Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare a statement of equity showing all the changes that took place from January 2018 to May 2020 Cam and Jam formed a partnership on

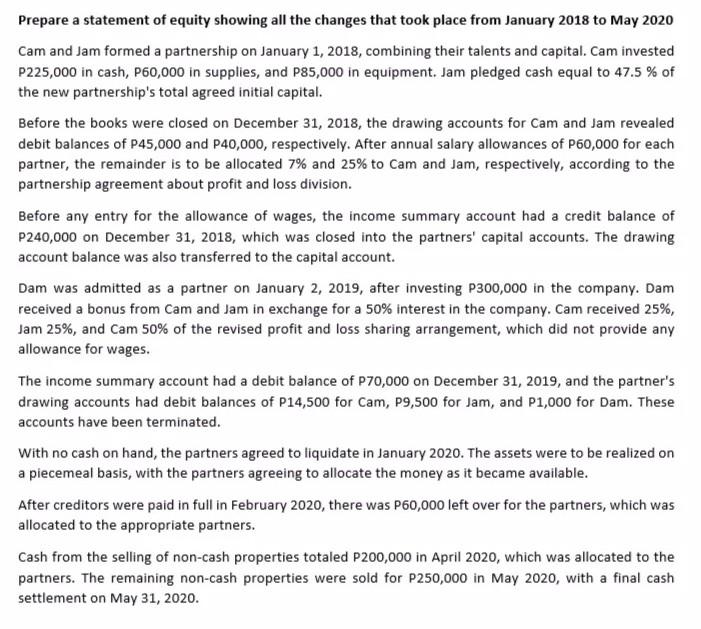

Prepare a statement of equity showing all the changes that took place from January 2018 to May 2020 Cam and Jam formed a partnership on January 1, 2018, combining their talents and capital. Cam invested P225,000 in cash, P60,000 in supplies, and P85,000 in equipment. Jam pledged cash equal to 47.5 % of the new partnership's total agreed initial capital. Before the books were closed on December 31, 2018, the drawing accounts for Cam and Jam revealed debit balances of P45,000 and P40,000, respectively. After annual salary allowances of P60,000 for each partner, the remainder is to be allocated 7% and 25% to Cam and Jam, respectively, according to the partnership agreement about profit and loss division. Before any entry for the allowance of wages, the income summary account had a credit balance of P240,000 on December 31, 2018, which was closed into the partners' capital accounts. The drawing account balance was also transferred to the capital account. Dam was admitted as a partner on January 2, 2019, after investing P300,000 in the company. Dam received a bonus from Cam and Jam in exchange for a 50% interest in the company. Cam received 25%, Jam 25%, and Cam 50% of the revised profit and loss sharing arrangement, which did not provide any allowance for wages. The income summary account had a debit balance of P70,000 on December 31, 2019, and the partner's drawing accounts had debit balances of P14,500 for Cam, P9,500 for Jam, and P1,000 for Dam. These accounts have been terminated. With no cash on hand, the partners agreed to liquidate in January 2020. The assets were to be realized on a piecemeal basis, with the partners agreeing to allocate the money as it became available. After creditors were paid in full in February 2020, there was P60,000 left over for the partners, which was allocated to the appropriate partners. Cash from the selling of non-cash properties totaled P200,000 in April 2020, which was allocated to the partners. The remaining non-cash properties were sold for P250,000 in May 2020, with a final cash settlement on May 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started