 2017 Net cash used in operating activities Net cash used in financing activities Cash flows from operating activities Ending cash balance 2017 Net increase in cash Cash flows from investing activities Cash flows from financing activities pany Indirect method 11885 -824 -606 -1217 649 427 *Problem 13-12 (Part Level Submission) The following financial statements were furnished by the Sweetwater Company: Sweetwater Company Balance Sheets As of December 31, 2016, and 2017 2016 2017 Asset Cash Accounts receivable Inventory Prepaid expenses Plant and equipment Accumulated depreciation Total assets Liabilities and Equity Accounts payable (all relate to inventory purchases) Accrued wages payable Common stock Retained earnings Total liabilities and equity $16,710 $18,190 6,177 9,623 2,465 49,310 7,496 $65,308 $78,269 5,571 8,406 1,343 39,950 6,672 $6,224 1,571 37,000 21,58933,474 $65,308 $78,269 $5,575 1,144 37,000 Sweetwater Company Income Statement For the Year Ended December 31, 2017 Sales Less cost of goods sold Gross margin Less wage expense Less other operating expenses (1,185) Less depreciation expense Net income (loss) $39,500 12,640 26,860 (10,270) 3,520 $11,885 In 2017, Sweetwater purchased equipment for $22,920 and sold some equipment for its book value (i.e., no gain or loss resulted) Prepare a statement of cash flows using the indirect method. (Enter amounts that decrease cash flow either with a negative sign preceding the number, e.g.-15,000 or parenthesis e.g. (15,000).) Sweetwater Company Statement of Cash Flows Indirect method (a) Prepare a statement of cash flows using the indirect method. (Enter amounts that dec negative sign preceding the number, e.g. -15,000 or parenthesis e.g. (15,000). Sweetwater Company Statement of Cash Flows Indirect method For the Year Ended December 31, 20177 Beginning cash balance - 2017 11885 Net income 824 Depreciation expense Payments to purchase equipment Decrease in accounts payable Decrease in prepaid expenses Increase in accounts receivables Cash from sale of equipment Decrease in accounts receivables Increase in inventory Net income Depreciation expense Decrease in inventory Increase in prepaid expenses Increase in accounts payable Increase in accrued wages payable Decrease in accrued wages payable -606 1217 649 427 direct method. (Enter amounts tha 15,000 or parenthesis e.g. (15,0 Net cash provided by investing activities Net cash used in investing activities Net cash provided by operating activiies er 31, 2017 Net decrease in cash Net cash provided by financing activities Beginning cash balance - 2017 Net cash used in operating activities Net cash used in financing activities Cash flows from operating activities Ending cash balance 2017 Net increase in cash Cash flows from investing activities Cash flows from financing activities pany Indirect method 11885 -824 -606 -1217 649 427 *Problem 13-12 (Part Level Submission) The following financial statements were furnished by the Sweetwater Company: Sweetwater Company Balance Sheets As of December 31, 2016, and 2017 2016 2017 Asset Cash Accounts receivable Inventory Prepaid expenses Plant and equipment Accumulated depreciation Total assets Liabilities and Equity Accounts payable (all relate to inventory purchases) Accrued wages payable Common stock Retained earnings Total liabilities and equity $16,710 $18,190 6,177 9,623 2,465 49,310 7,496 $65,308 $78,269 5,571 8,406 1,343 39,950 6,672 $6,224 1,571 37,000 21,58933,474 $65,308 $78,269 $5,575 1,144 37,000 Sweetwater Company Income Statement For the Year Ended December 31, 2017 Sales Less cost of goods sold Gross margin Less wage expense Less other operating expenses (1,185) Less depreciation expense Net income (loss) $39,500 12,640 26,860 (10,270) 3,520 $11,885 In 2017, Sweetwater purchased equipment for $22,920 and sold some equipment for its book value (i.e., no gain or loss resulted) Prepare a statement of cash flows using the indirect method. (Enter amounts that decrease cash flow either with a negative sign preceding the number, e.g.-15,000 or parenthesis e.g. (15,000).) Sweetwater Company Statement of Cash Flows Indirect methodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started