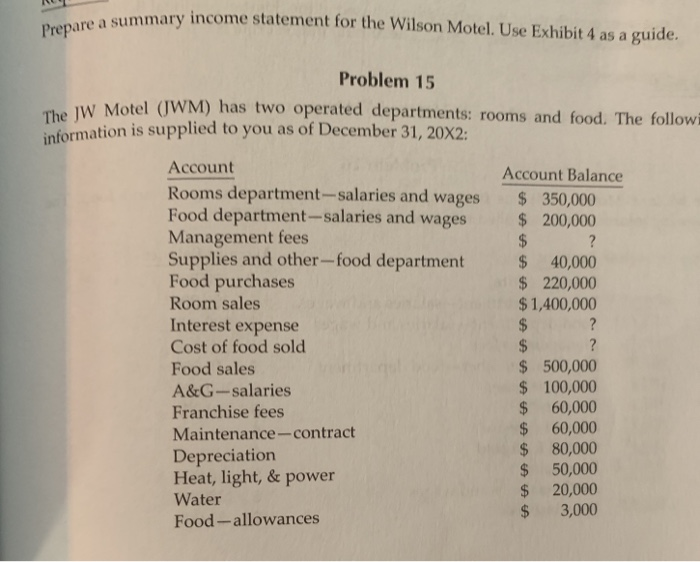

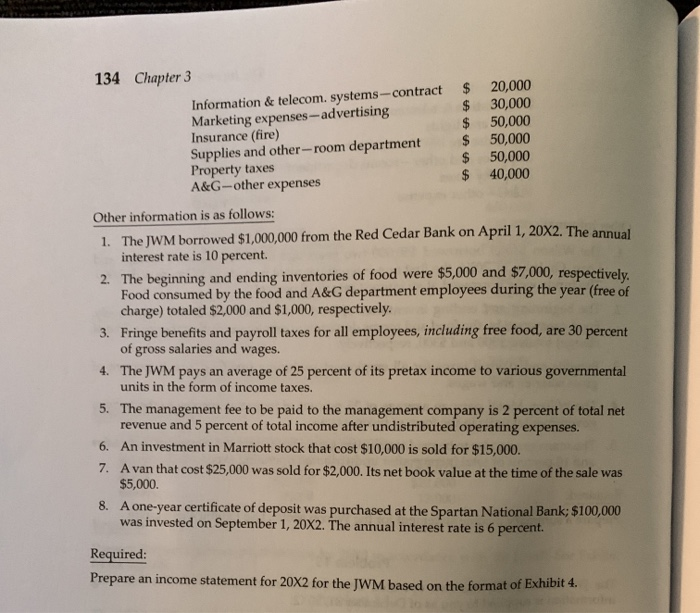

Prepare a summary income statement for the Wilson Motel. Use Exhibit 4 as a guide. information is supplied to you as of December 31, 20X2: Problem 15 Account Account Balance Rooms department--salaries and wages $ 350,000 Food department-salaries and wages $ 200,000 Management fees $ ? Supplies and other-food department $ 40,000 Food purchases $ 220,000 Room sales $1,400,000 Interest expense $ ? Cost of food sold $ ? Food sales $ 500,000 A&G-salaries $ 100,000 Franchise fees $ 60,000 Maintenance-contract $ 60,000 Depreciation $ 80,000 Heat, light, & power $ 50,000 Water $ 20,000 $ 3,000 Food - allowances 134 Chapter 3 20,000 Information & telecom. systems --- contract $ 30,000 Marketing expenses -- advertising $ 50,000 Insurance (fire) $ 50,000 Supplies and other-room department $ 50,000 Property taxes A&G-other expenses $ 40,000 Other information is as follows: 1. The JWM borrowed $1,000,000 from the Red Cedar Bank on April 1, 20X2. The annual interest rate is 10 percent. 2. The beginning and ending inventories of food were $5,000 and $7,000, respectively. Food consumed by the food and A&G department employees during the year (free of charge) totaled $2,000 and $1,000, respectively. 3. Fringe benefits and payroll taxes for all employees, including free food, are 30 percent of gross salaries and wages. 4. The JWM pays an average of 25 percent of its pretax income to various governmental units in the form of income taxes. 5. The management fee to be paid to the management company is 2 percent of total net revenue and 5 percent of total income after undistributed operating expenses. 6. An investment in Marriott stock that cost $10,000 is sold for $15,000. 7. A van that cost $25,000 was sold for $2,000. Its net book value at the time of the sale was $5,000 8. A one-year certificate of deposit was purchased at the Spartan National Bank; $100,000 was invested on September 1, 20X2. The annual interest rate is 6 percent. Required: Prepare an income statement for 20X2 for the JWM based on the format of Exhibit 4. Prepare a summary income statement for the Wilson Motel. Use Exhibit 4 as a guide. information is supplied to you as of December 31, 20X2: Problem 15 Account Account Balance Rooms department--salaries and wages $ 350,000 Food department-salaries and wages $ 200,000 Management fees $ ? Supplies and other-food department $ 40,000 Food purchases $ 220,000 Room sales $1,400,000 Interest expense $ ? Cost of food sold $ ? Food sales $ 500,000 A&G-salaries $ 100,000 Franchise fees $ 60,000 Maintenance-contract $ 60,000 Depreciation $ 80,000 Heat, light, & power $ 50,000 Water $ 20,000 $ 3,000 Food - allowances 134 Chapter 3 20,000 Information & telecom. systems --- contract $ 30,000 Marketing expenses -- advertising $ 50,000 Insurance (fire) $ 50,000 Supplies and other-room department $ 50,000 Property taxes A&G-other expenses $ 40,000 Other information is as follows: 1. The JWM borrowed $1,000,000 from the Red Cedar Bank on April 1, 20X2. The annual interest rate is 10 percent. 2. The beginning and ending inventories of food were $5,000 and $7,000, respectively. Food consumed by the food and A&G department employees during the year (free of charge) totaled $2,000 and $1,000, respectively. 3. Fringe benefits and payroll taxes for all employees, including free food, are 30 percent of gross salaries and wages. 4. The JWM pays an average of 25 percent of its pretax income to various governmental units in the form of income taxes. 5. The management fee to be paid to the management company is 2 percent of total net revenue and 5 percent of total income after undistributed operating expenses. 6. An investment in Marriott stock that cost $10,000 is sold for $15,000. 7. A van that cost $25,000 was sold for $2,000. Its net book value at the time of the sale was $5,000 8. A one-year certificate of deposit was purchased at the Spartan National Bank; $100,000 was invested on September 1, 20X2. The annual interest rate is 6 percent. Required: Prepare an income statement for 20X2 for the JWM based on the format of Exhibit 4