Answered step by step

Verified Expert Solution

Question

1 Approved Answer

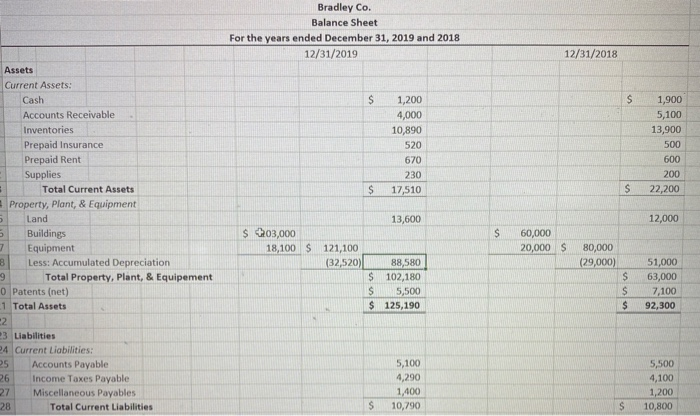

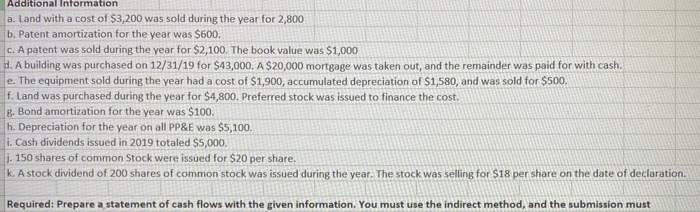

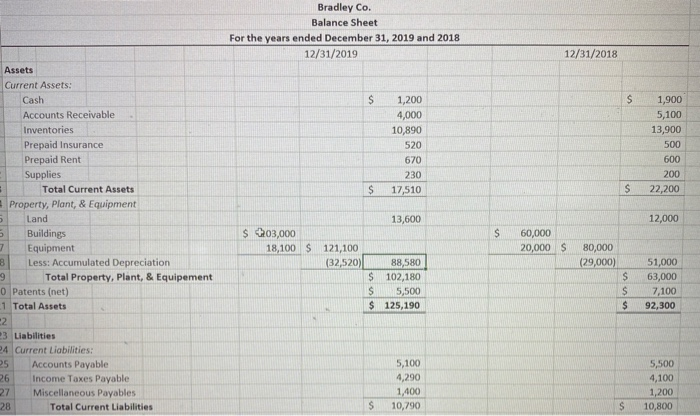

prepare a Statement of Cashflow in the Indirect method, by using the balance sheet and addition information. Bradley Co. Balance Sheet For the years ended

prepare a Statement of Cashflow in the Indirect method, by using the balance sheet and addition information.

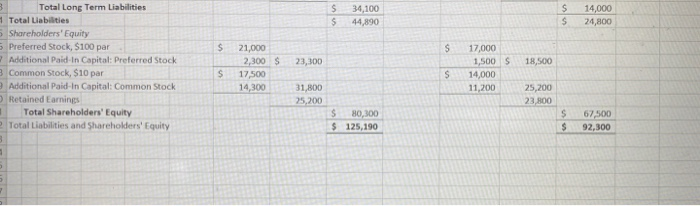

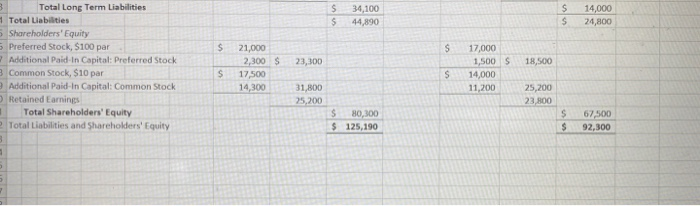

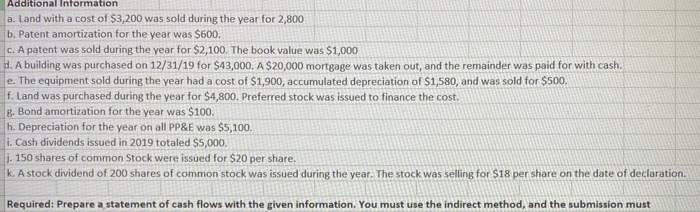

Bradley Co. Balance Sheet For the years ended December 31, 2019 and 2018 12/31/2019 12/31/2018 $ S 1,200 4,000 10,890 520 670 230 17,510 1,900 5,100 13,900 500 600 200 22,200 $ S 13,600 12,000 $ Assets Current Assets: Cash Accounts Receivable Inventories Prepaid Insurance Prepaid Rent Supplies Total Current Assets Property, plant, & Equipment 5 Land 5 Buildings 7 Equipment 8 Less: Accumulated Depreciation 9 Total Property, Plant, & Equipement 0 Patents (net) -1 Total Assets 2 3 Liabilities 24 Current Liabilities: 25 Accounts Payable 26 Income Taxes Payable 27 Miscellaneous Payables 28 Total Current Liabilities $ 2203,000 18,100 $ 121,100 (32,520) 60,000 20,000 $ 80,000 (29,000) 88,580 $ 102,180 $ 5,500 $ 125,190 $ $ $ 51,000 63,000 7,100 92,300 5,100 4,290 1,400 10,790 5,500 4,100 1,200 10,800 $ S $ $ 34,100 44,890 UU 14,000 24,800 $ $ 23,300 18,500 Total Long Term Liabilities Total Liabilities 5 Shareholders' Equity Preferred Stock, $100 par Additional Paid In Capital: Preferred Stock 3 Common Stock, $10 par Additional Paid-in Capital: Common Stock Retained Earnings Total Shareholders' Equity Total Liabilities and Shareholders' Equity 21,000 2,300 $ 17,500 14,300 17,000 1,500 5 14,000 11,200 $ S 31,800 25,200 25,200 23,800 $ 80,300 $ 125,190 $ $ 67,500 92,300 Additional Information a. Land with a cost of $3,200 was sold during the year for 2,800 b. Patent amortization for the year was $600. c. A patent was sold during the year for $2,100. The book value was $1,000 d. A building was purchased on 12/31/19 for $43,000. A $20,000 mortgage was taken out, and the remainder was paid for with cash. e. The equipment sold during the year had a cost of $1,900, accumulated depreciation of $1,580, and was sold for $500. f. Land was purchased during the year for $4,800. Preferred stock was issued to finance the cost. 8. Bond amortization for the year was $100. h. Depreciation for the year on all PP&E was $5,100. i. Cash dividends issued in 2019 totaled $5,000. j. 150 shares of common Stock were issued for $20 per share. k. A stock dividend of 200 shares of common stock was issued during the year. The stock was selling for $18 per share on the date of declaration. Required: Prepare a statement of cash flows with the given information. You must use the indirect method, and the submission must

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started